- AccountsRecovery Daily Digest

- Posts

- Daily Digest - October 16, 2025

Daily Digest - October 16, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Andrew Hartweg of SmartHart Solution, Matt Swanner of Coastal Credit Union, Sean Sturgill of Hunter Warfield, and Nick Campano of Debt Collection Partners.

🔔 October Meeting Schedule

Monday, October 20 @3pm ET: Women in Collections

Wednesday, October 22 @3pm ET: ARMTech Innovation Lab

Thursday, October 23 @3pm ET: Platform Pulse

Monday, October 27 @3pm ET: Compliance Chat

Tuesday, October 28 @3pm ET: Vendor Roundtable

Thursday, October 30 @3pm ET: Small Agency TechTactics

Getting to Know Frank Tirre of Cedar Financial

For every new collector Frank Tirre trains, he feels like a proud father, doing everything he can to help them succeed. He wants them to be the best and help them provide for their families. It is that dedication to helping others and giving training everything he has that has propelled him to a career in an industry he was never sure he was going to like. Read on to learn more about Frank, why he loves seeing Dodger blue on the road, and the person he would like to travel the world with if he had the chance.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Court Rejects Bona Fide Error Defense in FDCPA Case

A District Court judge in Florida has granted a plaintiff’s motion for partial summary judgment in a Fair Debt Collection Practices Act case after the defendant filed a collection lawsuit in the wrong jurisdiction, ruling that a violation of the statute’s venue provision occurs when the suit is filed, not when the plaintiff is served, and that the defendant was not entitled to the FDCPA’s bona fide error defense because it did not follow its own procedures.

Vought: CFPB To Close in ‘Two or Three’ Months

Russell Vought, the Director of the Office of Management and Budget and the Acting Director of the Consumer Financial Protection Bureau announced yesterday during an appearance on “The Charlie Kirk Show” that the CFPB will be closed “within the next two to three months,” claiming the agency “is not protecting consumers” and instead weaponizes financial law against small lenders. He pointed to what he called the CFPB’s “DNA of Elizabeth Warren” as evidence of partisan overreach.

Lawmakers Warn of ‘Student Loan Default Cliff’ That Could Threaten Broader Economy

A coalition of more than 70 Congressional Democrats, led by Rep. Ayanna Pressley [D-Mass.] and Sen. Elizabeth Warren [D-Mass.], is urging the Trump administration to take immediate action to address what they call a “student loan default cliff” that could push millions of borrowers into financial ruin and ripple across the economy. Their letter, sent to Education Secretary Linda McMahon, cites record-high delinquency and default rates and blames recent federal policies for deepening the crisis.

WORTH NOTING: A lot of employees are unhappy about not having more of a say in how their companies are deploying technology resources like AI ... Which states are most, and least, affected by the government shutdown ... Don't get me wrong, I loved my TiVo when I had it, but I think it's time for people to let it go ... SoFi is expanding its offices in Utah and hiring more than 400 new employees ... The number of senior citizens in America is going to explode over the next 25 years ... A list of 65 essential children's books ... The latest coffee craze can make your brew smoother without needing sugar or cream ... Lessons from disruptive innovators who changed the world.

Top 10 Thursday, part I

Top 10 Thursday, Part II

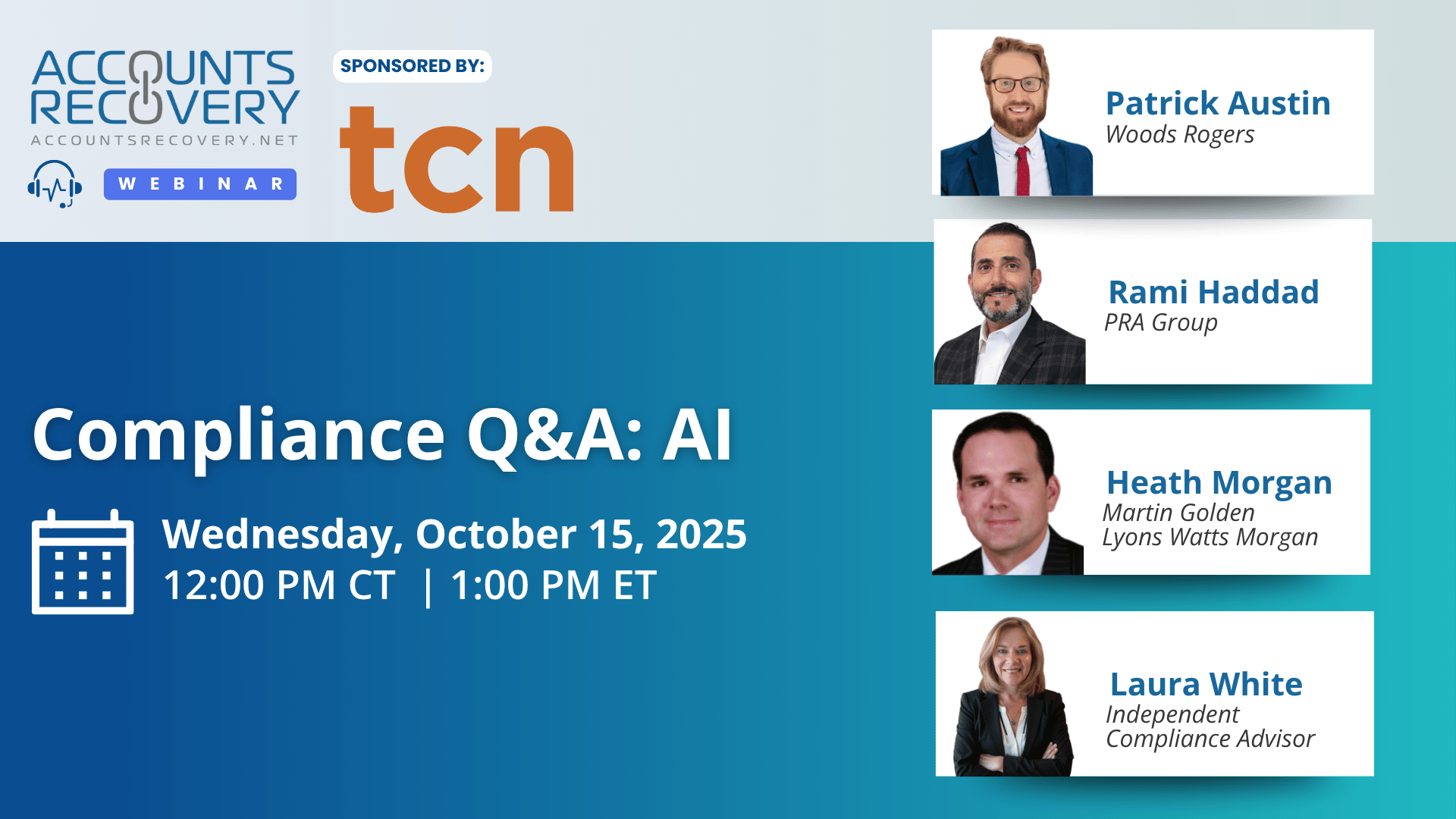

Webinar Recap: Compliance Q&A: AI

As artificial intelligence continues to reshape the credit and collections industry, compliance leaders are under pressure to balance innovation with regulatory responsibility. In the recent Compliance Q&A: AI webinar, moderated by Leslie Bender, experts Patrick Austin (Woods Rogers), Rami Haddad (PRA Group), Laura White, and Heath Morgan explored how agencies can adopt AI safely while staying compliant.

The discussion centered on the importance of developing strong AI governance frameworks that define clear roles, ensure data transparency, and include human oversight. As Austin noted, “If your company already has an AI governance policy, you’re ahead of the game.” Panelists agreed that organizations must not only establish governance policies but also review and update them regularly as technology and laws evolve.

White emphasized that “all employees need to understand when to step in or override what the model is doing.” She and Haddad both stressed the need for comprehensive training and acceptable-use policies that prevent staff from mishandling sensitive data when using AI tools. The panel also discussed potential legal risks—such as bias, disclosure obligations, and privacy violations—and highlighted the need for transparency with consumers, especially as more states move toward requiring AI interaction disclosures.

“AI isn’t replacing compliance—it’s redefining it,” said Morgan, urging attendees to embrace AI intentionally and responsibly.

🧠 Key Takeaways:

Establish AI Governance: Define accountability, oversight, and vendor management standards before expanding AI use.

Educate and Monitor Employees: Train staff on acceptable AI use, data protection, and when human judgment is required.

Stay Ahead of Regulations: Track evolving AI disclosure and privacy laws in states like California, Texas, and Utah to remain compliant.

AI is here to stay—those who adapt early and build structured governance will set the standard for ethical, compliant innovation in collections.

The Daily Digest is sponsored by TCN