- AccountsRecovery Daily Digest

- Posts

- Daily Digest - July 14, 2025

Daily Digest - July 14, 2025

Brought to you by: TCN | By Mike Gibb

📝 EDITOR’S NOTE: The webinar recap will return on Monday. Sorry for any inconvenience.

🥳 🎂 Happy Birthday to: Adam Kazmark of Credit Vision, Kelly Maynard-Schellig of Encore Capital, Melissa Dalton of Persolve, Kristen Jennings of Navient, and Bart Shea of BC Services. Happy belated Birthday to: Jeremiah Wheeler of DRN Data (July 13), Robert Pinchuk of FDCPA Certifications (July 13), Tom Lockard of CBE Companies (July 12), and Adam Pearlman of A.R.M. Solutions (July 12).

🙌 🎉 Congratulations to: John McNamara, the new Chief Growth Officer at Avtal.

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Judge Vacates CFPB Medical Debt Credit Reporting Rule

A federal judge in Texas has vacated the Consumer Financial Protection Bureau’s rule prohibiting the inclusion of medical debt in consumer credit reports, siding with industry trade groups and the Trump administration in a high-profile legal battle over the Bureau’s regulatory authority.

A MESSAGE FROM TCN

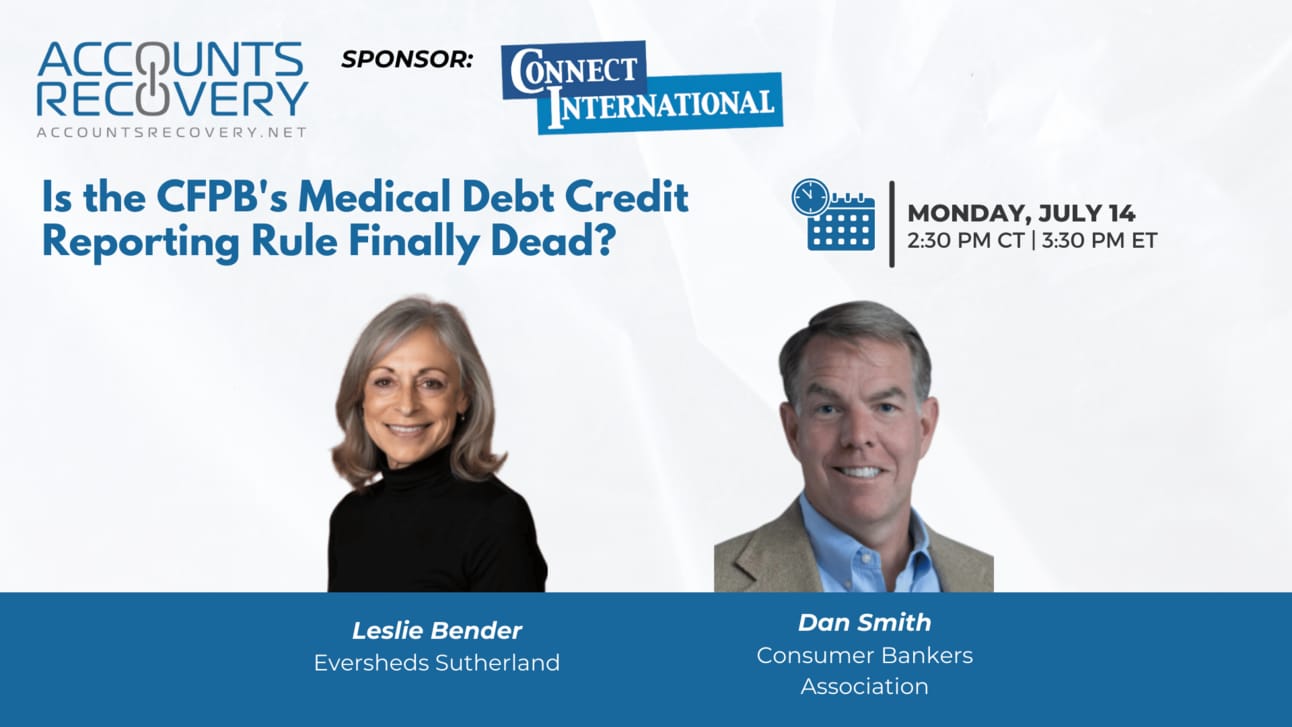

TODAY‘S WEBINAR

UPCOMING WEBINARS

CFPB, FirstCash Reach $9M Settlement Over Military Lending Act Violations

The Consumer Financial Protection Bureau has reached a $9 million settlement with FirstCash and 19 of its subsidiaries, resolving allegations the company violated the Military Lending Act by issuing unlawful pawn loans to active-duty servicemembers and their families. The proposed settlement, which needs to be approved by a federal judge, will end an enforcement action that began back in 2021 when the company was sued by the Bureau.

AI Startup Murphy Raises $15M

Barcelona-based Murphy has raised $15 million in a funding round led by Northzone to scale its artificial intelligence-based debt collection platform. Other participants in the funding included ElevenLabs, Lakestar, and Seedcamp.

Judge Grants Motion to Compel in FDCPA Case Involving Wife

A District Court judge in Georgia has ruled that the wife of a man who signed a contract to purchase a vehicle only to default on the contract, leading the vehicle to be repossessed is bound by the terms of the agreement even if she didn’t sign it because she literally inserted herself in the situation when she got into the vehicle in order to prevent the repossession from taking place and then sued, alleging the lender and the repossession agent violated the Fair Debt Collection Practices Act and Georgia state law.

Compliance Digest – July 14

When it comes to lawsuits and regulatory updates, reading what is going on is important, but what's usually more important is having someone explain the updates and rulings in plain English. Enter the weekly Compliance Digest, in which industry experts -- Stefanie Jackman, Nick Prola, Mike Frost, Akeela White, John Marees, and Mitch Williamson -- tell you exactly what you need to know about all the compliance news in the credit and collection industry.

This series is sponsored by Bedard Law Group

WORTH NOTING: A deep dive on the efforts of the Trump administration to abolish the CFPB and where things stand for those working at the Bureau today ... The five rules of engagement if you are dealing with members of Generation Z ... A list of the biggest healthcare data breaches during the first half of 2025 ... The House Financial Services Committee is holding a hearing tomorrow to celebrate the 15th anniversary of the Dodd-Frank Act becoming law ... If you are always late, mental health experts may have an explanation for you ... If you feel guilty about taking your vacation days, you are not alone ... The reasons why women are slower to start using AI when at work ... How America fell head over heels for "Love Island."

Music Monday, part I

Music Monday, Part II

Webinar Recap: Best Practices in Judgment Collections

Collecting on a judgment may sound straightforward—after all, it’s a court order in your favor—but as panelists in this webinar emphasized, it’s anything but simple. Successfully converting a judgment into dollars takes preparation, strategy, patience, and deep jurisdictional knowledge.

Three experienced legal collection professionals—Jared Buchanan (Faber and Brand), Naomi Ivker (Zacher and Schwartz), and Bill Marohn (Tobin and Marohn) unpacked what makes post-judgment collections so complex and how to optimize your recovery efforts.

Key Themes:

Judgments are only as valuable as your follow-through. A judgment is often called “just a piece of paper”—but in the right hands, it’s a tool for garnishments, liens, property executions, and leverage in settlement discussions.

Not all judgments are created equal. Jurisdiction matters. Some states prohibit wage garnishments or have strict exemption laws. Knowing the landscape ahead of time can help avoid wasted effort.

Long-term planning wins. Life circumstances change—someone who’s “judgment-proof” today may not be in five or ten years. Monitoring and renewal are essential, and collecting a decade-old judgment is not uncommon.

Top 3 Takeaways for Collections Professionals:

Invest in Preparation: Perform robust due diligence before suing. Know the debtor’s assets, employment status, and payment history—and share that info clearly with your legal partner.

Choose Your Legal Partner Wisely: Work with firms who understand your state laws, have a plan for post-judgment remedies, and communicate expectations clearly—especially around costs, documentation, and renewals.

Stay Engaged and Informed: Laws are evolving. From asset exemptions to medical debt limits, staying involved in trade groups and legal discussions can help avoid costly mistakes and maximize recoveries.

Judgment collections aren’t passive—success belongs to those who treat them as a long game, with strategy and persistence at every step.

The Daily Digest is sponsored by TCN