- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 28, 2025

Daily Digest - July 28, 2025

Brought to you by: TCN | By Mike Gibb

🥳🎂 Happy Birthday to: Pete Klipa of Harvest Strategy Group, Dixie Newsome of Crown Asset Management, and Neil Koonce of Revco Solutions. Belated Happy Girthday to: Christopher Gateas of Repay (July 27), Angela Benach of InDebted (July 27), Rick Roark of Revenue Cycle Management (July 27), Jenna Leigh Guyton of Americollect (July 27), Starr Judd of Solutions by Text (July 27), Greg Ferrall of Venandi Systems (July 27), Nick Kalamotousakis of Nationwide Credit & Collection Inc. (July 26), Shannon Miller of Maurice Wutscher LLP (July 26), Tyler Parisi of Kore.ai (July 26), and John C. Dontje of Contact Center Performance Institute (July 26).

🎉 Congratulations to Timothy Jansen for starting new position as Senior Manager at Capital One.

Small Agency TechTactics Meeting Today!

The monthly Small Agency TechTactics meeting will take place at 4pm ET today. Sign up and get your credentials here!

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Judge Rejects BFE Defense in Collection Case

A District Court judge in California has granted a defendant’s motion for summary judgment over claims it violated the Fair Debt Collection Practices Act, but denied motions that it is entitled to the bona fide error defense while also ruling the plaintiff has standing to pursue claims the defendant violated state law.

A MESSAGE FROM TCN

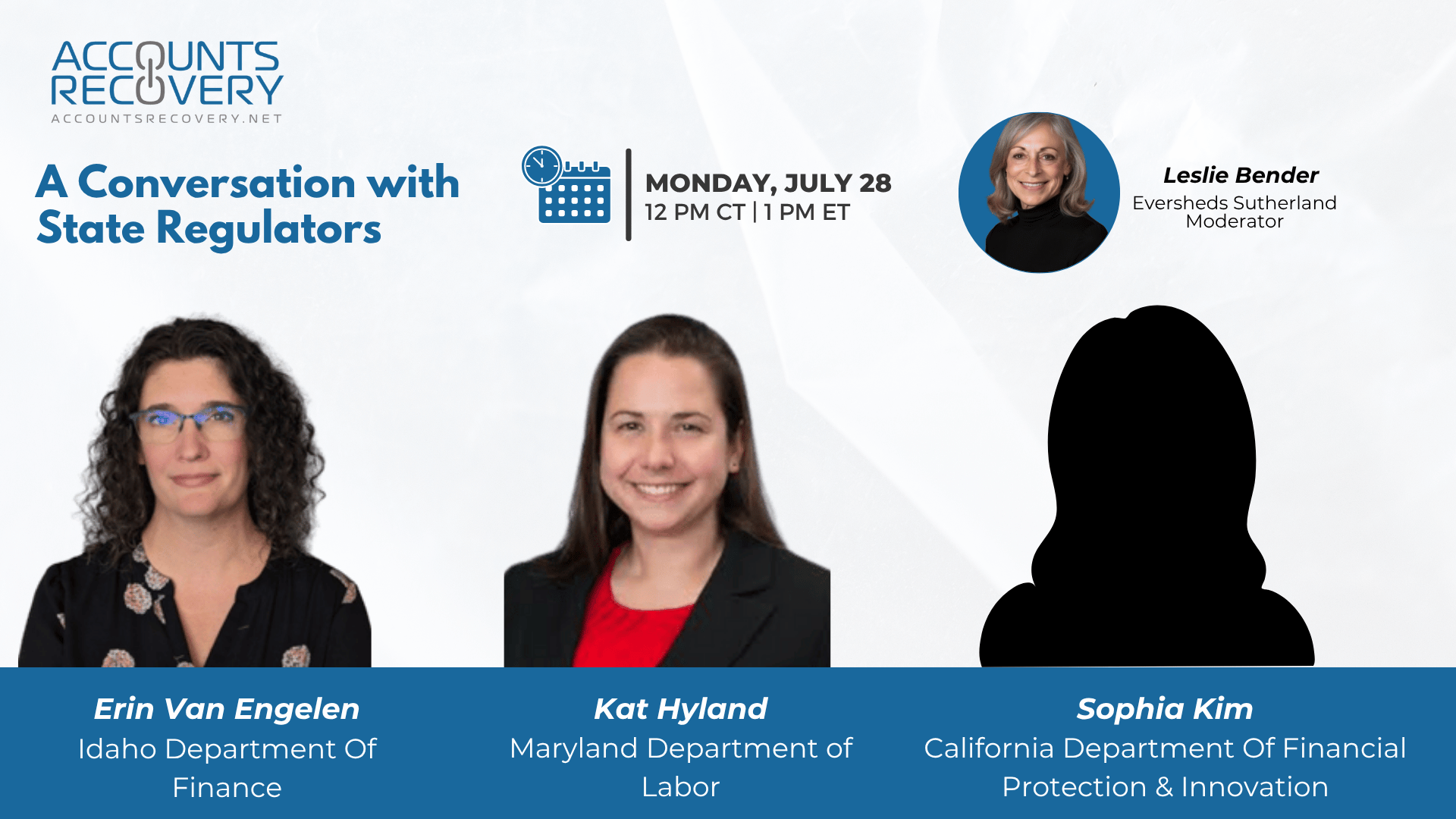

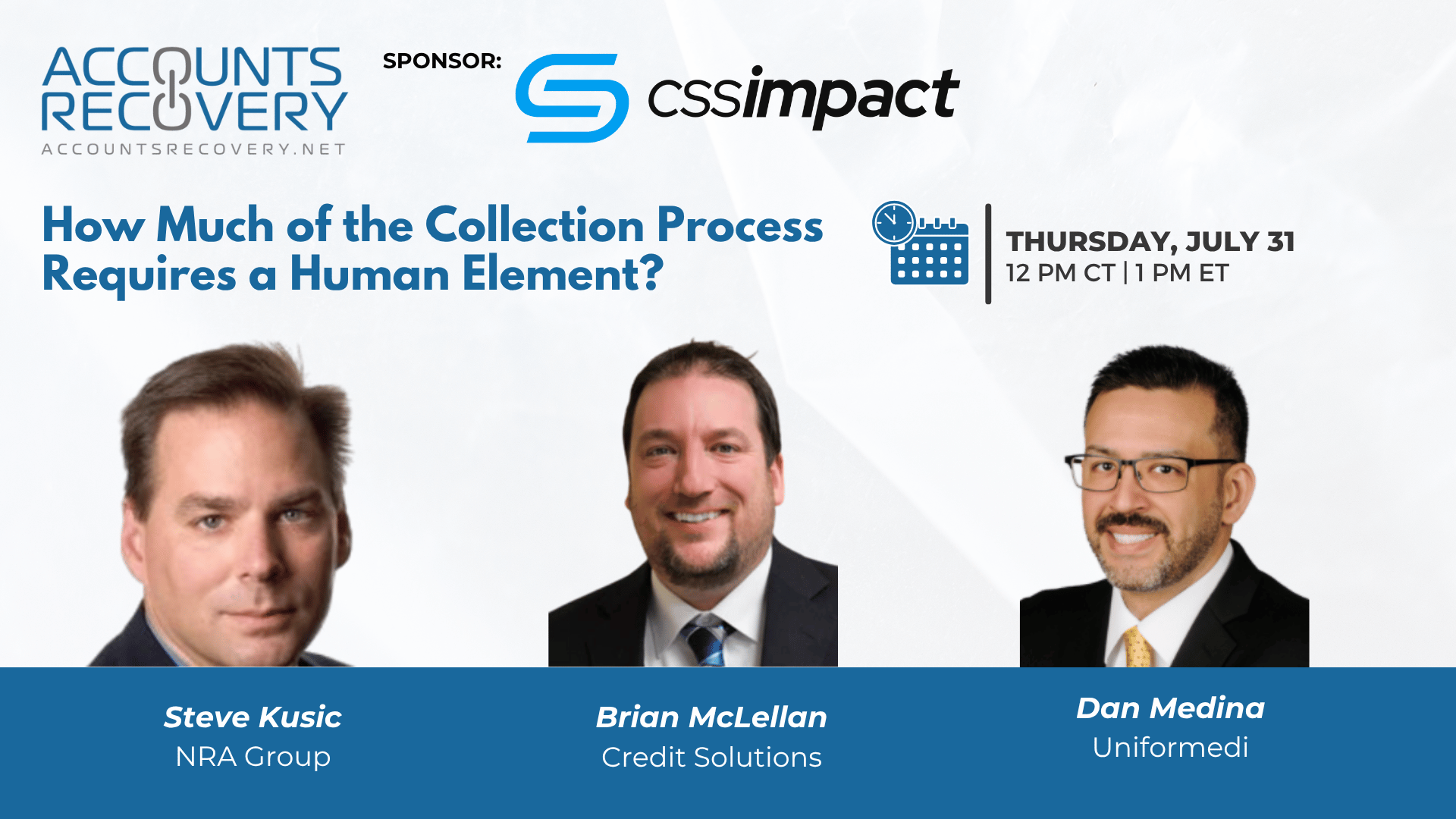

TODAY‘S WEBINAR

UPCOMING WEBINARS

DOGE Deploys ‘Deregulatory’ AI Tool at CFPB, Flags 100k Rules Government-wide for Deletion

The Department of Government Efficiency has rolled out a new “DOGE AI Deregulation Decision Tool” which has already been deployed at the Consumer Financial Protection Bureau, marking an unprecedented AI‑driven effort to slash federal regulations by half, according to a report in Saturday’s Washington Post. A PowerPoint presentation that was dated July 1 shows the tool can scan roughly 200,000 rules, has flagged some 100,000 as candidates for elimination, and then generate a full “delete list” in under four weeks.

New Senate Bill Aims to Double CFPB Funding and Pay Whistleblowers

Sen. Catherine Cortez Masto [D-Nev.] last week introduced the S. 2429, the Stop the Scammers Act, a bill that would restore funding to the Consumer Financial Protection Bureau and establish a whistleblower incentive program aimed at rooting out financial misconduct. The legislation comes in response to a Republican-led tax bill that sharply reduced the CFPB’s funding and curtailed its enforcement capabilities.

26M More Americans Struggling to Make Ends Meet: Report

A new report from the FINRA Investor Education Foundation reveals a significant shift in the financial health of American households, with millions more struggling to make ends meet compared to just three years ago. The findings, drawn from the sixth edition of the National Financial Capability Study (NFCS), have important implications for professionals across the credit and collection industry.

WORTH NOTING: A lack of estate planning for both older individuals and those who stand to inherit what they leave behind is something that neither side is addressing ... A new estimate for how many people will lose their health insurance during the next 10 years, and it's a big number ... Parents are ditching the soft approach and taking a harder stance with their kids ... How one healthcare provider is preparing its members for changes to medical debt credit reporting ... A deep-dive on surveillance pricing and how its costing you money ... The world's most premature baby just turned one year old ... The best and worst things to say to someone who was just diagnosed with cancer ... In a number of states across the country, tarantula mating season has started.

Music Monday, part I

Music Monday, Part II

Webinar Recap: Are all the State Changes Leading to More Collection Lawsuits?

State-level regulatory changes have been transforming the credit and collection landscape—raising questions about whether these shifts are fueling a rise in collection lawsuits. In this insightful webinar, experts Dani Schinzing and Scott Weltman explore trends in litigation volume, the interplay between compliance and operational demands, and how technology and staffing strategies are evolving in response.

Both panelists confirmed an uptick in collection lawsuits across the industry, though they cautioned against drawing a direct line from state regulation to lawsuit volume. Instead, they pointed to a confluence of drivers: limitations on credit reporting (particularly for medical debt), consumer use of cease and desist requests, and ongoing challenges in engaging borrowers through traditional channels.

Litigation, while resource-intensive, has proven effective at prompting consumer engagement and resolution. However, the increase in filings has placed added strain on court systems, often resulting in delays and heightened documentation requirements.

🧠 Key Takeaways:

Plan for Volume Increases

Whether due to state laws or economic factors, collection firms must proactively scale staffing and infrastructure to manage surges in litigation. Not being prepared can jeopardize both client relationships and recovery outcomes.Technology Helps—But Only to a Point

Remote hearings and automation can increase efficiency, but legal proceedings still require human judgment. Investment in both tech and professional staff remains essential.Compliance and Documentation Are Critical

With judges and states demanding more transparency, firms must ensure they have complete and accessible documentation before filing. Failure to meet these expectations can stall or derail litigation.

As collection strategies shift in response to evolving regulations, staying compliant, adaptable, and operationally ready is more crucial than ever.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN