- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 24, 2025

Daily Digest - July 24, 2025

Brought to you by: TCN | By Mike Gibb

🥳 🎂 Happy Birthday to Trina DeWeese of Pinnacle Financial Partners, Karley Gloede of GoodLeap, Steve Flite of National Recovery Agency, Jeff Willyerd of TCN, and James A. Zadoorian of ARxChange.

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Getting to Know Jennifer Bergman of American Municipal Services

It may have seemed like Jennifer Bergman was destined to become part of the credit and collection industry, following in her father’s footsteps. But it’s only recently that she has jumped in to working at the family business with both feet, after first working as an engineer and college professor. Now, as she says, she has found her place. Read on to learn more about Jennifer, what she is proud to have inherited from her father, and why she never wants to be the most experienced person in the room.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

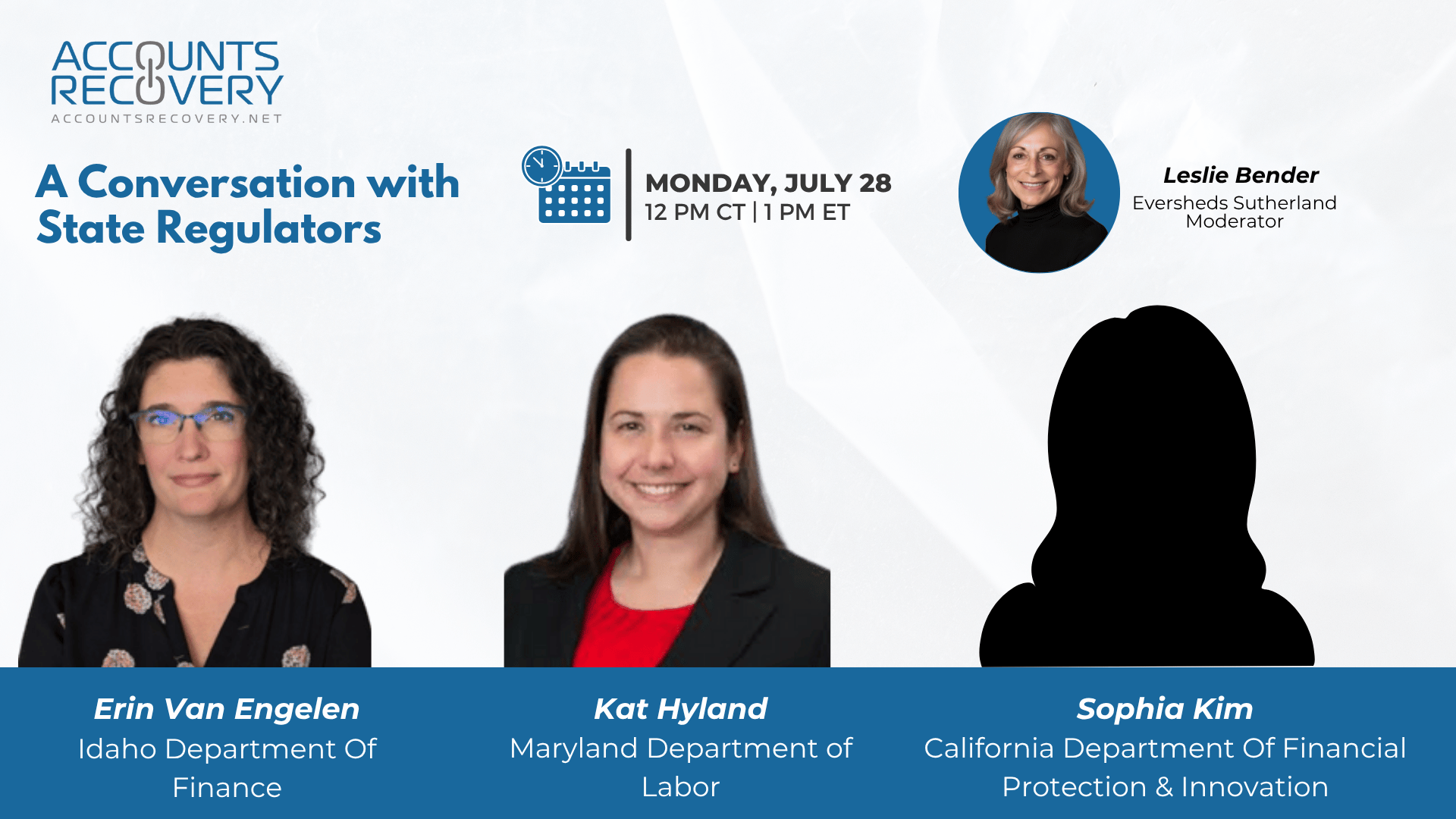

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court Rules Filing Lawsuit on Expired Debt Waived Arbitration Rights

The Court of Appeals for the Fourth Circuit has affirmed a lower court’s ruling preventing a debt buyer from invoking the underlying credit agreement’s arbitration clause because it chose to file a lawsuit to collect on the debt even though the statute of limitations had expired.

CFPB to Foot $4.7M Security Bill for Acting Director: Report

The Consumer Financial Protection Bureau is set to transfer nearly $4.7 million to the Office of Management and Budget to cover the security detail for its acting director, Russell Vought, under a hastily arranged interagency agreement that was not included in CFPB’s fiscal 2025 budget, according to a published report.

Medical Debt’s Heavy Toll: Why Nearly Half of Adults Struggle to Afford Care

Last week, a federal judge blocked a newly finalized Consumer Financial Protection Bureau rule that would have removed medical bills from consumer credit reports. But even before that, consumers were feeling more stressed about their medical debt burdens, according to data released by KFF.

WORTH NOTING: If you are looking to get promoted, don't be afraid to volunteer for something that is complicated ... More consumers, especially younger ones, are turning to chatbots for their online searches ... The top four counties with the highest average credit score all come from the same state. Think you can guess it before clicking to find out? ... You can't outrun a bad diet if you are looking to lose weight or stay in shape ... A list of the 100 best podcasts of all time ... TD Bank is the latest financial institution mandating employees return to the office ... What your team really wants, and it's not always a promotion ... Ways to celebrate today being National Tequila Day.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: What is UDAP (UDAAP) in Today’s Credit and Collection Industry

In this timely and eye-opening webinar, legal and compliance experts Jessica Klander and Jesse Silverman dissected how Unfair, Deceptive, or Abusive Acts or Practices (UDAP/UDAAP) continue to evolve and impact credit and collection operations. As regulators expand the scope of enforcement, understanding and proactively managing UDAAP risk has become more important—and more challenging—than ever.

The conversation focused on how the inherently subjective nature of UDAAP law gives both federal and state regulators wide latitude to pursue enforcement. This means that collection agencies, creditors, and financial services providers must anticipate scrutiny even when their practices fall into legal gray areas. The panel stressed that prevention is the best defense—starting with strong policies and procedures, robust call center training, and diligent review of consumer complaints.

🧠 Key Takeaways:

Frontline Staff Are Your First Line of Defense

Train call center agents like they are “your Navy SEALs”—tone and treatment matter. Regulators often pursue cases where consumer interactions “feel” unfair, regardless of technical compliance.Keep Policies Updated—and Follow Them

Regulators consider out-of-date or ignored policies low-hanging enforcement fruit. Align written procedures with your actual practices and review them regularly.Use Consumer Complaints as a Compass

Complaints are early warning signals. Repeated feedback—even if it seems minor—should trigger internal reviews. Assume systemic issues, not one-offs.

As UDAAP enforcement remains fluid and politically influenced, organizations must stay vigilant, modernize compliance efforts, and collaborate across departments to manage risk effectively.

This webinar offered practical insights and a strong reminder: in UDAAP compliance, what you don’t know—or fail to update—can hurt you.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN