- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 7, 2025

Daily Digest - November 7, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to Dave Piotrowski of Waterford Capital, and Ethan Drain of Health Care Reimbursement Solutions. Happy belated Birthday to: Mindy Chumbley of Solverity (November 5)

🎉Congratulations for starting new positions: Robert Fagan as SVP of Managed Assets at Wintrust Specialty Finance, Paul Emanuels as Chief Lending Officer at Ventura County Credit Union, and Kevin Bennick as Chief Revenue Officer at SWC Group.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Jennifer Peck from The Stark Agency shares the one thing every collector should do before making a call. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

📝 Quick Notes

📖 Interested in joining a book club to discuss this book? Let me know.

Suit Accuses Collection Operation of Abandoning Settlement Negotiations

If you got letters and phone calls attempting to collect on a debt that you did not believe was yours, what would you do? A consumer has accused a collection operation of violating the Fair Debt Collection Practices Act for attempting to collect on a debt that the plaintiff believes he does not owe and the circumstances and details of the situation just seem a little odd.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

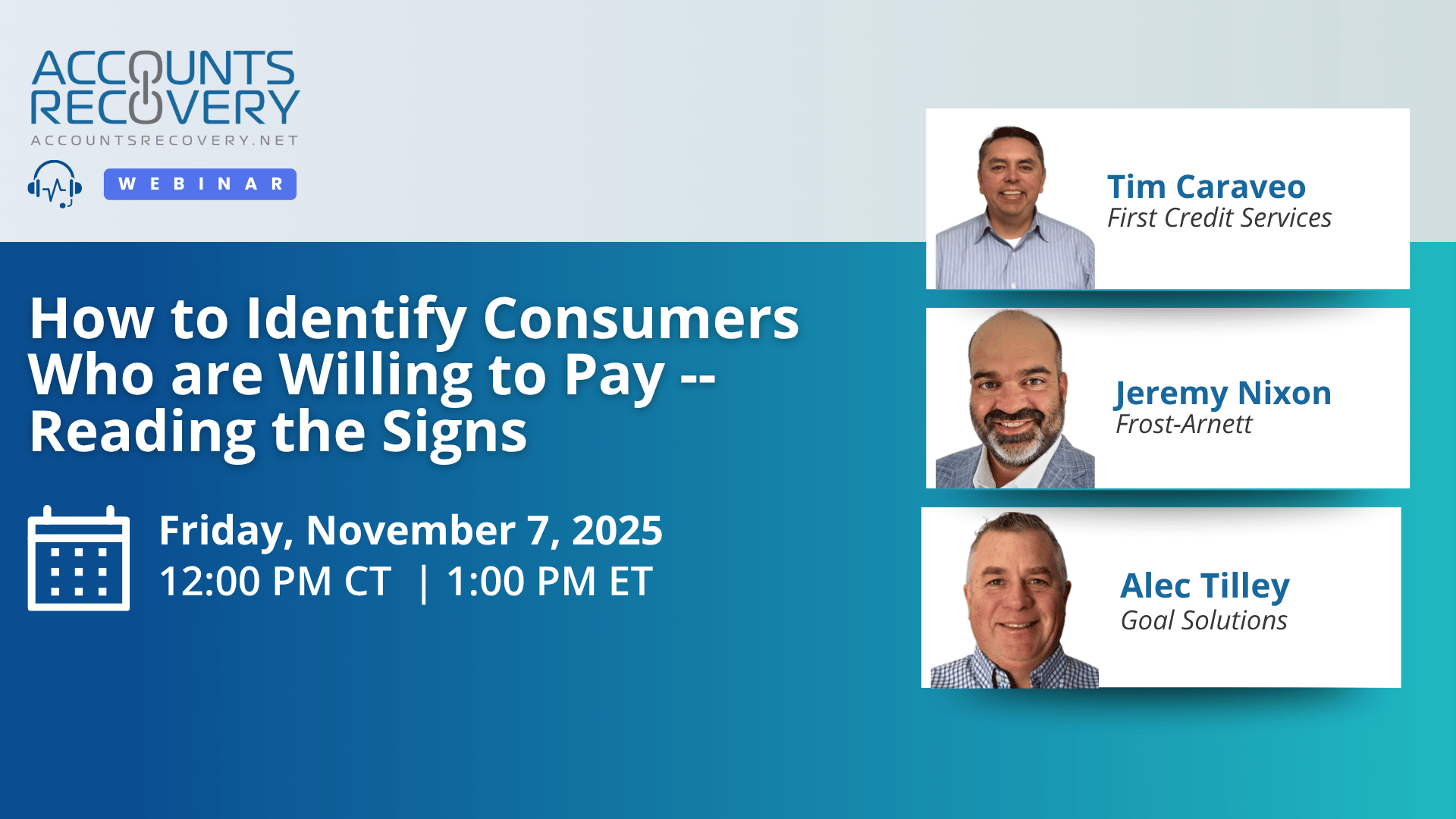

TODAY‘S WEBINAR

UPCOMING WEBINARS

Illinois Appeals Court Upholds Sanctions Against Consumer Who Fabricated FCRA Evidence

An Illinois Appeals Court has affirmed a trial court’s ruling in favor of a financial institution and sanctions against a consumer who claimed the bank violated the Fair Credit Reporting Act and was found to have manufactured evidence to try and make his case.

Michigan Lawmakers Introduce Bipartisan Bills to Curb Aggressive Medical Debt Collection

A bipartisan group of Michigan lawmakers has introduced a pair of bills aimed at protecting consumers from certain medical debt collection practices and give the Attorney General more power under the state’s consumer protection laws. The proposals would cap interest rates on unpaid medical bills, limit certain collection actions, regulate the sale of medical debt, and classify violations as unfair trade practices under the Michigan Consumer Protection Act.

North Carolina’s Medical Debt Relief Program Erases $6.5 Billion, Expands Credit Reporting Push

North Carolina’s landmark medical debt relief initiative continues to make waves, with Gov. Josh Stein highlighting its impact during a roundtable discussion this week in Greensboro, N.C.. The program, the first of its kind in the nation, has erased more than $6.5 billion in medical debt for 2.5 million residents, a sweeping effort to relieve financial strain and prevent future medical debt accumulation. At the same time, Gov. Stein has called on the credit reporting agencies to further protect consumers by not including medical debt on credit reports.

WORTH NOTING: Fans awaiting the new "Grand Theft Auto" will have to wait a little longer ... The words defining technology and culture in 2025 ... What it's like trying to get a board game made today ... How long is it before you start to overstay your welcome ... A trio of somewhat unexpected tips to help you clean your bathroom ... How seasoned flyers and travel insiders deal with flight delays ... Why you may want to cut back on the alcohol ... AI isn't replacing jobs, but spending on AI is.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: Dealing with Pro Se Litigants

In the latest AccountsRecovery.net webinar, a panel of experts—Caren Enloe of Smith Debnam, Kat O’Brien of United Holding Group, and Justin Penn of Hinshaw & Culbertson—joined host Mike Gibb to discuss one of the industry’s growing challenges: the rise of pro se litigants. These are consumers representing themselves in court, often armed with online resources and social media guidance, making debt-related litigation more unpredictable and complex.

According to Enloe, the proportion of pro se cases has surged from 10–20% to as high as 50% of filings in some areas. The panel attributed this increase to the accessibility of legal information online and the low cost of small claims filings. As O’Brien noted, “You can Google ‘this person sued me’ and get a step-by-step guide to file a counterclaim.” The discussion emphasized that while some pro se litigants are genuinely seeking justice, others use the system to pressure settlements or file repetitive, meritless claims.

Panelists shared practical strategies for managing these cases. Penn recommended identifying early whether a litigant is likely to settle or prolong proceedings, while Enloe advised setting depositions early—“They either don’t show up, or once they’re heard, they settle quickly.” O’Brien highlighted the importance of data tracking and compliance documentation to spot repeat filers and avoid costly missteps.

🧠 Key Takeaways:

Document Everything: Keep thorough records of all communications and filings to protect your organization and identify repeat litigants.

Stay Professional and Composed: Judges often show leniency to self-represented consumers, making patience and professionalism critical.

Evaluate Each Case Strategically: Treat pro se matters as business decisions—balance the cost of litigation with long-term compliance and reputation risks.

As the number of pro se litigants continues to climb, agencies and creditors must adapt with proactive compliance, meticulous documentation, and a balanced approach to resolution.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN