- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 22, 2025

Daily Digest - July 22, 2025

Brought to you by: TCN | By Mike Gibb

🥳 🎂 Happy Birthday to Jennine Rexon of Rex Martech. Happy belated Birthday to: Jeremy Nixon of Frost-Arnett.

🎉 🙌 Congratulations to Amy Stratz, who started a new position as Head of Sales & Account Management at Skit.ai and Scott Wittosch, the new Director of Credit Collections Business Development at ProVest.

📆 Going to ACA? Want to sit down and chat? I would love to meet with you! Shoot me an email and let’s set up a time to meet.

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Suit Accuses Law Firm of Pursuing Case After Notified of Improper Venue

A collection law firm and the owner of a debt are facing a class-action lawsuit in New Jersey federal court for allegedly filing a collection lawsuit in the wrong venue, and then failing to transfer the suit or do anything when the plaintiff filed an answer indicating she lived in a different county.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY‘S WEBINAR

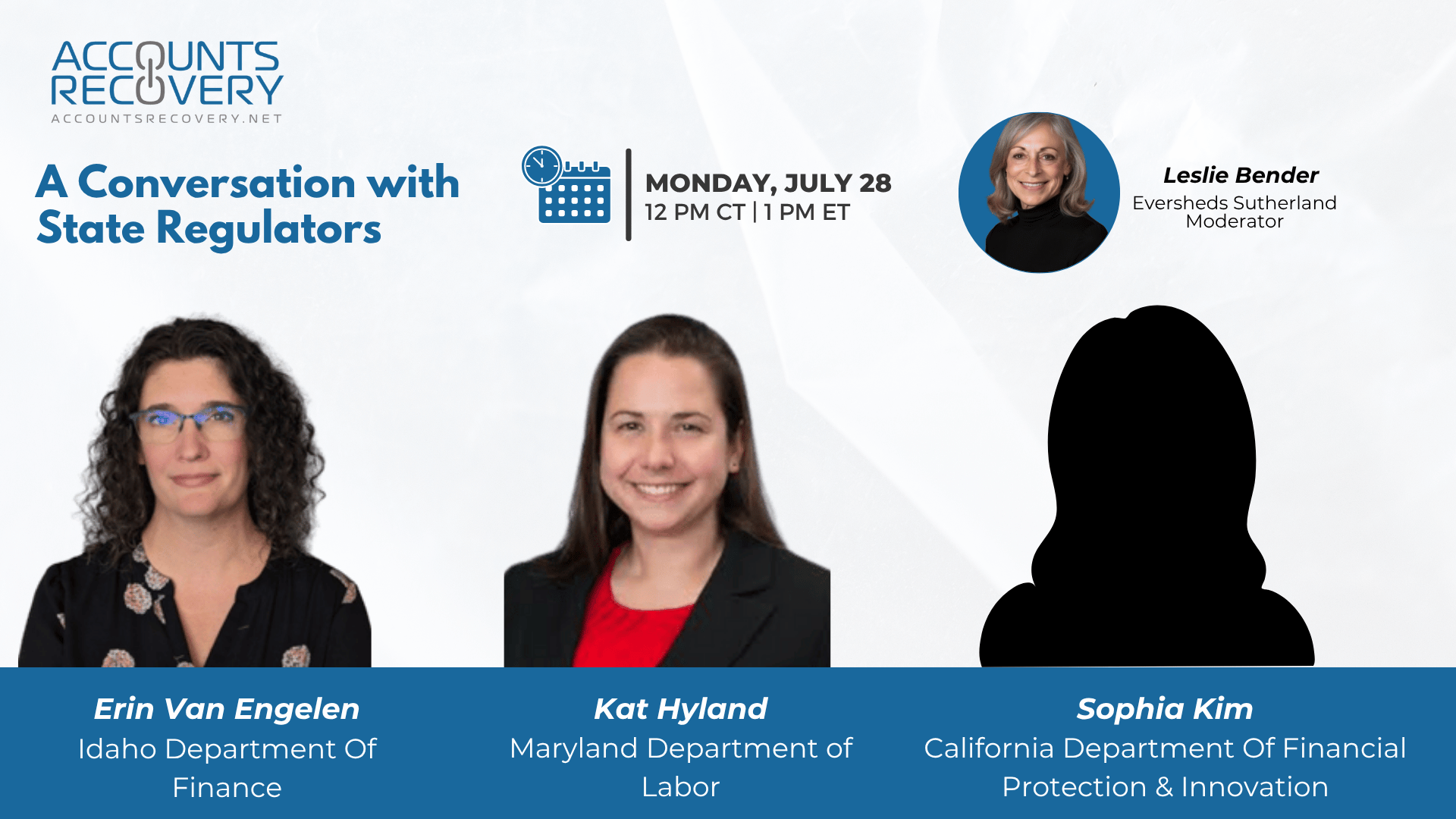

UPCOMING WEBINARS

Appeals Court: Time and Money Spent on Unshared Credit Report Errors Does Not Meet Standing Threshold

The Court of Appeals for the Eleventh Circuit has vacated a lower court’s ruling after determining that a plaintiff did not have standing when she accused a credit reporting agency of violating the Fair Credit Reporting Act because it did not correct information that was never provided to a third party.

FTC Shuts Down $100 Million Debt Relief Scheme That Targeted Seniors and Veterans

The Federal Trade Commission has secured a court order halting the operations of a debt relief enterprise that allegedly scammed consumers, primarily older Americans and veterans, out of more than $100 million through impersonation and deception. The scheme, run by a network of seven companies and three individuals operating under names like Accelerated Debt Settlement, is accused of impersonating banks, government agencies, and credit bureaus to convince consumers to pay thousands in illegal advance fees for debt relief services that were ineffective or never delivered.

CFPB Terminates Enforcement Order Against Credit Union

The Consumer Financial Protection Bureau has terminated a consent order against VyStar Credit Union. The order, originally issued in October 2024, imposed a $1.5 million penalty because the institution was accused of mishandling of an online banking system overhaul in 2022, which left members without full access to services for extended periods. While the credit union has paid the fine, the termination of the order means the credit union will not have to develop or implement redress plans that were required under the original order.

WORTH NOTING: Why bosses should never speak first, or even second, in a meeting ... If today flies by faster than usual, it's not just you ... The silver lining for the company at the center of last week's KissCam scandal ... What to do if your boss is playing favorites and the favorite isn't you ... Interest rates are keeping a lot of people from being interested in buying a new house ... Talk about lightning striking twice ... How to spot and guard against wrong number scams ... A look at the list of candidates for song of the summer.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: From Burnout to Buy-In: How Agent Experience Directly Lowers Delinquency

Yesterday, experts discussed a pressing issue for all stakeholders in credit and collections: frontline agent burnout and its impact on recovery rates. Titled "From Burnout to Buy-In", the session highlighted how improving the agent experience can directly reduce delinquency and boost performance.

The webinar featured panelists from across the industry, including Michael Ciancio (Centrical), Blair DeMarco-Wettlaufer (Kingston Data and Credit), and Josh Seuberling (Lendly). Together, they explored the connection between agent engagement, real-time coaching, and recovery outcomes.

Key discussion points included:

The breakdown of traditional collector playbooks under modern pressures

How bite-sized coaching and goal clarity transform stressed agents into motivated problem solvers

A collector-focused playbook and a 3-step framework teams can begin using immediately

The conversation also delved into the economics of retention, emphasizing how investing in your team drives measurable business results.

🧠 Key Takeaways:

Start Small with Coaching: Implement real-time, bite-sized feedback to improve agent performance without overwhelming them.

Define and Share Clear Goals: Agents are more motivated and effective when they understand exactly what success looks like.

Prioritize Agent Retention: The cost of burnout is high—investing in agent well-being leads to higher recoveries and compliance.

Whether you're at a collection agency, fintech, bank, credit union, or healthcare provider, this webinar offered actionable insights to modernize your approach and empower your frontline.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN