- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 27, 2026

Daily Digest - January 27, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to: Irwin Bernstein of CMS Services and Thomas Tirabassi, Jr. of Recovery Management Solutions.

🎉Congratulations for starting new positions: Chantel Wonder as Partner at Kaufman Dolowich, Racher Eaker as Senior Manager, Business Analytics at 2nd Order Solutions, and Ryan Medina as SVP Vendor Management at Secure Collateral Management.

Consumer Seeks Removal of Collection Lawsuit to Federal Court to Address FDCPA Claims

This isn’t something that you see everyday. A consumer, the defendant in a collection lawsuit filed in Kansas state court is seeking to have the case removed to federal court in order to address allegations that the plaintiff, a debt buyer, has violated the Fair Debt Collection Practices Act by failing to validate the debt and by filing the lawsuit in the wrong venue. Normally, it’s the other way around — a consumer files a lawsuit in state court and the collection operation tries to have the case heard in federal court.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

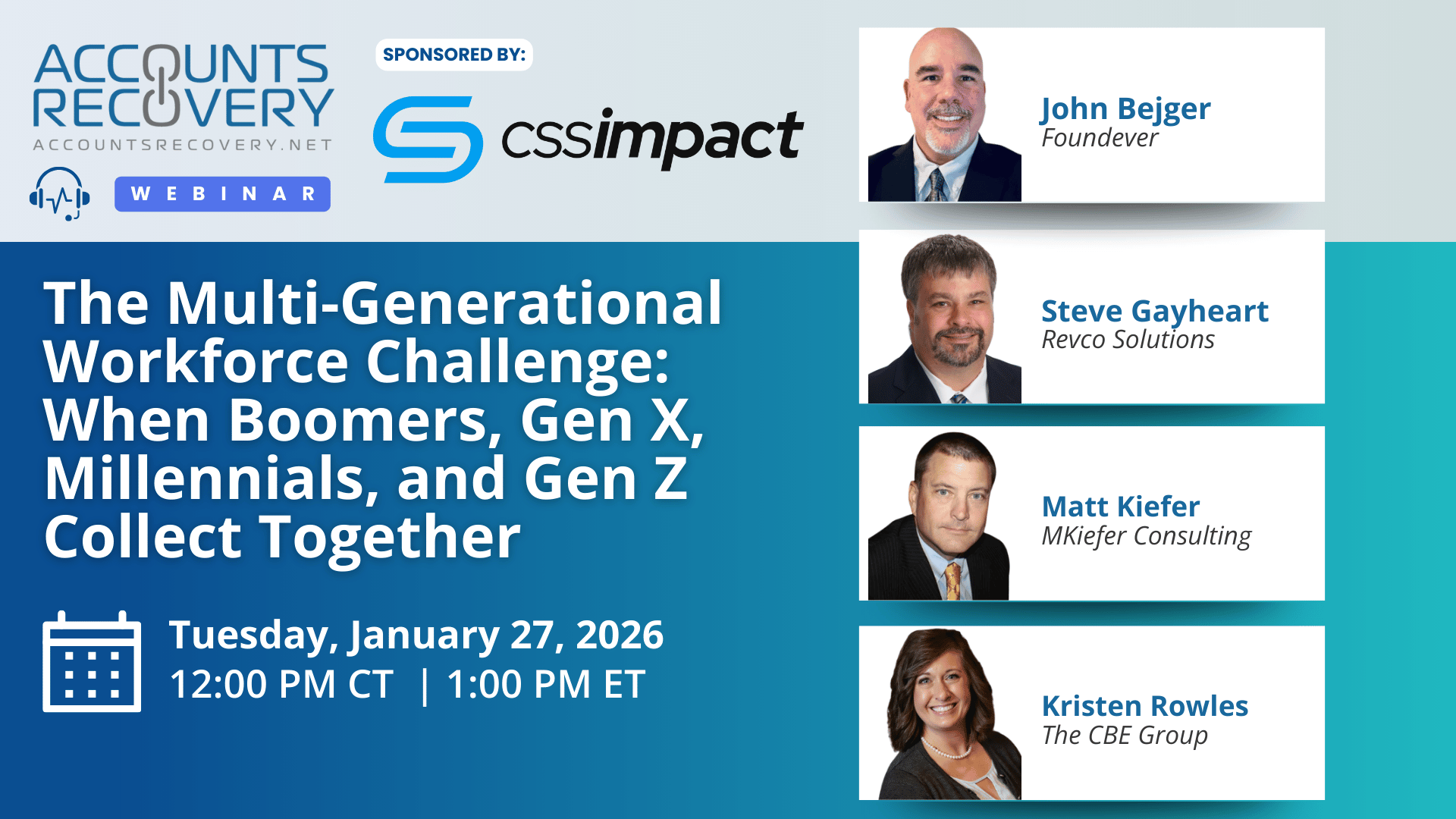

TODAY’S WEBINAR

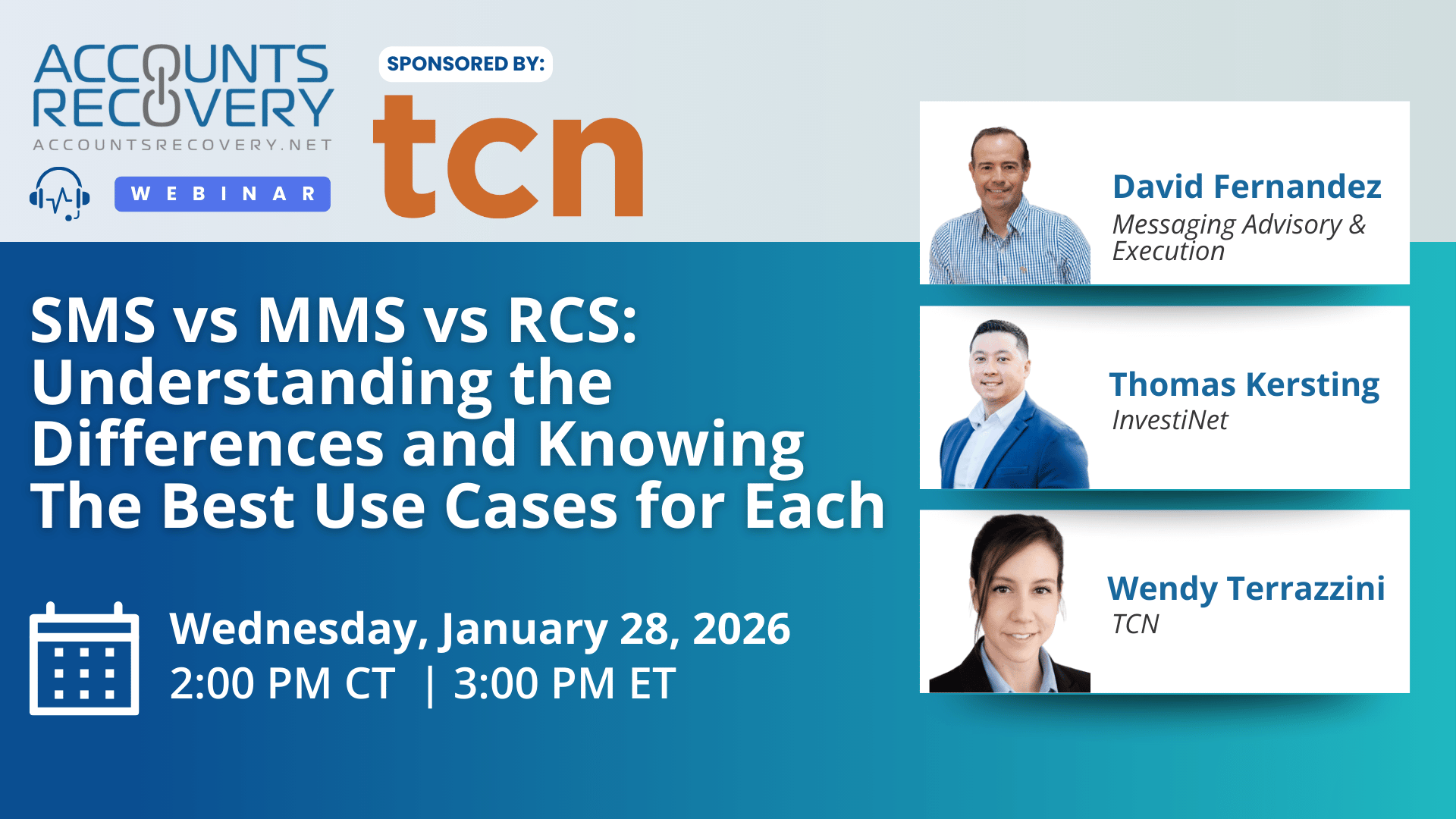

UPCOMING WEBINARS

Judge Orders Repeat FDCPA Filer To Get Court Approval Before Launching New Suits

In a case being defended by Manny Newburger of Barron & Newburger, a District Court judge in Texas has granted a request from the defendants in a Fair Debt Collection Practices Act case and imposed an injunction on the plaintiff forcing him to get approval of the court before filing any future lawsuits. The judge did deny a request from the defendants to sanction the plaintiff.

Study: Payment Disruptions Trigger Rapid Abandonment and Lost Revenue

Payment system disruptions are quietly draining billions of dollars from U.S. businesses each year, and the implications extend well beyond retail and hospitality. A new study estimates that payment outages put $44.4 billion in annual sales at risk, with most losses occurring during peak hours and within minutes of a disruption. The research found that consumers typically wait just seven minutes before abandoning a transaction, while the average outage lasts nearly two hours. For organizations that rely on digital channels and payment portals to collect from consumers, the message is clear: when payments fail, consumers do not wait around, and revenue disappears quickly.

Online Referral Clicks Create Enforceable Arbitration Agreement, Appeals Court Rules

The Court of Appeals for the Sixth Circuit has overturned a lower court’s ruling that refused to bind a consumer to the arbitration provisions of an affiliate who referred business to the defendant after the consumer clicked to agree to the terms of service provided in an online form.The appellate court held that the consumer’s repeated clicks on an online mortgage referral website constituted valid acceptance of the website’s terms of use, including a broad arbitration provision that extended to affiliated companies.

KPMG: Most Companies Are Betting Big on AI, but Few Are Scaling It Successfully

KPMG’s newly released Global Tech Report 2026 paints a clear picture of where organizations stand on artificial intelligence and advanced technology adoption and where many are likely to struggle next. According to the report, 68% of organizations expect to reach the highest level of AI maturity by the end of 2026, yet only 24% say they have successfully scaled AI across multiple use cases and achieved consistent ROI today. The gap between ambition and execution is widening as companies move beyond experimentation and attempt to embed AI directly into core operations. global-tech-report

Heath Morgan’s New Novel The Memory Project Explores the Future of AI, Data, and Humanity

ARM Industry veteran Heath Morgan announces the release of his debut novel, The Memory Project, available January 27, 2026, on Amazon in softcover, hardcover, e-book, and audiobook formats.

WORTH NOTING: Anytime delinquency rates are referred to as "surging" it's never a good thing ... One trick to help get people to figure out if a message is true or false ... An interesting look at how remote work and online shopping are reshaping how and when Americans spend their money ... The Federal Trade Commission is hosting a workshop on noncompete agreements this afternoon ... A look at how rulemaking at the Consumer Financial Protection Bureau shifted in 2025 ... How was your 2025? Most Americans say it was "meh" ... Seven common public speaking issues and how to fix them ... Why you may want to cut back on your drinking before it's too late.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: How To Manage a Digital/Agentic Workforce

The recent webinar, hosted by AccountsRecovery.net and sponsored by InterProse, explored the rise of agentic AI—digital agents capable of reasoning, planning, and executing tasks beyond traditional scripted automation. Panelists from Williams & Fudge, Paycourt, MRS BPO, and InterProse emphasized that adopting these systems is not just a technical upgrade but a management transformation.

Jeff Freedman described agentic workers as systems that “own the outcome rather than just the process,” while Jon Balon highlighted the need to “coach the agentic AI” much like employees. Rick Bonitzer noted that conversational AI and workflow automation are stepping stones, but true agentic AI involves autonomous decision-making. Aaron Reiter stressed the importance of compliance guardrails and consistent consumer experiences.

The discussion covered practical applications such as inbound communication parsing, automated call routing, and digital assistants managing payment plans. Panelists agreed that organizations should start small, measure outcomes carefully, and view AI as an assistant rather than a replacement for human staff.

🧠 Key Takeaways:

Start with simple automations: Identify manual, repetitive tasks (e.g., wrong-number text responses, file downloads) and automate them first to build confidence and ROI.

Measure compliance-focused outcomes: Track metrics like containment rate and cost to resolve compliantly to ensure automation improves—not harms—customer engagement.

Shift culture toward AI-as-assistant: Position agentic AI as a tool that supports staff, reduces busywork, and enhances productivity, rather than as a threat to jobs.

This webinar underscored that agentic AI is still evolving, but early adopters in collections and financial services are already seeing efficiency gains. The path forward requires balancing innovation with compliance, transparency, and cultural adaptation.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN