- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 4, 2025

Daily Digest - September 4, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Ty A. Schwamberger of Elevex Capital, Patrick Ghere of Keystone International Capital Consultant Group, Justin Muscolino of High Risk Education, Lynne Wisehart of RSI Enterprises, Joan Dean of CBE Companies, Casey Cipoletti of CBE Companies, and Chad Orr of TransUnion Newburger.

🎉 Congratulations to the following for starting their new positions: Jay Stone as Executive Managing Director at Hilco Global, Brett Murray as Executive Vice President, Corporate Strategy & Analytics at Crown Asset Management, Lee Harris as CX and BPO Consultant at Quinn Growth Advisors, and Tiffany Hill as Head of Post-Sale Strategy & Partnership at Spring Oaks Capital.

🏈 NFL Football is back! Enjoy it with your Colleagues!

Survivor Pool: Just pick the winner of one game every week. Sign up here! or use this QR code:

I will also be starting a weekly DraftKings pool. Entry fee is $5. If you want to be invited, please send me an email ([email protected]) or reply to this email with the email address to invite you.

California is advancing a bill that would expand the enforcement authority of its Department of Financial Protection and Innovation, while also broadening its oversight of UDAP. For the credit and collection industry, this is a potential double whammy.

Developments like these are what make ComplianceCon 2025 such an important event. Not only do you need to stay on top of what the states are doing, but you also need to know the changes that everyone else is making.

ComplianceCon 2025:

📌 55 speakers (with more still being added)

📌 23 sessions

The status quo isn't good enough when it comes to compliance. You need to know what is on the horizon. ComplianceCon is your radar screen. Register at https://compliance-con.com.

🔖 🎓 Now with CLE Credits!

Getting to Know Pauline Gaudio of Collexx

Pauline Gaudio loves a challenge. She loves being told that something can’t be done. Perhaps that explains why she has thrived in the credit and collection industry, first as a skiptracer and now as an agency owner. This industry is not for the faint of heart. But thanks to a group of peers supporting and empowering her, Pauline has become a success story. Read on to learn more about Pauline, the book that goes with her everywhere, and where you’re likely to find her on weekends with her husband and dog.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

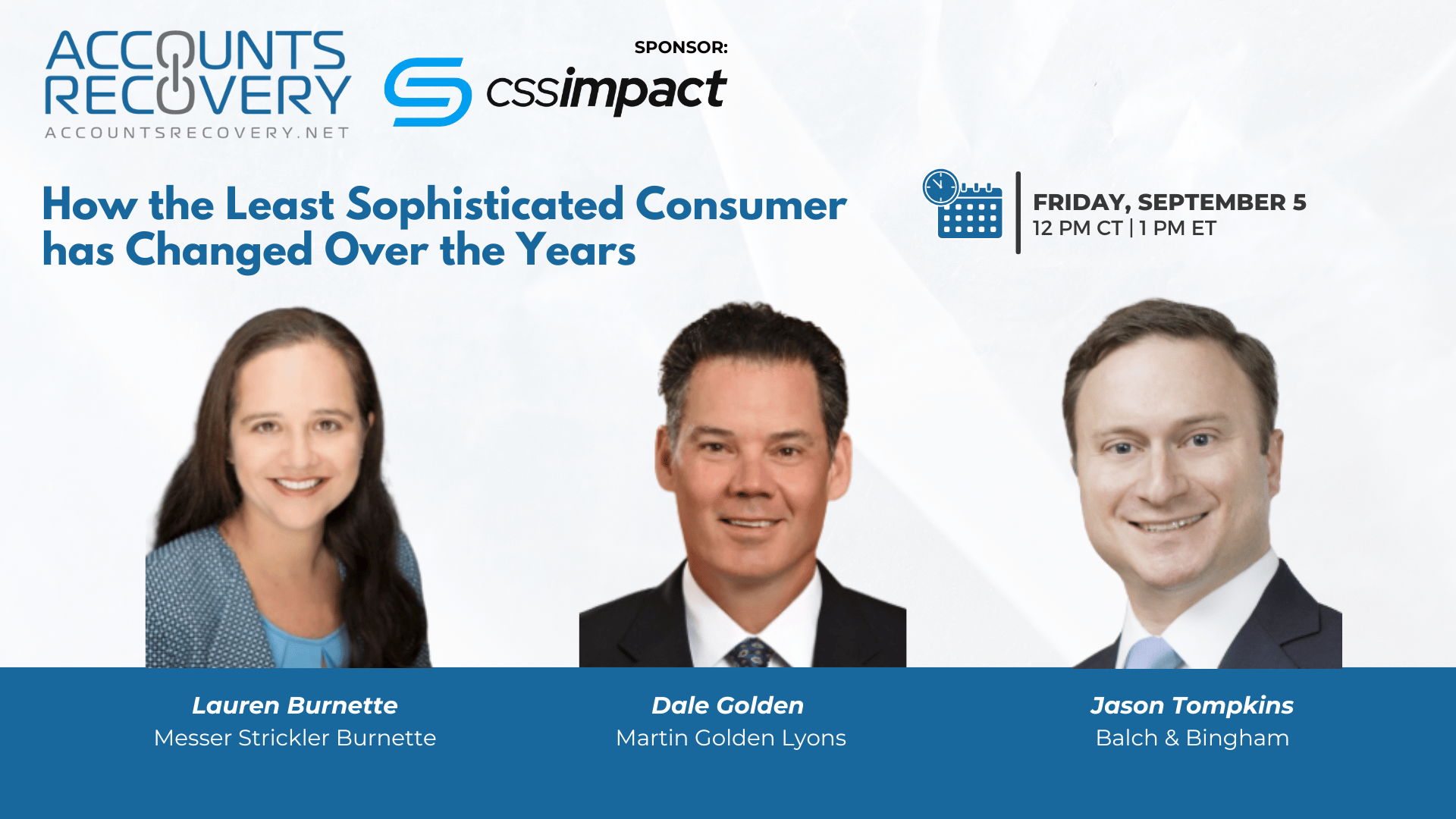

TODAY‘S WEBINARS

UPCOMING WEBINARS

Judge Denies Early Judgment in FDCPA Case Over Cease Letter, Interest Claim

You don’t often see plaintiffs seeking motions for judgment on the pleadings in a Fair Debt Collection Practices Act case so that makes this a little unusual, but a District Court judge in Minnesota has denied the motion, ruling that whether the plaintiff has standing to pursue her suit or not could not be resolved at this point in the proceedings.

New AI Agents Promise Human-Like Engagement at Scale

A company that got its start bringing digital characters to life in the movies has announced the launch of a “digital workforce” platform backed by AI-enabled agents. Soul Machines, which brands itself as “humanizing AI,” rolled out Digital Workforce this week, aimed at large enterprise clients, including healthcare organizations.

Op-Ed: Fewer Federal Enforcement, More State-Level Mandates

An op-ed that was published in yesterday’s American Banker and was written by a research institute reinforced what we have all been thinking and saying during the past few months with respect to the aftershocks reverberating around the country as the Consumer Financial Protection Bureau retreats from its role as the industry’s primary regulator. The article, “Out of One, Many” was written by the head of the Southwest Public Policy Institute.

WORTH NOTING: Are things going well or getting worse? It's hard to tell ... The FBI and the American Bankers Association have released an infographic to help people spot deepfake scams ... The average reader has read their favorite book this many times ... Why you should stop using liquid dishwasher detergent ... Why you may want to think twice before using your phone on the throne ... Employers are expecting steep increases in healthcare costs for next year ... Why most workplace training programs fail ... A list of 10 TV shows to watch this Fall.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: Modern Strategies for Call Center Retention: Perspectives from Technology Leaders and Collection Agency Executives

Retention in collections isn’t just a staffing issue—it’s a survival strategy. This TEC-sponsored webinar brought together agency leaders Brian Answeeney (CBE Companies), Terry Merrell (FFR), and tech innovator Jimmy Chebat (ZIZO Technologies) to unpack what’s working in today’s high-turnover call center environments.

The panel emphasized that retention must be approached holistically: from hiring and onboarding to performance management and incentive design. Brian shared that agents who stay past six months are significantly more productive and less likely to leave—making that milestone a critical target. Terry highlighted the cultural ripple effect of turnover, noting that even one departure can disrupt team momentum. Jimmy introduced behavioral science principles to show how real-time feedback and gamified incentives can drive engagement and reduce attrition.

Technology plays a key role, but it’s not a replacement for human leadership. The speakers agreed that transparency, empathy, and recognition are essential—especially in remote and hybrid setups. Managers must be equipped to coach, connect, and celebrate small wins, while platforms like ZIZO automate performance tracking and reward systems to keep agents motivated.

🧠 Key Takeaways:

Retention Starts at Six Months

Agents who reach the six-month mark show higher productivity and lower attrition. Design onboarding and coaching programs to get them there.Gamify Performance, But Don’t Ignore Culture

Use real-time dashboards, micro-rewards, and rank-based incentives to motivate agents. But don’t forget the power of human connection and team camaraderie.Optimize Managers, Not Just Metrics

Invest in leadership development. Managers should be trained to recognize effort, reinforce purpose, and build trust—especially in remote environments.

This session was a wake-up call: retention isn’t a line item—it’s a strategy. Agencies that treat it as such will outperform, outlast, and out-hire the competition.

The Daily Digest is sponsored by TCN