- AccountsRecovery Daily Digest

- Posts

- Daily Digest - October 15, 2025

Daily Digest - October 15, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂 Happy Birthday to: Gary Fair of Certegy Payment Solutions and Cammi Smith of Citi.

🎉 Congratulations for starting new positions: Tyler Mayer as Vice President, Global Call Center Services at Halsted Financial Services, Andy Dickson-Rekasi as Manager Compliance II - Complaints Management at First Citizens Bank, and Jared Buchanan as Chief Legal Officer at Southwood Financial.

🔔 October Meeting Schedule

Monday, October 20 @3pm ET: Women in Collections

Wednesday, October 22 @3pm ET: ARMTech Innovation Lab

Thursday, October 23 @3pm ET: Platform Pulse

Monday, October 27 @3pm ET: Compliance Chat

Tuesday, October 28 @3pm ET: Vendor Roundtable

Thursday, October 30 @3pm ET: Small Agency TechTactics

Judge Rules Fintech’s Cash Advance Product Falls Under Military Lending Act, Denies Arbitration Request

A District Court judge in California has denied a defendant’s motion to compel arbitration in a class-action lawsuit, ruling the defendant meets the definition of creditor under the Military Lending Act, which prohibits arbitration claims for covered members of the armed forces.

A MESSAGE FROM TCN

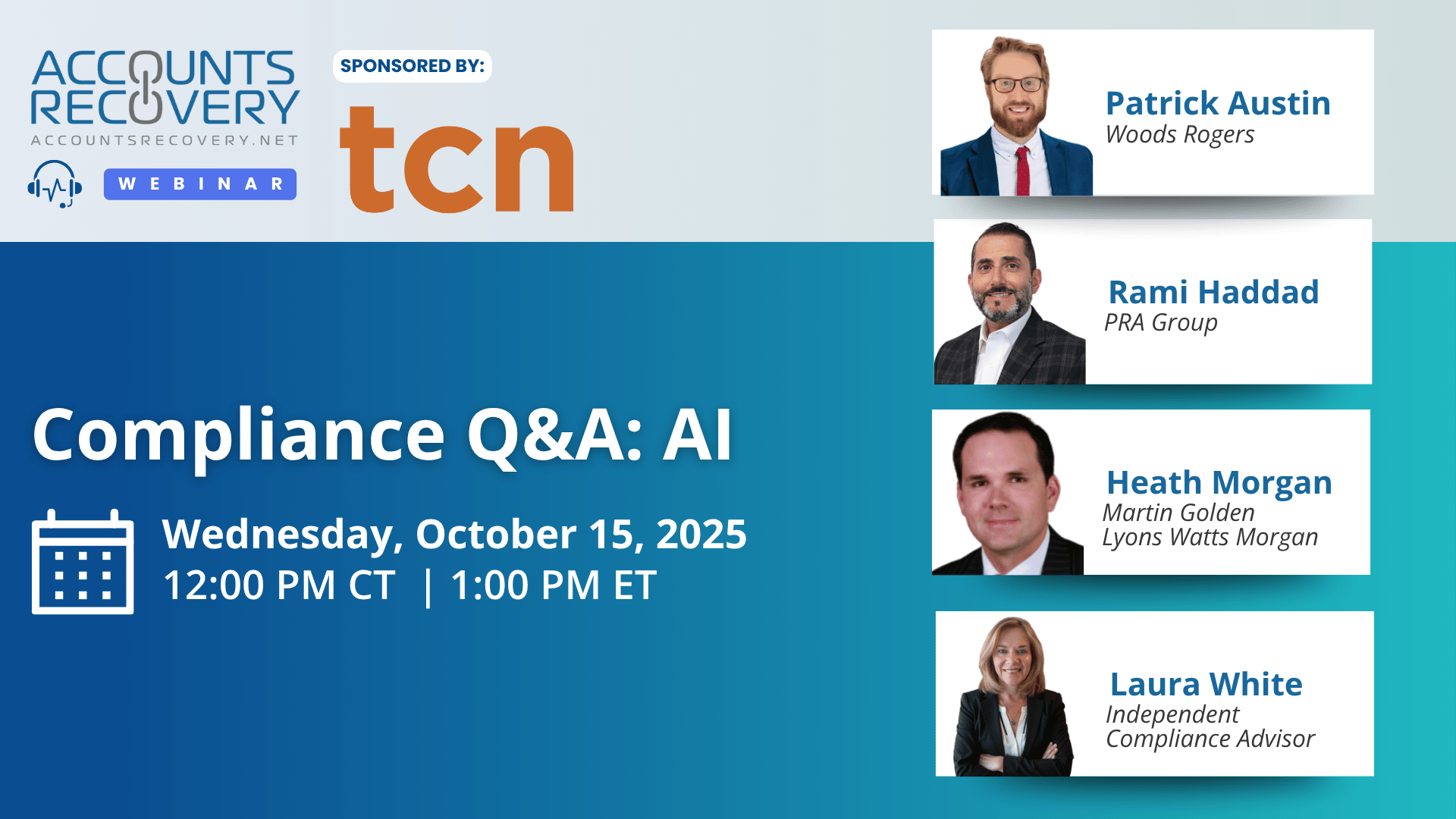

TODAY‘S WEBINAR

UPCOMING WEBINARS

Maryland Regulator Issues Guidance on New Medical Debt Collection Laws

The Maryland Office of Financial Regulation (OFR) has issued formal guidance outlining three major laws that significantly change how medical debts may be collected, reported, and enforced in the state. The laws — HB 428, HB 1020, and HB 268 — took effect on October 1.

Americans’ Paychecks Still Lag Behind Rising Costs

More than six in 10 American workers say their paychecks have not kept up with rising household costs over the past year, the highest share in four years, according to Bankrate’s latest Pay Raise Survey. That figure is up from 59% in 2024, highlighting increasing consumer pressure to make ends meet.

36 Companies Seeking Collection Talent

One of the things that always fascinates me -- and frustrates me -- is the number of different ways that people describe collectors in job ads. Debt resolution specialist. Customer service associate. Call center representative. Collection recovery specialist. Those are just some of the terms used in this week's job listing summary. Check out those listings, and nearly three dozen more from across the industry.

WORTH NOTING: Small businesses are less optimistic about the direction the economy is heading ... You may love Honeycrisp apples, but farmers definitely don't ... The average American's credit score is falling. Here are some reasons why ... The average price for a new car hit another record high in September ... How to know what is in your drinking water ... The man behind some of the most iconic movie posters of all time has died ... How members of Generation Z are tackling their job fears ... This is a fee charged by airlines that I can definitely get behind.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: Addressing and Understanding the Increase in CFPB Consumer Complaints

The volume of consumer complaints filed with the CFPB has surged — doubling two years in a row. In this webinar, industry experts Vaishali Rao (Hinshaw Culbertson), Katie Jimenez (Mission Lane), Dr. Jermaine Kimble (Sedric), and Jim McCarthy (McCarthy Hatch) explored what’s driving the increase and how companies can effectively respond.

Panelists pointed to a mix of factors fueling the rise: economic strain, higher consumer awareness, the spread of misinformation on social media, and even AI-generated complaint submissions. “Consumers feel more empowered to demand what they think is fair,” said Rao, while Jimenez noted that growing debt levels and confusion over credit terms are adding to frustration.

McCarthy shared that over 45% of debt collection complaints involve debts not owed, highlighting persistent identity and data quality issues. He warned that organizations should focus on using complaint data to identify operational weaknesses rather than viewing complaints solely as compliance risks. Kimble added that the industry’s challenge now lies in scaling complaint management efficiently as volumes continue to grow.

Panelists agreed that consistency in complaint handling, data-driven analysis, and proactive consumer education will be critical in navigating the current landscape.

🧠 Key Takeaways:

Treat complaints as intelligence, not just risk. Analyze complaint narratives to uncover process gaps, training needs, or data quality issues.

Be proactive and consistent. A single complaint can still trigger scrutiny; ensure every channel—from CFPB to social media—is handled with care and uniformity.

Prepare for growth in volume. As Jimenez warned, “Don’t take your foot off the gas.” With automation and better documentation, agencies can scale responsibly and stay ahead of rising consumer expectations.

The Daily Digest is sponsored by TCN