- AccountsRecovery Daily Digest

- Posts

- Daily Digest - September 19, 2025

Daily Digest - September 19, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Tony Green of PRA Group and Kristy Piper Richmond of Commercial Acceptance Company.

🎉 Congratulations to the following for starting their new positions: Garett Johnson as Director of Collections Strategy at Kompato AI, Melissa Krucher as Collections Manager at NBT Bank, and Drek Scheskie as VP of Operations at Capio Partners.

So far this year, lawmakers in 38 states have introduced 123 bills on medical debt and 14 have become law.

Staying on top of this is critically important for collection operations of all shapes and sizes. This trend is not going to stop moving across the country and won’t stop with medical debt.

Sign up for ComplianceCon to get real-time updates on these developments and others that states are working on. Https://compliance-con.com.

🔖 🎓 Now with CLE Credits!

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Candace Allen from Williams & Fudge breaks down common signs that a consumer may be getting upset and the best ways to prevent that from happening. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

Only 1 Day Left!

The Memory Project, a thrilling, self-published science fiction novel by AI thought-leader Heath Morgan, explores how we can adopt AI and emerging technologies intentionally, while preserving data integrity, human agency, and autonomy in the face of accelerating change.

There’s still time to pre-order the book or name a character within its visionary world before the Kickstarter campaign ends. As a special thank you, anyone who contributes to the campaign will receive a free copy of Heath’s ChatGPT Employee Training PowerPoint, a ready-to-use compliance and onboarding resource for how your employees can use ChatGPT and other LLMS at work. Don’t miss your chance to be part of the future, and help this important message get out. Click on the link below to check it out!

Creditor Accused of Rote Investigation into ID Theft Claim

There’s plenty in this complaint to question, but there is also potentially a lot to learn. A plaintiff is accusing a credit card lender of violating state law in California, including the Rosenthal Fair Debt Collection Practices Act, because it furnished information about a debt and attempted to collect on it even though the plaintiff claimed the debt was incurred as a result of identity theft. The defendant is accused, among other claims, of failing to take into account the specifics of the plaintiff’s disputes and responding “with form letters.”

This series is sponsored by WebRecon

A MESSAGE FROM TCN

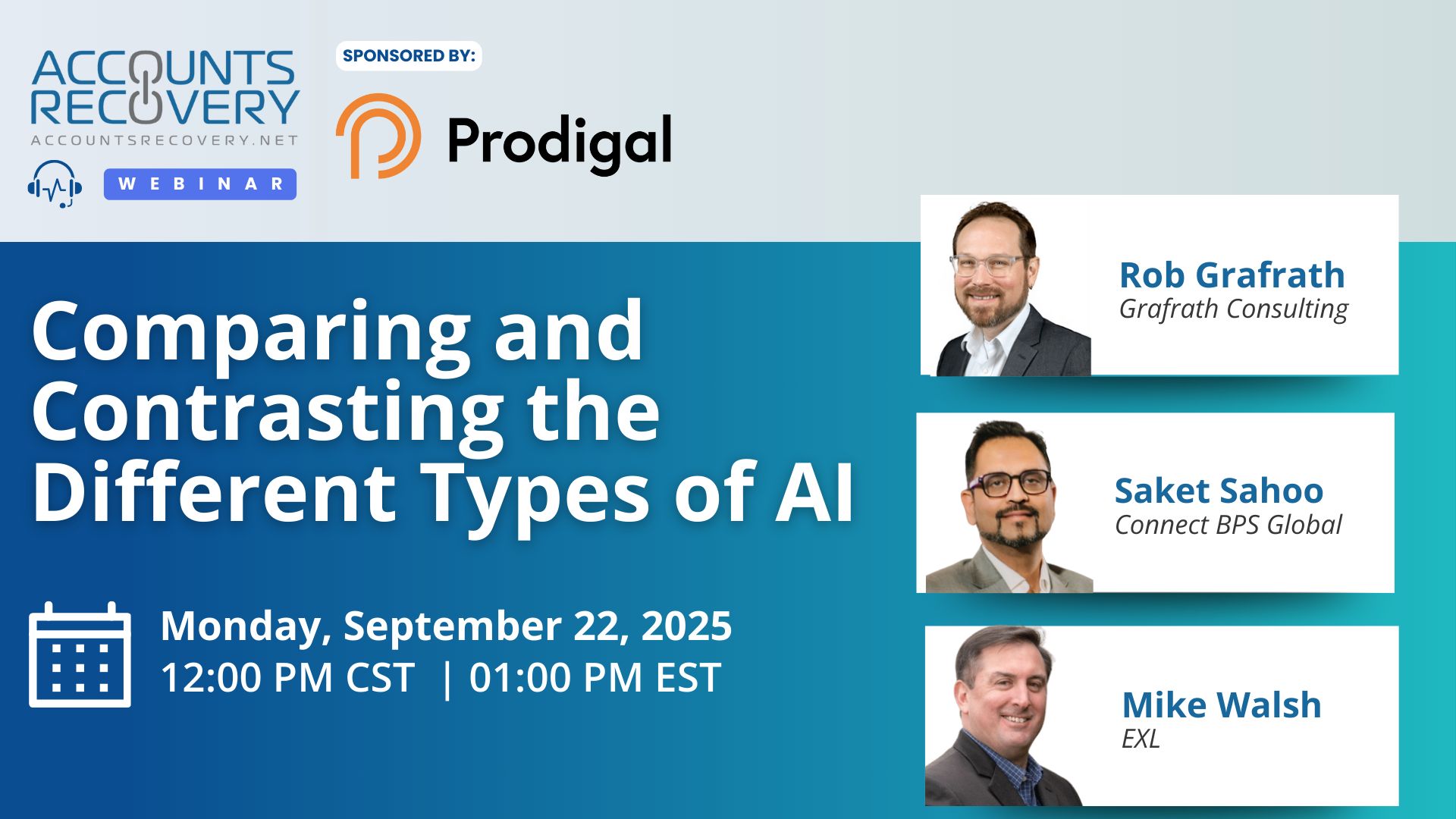

TODAY‘S WEBINAR

UPCOMING WEBINARS

Judge Vacates Default Judgment in FDCPA Case, Calls Out Plaintiff’s ‘Gamesmanship’

Not so fast there, Skippy. A Magistrate Court judge in New York has granted a defendant’s motion to vacate a default judgment that had been issued against it in a Fair Debt Collection Practices Act case, ruling that if anyone is “guilty” of “tactical maneuvering” and “procedural gamesmanship” it was the plaintiff who rushed to the court to enter a $301,000 judgment against the defendant less than seven hours after the deadline to respond to the complaint had passed.

Building a Playbook for Lasting Collector Performance

The problem every operations leader recognizes and few are able to solve well: agents leave training energized and aligned, and then, under the pressure of a live phone, much of that learning slips away. A panel of industry practitioners unpacked what actually works to keep skills sharp after day one on the phones. The conversation, which was sponsored by Peak Revenue Learning, featured Ken Aldrich of Harris & Harris, Gwen Gullicksen from Sentry Credit, and InterProse’s Greg Ruffino.

Akuvo Secures Strategic Investment to Accelerate AI Collections Roadmap

Akuvo, a technology provider specializing in collections and credit risk management products, announced yesterday that it has received a strategic investment from Vista Equity Partners, a global investor focused on enterprise software. While the amount of the deal was not disclosed, the funding is aimed at significantly accelerating Akuvo’s artificial intelligence strategy and advancing its mission to modernize collections and risk management for financial institutions.

WORTH NOTING: Three dozen "essential" book recommendations by and for IT leaders ... Consumers continue to feel less confident about the direction the economy, and their financial situations, are heading ... One in four small businesses are in "survival" mode and not doing anything about it ... Grocery prices are spiking again, sparking fears among consumers ... No matter how rich you are, anyone can live a nightmare we have all feared could happen to us ... When it comes to tough love, chatbots aren't very good at it ... If you care who the hosts and musical guests will be on the new season of "Saturday Night Live" ... How to overcome "executive dysfunction."

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: Where Disputes are Likely to Fall Through the Cracks

In a recent webinar, industry experts explored one of the most persistent compliance challenges in collections: determining when consumer communications qualify as disputes. The panel—featuring attorneys Michael Chapman and Stefanie Jackman, compliance leader Michael Kane, and credit reporting manager Alishea Prince—shared insights into gray areas, risks, and best practices for preventing disputes from slipping through unnoticed.

“Gone are the days where all you had to say was, ‘I’m disputing,’” Chapman noted. Today, vague comments such as “I thought my insurance covered that” or “This doesn’t seem right” can be deemed disputes, requiring collectors to act cautiously. Kane added that oral disputes pose the greatest risk, urging collectors to err on the side of caution and clarify intent during calls.

Panelists also discussed the complexities of written and digital disputes, including letters stating “I dispute this debt but do not want validation.” Such phrasing, they warned, may indicate litigation risks. Prince stressed the importance of treating nearly all consumer outreach as potential disputes: “If their account is accurate, they wouldn’t be calling.”

Technology was another focal point. While AI and automation can streamline simple disputes, panelists agreed human oversight remains critical, especially for fraud or identity theft claims. As Jackman put it, “We’re not there yet, but volume alone makes automation necessary.”

🧠 Key Takeaways:

Train Collectors Differently: Equip them to recognize vague or indirect language as disputes, and encourage active listening and clarifying questions.

Strengthen Internal Processes: Regularly review dispute workflows, tracking systems, and response protocols to prevent errors and missed disputes.

Balance Technology with Oversight: Use automation for simple verifications, but keep humans involved for high-risk or ambiguous cases.

The consensus was clear: in today’s environment, agencies must assume more communications qualify as disputes, ensuring nothing falls through the cracks.

The Daily Digest is sponsored by TCN