- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 3, 2025

Daily Digest - November 3, 2025

Brought to you by: TCN | By Mike Gibb

🎉Happy Birthday to: Danielle Hart of Shellpoint Mortgage Servicing and Ashley Campanella of Arbeit. Happy belated Birthday to: Jon R. Lunn of SouthStar Capital (Nov. 2), Ashley Mosier of EverChain (Nov. 2), Christina Elliott of Synchrony (Nov. 1), Mike Blatteau of Reprise Financial (Nov. 1), Hailey Boyer of Legal Stream (Nov. 1), Benjamin Harold Wright of Zwicker & Associates (Nov. 1), Matthew P. Zeller of Navy Federal Credit Union (Nov. 1), Heather Kennedy of CIG Financial (Nov. 1), and John Brown of Creditor Advocates (Nov. 1).

🎉 Congratulations for starting new positions: Michael Cook as Vice President, Legal & Compliance at Advance Financial, and Zac Robinson as Senior Vice President, Sales & Marketing at Ascendant.

📝 Quick Notes

📖 Interested in joining a book club to discuss this book? Let me know.

Court Dismisses Consumer’s FDCPA and FCRA Claims Over Debt Validation and Reporting

A District Court judge in Illinois has granted a defendant’s motion for summary judgment after it was accused of violating five different laws including the Fair Credit Reporting Act and the Fair Debt Collection Practices Act over how it handled the tear-off portion of the Model Validation Notice and a subsequent dispute from the plaintiff.

A MESSAGE FROM TCN

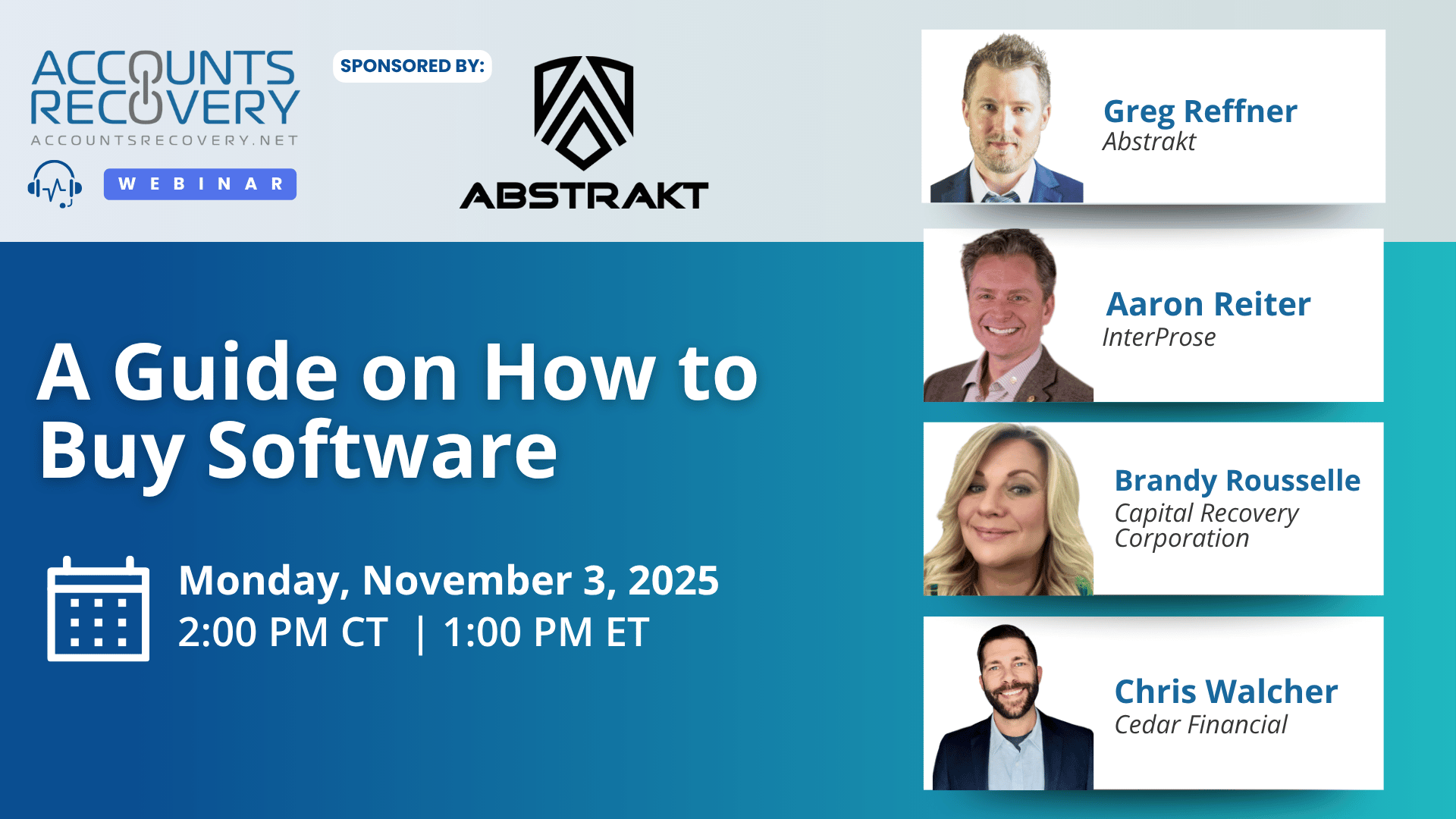

TODAY‘S WEBINARS

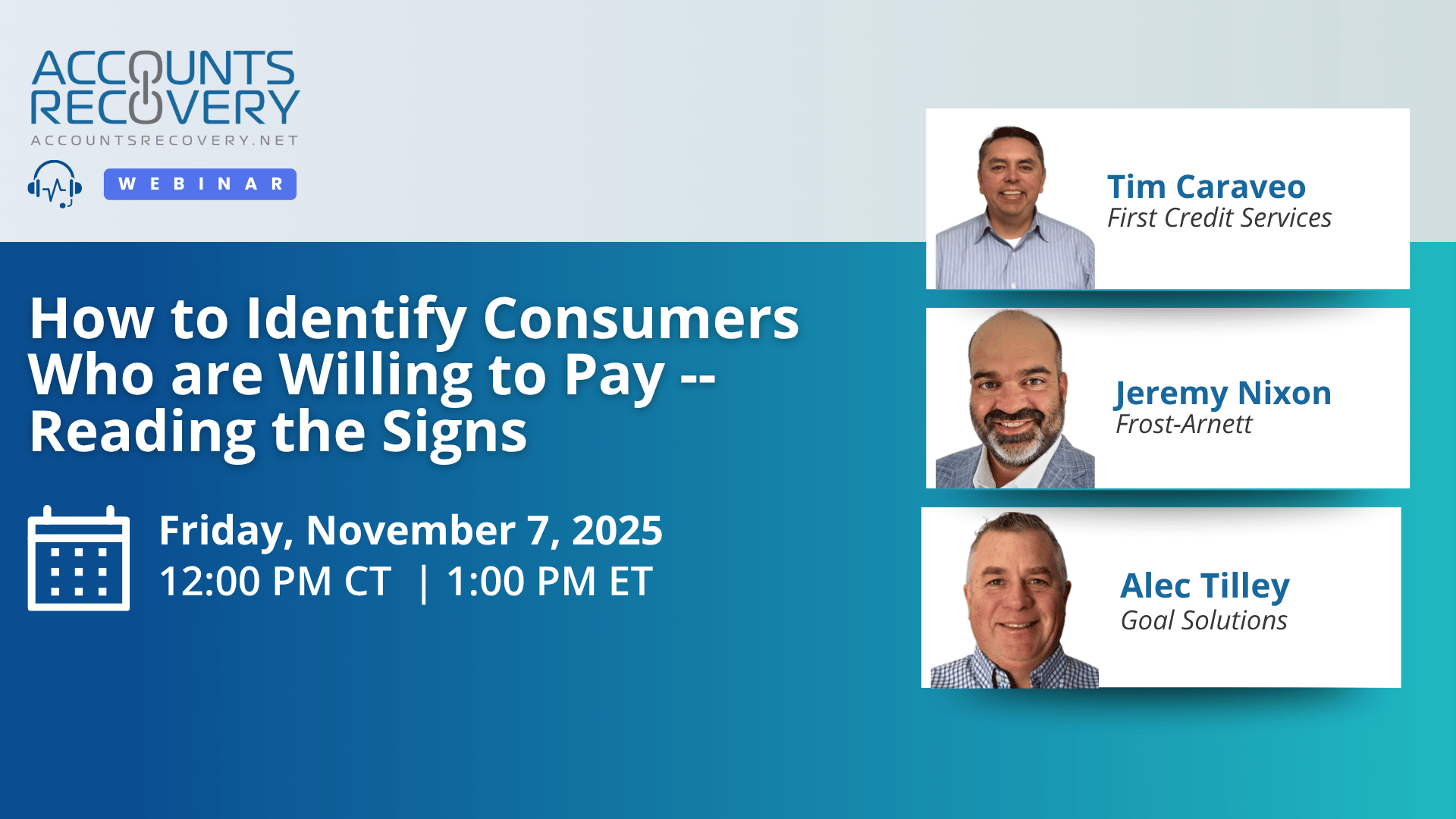

UPCOMING WEBINARS

Lawsuit Claims Ed. Dept., CRAs ‘Weaponized’ Credit Reporting

The former head of the Department of Education’s student loan portfolio during President Trump’s first term is behind a class-action lawsuit that was filed last week accusing the department and the three major credit reporting agencies of violating the Fair Credit Reporting Act for allegedly forcing student loan borrowers into default by inaccurately furnishing information about the debts.

Voters Agree: Healthcare Costs Are Driving Medical Debt, And They Want States To Act

A new national study sponsored by Undue Medical Debt paints a clear picture for revenue cycle leaders and collections professionals: healthcare is widely viewed as unaffordable, medical debt is common, and voters across party lines support stronger state protections.

Compliance Digest – November 3

Two new bills, one new piece of guidance, and a handful of rulings in court cases — all for you to digest and understand. Thanks to experts like Loraine Lyons, James Schultz, Lori Quinn, Kim Phan, Jessica Klander, and Chad Echols, you can learn exactly what you need to know in this week’s Compliance Digest.

This series is sponsored by Bedard Law Group

WORTH NOTING: One rule for how to evaluate hardware that is backed by artificial intelligence ... In honor of Veterans Day, which is coming up next week, a look at how people feel about military personal finance perks ... Why companies are no longer holding onto employees because they worry about not being able to get them back later ... The old-fashioned landline telephone is making a comeback ... It's that time of year (I saw some up already over the weekend) -- the best Christmas lights ... How to sync your health habits to your internal body clock ... The return-to-office push is gaining steam thanks to an unlikely ally ... Why some people have better jobs than others.

Music Monday, part I

Music Monday, Part II

Webinar Recap: How to Teach Collectors to be Good Communicators

Effective communication remains one of the most critical—and challenging—skills for collectors to master. In this webinar, hosted by AccountsRecovery.net and sponsored by CSS Impact, a panel of experts—Gwen Gullickson (Century Credit), Bill Marohn (Tobin & Marohn LLP), and Jennifer Peck (The Stark Agency)—shared practical strategies for helping collectors become more confident, empathetic, and effective communicators.

The panel agreed that successful collection calls depend on more than scripts or talk-offs—they require genuine understanding, adaptability, and empathy. “You can follow the rules and still be your own person,” Gullickson emphasized, urging trainers to teach the why behind compliance rather than enforcing robotic phrasing. Peck added that over-scripting new collectors can “freeze” them, preventing natural conversation and causing missed opportunities.

The speakers also discussed the importance of continual feedback and reflection. Gullickson recommended ongoing call reviews and self-assessments, comparing them to “game tape” that helps agents spot missed cues. Marohn noted that letting silence work in conversations—rather than rushing to respond—often builds trust and leads to better outcomes.

Technology’s role in communication training was also explored. Ryder Thompson of CSS Impact showcased how AI-powered coaching tools can analyze sentiment and suggest tone adjustments in real time, helping new collectors learn faster while maintaining compliance.

Ultimately, the panelists agreed that empathy and adaptability are the cornerstones of effective communication. As Marohn summarized, “You’re only one or two life circumstances away from being on the other side of that phone call.”

🧠 Key Takeaways:

Move beyond rigid scripting—teach collectors context, intent, and adaptability.

Use regular call reviews and AI tools for immediate feedback and improvement.

Prioritize empathy, active listening, and tone to build trust and long-term success.

The Daily Digest is sponsored by TCN