- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 25, 2025

Daily Digest - July 25, 2025

Brought to you by: TCN | By Mike Gibb

🥳🎂 Happy birthday to: Ron Canter and Olivia Currin-Britt of Savista.

🎉Congratulations to Katie (Blue) Oblak for starting new position as Director Account Managers at Drip, Chris Peppler as Digital Strategy Director at Solvent+, Bryan Eichenbaum as Chief Lending Officer at American Heritage Credit Union, Patrick Whisennand as Director of Revenue Improvement at CompleteCare, Inc.

New Training Bytes Video Published

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Kristi Loyer from Wilber discusses how to ask for a consumer’s feedback or to ask them to leave a Google review? Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Collector Facing Class Action Over Multiple Letters, Missing Disclosure

A collection operation and the creditor it was working on behalf of are facing a class-action lawsuit for allegedly violating the Fair Debt Collection Practices Act because the collector sent two letters, one being a Model Validation Notice, to the plaintiff on the same day, which referenced the same date and attempted to collect the same amount, but had different itemization dates.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY‘S WEBINAR

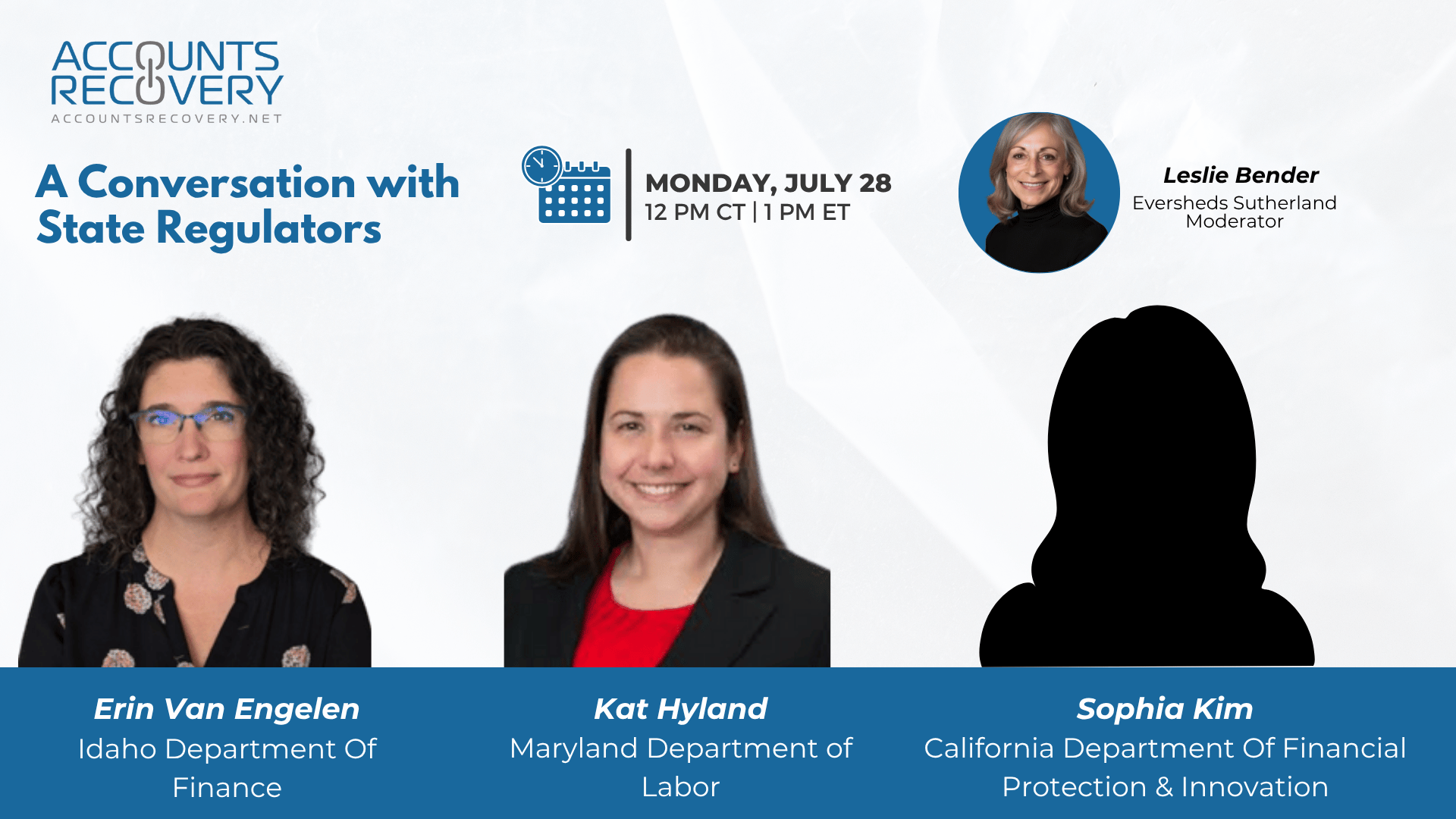

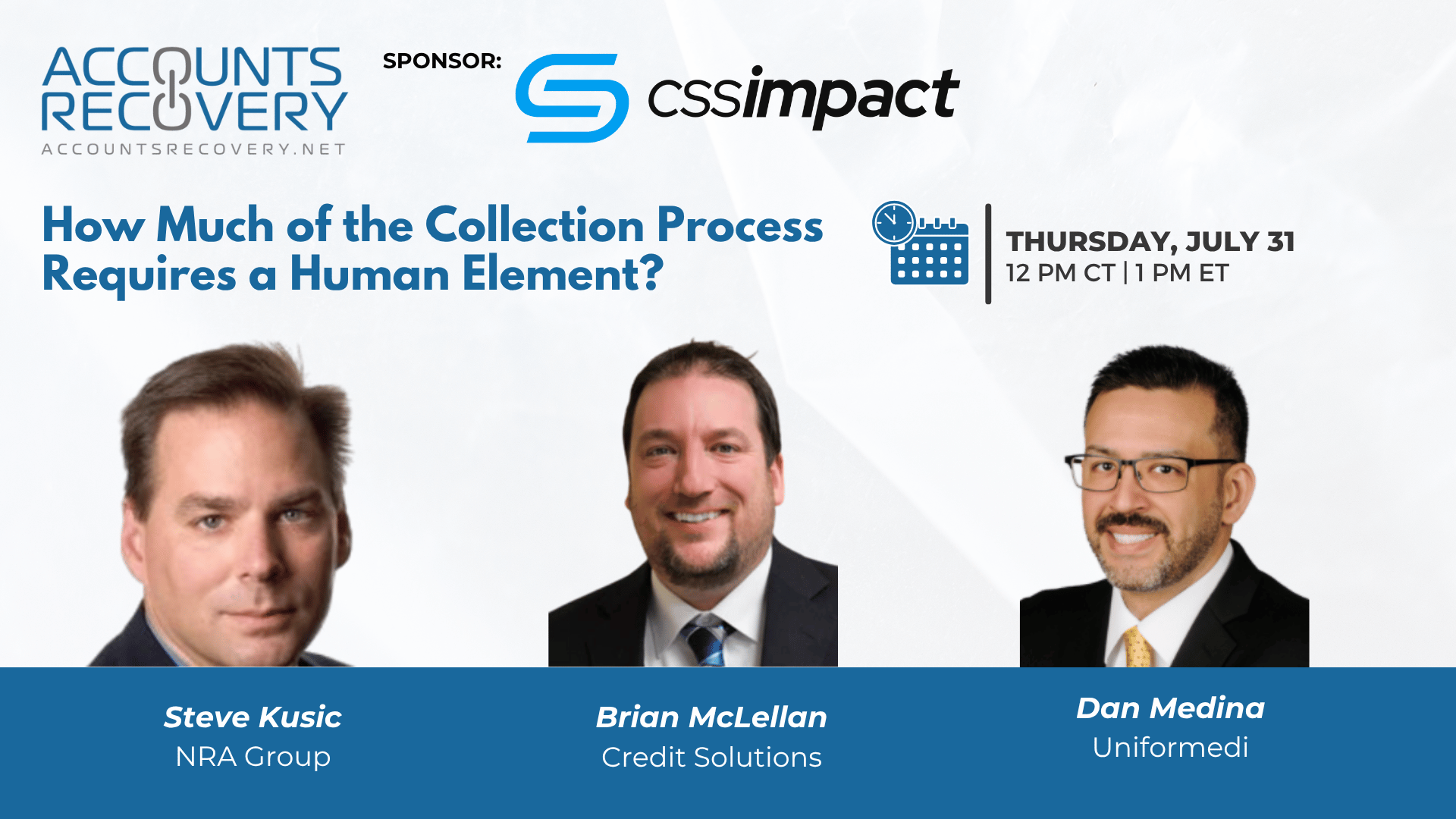

UPCOMING WEBINARS

Indiana Appeals Court Affirms Ruling for Defendant in FDCPA Dispute Case

An Indiana Appeals Court has affirmed the dismissal of a Fair Debt Collection Practices Act case against a collection operation that centered over an alleged dispute that may have been made against the plaintiff before the defendant filed a collection lawsuit.

White House Fast‑Tracks AI: Red Tape Cut, ‘Woke AI’ Barred from Federal Contracts

Faster data‑center approvals and clearer procurement rules could lower adoption barriers for companies in the credit and collection industry, but ideological and environmental carve‑outs may introduce compliance complexities.

Multistate Probe Ends in $2.9 M HCA Settlement, Nurses’ Training Debt Erased

The Attorneys General of California, Colorado, and Nevada yesterday announced a $2.9 million settlement with HCA Healthcare and its staffing arm, HealthTrust Workforce Solutions, resolving allegations that the hospital giant imposed unlawful training‑repayment agreements on new nurses. The agreement follows a multistate probe conducted by the attorneys general in partnership with the Consumer Financial Protection Bureau.

WORTH NOTING: Trends to watch that will help you stay on top of what's going on in the housing market ... There is a good chance that at least one person in your office is sabotaging your AI strategy ... Nearly 50% of workers plan to look for a new job in the next year ... Six movies that are better than the books they were based on ... An AI tool is better than cardiologists at detecting a deadly heart disease ... Target is dropping its price-matching policy amid slowing sales ... Employee benefits that you won't believe some companies are offering these days ... People are starting their back-to-school shopping early this year.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: Collecting While Maintaining the Customer Relationship

In today’s credit and collections landscape, maintaining a strong relationship with consumers is no longer optional—it’s a strategic imperative. The webinar “Collecting While Maintaining the Customer Relationship,” sponsored by CSS Impact, explored how organizations can collect effectively while preserving trust and loyalty. Industry leaders from TD ECU, Security Service Federal Credit Union, and State Collection Service shared how empathy, technology, and strategy can align collection efforts with long-term customer engagement goals.

Panelists emphasized that reputation risk is real, especially for credit unions and healthcare providers where relationships span generations. Collecting with care isn’t just good practice—it’s necessary to avoid losing future business. The discussion also highlighted how AI-powered tools can streamline processes, allowing agents to focus on human-centered communication rather than manual data searches.

Whether working accounts in-house or through third-party agencies, the key is alignment—of tone, values, and expectations. Agencies need to act as true extensions of the brand, not just as outsourced vendors.

🧠 Key Takeaways:

Empathy is a Performance Tool

Leading with empathy doesn’t mean avoiding tough conversations—it means approaching them with understanding. This approach builds trust and increases engagement, which often leads to better recovery outcomes.Right-Party Vendors Matter

Choosing a third-party partner isn’t just about performance metrics—it’s about risk mitigation. Agencies must undergo rigorous compliance and reputation vetting before being entrusted with customer relationships.Internal vs. External Collection Strategy

Many organizations are reassessing the mix between internal collections and external placements. Some bring collections in-house to retain control and protect brand reputation; others strategically outsource later-stage accounts to preserve internal resources.

This webinar makes it clear: smart collections are about more than dollars collected—they’re about relationships preserved.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN