- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 23, 2026

Daily Digest - January 23, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to: Ryan Peter of MRS BPO, John McNeill of Spring Oaks Capital, and Jason Yates of InvestiNet.

🎉Congratulations for starting new positions: Rachell Fauble as Senior Human Resources Manager at Rent Recovery Solutions, Jeffrey Couto as Sr. Director, Marketing Operations and AI at FairSquare, Christine Caldwell as Customer Success Manager at SellersFi, and Kylie Hart as Senior Messaging Solutions Advisor at Solutions by Text.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Nick Prola from Bassford Remele shares the point where a consumer’s comments become an official dispute. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

Lawsuit Raises Questions About Investigations of ID Theft Claims

How much proof is needed when a consumer claims to be the victim of identity theft? That appears to be the crux of a case filed in California federal court, accusing a bank, a collection operation, and two credit reporting agencies of violating a number of statutes, including the Fair Credit Reporting Act and state laws by not believing the plaintiff’s claim that the underlying debts were a result of his former roommate and business partner that were taken out in the plaintiff’s name.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY’S WEBINAR

UPCOMING WEBINARS

Defendant in FDCPA Cases Faces $15k in Attorney’s Fees

A District Court judge in New York has awarded plaintiffs in separate Fair Debt Collection Practices Act cases more then $15,000 in attorney’s fees and costs against the same defendant, after default judgments were entered nearly a year ago. What makes the rulings more interesting is that the cases were filed back in 2021, and settlements were reached in both cases back in 2022 before things fell apart.

FCRA Claims Over Post CARES Act Credit Reporting Allowed to Proceed

A District Court judge in Delaware has denied a plaintiff’s motion for summary judgment and partially granted a defendant’s motion in a Fair Credit Reporting Act case involving how information should have been furnished to the credit reporting agencies related to payments during the COVID-19 pandemic. The case centers on whether a mortgage servicer properly investigated and corrected credit reporting after receiving consumer disputes tied to a trial payment plan and a permanent loan modification that occurred during the CARES Act accommodation period.

CBA White Paper Flags New Risks as Agentic AI Moves Into Consumer Payments

Agentic artificial intelligence may soon be making payments, booking purchases, and managing bills on behalf of consumers, and the Consumer Bankers Association is urging the industry to think carefully about what that shift means before it becomes mainstream. In a newly released white paper, Agentic AI Payments: Navigating Consumer Protection, Innovation, and Regulatory Frameworks, the CBA examines how autonomous AI tools could reshape the payments ecosystem, while also introducing new risks around authorization, liability, fraud, and consumer understanding.

Increased BNPL Use Signals Deeper Financial Stress for Consumers

For many New Yorkers, Buy Now, Pay Later has quietly shifted from a checkout option to a coping mechanism. New data from the Community Service Society of New York paints a clear picture: a growing share of consumers are relying on short-term debt, including BNPL, not for discretionary purchases, but to cover everyday necessities.

WORTH NOTING: Consumers don't like returning merchandise and would prefer to just hold on to their purchases ... A lawsuit is going after a widely used AI hiring platform ... A handful of takeaways from this year's Oscar nominations ... What you should be stocking up on in advance of this weekend's winter storm ... Why you should stop relying on self-discipline and do this instead ... There is a new deadliest form of cancer for people under the age of 50 ... What works and what doesn't if you are thinking about using AI to be your life coach ... Why the color on car headlights changed from yellow to white.

Funny Friday, part I

Funny Friday, Part II

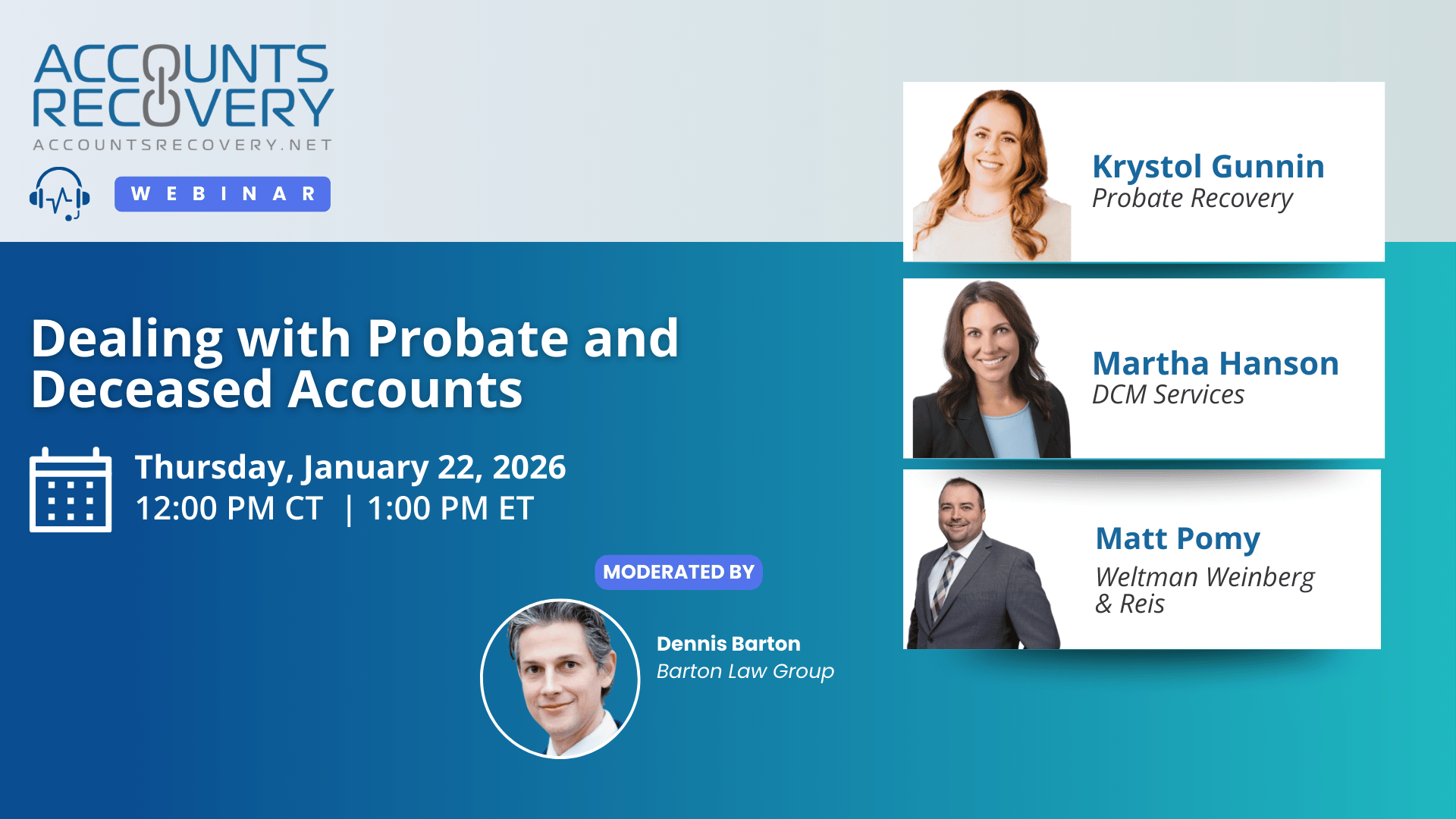

Webinar Recap: Dealing with Probate and Deceased Accounts

Managing deceased accounts presents unique challenges for the credit and collection industry, requiring a balance of compliance, compassion, and business necessity. In a recent webinar hosted by AccountsRecovery.net, panelists Krystol Fanning (Probate Recovery Systems), Martha Hanson (DCM Services), and Matt Pomy (Weltman Weinberg & Reese)—moderated by Dennis Barton (Barton Law Group)—shared strategies for navigating probate and non-probate workflows.

The panel emphasized that identifying the right party contact (RPC) is often the most difficult step. Probate court records, skip tracing, and vendor data are critical tools, but relationships with clerks and gatekeepers remain invaluable. As Hanson noted, “It can be highly emotional for individuals when you’re contacting grieving parties,” underscoring the need for sensitivity.

Panelists also discussed the importance of multi-source verification. While the Social Security Administration’s Death Master File is a key resource, it is imperfect. Layering data from vendors such as LexisNexis or Accurint, along with family-provided documentation, helps reduce errors.

Timing was another focal point. Acting too quickly risks reputational harm, while waiting too long can forfeit creditor rights. Barton summarized the tension well: “Business necessity collides with human decency.” Most panelists recommended pausing outreach for several weeks, while maintaining vigilance for statutory deadlines that vary by state.

🧠 Key Takeaways:

Implement layered verification processes: Use multiple data sources (SSA, probate records, vendor databases) to confirm deceased status and avoid false positives.

Establish respectful waiting periods: Pause outreach for 4–6 weeks to allow families time to grieve, but monitor state-specific claim deadlines closely.

Strengthen relationships with probate clerks and attorneys: Courthouse personnel are gatekeepers to critical information; respectful engagement ensures smoother access to records.

This webinar highlighted that probate collections are not just about compliance—they demand compassion, precision, and proactive processes to protect both reputations and creditor rights.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN