- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 22, 2025

Daily Digest - September 22, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Kelly Powell of Southern Bank and Trust Company. Happy belated Birthday to: Mary Emily Wood of Revco Solutions (Sept. 21), Michael S. Lewis of Keith D Weiner & Associates (Sept. 21), Kevin Cloud of Pay N Seconds (Sept. 21), David Kaminski of Carlson & Messer (Sept. 20), and Melissa Plunkey of L J Ross Associates (Sept. 20).

🎉 Congratulations to the following for starting their new positions: Jackie Montoya as Senior Internal Auditor at World Finance, Mary Diana as Program Analyst Lead at Phillips & Cohen Associates, Robert Lamaster as Assistant Vice President of Sales at State Collection Service, and Tyler Diggs as IT Support Specialist at Figure.

I saw a commercial on TV this weekend. That's not the news, but that is something that doesn't happen often anymore. The commercial made the statement, "It's never been a worse time to be a problem." That really stuck with me. Between all the technology and resources that are available, answers are everywhere. Figuring out which answer is the right one can still be a challenge, but if someone is looking for an answer, there are plenty of places to look.

That's one of the reasons why I love sharing as much content as I do, because it helps provide answers. I believe a rising tide lifts all boats and it's an honor and a privilege to contribute to that tide for the credit and collection industry.

Opportunities like ComplianceCon don't come around often. Sure, there are no shortage of events aimed at this industry, but I truly believe the value that you get by coming to ComplianceCon -- 23 hours of content, CLE credits, access to experts that you don't see all the time -- offers an abundance of solutions to a wide variety of problems.

If you haven't registered yet, there is still time. I would love to see you in Nashville. If you haven't checked out the conference yet, you can see the agenda and all the speakers at compliance-con.com. It's a true problem solver.

🔖 🎓 Now with CLE Credits!

Judge Rejects Bid to Halt State Court Collection Case in FDCPA Suit

A District Court judge in New York has denied a motion from a plaintiff who has filed a Fair Debt Collection Practices Act complaint against a collection law firm that sought an injunction stopping a collection lawsuit that was filed against her in state court.

A MESSAGE FROM TCN

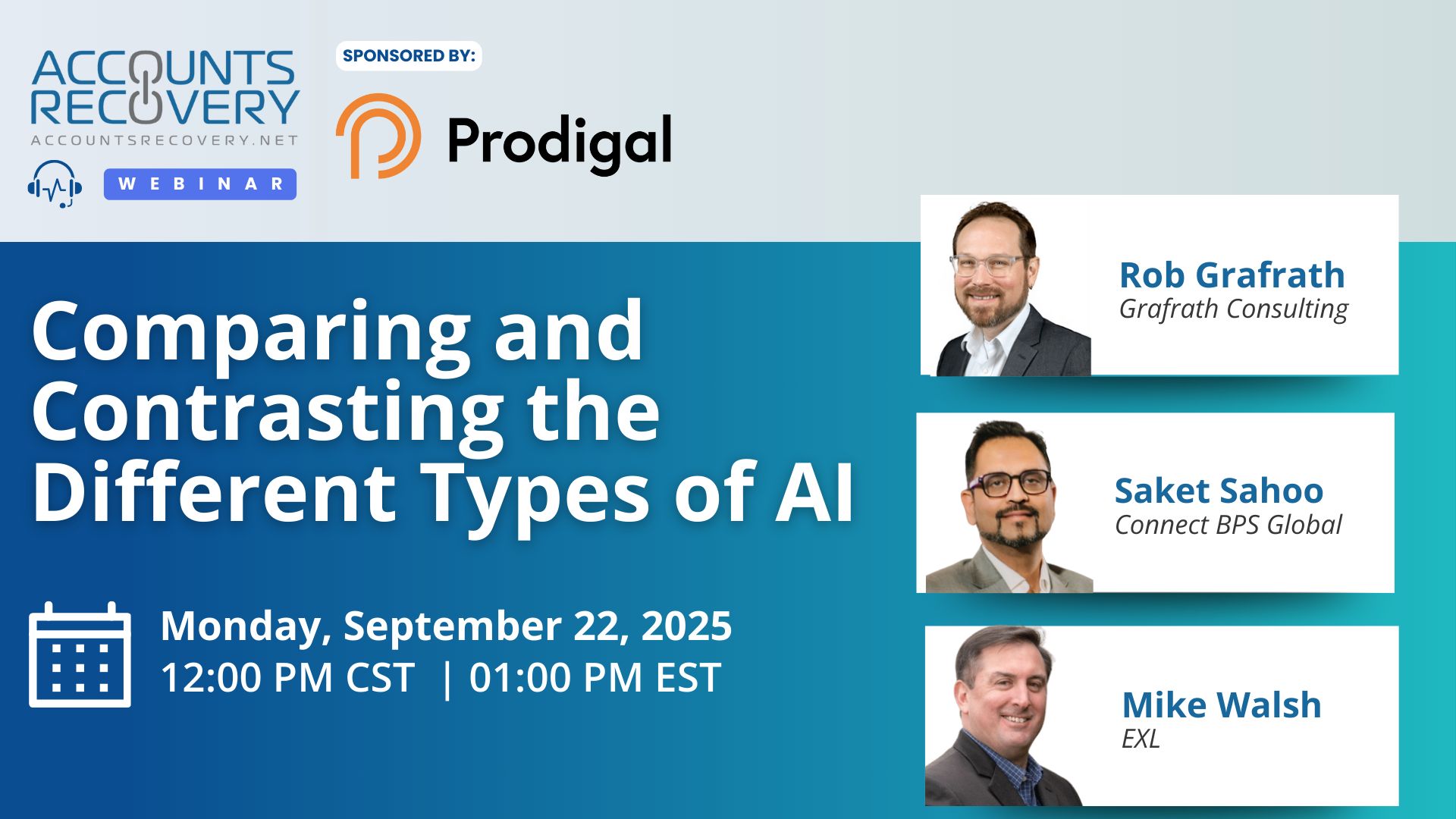

TODAY‘S WEBINAR

UPCOMING WEBINARS

Bills Target Forced Arbitration in Consumer and Employment Disputes

Rep. Hank Johnson [D-Ga.], ranking member of the House Judiciary Subcommittee on Courts, Intellectual Property, Artificial Intelligence and the Internet, and Sen. Richard Blumenthal [D-Conn.] last week reintroduced the Forced Arbitration Injustice Repeal Act of 2025 (FAIR Act), which seeks to restore consumers’ and workers’ access to the courts.

How AI Can Turn Contact Centers into Growth Engines

Financial institutions and everyone in the credit and collection industry are sitting on a goldmine of customer intelligence hidden inside their contact centers. Every phone call, chat, or email represents unstructured data that artificial intelligence can now analyze at scale. Agentic AI, which are autonomous systems capable of planning and executing tasks, is moving beyond pilots and could transform customer conversations into measurable business value, according to a report from Bank of America.

Compliance Digest – September 23

If you are reading this, then chances are, you care about doing things the right way. First, good for you! 😁. In all seriousness, caring about doing things the right way means keeping up-to-date on important compliance updates. There is no better place to do that than by reading the Compliance Digest. This week, see what Loraine Lyons, Mike Frost, Stefanie Jackman, Mitch Williamson, Akeela White, Nick Prola, Brendan Little, and James Schultz have to say.

This series is sponsored by Bedard Law Group

WORTH NOTING: The states where people are carrying the most and least student debt ... Expedia has come out and announced the single best and worst days to fly this Fall ... If you are a grandparent, here are nine reasons not to move near your grandchildren in retirement ... For all their efforts to get employees back to the office, the rush to return to the office is stalling ... The broke college student's guide to managing money ... All options are on the table as Social Security nears the point of insolvency ... Seven different health reasons why you shouldn't use your phone in the bathroom ... How AI can help people thrive, not just be productive.

Music Monday, part I

Music Monday, Part II

Webinar Recap: Email List Hygiene Best Practices

Email remains one of the most effective communication tools in the credit and collections industry—but only if it’s managed properly. In a recent webinar sponsored by CSS Impact, a panel of experts shared strategies for maintaining healthy email lists, improving deliverability, and ensuring compliance with regulatory requirements.

Moderator Mike Gibb opened by dispelling a common myth: bigger isn’t always better. “Size matters, but not in the way you think. Your email deliverability is impacted by who opens and engages with your email.” The panel agreed that list quality and segmentation matter far more than raw numbers.

Heath Morgan, attorney and compliance advisor, emphasized the need to clearly define the purpose of email campaigns—whether for cost savings, engagement, or compliance—and to build technical infrastructure such as SPF, DKIM, and verified marks to avoid spam traps. Jenna Munoz from TransUnion highlighted the importance of tailoring content and calls to action for different consumer segments, noting that “a one-size-fits-all email” won’t drive results. Erin Gallagher of Concepts2Code underscored the role of continuous monitoring, from IP reputation to inbox placement, and the need to scrub invalid or disengaged emails regularly. Josh Allen of Trada reminded the audience that ROI must be measured beyond opens and clicks, tying emails directly to payments and revenue.

The discussion made clear that poor email hygiene doesn’t just reduce engagement—it can damage deliverability, reputation, and compliance standing. As Allen put it, “The money’s in the list. Don’t ruin it.”

🧠 Key Takeaways:

Define your “why”: Be clear on whether your campaign is designed for cost savings, compliance, or engagement—this dictates strategy and KPIs.

Segment and tailor: Group consumers by behavior and engagement level, then adjust messaging and calls to action for each segment.

Monitor and maintain: Regularly scrub invalid or inactive emails, track IP/domain reputation, and measure ROI in terms of payments and revenue, not just open rates.

The Daily Digest is sponsored by TCN