- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 25, 2025

Daily Digest - November 25, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Tom Murtha of Portfolio Recovery Associates, Jeremy Alcantar of Credit One Bank, Alan Zeppenfeld of Zenith Small Business Advisory, David Saxton of North American Recovery, and Terry Glidden of The Intelitech Group.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Christopher Nye from Radius Global Solutions shares how collectors should respond when a consumer keeps interrupting. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Collection Law Firm, Debt Buyer Facing FDCPA Class Action Over MVN Issues

A collection law firm and debt buyer are facing a class-action lawsuit in Georgia federal court accusing them of violating the Fair Debt Collection Practices Act over issues in a Model Validation Notice that was sent to an attorney who was purportedly not representing the plaintiff.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY‘S WEBINAR

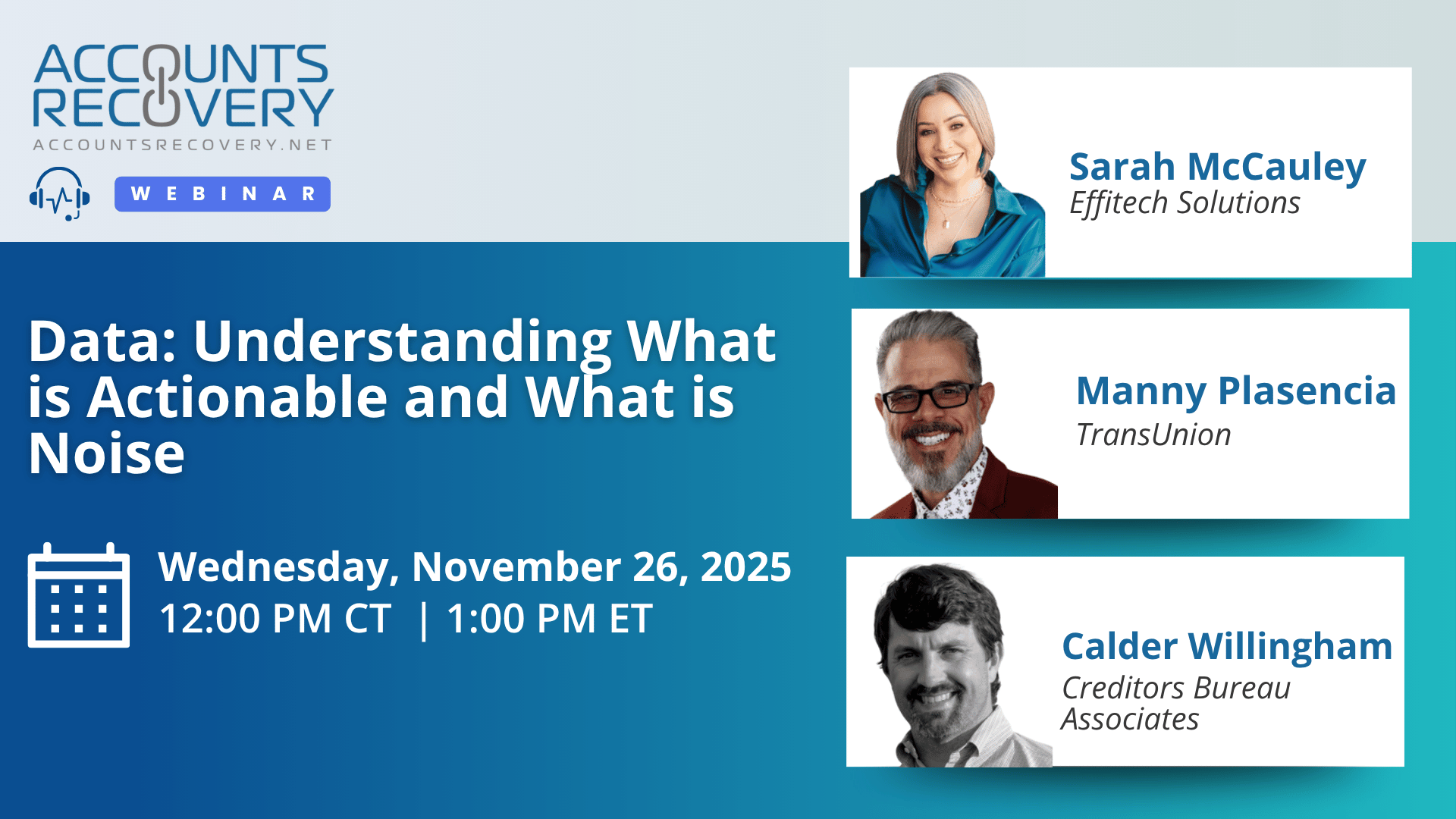

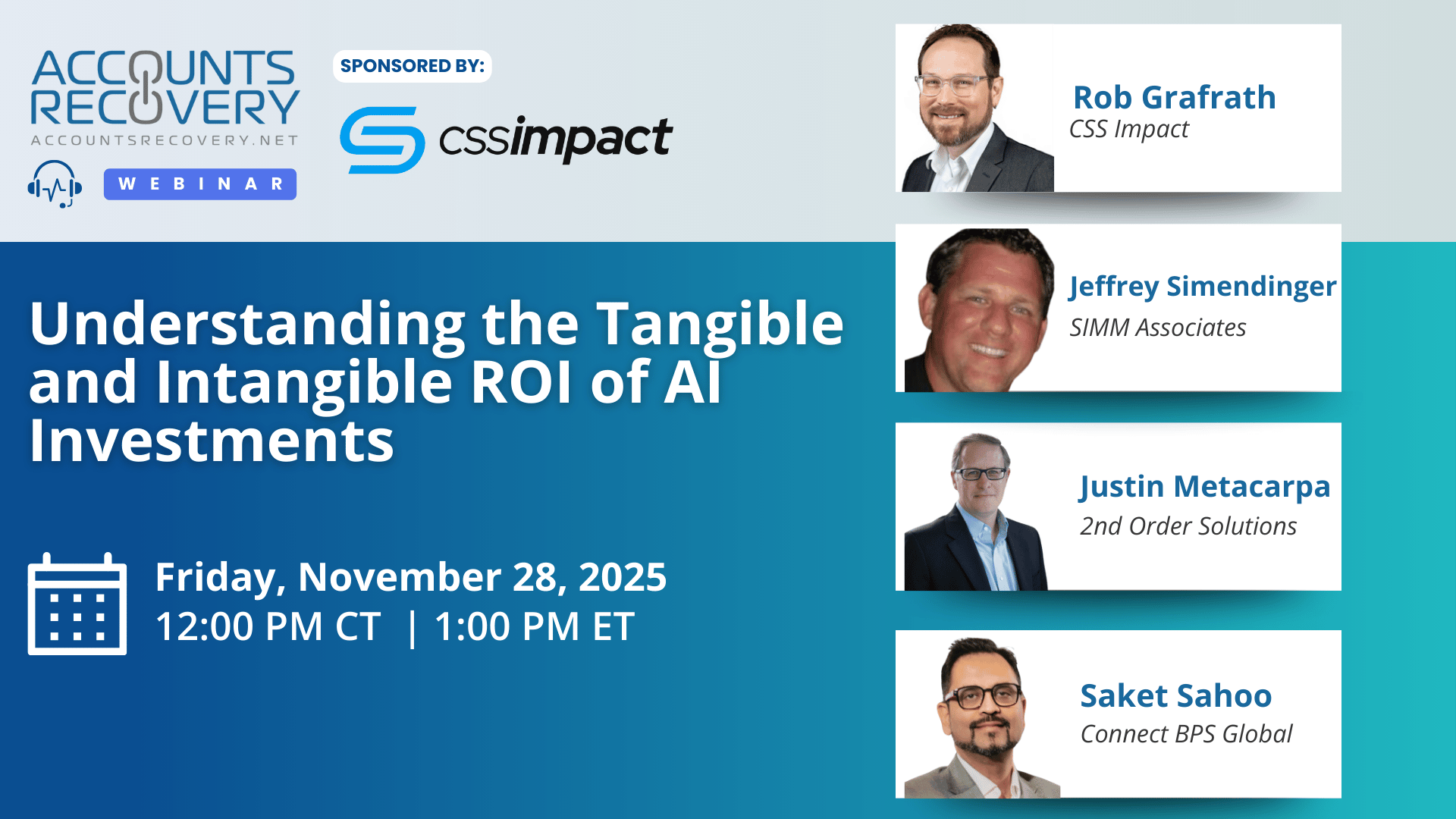

UPCOMING WEBINARS

Comcast Hit With $1.5M Fine After Debt Collection Vendor Breach

The Federal Communications Commission has fined Comcast $1.5 million following a data breach at Financial Business and Consumer Solutions (FBCS), a former debt collection vendor, that exposed sensitive information from 237,703 current and former Comcast customers. The breach occurred in early 2024, long after Comcast stopped placing accounts with the agency, but still involved customer data the vendor retained.

NY Appeals Court Overturns Denial of MTD in FDCPA Case

A New York state Appeals Court has reversed a lower court’s ruling, denying a defendant’s motion to dismiss a Fair Debt Collection Practices Act case, ruling the motion should have been granted because the plaintiff lacked standing to file the lawsuit in the first place.

Minnesota Appeals Court Clarifies What Counts as Debt Collection in the State

A Minnesota appeals court has affirmed a lower court’s ruling that seeks to define debt collection in the state and the circumstances under which an entity must be licensed to collect in Minnesota. The decision reinforces a broad interpretation of what activity constitutes debt collection and when out-of-state companies fall under Minnesota’s licensing requirements.

Illinois Supreme Court Reverses Class Certification in FACTA/FCRA Case

The Illinois Supreme Court has overturned rulings from two lower courts that granted class certification in a Fair Credit Reporting Act case involving the printing of more than the last five digits of a debit card number on a receipt provided to a consumer.

WORTH NOTING: Reaction to the CFPB's new humility pledge that examiners will have to read before beginning a review of a company ... Fintech Green Dot is splitting into two separate companies ... Rising Medicare premiums are going to eat into retirees' Social Security checks next year ... For people who like to give up and admit defeat, this is for you ... The rise of "fail watching" and why it might not be a good thing for your office ... If you haven't replied to one of my emails yet, and you start getting a lot more, this is why ... Strategies to help catch up if you are late to the retirement savings game ... The dirty secret of America's holiday shopping season.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: Managing Your Client's Reputation

Protecting a client’s reputation has become one of the most important responsibilities for collection agencies, law firms, and service providers. In this webinar sponsored by Connect International, a panel of industry leaders discussed how every consumer interaction now shapes the public identity of the creditor—whether that creditor is a bank, credit union, healthcare provider, fintech, or debt buyer.

Panelists emphasized that reputational risk is no longer a compliance box to check; it is a competitive differentiator. One speaker noted, “Protecting a client’s reputation is no longer just a compliance issue. It’s a competitive advantage.” From highly sensitive credit union member interactions to rural hospital collections where “everyone knows everyone,” understanding each client’s culture and goals is essential.

Speakers shared how prescriptive some clients have become regarding tone, language, payment-plan parameters, and dispute handling, while others rely heavily on agencies to guide best practices. The consensus: transparency, consistency, and empathy are non-negotiable. As one panelist put it, “A collector having a bad day is not acceptable.”

The webinar also covered crisis-management planning, addressing errors such as incorrect letter batches, and the need to proactively communicate issues before they escalate. Training, QA monitoring, and data tools—such as speech analytics—play a major role in identifying risk signals early.

Finally, panelists encouraged agencies to educate clients on consumer communication preferences and industry trends, especially when outdated client policies may unintentionally harm consumer experience or brand perception.

🧠 Key Takeaways:

Build Client-Specific Reputation Playbooks

Define expectations, escalation paths, and communication standards for each client. Reputation protection varies significantly by industry segment.

Strengthen Training, QA, and Monitoring

Consistent tone and empathy across all interactions prevent complaints and support brand integrity.

Communicate Early, Often, and with Data

Proactively alert clients to risks or issues and use analytics to guide best practices—especially around consumer-preferred communication channels.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN