- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 31, 2025

Daily Digest - July 31, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Eric Rehmann of Compliance Umbrella and James Travis of Solutions by Text.

💬 Join the August Group Text Chat — Last Day to Sign Up!

Want to get to know your industry colleagues better? Looking for a sounding board to help you figure out the world’s problems? Sign up for the AccountsRecovery industry text chat. Each month, you are added to a group text with 8-to-10 others from across the credit and collection industry. The chats are a great way to plug in and stay connected. New chats start Friday!

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Getting to Know Dan Berezowski of Castle Credit

When he was unable to find a collection platform to replace a legacy system, Dan Berezowski went out and built his own. And, 15 years later, the software is still in production. Maybe it was his curiosity that sparked Dan to challenge himself. Or maybe it was his passion for solving problems. Read on to learn more about Dan, why he loves amusement parks, and the difference between getting things done and moving things forward.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

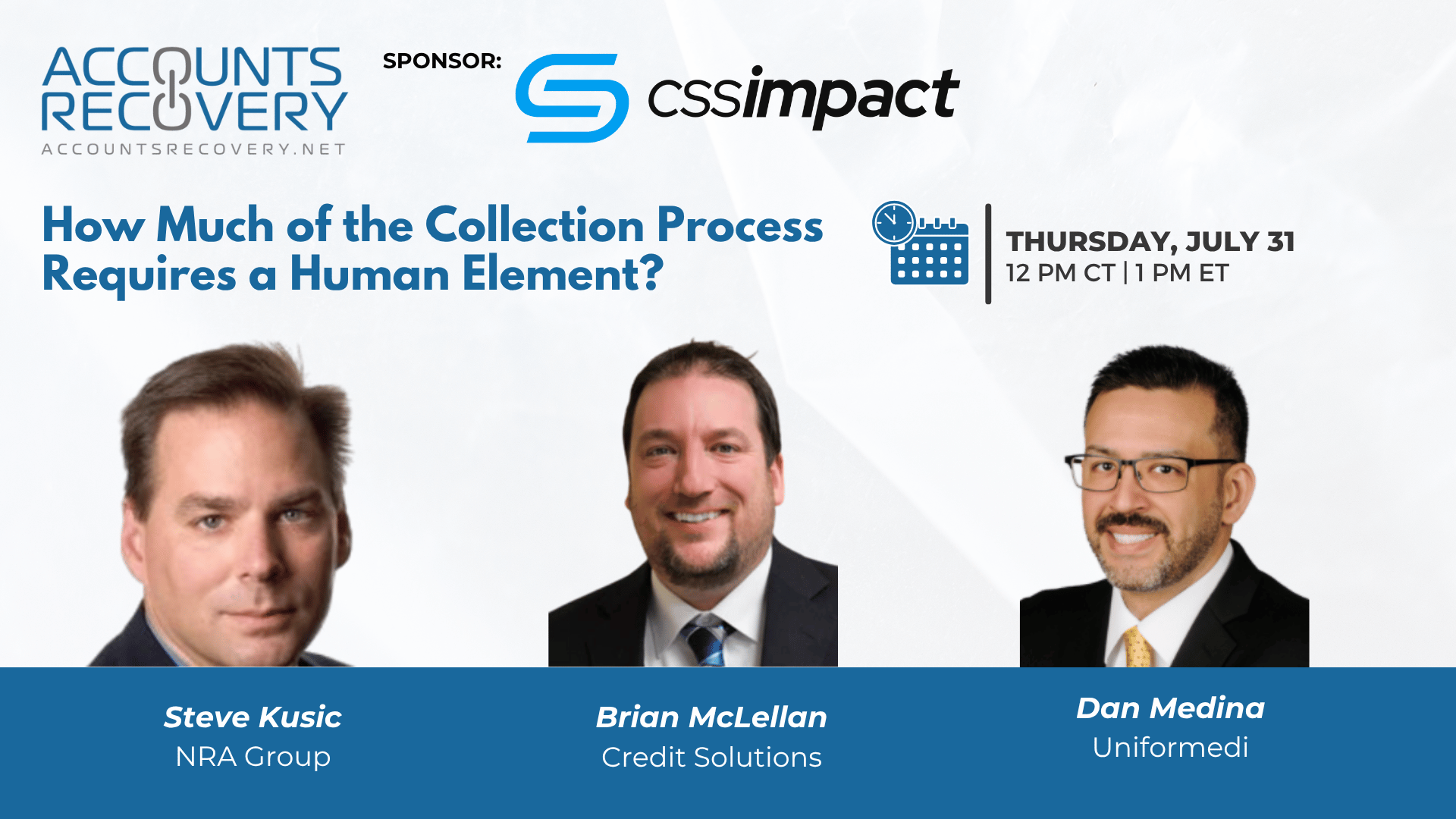

TODAY‘S WEBINAR

UPCOMING WEBINARS

Judge: Avoiding Family Doesn’t Qualify as Injury for Standing in FDCPA Case

The Seventh Circuit has been Ground Zero with respect to the issue of standing in Fair Debt Collection Practices Act cases. A District Court judge in Indiana has granted a plaintiff’s motion to remand a case back to state court — the second time she has done so in this matter — ruling that avoiding your family is not enough of a concrete injury to keep the case in federal court.

Medical Debt Credit Reporting Ban Reintroduced in Congress

A group of Democratic lawmakers in both the House of Representatives and the Senate have introduced the Medical Debt Relief Act of 2025 (S. 2519 and H.R. 4827), which would ban medical debt from appearing on consumer credit reports and prohibit creditors from using it when making lending decisions.

Creditors Can Still Arbitrate if Lawsuit Isn’t Prosecuted, Appeals Court Rules

We’ve seen a couple of rulings recently related to attempts to arbitrate claims after a lawsuit has been filed. The Court of Appeals for the Fifth Circuit has reversed a ruling denying a creditor’s attempt to arbitrate after it filed a collection lawsuit against the plaintiff, ruling that because the creditor ultimately didn’t pursue the lawsuit, it did not close the door to arbitration.

WORTH NOTING: Members of Gen Z are finding being adults tougher than expected, so they are taking steps to secure their financial futures ... Skechers wants to make sure you can always know where your kids are ... ChatGPT and Google AI will give you different answers to the same kinds of search queries ... Americans are happy to lie if it means they can help themselves out financially ... If you are curious how much Roman soldiers made 1,900 years ago, a paycheck in pristine condition has been found ... The perks that workers are looking for right now, and it's not just about being able to work from home ... How bad does the turbulence have to be for this to happen? ... Which NFL quarterbacks are most likely to lose their starting jobs this season?

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: Hiring Debate: New vs. Experienced Collectors. Which are Better?

The longstanding debate over whether to hire new or experienced collectors took center stage in this insightful webinar sponsored by CSS Impact. Industry veterans Leon Oldham (CBE Companies), David Speed (Nationwide Credit Corp.), and Cathy Tylutki (Harris & Harris) weighed in with candid perspectives on the advantages and challenges of both hiring paths.

The consensus? It depends. Each panelist emphasized the importance of aligning hiring decisions with team needs, client requirements, and the specific portfolios being worked. While experienced collectors can ramp up faster and bring industry knowledge, they may also carry baggage or resist coaching. On the flip side, new collectors offer coachability and a fresh perspective but require more time and structure to reach full productivity.

CSS Impact’s Ryder Thompson introduced a cutting-edge solution—Collector IQ Plus Copilot—that equips collectors with real-time AI support, sentiment analysis, and compliance guidance, bridging skill gaps regardless of experience level.

🧠 Key Takeaways:

Hiring Should Be Skills-Driven, Not Experience-Driven

Whether a candidate is new or experienced, resilience, active listening, empathy, and goal orientation matter more than years in the industry.Retention Requires Early Wins and Structured Support

Ramping programs, career pathing from first-party to third-party roles, and peer mentorship (like Harris & Harris’s ally program) help new hires stick through the critical first 90 days.AI Can Level the Playing Field

Tools like CSS Impact’s AI-powered Collector IQ Plus Copilot offer real-time coaching and workflow automation, making it easier to onboard and support collectors at any stage of experience.

This webinar is a must-watch for anyone looking to improve hiring decisions, reduce turnover, and maximize collector performance in today’s competitive market.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN