- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 21, 2025

Daily Digest - November 21, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Nathan Anderson of Alvaria and Debbie Rosen of Settlement Capital Corp.

🎉 Congratulations for starting new positions: Mike Pallotta as Asset Recovery Supervisor at AmeriCU Credit Union, and Lamar Nevels as Sr. Director of Collections-Specialized Services at Stellantis Financial Services US.

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Unhappy With Dispute Investigation Results Leads Consumer to File FCRA Suit Against Debt Buyer

The exotic, sovereign-citizen, you-threatened-to-have-me-arrested-after-calling-me-37-times-in-one-day-on-my-cell-phone-using-an-autodialer-after-I-revoked-consent cases can be fun to read. But the majority of suits that are filed against companies in the credit and collection industry aren’t that quirky. Most times, it’s a suit filed by a consumer who just didn’t get what he or she wanted. A debt buyer is facing claims it violated the Fair Credit Reporting Act because a consumer disputed a debt that he felt was inaccurate and the debt buyer verified the information was accurate.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

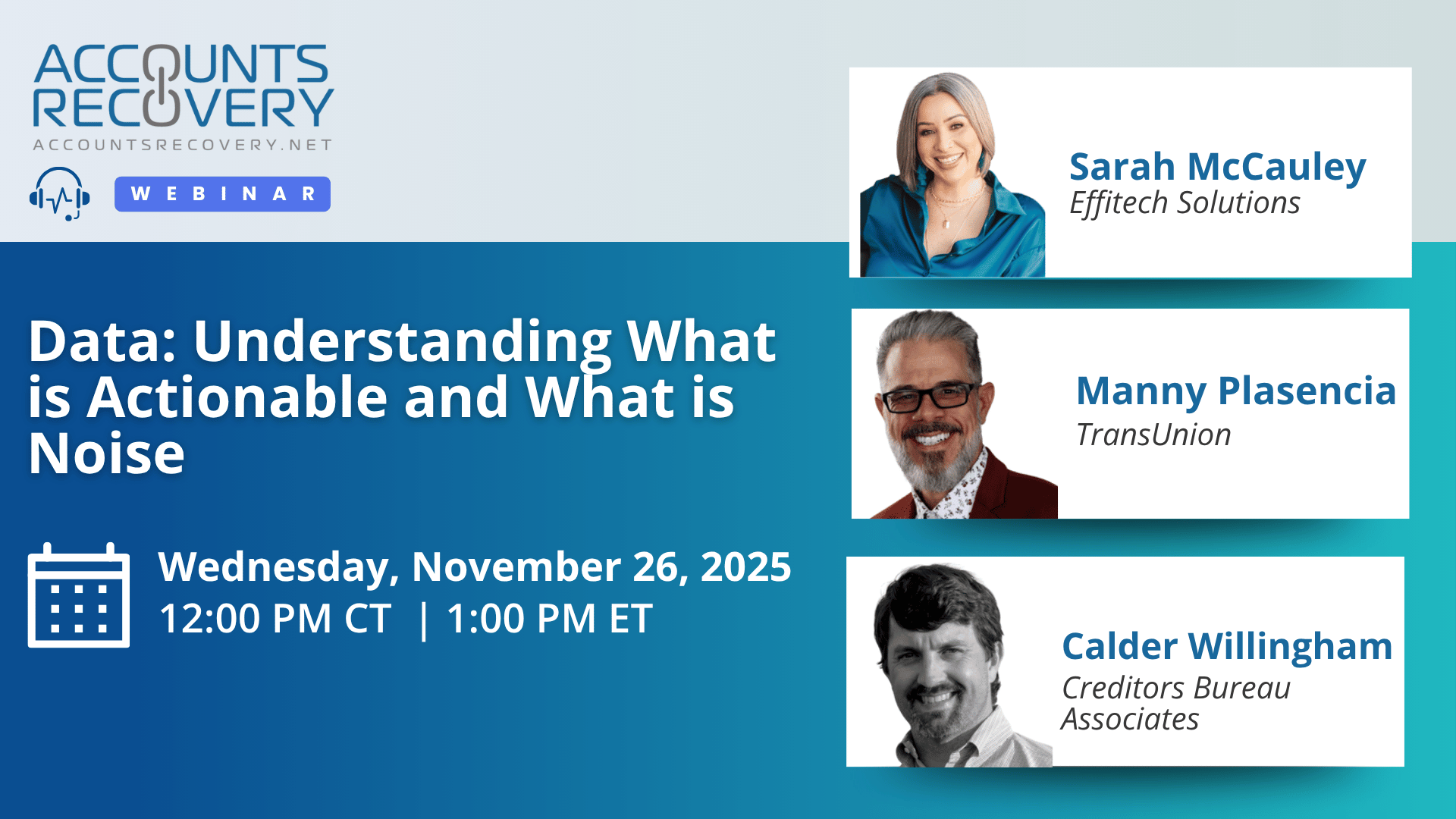

TODAY‘S WEBINAR

UPCOMING WEBINARS

With Money Running Out, CFPB Hands Off Enforcement Work to DOJ

The Consumer Financial Protection Bureau is preparing to transfer all remaining enforcement cases and regulatory litigation to the Department of Justice as it warns staff it will run out of money at the end of the year, according to multiple reports and individuals familiar with the agency’s plans.

Court Says FDCPA Claim Over Signing Bonus Can Proceed, Dismisses FCRA Claim

A District Court judge in Pennsylvania has partially dismissed a suit filed by a consumer alleging violations of the Fair Credit Reporting Act and Fair Debt Collection Practices Act over attempts to collect an employment signing bonus that was not fully repaid.

Minnesota Regulator Issues Enforcement Actions

State regulators in Minnesota have issued two separate enforcement actions against collection agencies — one for threatening lawsuits it did not intend to file, and another for collecting while unlicensed and misrepresenting its licensing status.

WORTH NOTING: More consumers are going to be relying on credit cards to make holiday purchases this year ... To combat that, here are some holiday shopping money-saving tips ... If you were looking for tips on how to spot whether something was written by AI, Wikipedia may have the best guide ... Nearly 60% of adults are using generative AI tools like ChatGPT to be more productive ... This might be a fun game to play around the Thanksgiving Day table next week: Guess who's stoned ... Only half of new jobs are offering employees health insurance, many of whom are willing to accept a lower salary for better healthcare ... Gift baskets are popular during the holidays. Here are some of the best options ... Here are some parent-approved tips for traveling with young children.

Funny Friday, part I

Funny Friday, Part II (NSFW language)

Webinar Recap: The Human Oversight Imperative: When AI Needs Guardrails

As artificial intelligence rapidly expands across collection operations, one message dominated this webinar: AI may accelerate productivity, but it cannot replace human judgment. Panelists Patrick Austin, Abby Hogan, and Alex Cox underscored how AI introduces new compliance risks, operational challenges, and oversight responsibilities—making a strong governance framework more important than ever.

The discussion opened with a core reality: AI systems analyze data, not context. While a collector can understand nuance, hardship, or intent, AI may misinterpret or mishandle consumer stories. The group emphasized that this gap makes “human-in-the-loop” systems essential—not as a bottleneck, but as a strategic checkpoint.

Panelists also warned that AI risks don’t stop at consumer-facing interactions. Internal errors such as data mix-ups, excessive permissions, or training models on inappropriate data can create serious privacy and financial consequences. Several noted examples of plaintiffs already targeting chatbots with creative legal theories, signaling that litigation risk is growing.

The regulatory landscape remains fragmented, but existing laws—UDAP/UDAAP, privacy statutes, Reg B adverse action requirements, and state-level rules—already give regulators authority to scrutinize AI deployments. The ability to explain how a model works is no longer optional.

The session closed with an important reminder: organizations should adopt AI gradually. Start with low-risk internal applications, rigorously test outputs, evaluate vendors, and build monitoring processes before moving into consumer-facing automation.

🧠 Key Takeaways:

Strengthen AI governance and vendor oversight. Ensure your vendors can clearly explain how their AI works, what data it uses, and how it manages risk. Avoid “black box” models.

Implement continuous monitoring for model drift and errors. AI systems degrade over time; organizations need monitoring tools, escalation paths, and contingency plans.

Adopt AI gradually through low-risk use cases. Test internally, attempt to “break” the system, and ensure compliance guardrails are in place before deploying consumer-facing automation.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN