- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 29, 2025

Daily Digest - July 29, 2025

Brought to you by: TCN | By Mike Gibb

🎂🥳 Happy Birthday to: RIck Howley of The CCS Companies and Jonathan Jensen of Dedicated Financial. Happy belated Birthday to Rob Yarmo (July 27).

🎉 Congratulations to Lexi Olsen for starting new position as Legal Specialist at ZuntaFi.

💬 Join the August Group Text Chat

Want to get to know your industry colleagues better? Looking for a sounding board to help you figure out the world’s problems? Sign up for the AccountsRecovery industry text chat. Each month, you are added to a group text with 8-to-10 others from across the credit and collection industry. The chats are a great way to plug in and stay connected. New chats start Friday!

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Separate Cases Allege Third-Party Disclosures via Different Channels

It might be too early to tell if this is just a few isolated cases or if it is the start of a new trend, but there have been three separate lawsuits, filed in three separate jurisdictions, against three separate collection operations, involving three separate modes of communication, in which each collector is being accused of communicating with a third party about a debt. Each of the three cases were filed within two days of one another.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

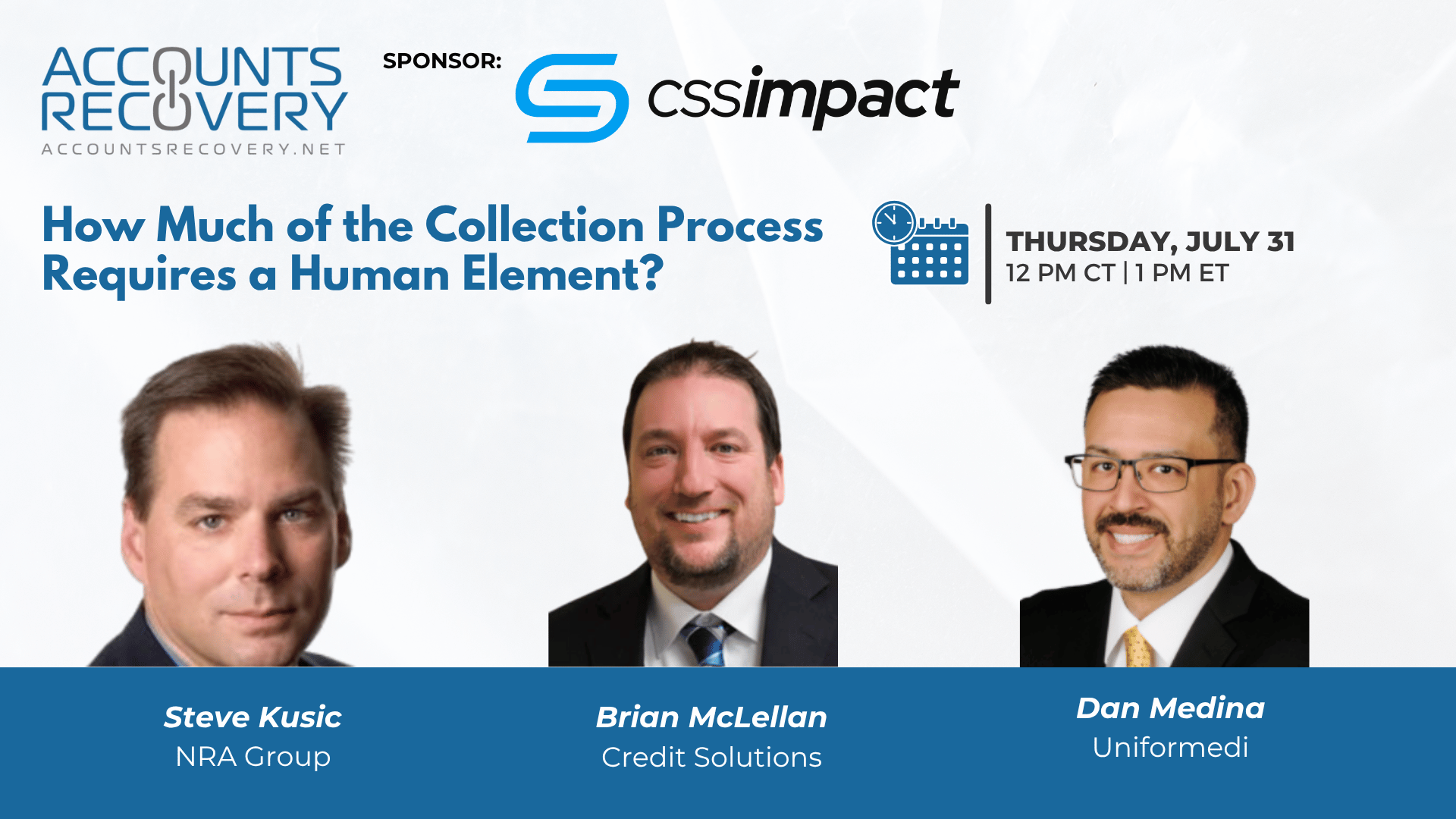

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court Reverses Ruling in FCRA Case

For the second time this month, the Court of Appeals for the Eleventh Circuit has overturned a lower court’s denial to compel arbitration in a Fair Credit Reporting Act case, addressing the process through which the plaintiff agreed to a website’s terms and conditions, a process known as “clickwrapping.”

NYC Debt Collection Rule Delayed Again; No New Effective Date Set

For at least the third time, the New York City Department of Consumer and Worker Protection has delayed the effective date of its debt collection regulation, this time providing no update other than to say the regulation will not go into effect on October 1 as originally planned and that it will provide three months’ notice before putting the rule into effect.

Oregon Expands Telemarketing Law, But Keeps Debt Collection Exemptions

The governor of Oregon has signed a bill into law that aims to limit solicitation calls and text communications made to consumers, with an explicit carve-out for calls made by collectors and debt buyers.

WORTH NOTING: A deep dive on the non-profit organizations that are helping to buy and forgive medical debts ... Did you know that there are 102 "official" cocktails? Here is a breakdown of someone's journey to try them all ... The credit and collection industry loves speech analytics. But experts say there are still gaps in the technology ... Tips to help you get the most out of your appliances ... How to maximize the health benefits of walking ... If you question your parenting skills more than once a week, you are in good company ... Some hotels are starting to charge extra for things like air conditioning ... Why this is a big week for the country's economy.

Trailer Tuesday, part I

Trailer Tuesday, Part II

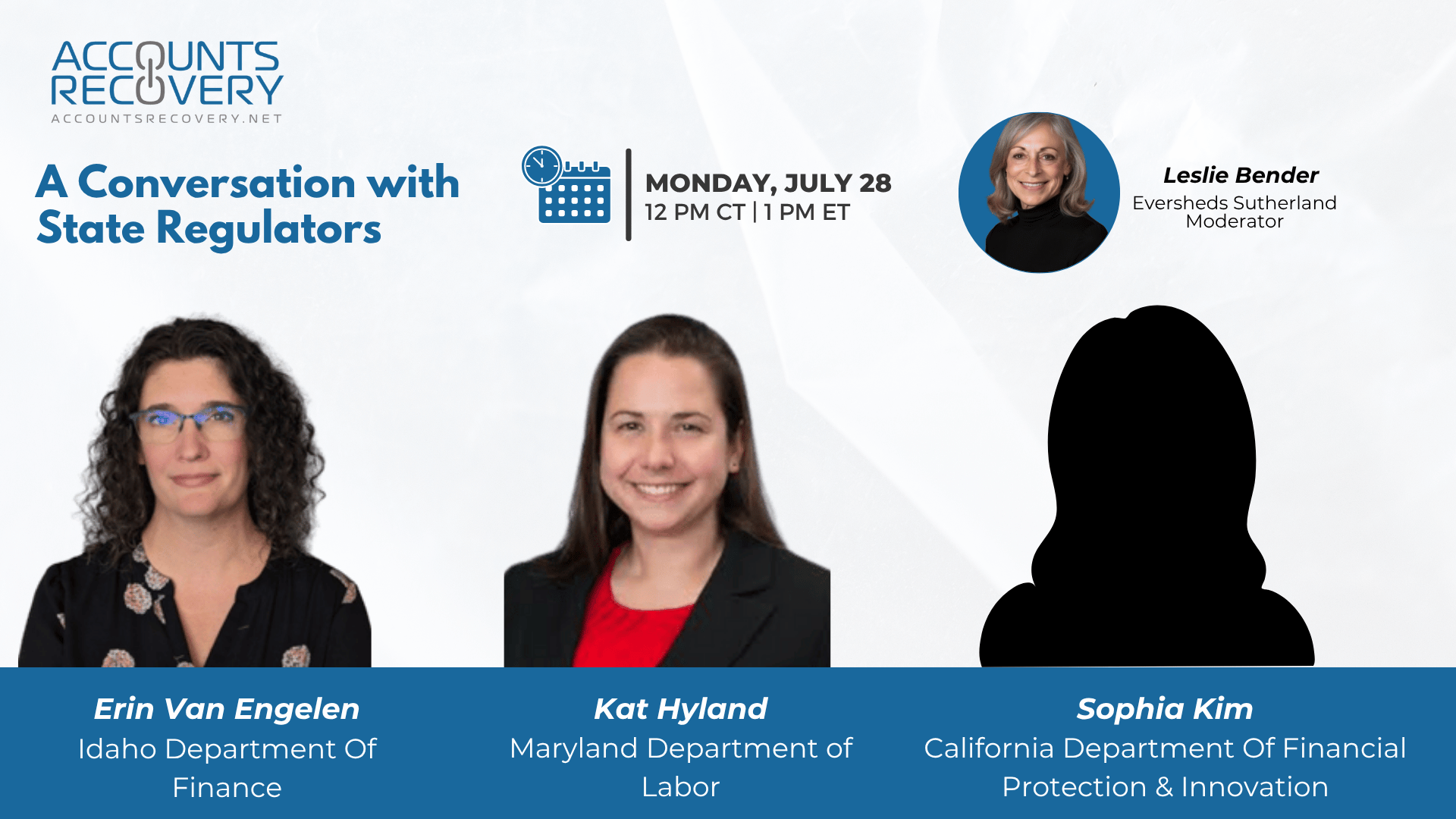

Webinar Recap: A Conversation with State Regulators

As the Consumer Financial Protection Bureau (CFPB) scales back direct enforcement in some areas, state regulators are stepping up to ensure consumer protections remain strong in the credit and collection industry. In this timely webinar, regulators from Maryland, California, and Idaho shared their priorities, enforcement strategies, and expectations for the businesses they oversee.

The panelists emphasized that while headlines may suggest a regulatory ramp-up, for most states, it's “business as usual”—states have long been active in exams, investigations, and enforcement actions, often working in tandem. However, regulatory divergence is growing as states establish and enforce their own standards in response to federal rollbacks and evolving market dynamics.

Regulators are particularly focused on:

Unlicensed activity, especially in debt settlement and first-party collections.

Consumer complaints around credit reporting, debt parking, and deceptive communications.

Data security and technology risks, including misuse of personal data, AI, and emerging payment methods like cryptocurrency.

Panelists also highlighted the increasing use of multi-state exam coordination, the importance of proactive consumer education, and their openness to industry tips on unlawful activity.

🧠 Key Takeaways:

Stay licensed and transparent. Regulators are prioritizing unlicensed activity—especially companies misclassifying their services or expanding into new areas like lending without proper licensing.

Expect scrutiny around data and tech. Regulators want to understand how businesses use consumer data, especially in AI-driven processes and alternative payments. Be ready to explain your systems and safeguards.

Build relationships and communicate. State regulators welcome tips from the industry and encourage proactive collaboration. Being responsive and cooperative during exams can mitigate potential enforcement.

For collection agencies, fintechs, and financial service providers, staying compliant in this decentralized regulatory environment means keeping a close eye on state-level developments and engaging with regulators early and often.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN