- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 23, 2025

Daily Digest - July 23, 2025

Brought to you by: TCN | By Mike Gibb

🥳 🎂 Happy Birthday to Shelby Morlock of Dynamic Recovery Solutions, David Anthony of Troutman Pepper, Matthew Kennedy of Avvo, and Jay Coulter of Resurgent Capital Services.

📆 Going to ACA? Want to sit down and chat? I would love to meet with you! Shoot me an email and let’s set up a time to meet.

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

N.J. Appeals Court Affirms Ruling Over Failure to Arbitrate in Collection Lawsuit Case

If a tree falls in the forest and nobody is around to hear it, does it make a sound? Similarly, if an arbitration agreement is in a contract, but neither party invokes it, can it be used to fight a collection lawsuit that is filed against you? A New Jersey Appeals Court has affirmed a lower court’s ruling that no, it can’t be used if it is never invoked.

A MESSAGE FROM TCN

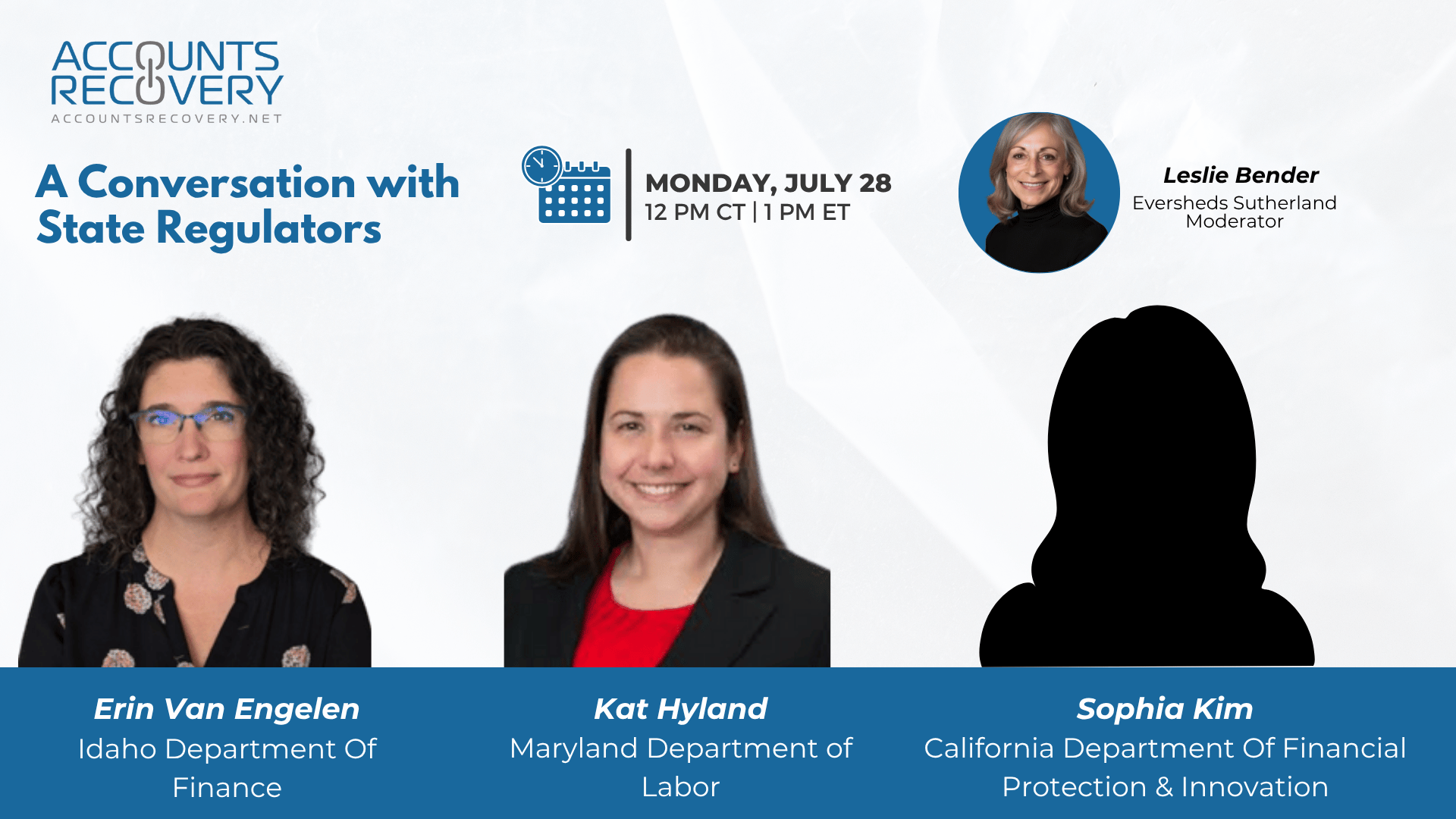

TODAY‘S WEBINAR

UPCOMING WEBINARS

Racial and Income Gaps Emerge in Medical Debt Litigation: Study

A report published last week in a medical journal revealed that medical debt is disproportionately affecting minorities and lower-income individuals in St. Louis, whi are being sued far more than other groups. Between January 2020 and May 2023, two major academic physician groups in St. Louis — SLUCare Physicians and Washington University Physicians — filed 973 small‑claims suits against patients over unpaid medical bills. Of these cases:

With Nearly Half of Customers Struggling, Financial Advice Becoming More Valuable

More U.S. bank customers are struggling to keep up with bills, leaving them financially exposed and eager for help. According to J.D. Power’s 2025 U.S. Retail Banking Advice Satisfaction Study, 43% of retail bank customers now fall into the “financially vulnerable” category, which is up sharply from 27% just five years ago. For credit and collection professionals, these numbers point to both a challenge and an opportunity: consumers are crying out for guidance, and institutions that deliver timely, tailored advice can build deeper, more enduring relationships.

31 Companies Seeking Collection Talent

Jobs in 23 different states, plus a handful that are remote/work-from home. Seven entry-level vacancies, nine at the management level. Creditors, credit unions, banks, collection operations, and fintechs. Check out this week's job listings summary to see who is hiring and how they are going about it.

WORTH NOTING: How Millennials are handling their financial wellness ... Worries and stresses about debt are impacting the mental well-being for a lot of consumers these days ... Isn't this ironic -- the more time that AI spends thinking about something, the performance of the model actually decreases ... A look at how much more some student loan borrowers are going to be paying in the near future ... For families, mealtimes matter if you want to connect with your kids ... Does pre-cooling your home before a hot day work? Depends on who you ask ... Is pickle juice good for you if you are looking to hydrate yourself? ... Fans of Fall rejoice: Starbucks has announced when the Pumpkin Spice Latte is coming back to its menu.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: How to Easily Identify the Accounts That are Most Likely to Pay

In today’s environment of constrained resources and rising costs, efficiently identifying which accounts to prioritize is no longer optional—it’s mission-critical. This webinar brought together experts from across the ARM industry to explore how scoring models, AI, and digital communications can work in concert to not just predict who’s likely to pay—but also guide how, when, and where to contact them for maximum impact.

Panelists emphasized that traditional “propensity-to-pay” models alone aren’t enough. Modern strategies must incorporate machine learning, yield analysis, and real-time behavioral data (like email opens or portal visits) to suggest the next best action—not just the next account. The discussion also tackled the dangers of over-contacting low-probability consumers and how it can damage email deliverability and drive down ROI.

The panel also explored how to optimize outreach by leveraging low-cost digital channels for low-yield accounts and reserving high-effort tactics, like outbound voice, for high-value cases. Testing, measurement, and constant iteration emerged as essential themes. It’s not about working all accounts—it’s about working the right accounts, in the right way, at the right cost.

🧠 Key Takeaways:

Go beyond propensity—Incorporate channel preferences, timing, and expected yield to drive action-based segmentation.

Test and iterate constantly—Use A/B testing and data-driven attribution models to refine outreach strategies and messaging.

Optimize cost-to-collect—Match communication methods to account value and likelihood to pay to maximize yield without overspending.

This webinar is a must-watch for operations leaders looking to boost recoveries without increasing costs, and for anyone ready to replace gut instinct with data-backed precision.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN