- AccountsRecovery Daily Digest

- Posts

- Daily Digest - November 13, 2025

Daily Digest - November 13, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to John Marees of Messer Strickler Burnette, George Bresler of GB Collects, Rishabh Sharma of Equabli, Jen Jenkins of ClarityPay, Andrea Jaegerman of Mission Lane, Thomas Williams of Oliphant, and Jim Richards of Capio Partners.

📝 Quick Notes

📖 Interested in joining a book club to discuss this book? Let me know.

Getting to Know John Erickson of Credit Service International

John Erickson might just serve as the prototype for the modern renaissance man. Between his devotion to his faith, his love of dogs, sailing, and tennis, and his commitment to personal and professional growth, he’s the kind of person you either admire for his efforts or hate for how much he seems to have it all together. Read on to learn more about John, why he thinks complexity is a good thing for the credit and collection industry, and which dog breed is the best, in his opinion.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Court Backs Certification in Fee-Based Collection Letter Suit, Questions Adequacy of Representative

A New Jersey Appeals Court has affirmed the certification of a Fair Debt Collection Practices Act case over an alleged attempt to collect improper fees while remanding the case back to state court to determine whether the plaintiff is able to represent both of the suit’s subclasses.

Former CFPB Enforcement Leaders Launch New Strategic Litigation Project

Three former senior enforcement lawyers from the Consumer Financial Protection Bureau are taking on a new role in consumer advocacy. Eric Halperin, Cara Petersen, and Tara Mikkilineni have joined Protect Borrowers as senior fellows to launch a strategic enforcement project aimed at challenging what they describe as harmful corporate practices affecting workers, consumers, and small businesses.

CFPB Proposes Major Revisions to Small Business Lending Rule

The Consumer Financial Protection Bureau has released a new proposal to significantly revise its Section 1071 small business lending rule, aiming to reduce compliance burdens, narrow the scope of required data collection, and delay the start date for reporting. The move comes as the agency continues to face litigation over the 2023 rule and ongoing questions about its own long-term funding.

WORTH NOTING: Probably not a surprise to anybody, but a new study links poverty and indebtedness to an increase in the chances of somebody dying young ... I bet you didn't realize there was a difference among gift cards. Here is a list of the best ones ... Cash App has unveiled a new AI assistant that answers questions about your finances ... Definitely not my font style of choice, but thanks to AI, it's making a comeback. ... This will likely be considered sacrilege by some, but here is a list of 22 different replacements for the Thanksgiving turkey ... Did you know that today is World Kindness Day? ... A list of the 100 must-read books of 2025. ... You just learned the person who does the same job as you is making more money than you. What do you do next?

Top 10 Thursday, part I

Top 10 Thursday, Part II

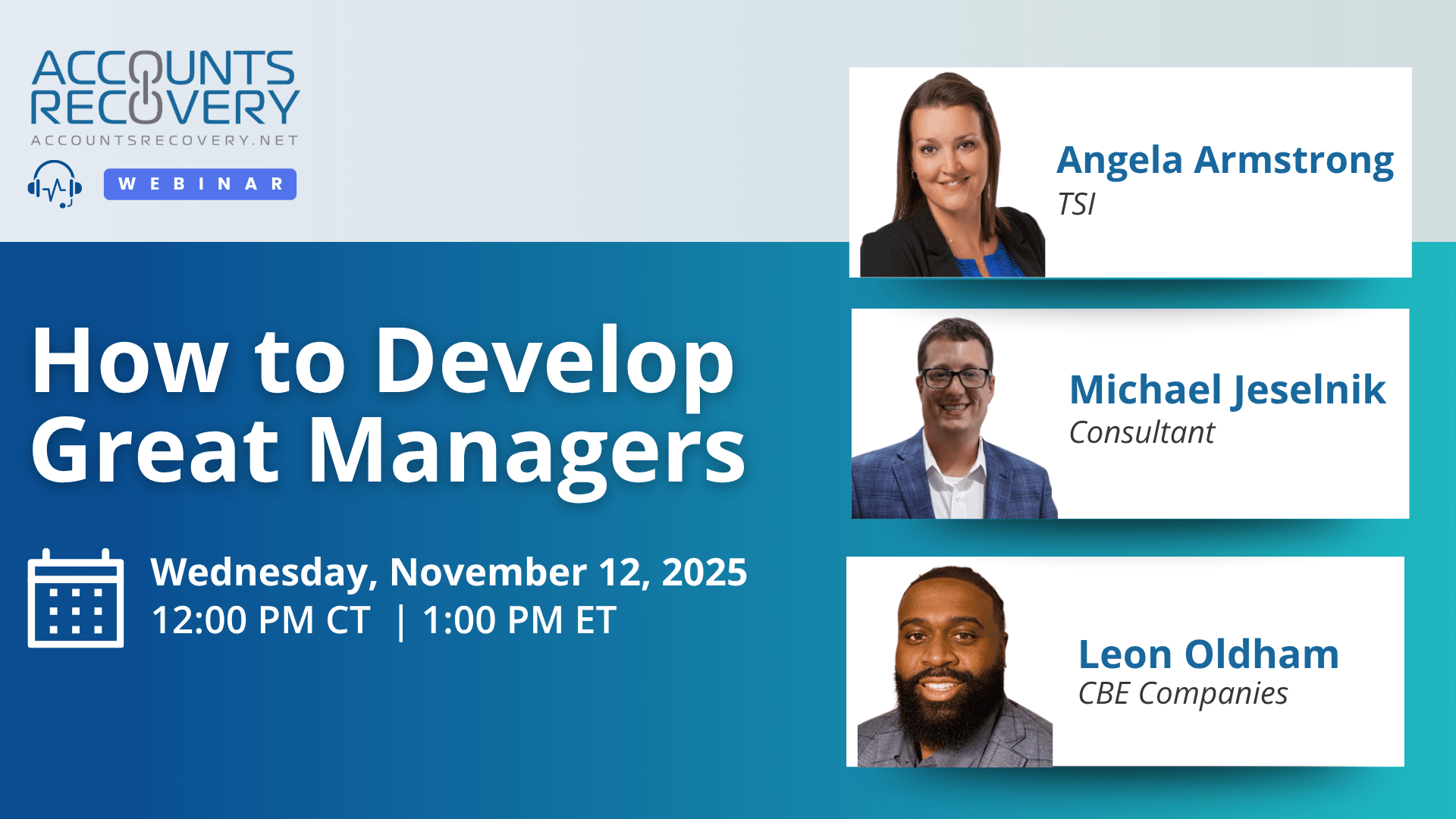

Webinar Recap: How to Develop Great Managers

Developing great managers is one of the toughest challenges in collection operations—especially when top-performing collectors don’t always make effective leaders. In this webinar, moderated by Dennis Barton of the Barton Law Group, industry leaders Angela Armstrong, Michael Jeselnik, and Leon Oldham discussed how to identify, train, and support the next generation of managers in the credit and collections industry.

Panelists emphasized that great leadership begins with empathy, clarity, and servant leadership—skills that go far beyond performance metrics. “A great leader creates clarity and confidence within their team,” said Armstrong. Jeselnik added that leadership is “putting others above yourself,” while Oldham noted that real leaders “practice servant leadership” and balance emotional awareness with operational performance.

The discussion also explored the distinction between being a manager and being a leader. As Barton summarized, managers focus on compliance and process, while leaders inspire growth, resilience, and accountability. The panel warned against the common industry mistake of promoting top collectors into management roles without assessing their people skills or readiness to lead. Instead, agencies should focus on mentorship programs, structured leadership pipelines, and opportunities for employees to demonstrate initiative and empathy.

Ultimately, great management is about responsibility, not prestige. As Jeselnik put it, “Leadership isn’t a perk—it’s a burden.” The best managers understand that their decisions directly affect their teams and the organization’s long-term success.

🧠 Key Takeaways:

Empathy Drives Performance: The ability to listen, understand, and support team members is a defining quality of effective leadership.

Leadership Can Be Learned: Empathy and communication are not innate—they can be developed through mentoring, coaching, and experience.

Build a Pipeline, Not Just Promotions: Invest in structured development programs that prepare employees to lead before they’re promoted.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN