- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 5, 2025

Daily Digest - November 5, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to Kami Traasdahl of Credit One Bank, Toni Ramseyer of Specified Credit Association Inc., and Martin Sher of AmSher Receivables Management.

📝 Quick Notes

📖 Interested in joining a book club to discuss this book? Let me know.

Judge Finds Factual Disputes in Air Ambulance Billing Collection Case

A District Court judge in Texas has denied a defendant’s motion for summary judgment in a Fair Credit Reporting Act and Fair Debt Collection Practices Act case over the portion of a medical debt that was not paid by the plaintiff’s health insurance when his daughter needed to be transported to a hospital via an air ambulance, but did dismiss one of the claims on the grounds the plaintiff lacks standing because he opened a Model Validation Notice that was inadvertently sent to his ex-wife at his address.

A MESSAGE FROM TCN

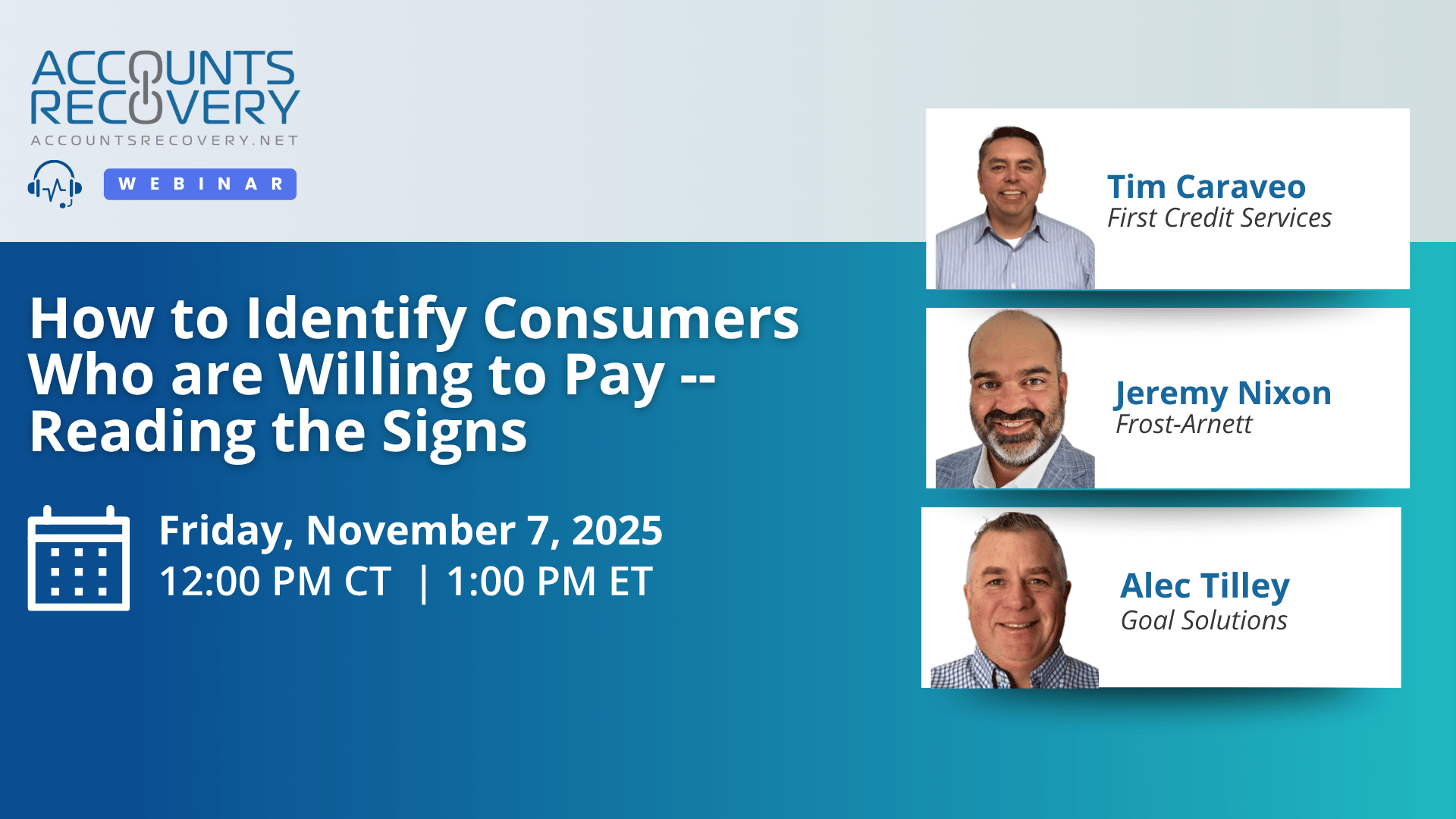

TODAY‘S WEBINAR

UPCOMING WEBINARS

PRA Group Reports 3Q Loss Amid Strong Collections and Cost Reductions

PRA Group reported a $408 million net loss for the third quarter of 2025, driven by a $413 million noncash goodwill impairment related to historical European acquisitions. Despite the headline loss, the company showed signs of operational strength, including higher legal collections here in the U.S., reduced leverage, and improved efficiency.The company also announced it is opening a second talent hub in 2026 to strengthen its analytics and technology departments.

Middle-Class Americans Are Stretched Thin But Still Saving for Retirement, Survey Finds

Despite economic uncertainty, rising debt, and caregiving demands, America’s middle class remains committed to saving for the future, according to the 25th Annual Transamerica Retirement Survey: Retirement Throughout the Ages. The study of more than 5,600 adults with household incomes between $50,000 and $199,999 paints a complex picture of how consumers are managing competing priorities, such as balancing debt, savings, and health in an economy reshaped by inflation and artificial intelligence.

36 Companies Seeking Collection Talent

This might mark the first time, or one of the first times, where I have seen someone actively hiring digital collectors. Want to see what they are looking for? Check out that job and more than three dozen others in this week's job listings summary.

WORTH NOTING: Google's AI agent will now let you make reservations and appointments ... Performance reviews are being overhauled, which is good news for employees ... The places where people like to chill most in their homes ... Five takeaways from last night's election results, which went really well for Democrats ... When you are as rich as Tom Brady is, you can clone your dog ... Hooters is making a comeback ... The two things that help make athletes mentally tough ... The five phrases that emotionally intelligent people use to strengthen relationships.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: You Sent a Link - Now What? The Real Economics of Digital Payments

In a recent webinar titled “You Sent a Link—Now What? The Real Economics of Digital Payments,” industry leaders tackled a question many agencies face: what happens after a consumer receives a payment link? Sponsored by Tratta, the discussion featured insights from Josh Allen (Tratta), Jon Balon (Williams & Fudge), John Erickson (Credit Service International), and Amruta Joshi (Atlantix), with moderation by Mike Gibb of AccountsRecovery.net.

The panel explored the full “post-click” journey—how to turn link clicks into completed payments, reduce friction in the process, and use data analytics to guide future engagement strategies. According to Amruta Joshi, conversion rates for digital-first organizations should reach 70–80% if payment experiences are truly seamless. Jon Balon stressed that trust is the biggest driver of success, saying that personalized URLs and recognizable account details can significantly boost conversions. Josh Allen added that success often comes from small, consistent refinements, remarking, “You can flip ‘death by a thousand cuts’ into ‘success by a million tweaks.’”

Panelists agreed that every digital interaction—whether a click, a login, or an opt-out—produces valuable data. The key is using that data intelligently to trigger timely follow-ups and personalize the payment experience without compromising compliance or consumer comfort.

🧠 Key Takeaways:

Simplify the path to payment. Minimize friction by reducing unnecessary steps and offering diverse payment options, from ACH to mobile wallets.

Let data drive your next move. Track engagement across every channel, then use A/B testing and behavioral insights to optimize timing, messaging, and follow-ups.

Build trust through transparency. Personalization should reinforce legitimacy and confidence, not cross privacy boundaries—data should serve consumers, not surprise them.

The panel’s conclusion was clear: the real economics of digital payments aren’t just about sending links—they’re about turning insights into action.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN