- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 26, 2025

Daily Digest - November 26, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Danielle McCarthy of January, Anna Sharpe of Armstrong & Associates, and Sean Hale of iServe Residential Lending.

🎉Congratulations for starting a new position: Deven Naicker as Head of Operations at Connect BPS.

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Judge Tosses FDCPA Suit Over $25 Autopay Dispute

A District Court judge in Minnesota has granted a defendant’s motion to dismiss claims that a pair of creditors violated the Fair Debt Collection Practices Act, which in and of itself isn’t that ground-breaking, but the demands that were made by the plaintiff and how he attempted to convince the judge that the defendants should be subject to the statute make this a more interesting case.

A MESSAGE FROM TCN

TODAY‘S WEBINAR

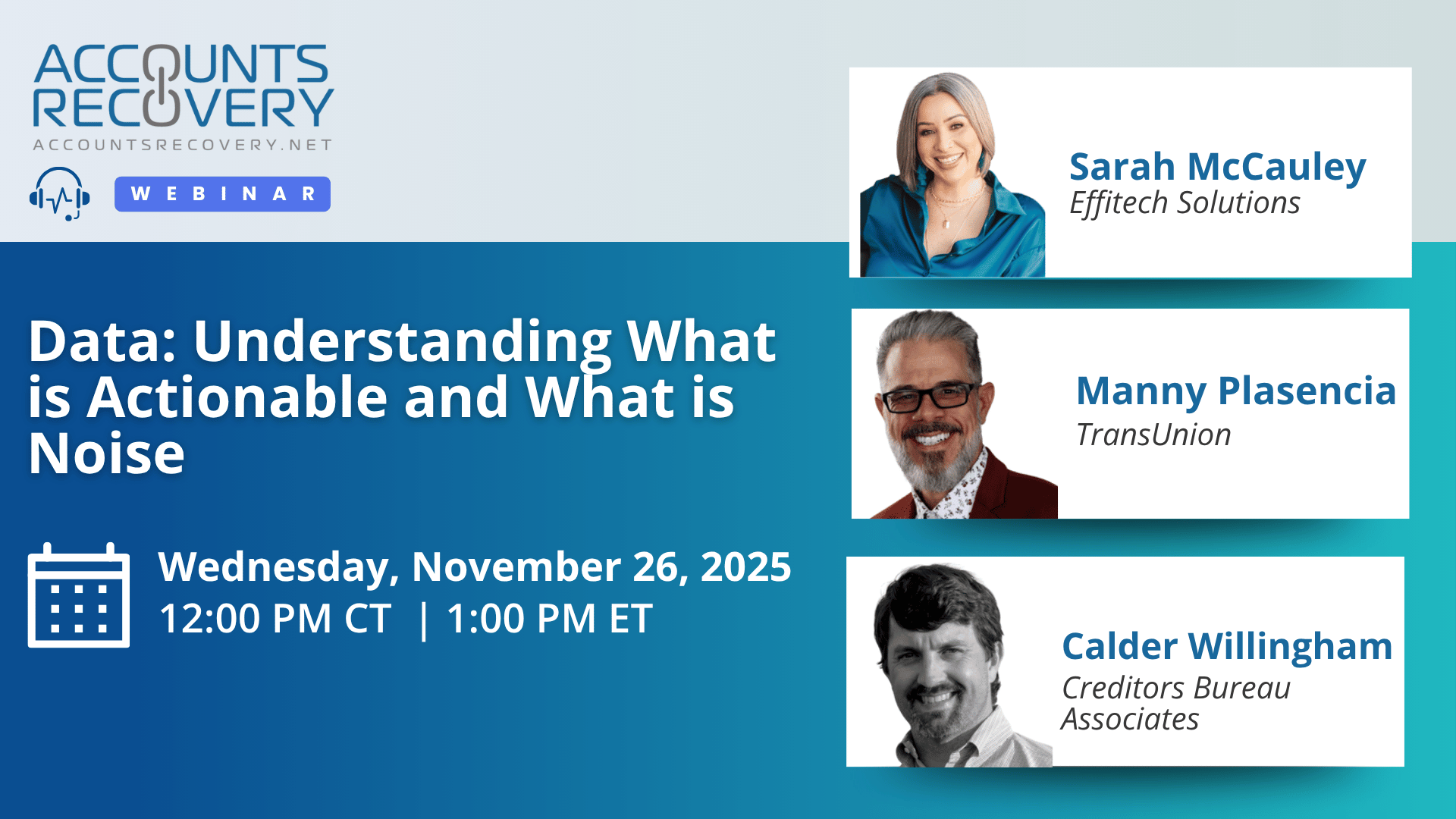

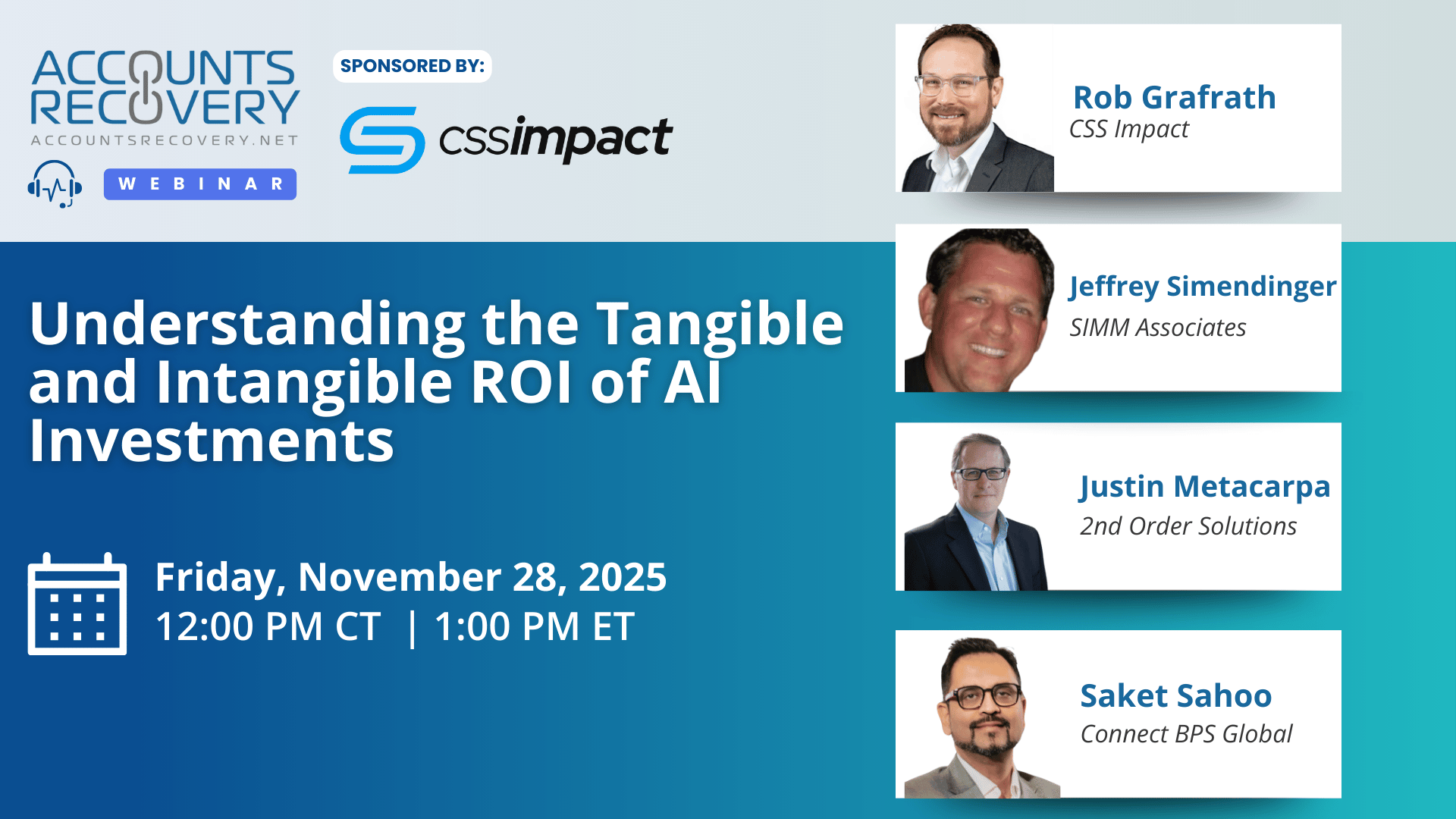

UPCOMING WEBINARS

Bankruptcy Filings Jump 11% Nationwide as Economic Pressures Mount

Bankruptcy activity across the United States continues to climb, with new data from the Administrative Office of the U.S. Courts showing a 10.6% increase in personal and business filings for the 12-month period ending September 30, 2025. While the total number of filings remains well below historic highs, the steady rise signals continued financial pressure on both consumers and businesses; a trend that professionals across the credit and collection industry are watching closely.

Plaintiff’s Attempt to Return FCRA Case to State Court Denied

A District Court judge in Indiana has denied a plaintiff’s motion to remand a Fair Credit Reporting Act case back to state court, ruling the plaintiff has standing for the case to be tried in federal court.

Senate Dems Warn CFPB Cybersecurity Has Deteriorated Amid Efforts to Dismantle the Agency

Senate Democrats are raising alarms about what they call a dangerous erosion of the Consumer Financial Protection Bureau’s ability to safeguard consumer data, pointing directly at actions taken by Acting Director Russell Vought and the Trump administration.

43 Companies Seeking Collection Talent

The year may be winding down, but the industry job market remains hot. Check out this week’s job listings summary for opportunities from Resurgent Capital Services, OneMain Financial, Harris & Harris, and more.

WORTH NOTING: A list of binge-worthy podcasts to help you get through the holidays ... How to enjoy all the holiday food without gaining weight, according to one expert ... The top 100 photos of 2025 ... Growing number of Americans are living paycheck to paycheck ... A lot of Americans are ignoring advice to help maximize their Social Security benefits ... Which state has the worst roads? ... How to be the right kind of thought leader ... How turning down clients might be your best growth strategy.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: How to Put Robotic Process Automation and Agentic AI to Work for You

In the webinar “How to Put Robotic Process Automation and Agentic AI to Work for You,” sponsored by the Hawes Group, industry experts explored how automation is transforming every layer of the credit and collections ecosystem. Panelists emphasized that automation is no longer experimental—it is operational, producing measurable gains in speed, accuracy, compliance, and margins.

The discussion opened with a clear distinction between traditional RPA and emerging agentic AI. RPA excels at rules-based, structured tasks, while agentic AI can interpret nuance, understand goals, and adapt in real time. Together, the two technologies create powerful systems capable of handling both predictable workflow tasks and dynamic decision-making.

Panelists highlighted that the highest ROI typically appears in middle- and back-office functions—payment posting, disputes, reporting, document processing, and data preparation. These areas offer predictable, repeatable workflows that can be automated safely before organizations expand into consumer-facing use cases like virtual agents and conversational AI.

Compliance and risk were central themes. Experts noted that large “black box” language models may not meet regulatory standards, making small, transparent language models a more suitable option for collections. Guardrails such as confidence thresholds, preapproved response libraries, and human-in-the-loop oversight are critical for safe deployment.

Across the conversation, panelists repeatedly reinforced the need to start small, document internal processes, and choose automation based on specific business problems—not hype. As one panelist put it, inconsistency in human-led processes is one of the biggest operational risks, and automation is uniquely positioned to solve it.

🧠 Key Takeaways:

Start in the Middle and Back Office

Begin your automation journey with structured workflows like payment posting, reporting, or dispute handling, where ROI is fastest and compliance risk is lowest.Document Everything

Clear, updated policies and work instructions are essential—AI cannot follow instructions that don’t exist.Use Guardrails for Compliance

Employ small language models, confidence thresholds, and preapproved outcomes to ensure accuracy, auditability, and regulatory alignment.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN