- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 2, 2025

Daily Digest - September 2, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Scott Tacke of Kansas Counselors, Julie Kaplan of Atradius Collections, and Jackson Dozier of Resurgent Capital Services. Happy belated Birthday to: LuJuana DeFrance of Exeter Finance (Sept. 1), Gina Eggebrecht of First Collection Services (Sept. 1), Thuanny Hamilton of Frontline Asset Strategies (Sept. 1), Darin Bunton of North American Credit Services (Sept. 1), Angelica Zeller of Equifax (Aug. 30), Brandon Amyot of Rely Services (Aug. 30), and Scott Butts of Paragon Revenue Group (Aug. 30).

🎉 Congratulations to the following for starting their new positions: Tracey Gibson, who was promoted to Corporate Compliance Officer at Viking Client Services, Alicia Paley, who is joining the Witkes Law Firm as Chief Operating Officer, and Patrick Lausen, who has joined DirectVoice Services as Managing Member.

🏈 NFL Football is back! Enjoy it with your collegaues!

Survivor Pool: Just pick the winner of one game every week. Sign up here!

I will also be starting a weekly DraftKings pool. Entry fee is $5. If you want to be invited, please send me an email ([email protected]) or reply to this email.

It should come as no surprise to anyone that there is more attention being paid to what state regulators are doing because federal regulators are "in a coma," according to former CFPB Director Rohit Chopra. But, any hockey fan knows that the best place to pass the puck isn't towards where someone is right now, it's ahead of them, in the direction they are going, so they don't have to slow down or stop and wait for it.

So, the key is not just to know that you need to pay attention to state regulators, but to know what they are on the lookout for. If they come knocking at your door, are they asking to borrow butter or sugar?

ComplianceCon is your best bet to get firsthand knowledge from the experts who are interacting with state regulators on a daily basis. They are the people having conversations and negotiations. They know what regulators are on the lookout for.

Come to ComplianceCon and make sure your radar screen is up-to-date, because, if you're anything like me, you hate surprises.

🔖 🎓 Now with CLE Credits!

Collector Sued for Not Honoring Cease Request in Four Hours

By and large, consumers are not a patient bunch these days. They expect things quickly. Thank you, Amazon and Apple and Google and everyone else who has trained us that we can get things faster and faster. What makes things even more complicated is that consumers are not always clear about what they want and what they are asking. Layer those two dynamics on top of one another and you have the basis for a Fair Debt Collection Practices Act lawsuit that was filed in Washington federal court.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

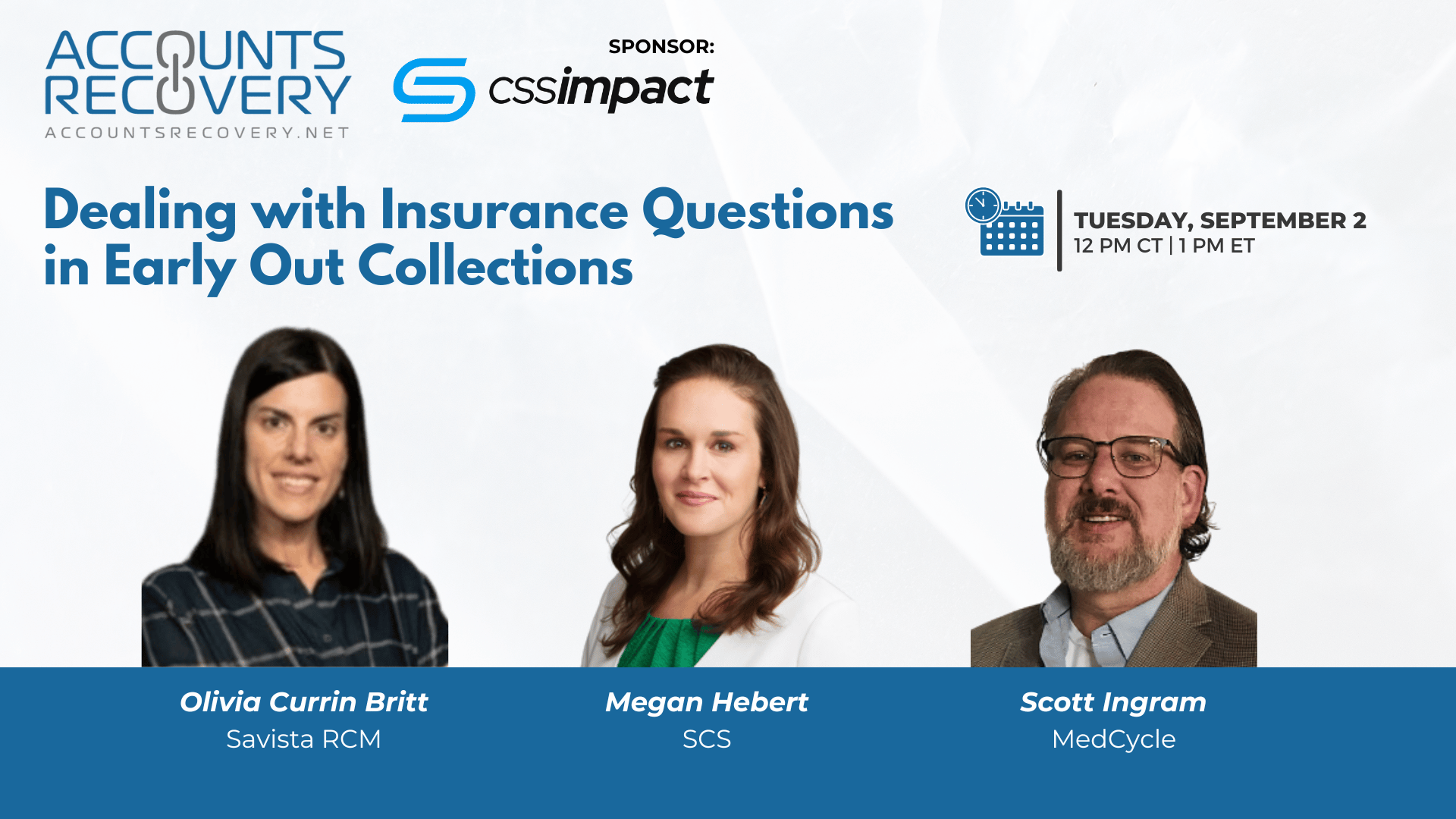

TODAY‘S WEBINAR

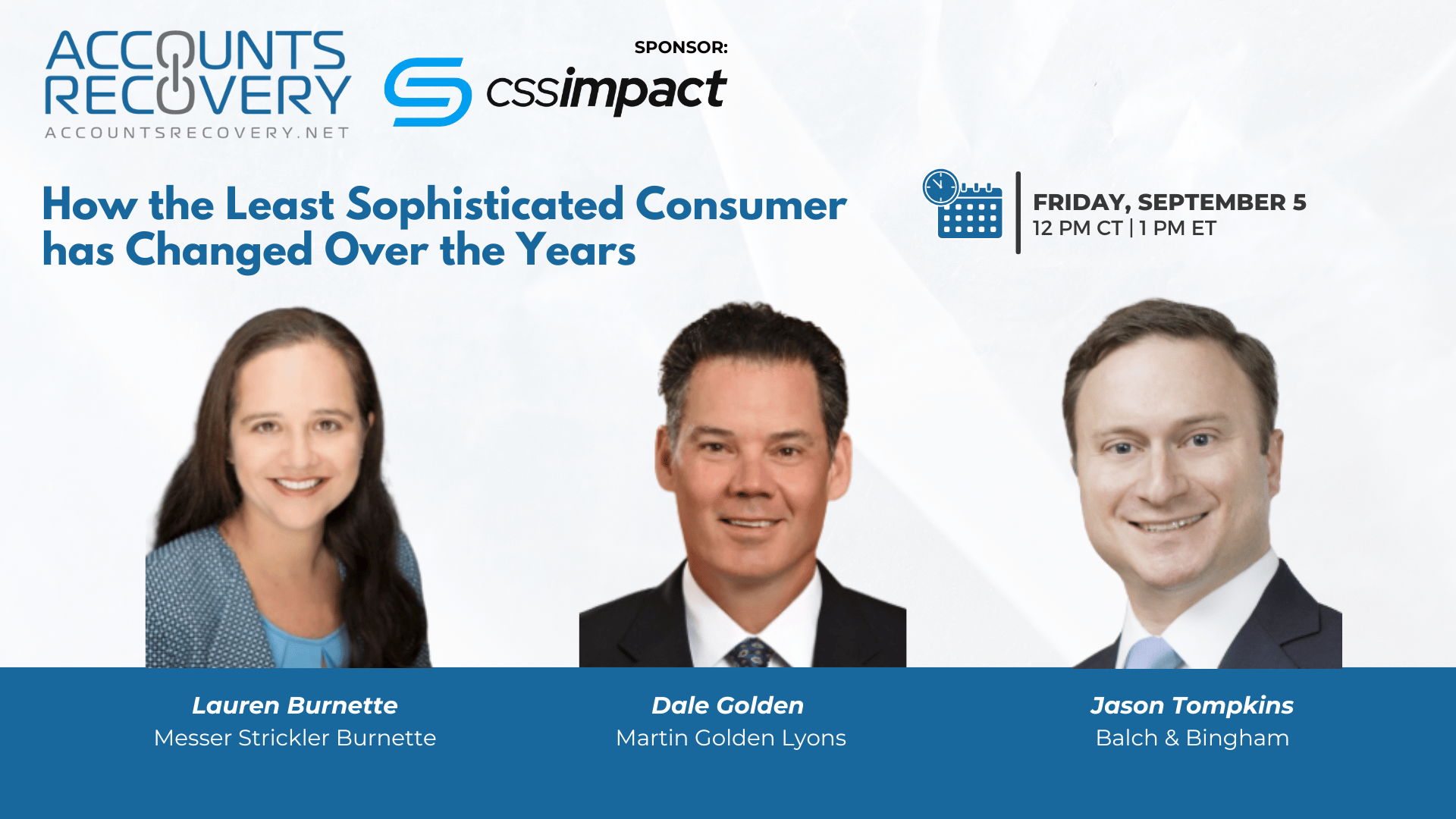

UPCOMING WEBINARS

FDCPA Suit Survives Dismissal on Claim That ‘Base Rent’ Could Mislead Consumers

A District Court judge in New Jersey has partially granted a defendant’s motion to dismiss a Fair Debt Collection Practices Act suit related to a rental dispute, allowing a claim over the amount the defendant said was owed in “base rent” to proceed because a least sophisticated consumer may not have understood that the defendant was referring to the total amount of rent that was due.

Consumers Open to Sharing Data, But Banks Lag on Open Banking

Seventy percent of consumers say they are willing to share their banking information in exchange for better loan rates, financial tools, or personalized spending insights, according to a recently released report from Experian. That’s the clear signal coming from recent research highlighting growing consumer comfort with data sharing and rising expectations for more personalized financial services.

Compliance Digest – September 2

Compliance is a moving target, with new rulings and rules and laws shifting how companies need to engage with consumers. Insights from six legal experts — Leslie Bender, Stefanie Jackman, David Schultz, Crystal Duplay, Virginia Bell Flynn, and Brendan Little — help make that target move slower and look easier to hit by sharing their insights in this week’s Compliance Digest.

This series is sponsored by Bedard Law Group

WORTH NOTING: Taco Bell is having second thoughts about relying on artificial intelligence to help it take orders at drive-throughs ... The best and worst places to retire in 2025 includes three cities from the same state ... If you are worried that you are falling behind on AI, here are some ways to help you catch up fast ... A look at how much consumers are losing to fraud and scammers these days ... Everyone knows you need to be prepared in case of a disaster, but most people don't have a plan ... Bill Belichick's first college football experience didn't go as well as many hoped it would, but at least he sold a cottage on Nantucket pretty quickly ... A list of the most anticipated books coming out this Fall ... How binge watching your favorite shows may actually be good for you.

Trailer Tuesday, part I

Trailer Tuesday, Part II

The recap from Friday’s webinar will be published tomorrow. Sorry for any inconvenience.

The Daily Digest is sponsored by TCN