- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 23, 2025

Daily Digest - September 23, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Kelli Van Cleave of ACA International, Hal Trapp of TeamHealth, Ian Campbell of Asset Compliant Solutions, Wyatt Shaw of Spring Oaks Capital, Davin Smith of ProCollect, and Alex Mobasher of PDS Health.

🎉 Congratulations to the following for starting their new positions: Phil Rohs as Assistant Vice President of Sales at State Collection Service.

I saw a commercial on TV this weekend. That's not the news, but that is something that doesn't happen often anymore. The commercial made the statement, "It's never been a worse time to be a problem." That really stuck with me. Between all the technology and resources that are available, answers are everywhere. Figuring out which answer is the right one can still be a challenge, but if someone is looking for an answer, there are plenty of places to look.

That's one of the reasons why I love sharing as much content as I do, because it helps provide answers. I believe a rising tide lifts all boats and it's an honor and a privilege to contribute to that tide for the credit and collection industry.

Opportunities like ComplianceCon don't come around often. Sure, there are no shortage of events aimed at this industry, but I truly believe the value that you get by coming to ComplianceCon -- 23 hours of content, CLE credits, access to experts that you don't see all the time -- offers an abundance of solutions to a wide variety of problems.

If you haven't registered yet, there is still time. I would love to see you in Nashville. If you haven't checked out the conference yet, you can see the agenda and all the speakers at compliance-con.com. It's a true problem solver.

🔖 🎓 Now with CLE Credits!

Complaint Accuses Law Firm, Debt Buyer of FDCPA Violations Related to Default Judgments

A collection law firm, one of its attorneys, and a debt buying entity are facing a class-action lawsuit in Pennsylvania federal court alleging violations of the Fair Debt Collection Practices Act and Pennsylvania state law over garnishments that were made related to decades-old default judgments that the plaintiffs claimed they had no knowledge of and that the defendants allegedly lacked the documents required to substantiate ownership and existence of the debts.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court Affirms Sanctions Against Lawyers Behind Contrived FDCPA Dispute Letters

The Court of Appeals for the Third Circuit has affirmed a ruling sanctioning a pair of plaintiff’s attorneys who were found to have been behind intentionally vague dispute letters that were allegedly written by consumers and sent to the defendant.

Survey: When Consumers Become ‘Debt Numb’

Consumers are stressed about their debt, but a new study suggests that stress has limits. Once debt reaches a certain threshold, many consumers report becoming “numb” to it, according to the results of a survey conducted by JG Wentworth.

AGs Push Back on CFPB Plans to Scale Back Oversight

California Attorney General Rob Bonta, joined by 19 other state attorneys general, has urged the Consumer Financial Protection Bureau not to move forward with proposals that would sharply limit its supervision of debt collection, credit reporting, auto finance, and international money transfer markets.

WORTH NOTING: What keeps customers engaged and committed in today's high-pressure economy, according to one fintech ... Fish with perfectly formed letters, numbers and symbols on their tails are showing up in the water ... ElevenLabs puts its AI agents to the test against OpenAI ... Cycle-breaking is one of the top parenting styles these days ... Making predictions about the upcoming leaf-peeping season ... If you are losing your hair, the answer may be in what you are eating ... A study of 6 million couples shows that they often share the same psychological disorders ... The price to get your car repaired is spiking.

Trailer Tuesday, part I

Trailer Tuesday, Part II

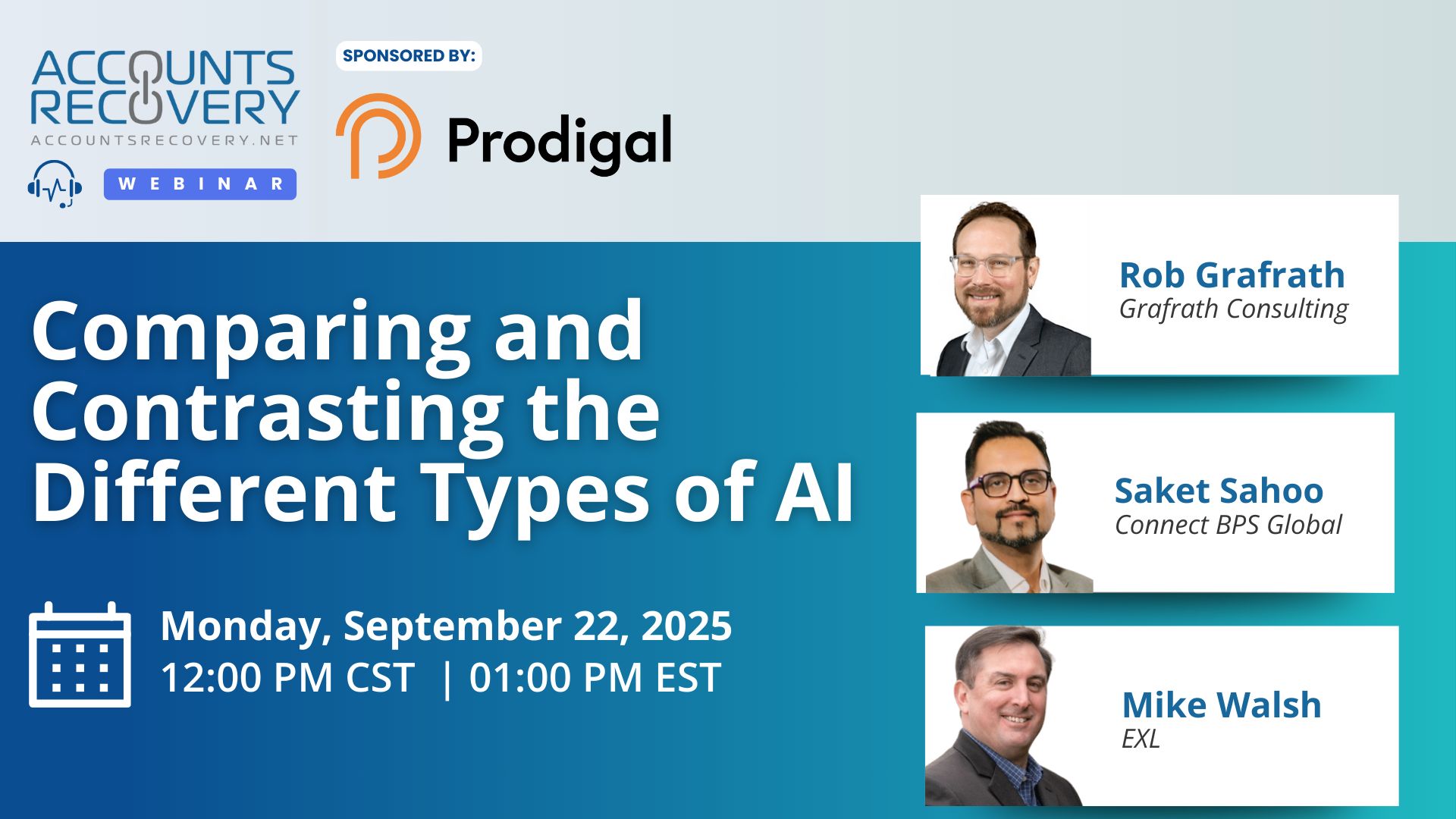

Webinar Recap: Comparing and Contrasting the Different Types of AI

Artificial intelligence is no longer just a buzzword—it’s embedded in the daily operations of many collection agencies, often without leaders even realizing it. In a recent webinar sponsored by Prodigal, industry experts broke down the different types of AI and discussed how organizations can put them to work effectively while staying compliant.

Panelists Rob Grafrath, Saket Sahoo, and Michael Walsh explored the spectrum of AI applications in credit and collections, from predictive models and conversational agents to robotic process automation (RPA) and document interpretation tools. Walsh noted that most companies should focus less on labels and more on outcomes: “Start with the outcomes. What do I want? What do I need to solve?”

The conversation highlighted that AI adoption in collections is happening faster than many anticipated. Virtual agents, QA automation, and compliance monitoring tools are already delivering measurable results, reducing costs, and enhancing consumer engagement. Still, panelists warned of pitfalls, including vendor hype, bias in models, and regulatory scrutiny. As Grafrath put it, today’s AI is more “driver assist” than “self-driving car,” but momentum is pushing the industry toward greater autonomy.

🧠 Key Takeaways:

Define success before you implement. Establish clear goals—whether reducing call handle time, improving compliance, or lifting recovery rates—so AI solutions can be evaluated against measurable outcomes.

Test before you commit. Start small with pilot programs like QA automation or document processing. As Walsh advised: “Don’t sign a ten-year deal. Test first.”

Choose partners wisely. Work with vendors who understand collections and compliance, and ask critical questions about how the AI is built, trained, and governed.

The bottom line: AI isn’t a futuristic add-on—it’s here, and the agencies that adopt it strategically will stay ahead in a rapidly evolving industry.

The Daily Digest is sponsored by TCN