- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 29, 2026

Daily Digest - January 29, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Rick Badeaux of Midland Credit Management, Cherlyl Jaye Valentine of Valentine & Kebartas, and Collin Grabowski of Gateway Financial Solutions.

🎉Congratulations for starting new positions: Tony Lamont as Executive Vice President, Director of Business Operations at C&F Finance and Jen Monteleone as Director of Talent Acquisition at Coast Professional.

Getting to Know Calder Willingham of Creditors Bureau Associates

Calder Willingham literally got his start in the industry on the ground floor. But it’s where he’s taken Creditors Bureau Associates and the direction in which the company is heading that is the bigger story. Calder’s turned CBA into a national presence and earned his place as one of the industry’s future leaders. Read on to learn more about Calder, why his guilty pleasure has to come from the gas station, and where you will find him if he ever wins the lottery.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

TODAY’S WEBINAR

UPCOMING WEBINARS

Judge Finds No Credit Reporting Inaccuracy Despite Consumer Scam

A District Court judge in Maine has granted a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act in a case involving the plaintiff being scammed out of nearly $60,000. The ruling narrows a lawsuit brought by a consumer who alleged that a credit union improperly investigated and reported a home equity line of credit balance that arose after she fell victim to a sophisticated fraud scheme. While the court allowed a narrow claim under the Electronic Fund Transfer Act to proceed related to timing requirements, it dismissed the FCRA claim.

From Experimentation to Execution: How One Bank Is Training 67,000 Employees in AI

Lloyds Banking Group has unveiled one of the most ambitious workforce AI initiatives in financial services, announcing plans to make 100% of its 67,000 employees AI literate by the end of 2026. The effort centers on a newly launched AI Academy, a mandatory, role-agnostic training program designed to move AI from isolated pilots into day-to-day operations. For organizations across collections, banking, fintech, and healthcare finance, the initiative offers a clear blueprint for how to scale AI responsibly without falling behind.

Judge Highlights Timing and Pleading Gaps in FDCPA Case

A District Court judge in Washington has granted a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act and the Fair Debt Collection Practices Act in a case that serves as a reminder about some of the timing and foundational elements that are required when alleging violations of the FDCPA.

N.J. Appeals Court Rejects Arbitration Clause Added by Bill Stuffer

A New Jersey Appeals Court has affirmed a lower court’s ruling that deemed an arbitration provision was unenforceable because the defendant failed to follow its own contact in how amendments to the underlying agreement needed to be made. The court emphasized that arbitration clauses cannot be imposed through shortcuts when an institution’s own agreement sets stricter requirements for contract changes.

WORTH NOTING: Which airlines have the best frequent flyer programs? ... Why is everyone suddenly so obsessed with 2016? ... A new study has revealed that older people are better at reading emotions and facial expressions than younger people in real-life situations ... The Department of Veterans Affairs is proposing its biggest healthcare overhaul in three decades ... What the FTC said yesterday during its workshop on noncompete agreements ... Recapping a hearing before the Michigan legislature on proposals to limit medical debt collection ... Live expectancy for people in the United States has hit a new all-time high ... Can you make your sweet tooth go away?

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: All the Tools Collectors Need in Their Toolbox

In a recent AccountsRecovery.net webinar, sponsored by Ituring.ai, industry leaders discussed the evolving mix of technology and talent that drives success in collections. Panelists Jason Hinkle (Shepherd Outsourcing) and Tim Woudenberg (Creditors Bureau USA) emphasized that while digital tools are reshaping operations, human skills remain indispensable.

Key themes included reducing friction in collector workflows, leveraging gamification to sustain motivation, and balancing investments between technology and training. As Hinkle noted, “If you take a tool out of the collector’s toolbox, you’ve got to put one back in.” Woudenberg added, “Talent sets the ceiling, technology sets the floor,” underscoring the need for both strong systems and skilled people.

The discussion highlighted practical examples such as automated note-taking tools that cut update time by 30% and increased talk time by 25%, as well as real-time dashboards that foster healthy competition and engagement across generations. The panel agreed that listening to top performers is critical when deciding which tools truly move the needle.

Ituring.ai showcased its AI-powered collections platform, designed to unify data, predict defaults, and deliver compliant, personalized outreach—all with full explainability and audit readiness.

🧠 Key Takeaways:

Prioritize friction-reducing tools: Invest in technologies that streamline workflows, such as automated note-taking or simplified payment portals.

Leverage gamification and dashboards: Use real-time metrics and leaderboards to motivate collectors and engage younger talent.

Balance tech with training: Continue developing communication and listening skills to ensure technology amplifies, rather than replaces, human judgment.

This webinar reinforced that the most effective collection operations are those that integrate cutting-edge technology with empathetic, well-trained professionals.

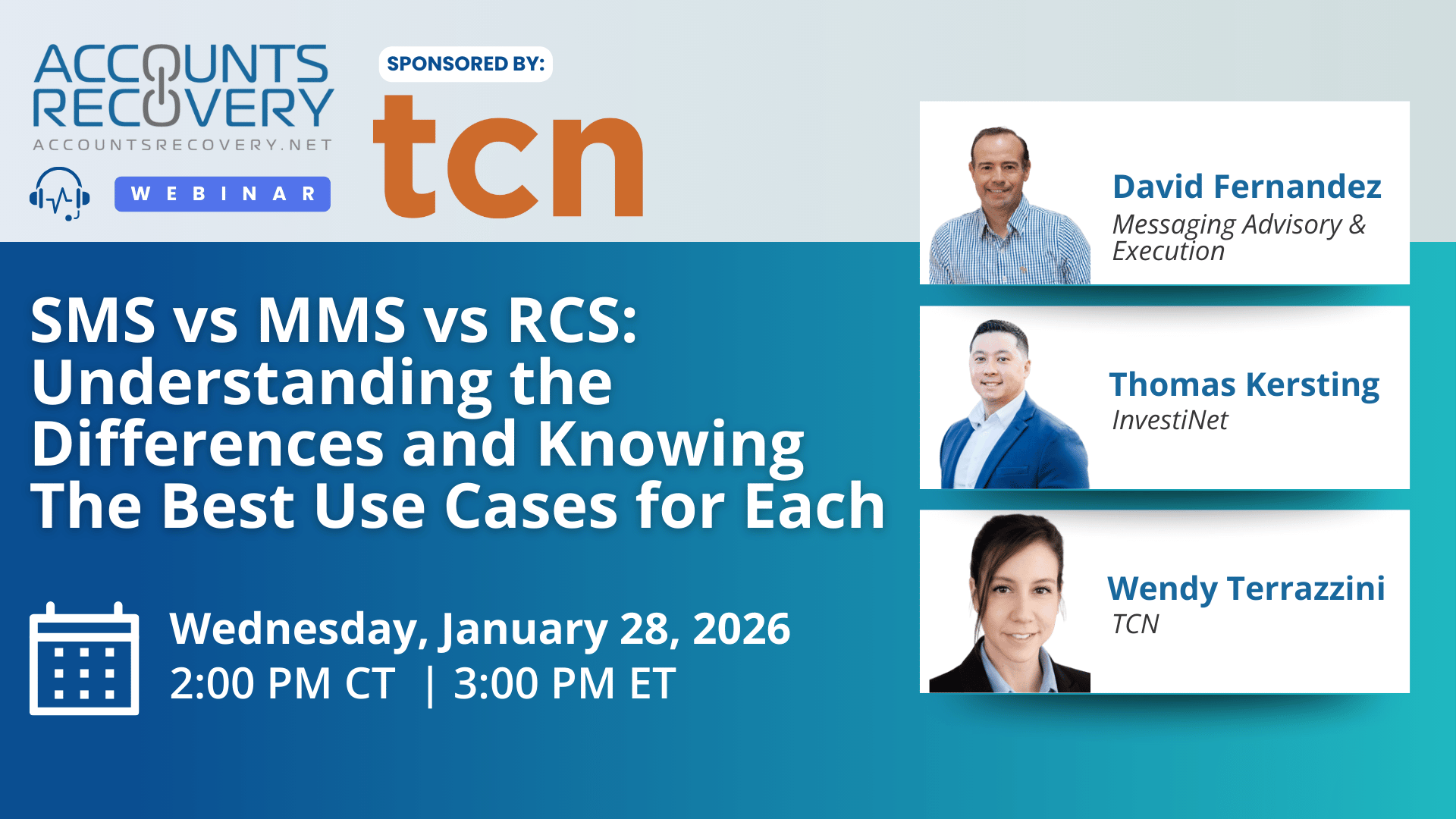

Webinar Recap: SMS vs MMS vs RCS: Understanding the Differences and Knowing The Best Use Cases for Each

In a recent AccountsRecovery.net webinar sponsored by TCN, industry experts explored the differences between SMS, MMS, and RCS messaging and their best use cases in collections and consumer engagement. Moderator Heath Morgan framed the discussion around trust, compliance, and consumer adoption, while panelists highlighted practical applications across financial services and healthcare.

Key insights:

SMS remains the most reliable for quick, transactional alerts such as payment confirmations or verification codes. Its universal support and speed make it indispensable, though it lacks branding and analytics.

MMS expands capabilities with multimedia and longer messages, useful for invoices, logos, or instructional content. However, compressed visuals can undermine trust if not managed carefully.

RCS represents the next evolution—verified, branded, and interactive. With features like call-to-action buttons, carousels, and crisp multimedia, RCS enables in-app payments and mini-app experiences. As David Fernandez noted, “Branded and verified messaging drives more consumer engagement.”

Panelists emphasized that RCS adoption in the U.S. is growing, with international markets already demonstrating 4–10x better outcomes compared to SMS. Trust and verification emerged as central themes, with Wendy Terrazzini adding: “With RCS, with the verified sender, you’re guaranteed of who you’re dealing with.”

🧠 Key Takeaways:

Evaluate channel mix: Use SMS for transactional alerts, MMS for richer content, and pilot RCS for interactive, branded engagement.

Prioritize compliance and trust: Ensure messaging strategies align with TCPA/CFPB rules and leverage RCS verification to reduce consumer skepticism.

Test and measure ROI: Compare engagement and conversion rates across SMS, MMS, and RCS to identify the most effective channel for collections.

This session underscored that while SMS and MMS remain essential, RCS offers a transformative opportunity for debt collectors, banks, and healthcare providers to build trust and drive higher engagement.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN