- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 6, 2025

Daily Digest - November 6, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to Joel Blackburn of Cornerstone Licensing, Thaddieus McCall of Block, Michael Knouse of Midland Credit Management, Lisa Smith of LJ Ross Associates, and Wendy Thomas of National Recovery Associates, Inc.

🎉Congratulations for starting new positions: Kevin Bennick as Chief Revenue Officer at SWC Group.

📝 Quick Notes

📖 Interested in joining a book club to discuss this book? Let me know.

Getting to Know Dave Bader of Mission Lane

Dave Bader fancies himself a juggler. Not of chainsaws or bowling pins, but tasks. His talent for multi-tasking has come in handy during his career, first at Capital One and now at Mission Lane, where he spends a good chunk of his day communicating and collaborating with coworkers. Read on to learn more about Dave, which Oreo special edition is the best, and why imposter syndrome isn’t a bad thing.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

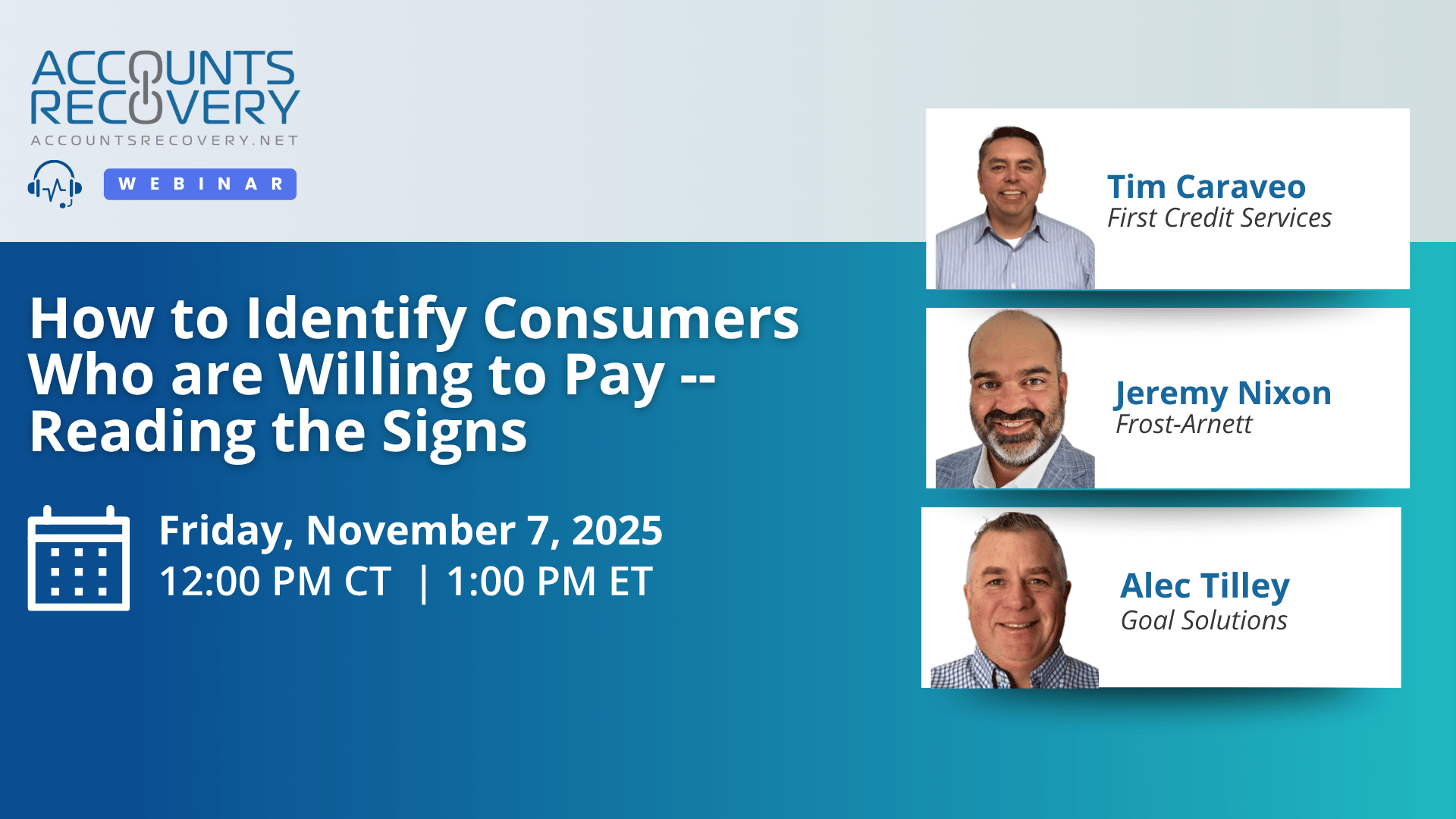

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court Upholds Denial of Motion to Vacate Satisfied Debt Judgment in Licensing Dispute

In a case that was defended by Rick Perr and Monica Littman of Kaufman Dolowich, a New Jersey appeals court has affirmed a lower court’s ruling denying a consumer’s motion to vacate a default judgment years after it was satisfied, disagreeing with the consumer’s allegation that the debt was void because previous owners of the debt were not licensed lenders in New Jersey.

Colorado Sued Over Medical Debt Credit Reporting Ban

ACA International and Creditors Bureau USA yesterday filed a lawsuit challenging Colorado’s medical debt credit reporting law on the grounds that it is preempted by the Fair Credit Reporting Act. The suit was filed days after the Consumer Financial Protection Bureau formally withdrew guidance and stated that the FCRA preempts state laws governing credit reporting.

Household Debt Climbs, But Liquidity Cushion Still Looks Solid

Total household debt rose to $18.59 trillion in the third quarter of 2025, according to data released yesterday by the Federal Reserve Bank of New York and WalletHub. On a per-household basis, balances reached $154,152, still $13,466 below the real-term peak. Liquidity metrics remain a relative bright spot: the debt-to-deposits ratio is 23% better than its historical average, and debt-to-assets sits at 9.36%, 24% better than long-run norms. For credit & collections leaders, that combination means capacity to repay remains, for the most part, intact, even as strain concentrates in specific products and consumer segments.

WORTH NOTING: A lot more consumers are worried about having enough money for holiday gifts this year ... 20 different tools to help you add intelligence to business processes ... A meal prep influencer shares his favorite cooking hacks ... Not quite sure what he was thinking when he did this ... Which prescription drugs are the most expensive for consumers to buy ... The "one-hour rule" can become your new secret weapon for growth ... A look at the most popular baby names for 2025 so far ... Why you should act your age when it comes to exercising.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: Legal Operations Efficiency Best Practices

In a recent webinar hosted by Mike Gibb of AccountsRecovery.net and sponsored by the Haws Group, industry experts explored how legal teams and collection law firms can streamline operations without compromising compliance or quality. Panelists Jeff Pappas of Absolute Resolution, Zabrina Shepherd of Southwood Financial, and Scott Walterbach of Walterbach Law Firm discussed what efficiency truly means in legal collections—and how firms can achieve it.

The panel agreed that efficiency isn’t just about working faster or cutting costs. As Shepherd noted, “Efficiency isn’t always just faster—it’s staying within those guardrails.” The discussion emphasized aligning the right people with the right tasks, using automation to remove repetitive work, and ensuring that compliance remains at the heart of every process. Automation, they said, should “eliminate repetition, not judgment.”

Communication emerged as a recurring challenge across the industry. The panelists called for integrated systems and data-sharing tools that reduce email overload and improve collaboration between clients, firms, and internal teams. “Clients think they want it fast,” Walterbach remarked, “but what they really want is it done right.” The experts also highlighted the growing need to analyze operational data—tracking placement timelines, judgment yields, and recovery rates—to identify bottlenecks and optimize performance.

Despite resource constraints, the panel stressed that cutting costs in compliance, technology, or experienced staff can backfire, weakening the very foundation of efficiency. Instead, legal teams should invest in tools, data integration, and training to achieve sustainable improvement.

🧠 Key Takeaways:

Automate wisely: Focus on automating repetitive tasks while maintaining human oversight for judgment-based decisions.

Invest strategically: Don’t sacrifice compliance, technology, or senior expertise when budgets tighten.

Improve communication: Use integrated systems and real-time data exchange to reduce inefficiencies and boost collaboration.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN