- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 8, 2025

Daily Digest - September 8, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Richard Stoltenborg of Fair Collections & Outsourcing, Michelle Macartney of Bridgeforce, Yerenia Gonzalez of National Auto Lenders, Bonnie Finley of Payliance, and Tyler Vidor of Receivables Control. Happy belated Birthday to: Scott Miller of Finvi (Sept. 7), Heather Slyman of Odessa (Sept. 7), Fonda Ross-Pierce of Account Control Technology (Sept. 7), Shawn Maillet of Common Collection Agency (Sept. 7), Darion Buckner of Credit Control (Sept. 6), Chase Wunder of State Collection Service (Sept. 6), Tony Spencer of Credit Corp (Sept. 6), Manny Yosipov of Advanced Recovery Group (Sept. 6), Matt Scott of Emprise Technologies (Sept. 6), and Justin Murphy of Hasson Law (Sept. 5).

🎉 Congratulations to the following for starting their new positions: Jeremy Kaster as SVP - Digital CX & Command Center at Selene Finance LP.

Unfortunately, this would likely not meet the definition for reasonable investigation. So, that means you're going to have to do some actual work. Why not see how your peers from across the credit and collection industry investigate the different types disputes that they are seeing in their files every day?

That's just one of two dozen sessions at ComplianceCon 2025. If you can find a way to save a few minutes on each investigation, or learn about a new tool that can help, think of how that will multiply across all of the investigations you have to do. The insights from this one session alone can pay for the cost of attending the event.

🔖 🎓 Now with CLE Credits!

FDCPA Suit Collapses After Court Finds No Underlying Licensing Violation

A District Court judge in Pennsylvania has granted a defendant’s motion to dismiss a Fair Debt Collection Practices class-action lawsuit that alleged the defendant violated the statute when it filed a proof of claim in the plaintiffs’ bankruptcy case on a loan it was allegedly not lawfully allowed to collect on.

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Calif. Appeals Court Reverses Dismissal of Collection Suit Stemming From 2006 Default Judgment

A California Appeals Court has reversed the dismissal of a suit against a collection operation that was sued for violating the Rosenthal Fair Debt Collection Practices Act because it renewed a judgment in which the plaintiff claims never to have been served with a summons or complaint for the original lawsuit, which dates back to 2006.

Collection Lawsuits Surge Past Pre-Pandemic Levels: Report

Debt collection lawsuits are back in force and are exceeding pre-pandemic levels in many places, according to data released recently. Two recent reports, one from January Advisors and another from the National Center for State Courts (NCSC), highlight the rise in filings during 2023 and 2024, signaling that the issue is once again crowding civil dockets across the country.

Compliance Digest – September 9

Eight different experts -- Jenna Williams, David Kaminski, Chuck Dodge, Jessica Klander, Issa Moe, Brent Yarborough, Nabil Foster, and Xerxes Martin -- share their insights into recent case rulings and other compliance updates, to make sure you know everything you need to know.

This series is sponsored by Bedard Law Group

WORTH NOTING: The age of artificial intelligence is making it a really good time to be an electrician ... Charge-off and delinquency rates on credit cards dropped in the second quarter, which is a good sign for consumers and the economy ... Catholics can now venerate the first millennial saint ... Being a grandparent can actually help improve your health ... Is the country heading for a national housing emergency? ... Can changes in the sound of your voice help detect if you have cancer? ... The design changes coming to messaging to make it more appealing ... Daniel Jones made history in his first start for Indianapolis yesterday.

Music Monday, part I

Music Monday, Part II

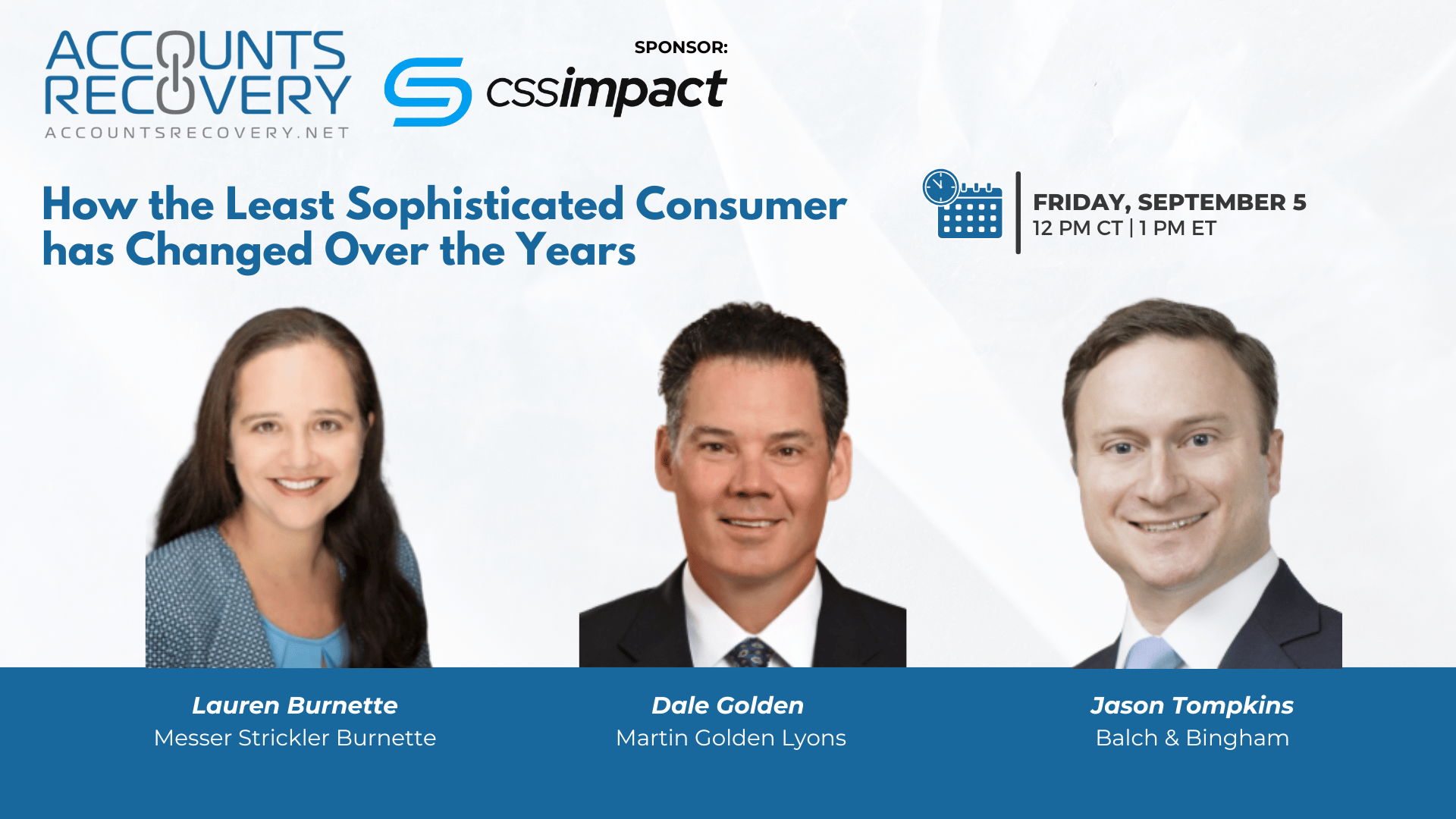

Webinar Recap: How the Least Sophisticated Consumer has Changed Over the Years

In a recent AccountsRecovery.net webinar sponsored by CSS Impact, a panel of legal experts explored how the “least sophisticated consumer” standard—used to judge the clarity of debt collection communications—has evolved in today’s digital and highly connected world.

Traditionally likened to a sixth grader, the least sophisticated consumer was once considered someone with limited knowledge and vulnerability to confusion. But panelists noted that modern consumers—armed with social media, online resources, and even AI tools—are far more savvy than their predecessors. This raises pressing questions about whether the standard, created in the late 1970s, is still relevant or needs to shift toward a more “reasonable consumer” benchmark.

The discussion also highlighted how consumer attorneys and pro se litigants are using sophisticated strategies, such as ghostwritten dispute letters, to create lawsuits. This has left collection agencies facing difficult choices: balance compliance with clear communication while also protecting against opportunistic claims.

🧠 Key Takeaways:

Review Communications with Fresh Eyes – Don’t rely solely on outdated “sixth-grade-level” readability tests. Instead, ensure letters, emails, texts, and voicemails are reasonable, transparent, and reviewed by counsel to anticipate evolving legal interpretations.

Monitor and Flag Trends in Consumer Letters – Many lawsuits stem from template or attorney-drafted dispute letters. Establish systems to identify patterns and prepare consistent, defensible responses.

Adopt a Proactive Compliance Mindset – Assume every letter or dispute could be a precursor to litigation. Maintain documentation, create protocols for attorney-involved disputes, and push back where appropriate to strengthen defenses.

The consensus: While the least sophisticated consumer standard remains a moving target, agencies can protect themselves by being deliberate, reasonable, and proactive in all consumer communications.

The Daily Digest is sponsored by TCN