- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 5, 2025

Daily Digest - September 5, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Glen Mallette of Wells Fargo, Richard Dorr of State Collection Service, and Kim Reibling of CBE Companies

🎉 Congratulations to the following for starting their new positions: Colene McNinch as Director, Business Operations and Compliance at InDebted, and Lorne Smith as Senior Vice President at MetCredit.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Candace Allen from Williams & Fudge breaks down how to get a consumer to remember information about a debt. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

🏈 NFL Football is back! Enjoy it with your Colleagues!

Survivor Pool: Just pick the winner of one game every week. Sign up here! or use this QR code:

I will also be starting a weekly DraftKings pool. Entry fee is $5/week. You can join every week or some weeks. Click here to join.

California is advancing a bill that would expand the enforcement authority of its Department of Financial Protection and Innovation, while also broadening its oversight of UDAP. For the credit and collection industry, this is a potential double whammy.

Developments like these are what make ComplianceCon 2025 such an important event. Not only do you need to stay on top of what the states are doing, but you also need to know the changes that everyone else is making.

ComplianceCon 2025:

📌 55 speakers (with more still being added)

📌 23 sessions

The status quo isn't good enough when it comes to compliance. You need to know what is on the horizon. ComplianceCon is your radar screen. Register at https://compliance-con.com.

🔖 🎓 Now with CLE Credits!

Use of Mini-Miranda Made Bank Collector, Suit Alleges

A consumer is accusing a bank of violating the Rosenthal Fair Debt Collection Practices Act and the Telephone Consumer Protection Act while also attempting to hold the bank liable for the actions of the collection law firm that it assigned the account to, because the bank included the mini-Miranda in emails and letters that were sent to the consumer and for leaving voicemail messages after the consumer sent the bank a refusal to pay letter.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

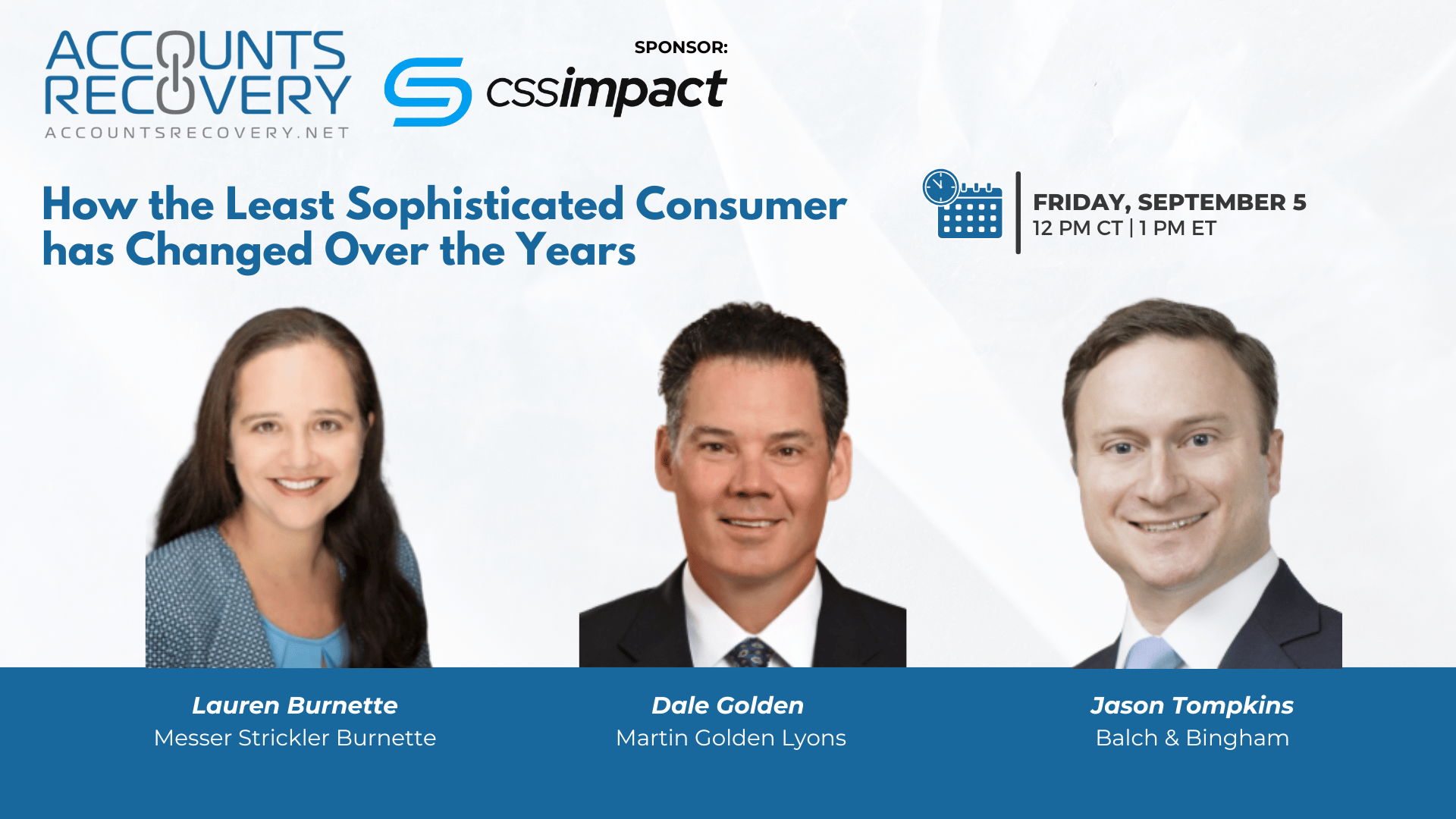

TODAY‘S WEBINAR

UPCOMING WEBINARS

States Pivoting From Credit Reporting in Fight Against Medical Debt

Medical debt reform has become a statehouse priority in 2025 after a federal court struck down a Biden-era CFPB rule that would have eliminated medical debt from credit reports. With federal action sidelined, states are stepping in, creating a patchwork of rules that collection operations must now navigate, according to a recently published report.

Court Says Landlord May Qualify as Collector Under False-Name Exception

A District Court judge in Pennsylvania has denied a defendant’s motion to dismiss a Fair Debt Collection Practices Act case against the owner of an apartment building, ruling, at this stage of the proceedings, that the FDCPA’s false-name exception applies and the owner “is properly considered” a collector under the FDCPA, while also ruling the owner of the company should remain a defendant, as well.

Bank Not Entitled to Attorney Fees in Credit Reporting Dispute

A District Court judge in Kentucky has denied an objection from a bank on its motion for attorney’s fees in a Fair Credit Reporting Act case over how it reported an account to the credit bureaus after the plaintiffs dismissed the bank from their suit.

WORTH NOTING: Not content with just getting rid of the CFPB, Russell Vought also wants to do away with the Government Accountability Office ... Small businesses are scaling back on hiring at a pace not seen in five years ... A map of all the galaxies in the "Star Wars" universe ... So I guess I have to start taking LSD now? ... A $1 million yacht lasted 15 minutes before tipping over. Money well spent ... The Social Security Administration is going to stop sending paper checks at the end of this month ... Being a leader today means needing to be more skilled than ever before ... How to go from quiet to commanding.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: How to Drive Consumers to Your Portal

In today’s digital-first collections environment, building a payment portal is just the beginning—driving consumers to actually use it is the real challenge. This webinar, hosted by AccountRecovery.net and sponsored by Concepts to Code, brought together a panel of industry experts: Kristyn Leffler (Resurgent Capital Services), Robert MacArthur (Collect Northwest), Tom Nusspickel (formerly American First Finance), Mark Reinhart (Concepts to Code), and Harry Strausser (Applied Innovation), moderated by Mike Gibb.

The panel emphasized that consumer behavior is shaped by convenience, clarity, and trust. Portals must be mobile-optimized, frictionless, and clearly branded to avoid confusion and build credibility. Messaging matters: consumers need to understand what the portal is, why they should use it, and how it benefits them. The speakers stressed the importance of consistent language across letters, emails, texts, and voicebots to reinforce portal usage and drive adoption.

Concepts to Code showcased its specialized solutions for the collections industry, including integrated payment portals, email and document delivery, and user-friendly interfaces designed to maximize engagement. The panel also discussed the role of compliance—ensuring that portal access and messaging align with regulatory expectations while still driving action.

🧠 Key Takeaways:

Make It Easy, Make It Clear

Use branded domains, dynamic links, and QR codes to simplify access. Confusing or generic URLs reduce trust and increase abandonment.Align Messaging Across Channels

Ensure your voicebots, letters, and digital outreach all point to the portal with consistent language and clear calls to action. Repetition builds familiarity and trust.Segment Portal Experiences by Account Status

Customize the portal journey based on delinquency stage, payment history, and consumer behavior. A one-size-fits-all portal misses key engagement opportunities.

This session was a reminder: your portal is only as effective as your strategy to drive consumers there. Build trust, reduce friction, and guide them with purpose.

Webinar Recap: How to Ensure Agents Don't Forget What They Learned During Training

Training is only the beginning—retention is the real challenge. In this AccountRecovery.net webinar sponsored by Peak Revenue Learning, panelists Ken Aldrich (Harris & Harris), Gwen Gullicksen (Director of Compliance and Training), Greg Ruffino (InterProse), and Chris Rickman (Peak Revenue Learning) shared practical strategies to ensure agents retain and apply what they’ve learned long after onboarding.

The discussion emphasized that forgetting is inevitable without reinforcement. Ken Aldrich highlighted the rapid decay of skills post-training and advocated for spaced repetition and ongoing practice. Greg Ruffino stressed the importance of hands-on learning and immediate application, using call calibrations to reinforce best practices. Gwen Gullicksen championed the “use it or lose it” approach, urging real-world scenarios and continuous feedback. Chris Rickman introduced microlearning and knowledge platforms as tools to combat the forgetting curve and deepen retention.

The panel agreed that training must be embedded into daily operations. Agencies should invest in coaching, QA feedback loops, and tech-enabled reinforcement to keep agents sharp and compliant.

🧠 Key Takeaways:

Implement Spaced Repetition and Microlearning

Reinforce key concepts through regular refreshers, quizzes, and bite-sized lessons to combat knowledge decay.Align Training with Real-World Practice

Use call calibrations, role-play, and immediate application to ensure agents can translate learning into action.Create Feedback Loops Between QA and Training

Use quality assurance data to identify knowledge gaps and target coaching or retraining where it’s needed most.

This session was a reminder: effective training is ongoing. Agencies that embed learning into daily operations will see stronger compliance, better performance, and higher retention.

The Daily Digest is sponsored by TCN