- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 24, 2025

Daily Digest - November 24, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Steve Stone from CopperPoint Insurance Companies, Marissa Bowes of Burns National, and Stan Wendt of Professional Bureau of Collections of Maryland. Happy belated Birthday to: Mindy Boeve of Huntington National Bank (Nov. 23), Diana Cooper of Citizens (Nov. 23), Melody Sasser of SWC Group (Nov. 23).

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Judge Sanctions Plaintiff’s Counsel for Prolonging FDCPA Case

A District Court judge in Michigan has partially granted a defendant’s motion for sanctions against the counsel representing the plaintiff in a Fair Debt Collection Practices Act case for refusing to dismiss the complaint after being supplied with enough information to show that the claims were meritless.

A MESSAGE FROM TCN

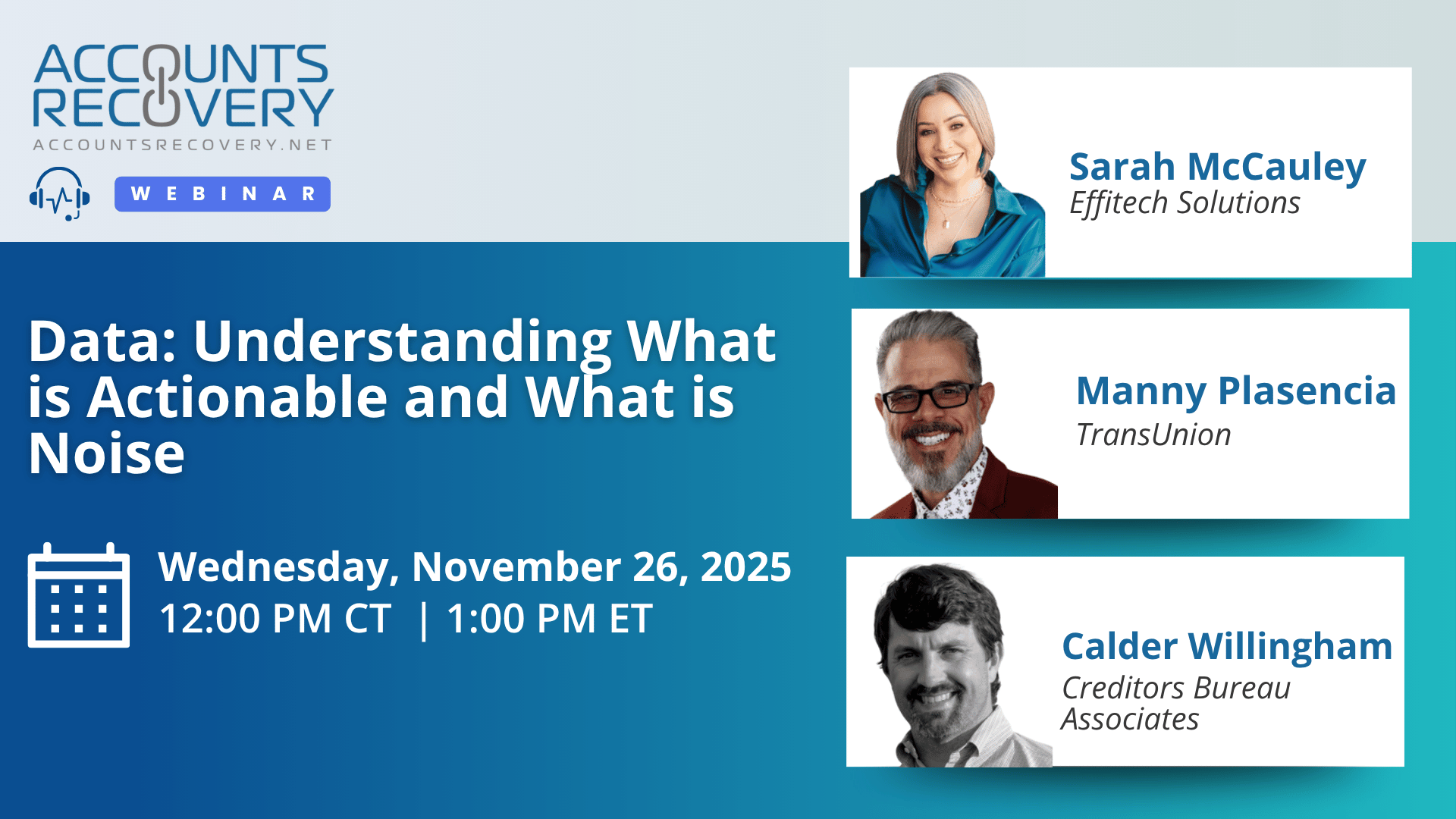

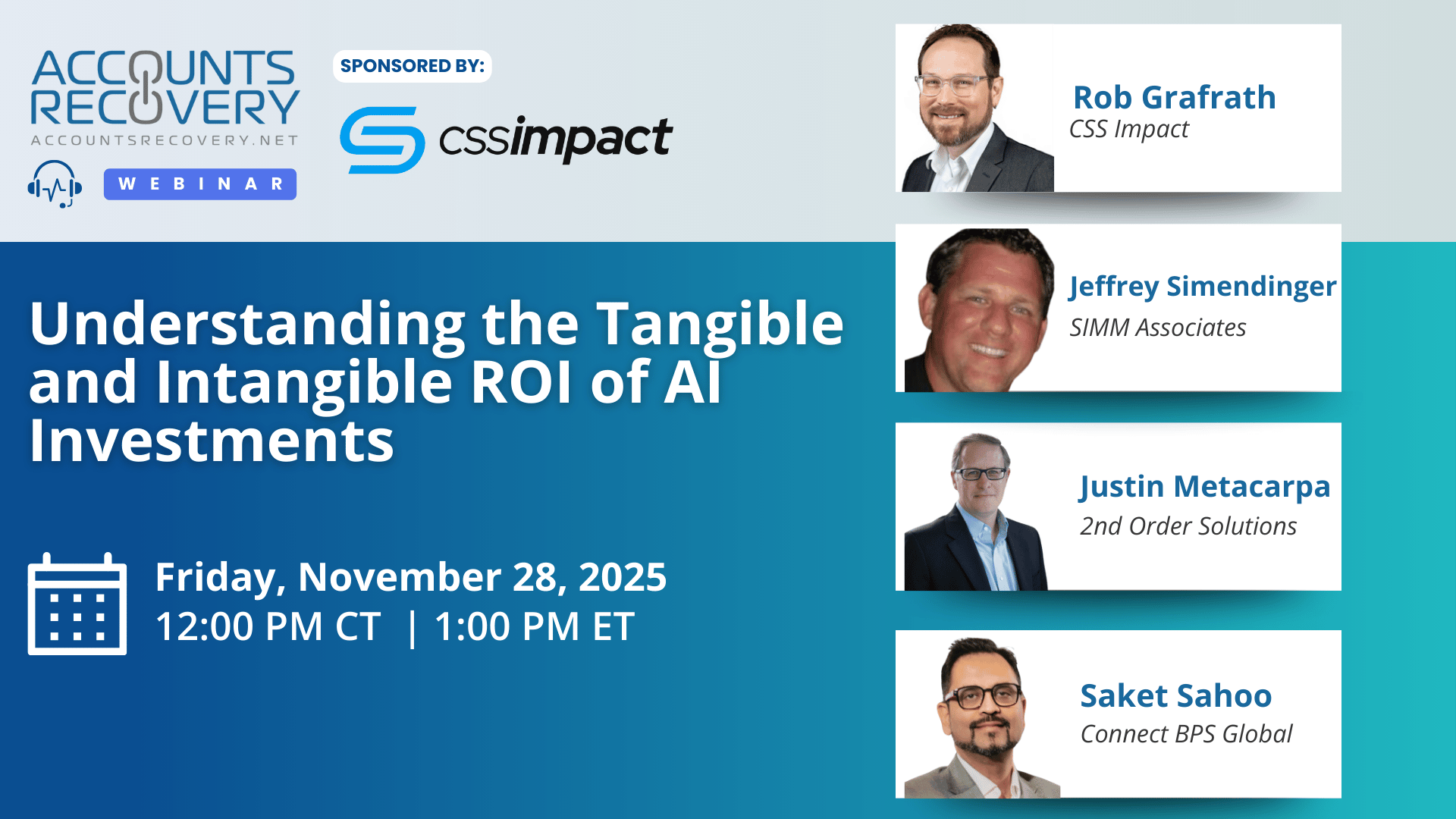

TODAY‘S WEBINAR

UPCOMING WEBINARS

CFPB Roundup: Union Pushes Court for Clarity, Bureau Issues Humility Pledge, MoneyLion Case Resolved

It wasn’t a quiet weekend at the Consumer Financial Protection Bureau. The union suing the Bureau wants to clarify the Bureau’s position about its funding, examiners will now have to read a “humility in supervisions” pledge at the start of each exam, and the CFPB finalized a settlement with a military lending operation.

Bill Introduced to Reinstate Chevron Deference

As the regulatory landscape continues to shift after the Supreme Court’s decision to overturn Chevron deference, a new bill introduced by Rep. Pramila Jayapal [D-Wash.] and Sen. Elizabeth Warren [D-Mass.] aims to dramatically reshape the rulemaking process. The proposal, called the EXPERTS Act, directly targets the balance of power between federal agencies, courts, and private industry.

Judge: Charged Off Status Was Accurate Despite Repayment Plans

A District Court judge in California has granted a defendant’s motion for summary judgment in a Fair Credit Reporting Act and California Consumer Credit Reporting Agencies Act case, finding that the defendant accurately reported two loans as charged off and that the plaintiff failed to establish any inaccuracy in the reporting.

Compliance Digest – November 24

Insights from attorneys that you don’t have to pay for … is there a better kind of legal advice? In all seriousness, thanks to Akeela White, Chuck Dodge, David Grassi, Michael Poncin, James Sandy, Virginia Bell Flynn, and Dale Golden for sharing their insights into recent rulings and compliance developments.

This series is sponsored by Bedard Law Group

WORTH NOTING: The Consumer Financial Protection Bureau is hosting a Consumer Advisory Board meeting in December ... What it's like to be on a test run for a new cruise ship ... Lawmakers aren't yet ready to move to a cashless society ... The Department of Government Efficiency has essentially been disbanded, according to published reports ... Childcare is now officially the biggest line item in a family's monthly expenses ... A debate raging in our house, as well as houses across the country: when to put up the Christmas tree ... The average cost of a new car continues to hit record levels ... The impact that Black Friday sale shopping has on your brain.

Music Monday, part I

Music Monday, Part II

Webinar Recap: How to Walk Away From Each Consumer Engagement With a Win

In this webinar, industry experts explored how collectors can transform every consumer interaction—whether it results in a payment or not—into a measurable win. Moderator Mike Gibb opened the discussion by highlighting that every engagement shapes performance, compliance, and long-term outcomes. Panelists Mindy Chumbley, Dennis Barton, and Tabor Laws shared practical strategies for improving call quality, strengthening consumer relationships, and building more effective collection operations.

A central theme was redefining what a “win” truly means. Mindy emphasized that a win is simply “a clean call,” noting that even a payment can become a loss if it triggers compliance issues or consumer complaints. Dennis reinforced that progress often happens in small steps—gaining updated information, building rapport, or clarifying next steps all move the account forward. Tabor added that many consumers fear collection agencies, and educating them about their options often leads to higher engagement and better future outcomes.

Panelists also identified behaviors that undermine results, including lack of empathy, dismissiveness, and poor listening. They stressed the importance of emotional resilience, helping collectors quickly reset after difficult calls. Another major focus was the critical role of data management. Properly tagging wrong numbers, ceases, and disputes ensures resources aren’t wasted and prevents compliance risks down the road.

As the industry continues shifting toward digital engagement, the panel emphasized that texts, emails, and online portals require the same level of monitoring and care as phone calls. Digital channels can offer unique insights—and should be integrated into a unified strategy for defining and achieving wins.

🧠 Key Takeaways:

Redefine Wins Beyond Payments

Recognize and reward clean calls, updated data, consumer understanding, and consent capture—not just dollars collected.Use Probing Questions to Overcome Barriers

Asking “why?” uncovers financial realities and misunderstandings that can open the door to resolution.Strengthen Data Management After Every Call

Accurate tagging of ceases, wrong numbers, and disputes reduces waste, limits risk, and improves long-term results.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN