- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 22, 2026

Daily Digest - January 22, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to: Jason Glenn of First Credit, Inc/RevCare, Nathan Copeland, Esq. of Community Choice Financial Family of Brands, Kris Royal, ETA CPP of BlytzPay, Chris Coleman of Finance System, Inc., and Lacey (Carnesecca) Cherrington of The Cherrington Firm, PLLC.

🎉Congratulations for starting new positions: Chief Keiser as Chief Legal Officer at Flagship Financial Group, JuliAnn Rich as Senior Manager of Employee Experience & Shared Services at Bridgecrest.

Getting to Know Crystal Duplay of Frost Echols

The first in her family to go to college. A state recordholder in weightlifting. Read 100 books in a year. Makes sourdough bread and quilts. Whether you think you are active or not, reading all the activities that Crystal Duplay is involved in will tire you out. It’s no wonder her day begins as early as it does. Read on to learn more about Crystal, the event she is happy to get on a plane to go watch, and why 7:30am is primetime for getting things done.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

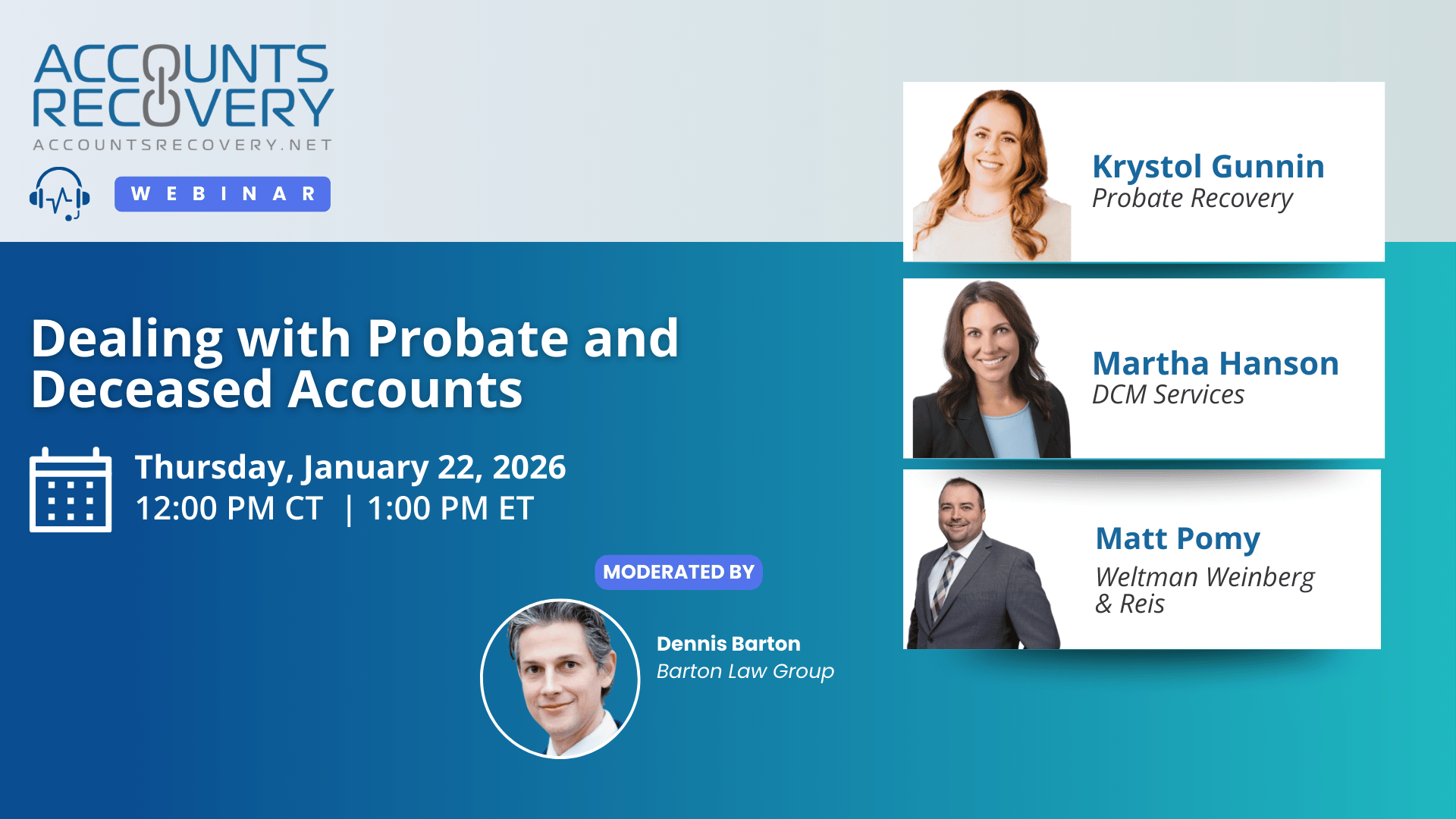

TODAY’S WEBINAR

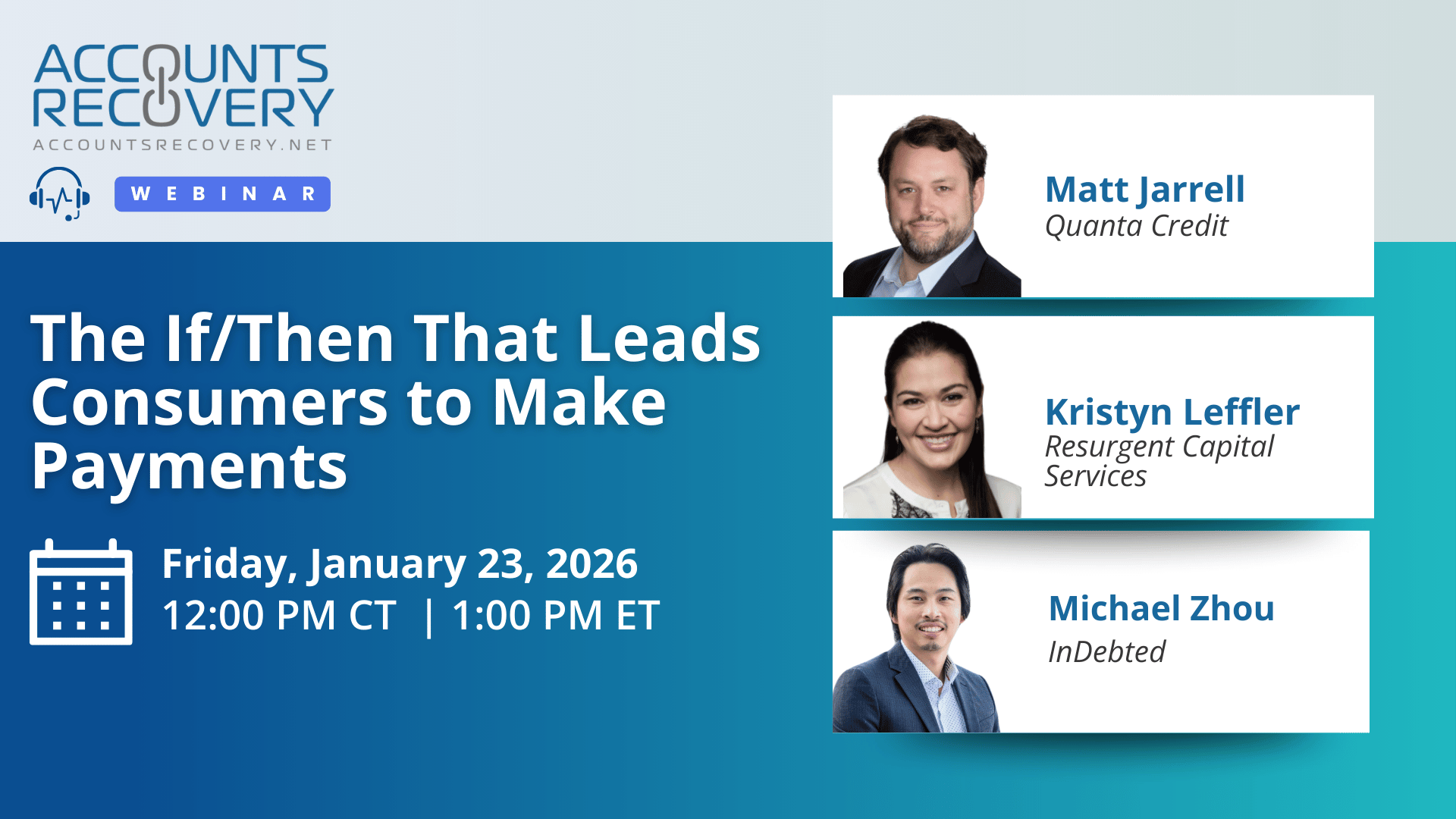

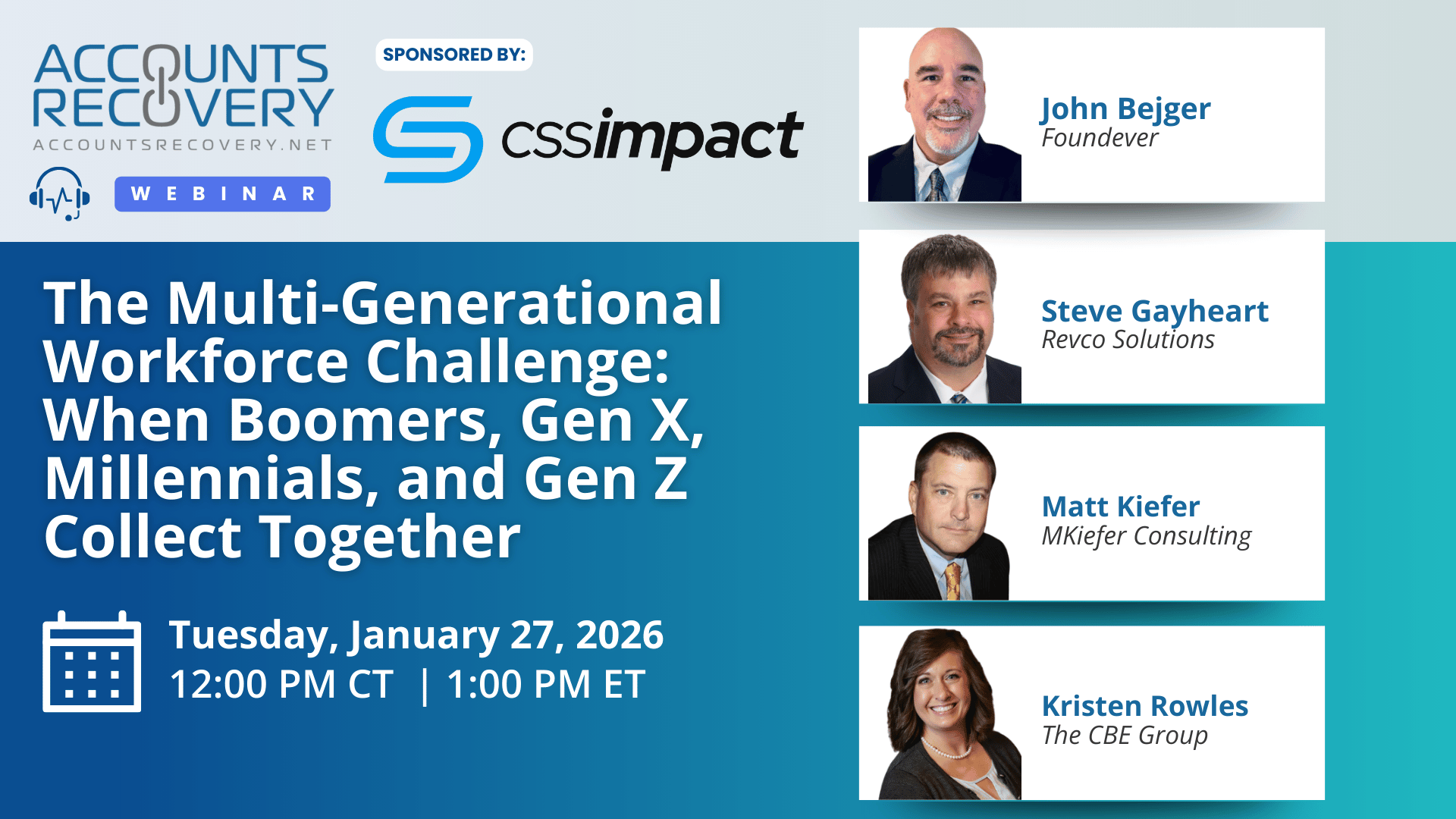

UPCOMING WEBINARS

Judge Says Federal Courts Cannot Revisit Arbitration Awards Through FDCPA and FCRA Claims

A Magistrate Court judge in New Mexico has recommended dismissing a lawsuit filed by a consumer against a financial institution that sought to vacate an arbitration award of nearly $50,000 in the institution’s favor over claims the institution violated the Fair Debt Collection Practices Act and the Fair Credit Reporting Act. The recommendation, issued in a Proposed Findings and Recommended Disposition, centers not on the merits of the consumer protection claims themselves, but on whether the federal court had the authority to hear the case at all.

Judge: Furnishers Not Liable for CRA Reporting Differences Without Specific Errors

A District Court judge in Wisconsin has granted a motion to dismiss filed by three furnishers in a Fair Credit Reporting Act case involving claims they failed to investigate and correct disputed information.

Why Chatbots Can Be a Compliance and Fraud Risk

AI chatbots are quickly becoming a frontline channel for consumer-facing financial services, but new research suggests the technology may be far riskier than many institutions realize. An applied AI researcher who tested 24 leading AI models configured as banking customer-service chatbots found that every single one was exploitable, sometimes with alarming success rates. The findings raise serious implications for banks, fintechs, healthcare providers, and collection operations that rely on chatbots to handle disputes, eligibility questions, and account-related conversations — areas where a single incorrect or misleading response can trigger regulatory exposure or enable fraud.

Washington Lawmakers Target Medical Debt Interest in New Consumer Protection Push

A medical debt collection bill has been introduced in the Washington legislature that aims to enhance consumer protections and eliminate interest charges on new and unpaid medical debt incurred in the state, a move that could significantly alter how medical balances are serviced, collected, and enforced.

WORTH NOTING: Last year marked the first time that consumers spent more on mobile apps than they spent on mobile games, driven by adoption of Generative AI ... Why is it so hard to get AI to sound like a human when it writes? ... A report on emergency savings shows the poor financial shape that many consumers are in ... The 10 worst times to try and buy a used car ... The Secretary of Education weighs in on why it paused its garnishment plan for unpaid student loans ... With a big winter storm bearing down on much of the country, here is a guide to what all the terms they are using mean ... The best and worst airlines of 2025 ... Why fast food deals that seem like bargains can quietly cost you more.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: What is on State Radars for 2026

State legislatures are entering 2026 with renewed focus on compliance and consumer protection, signaling significant operational impacts for debt collection agencies, debt buyers, fintechs, banks, credit unions, consumer finance companies, and healthcare providers.

Panelists highlighted medical debt as the most prominent issue, with numerous bills proposing bans on credit reporting, enhanced patient rights, and restrictions on collection activity. As one speaker noted, “Every single bill… was medical debt related.” This trend is driven by affordability concerns and political momentum heading into midterm elections.

Beyond medical debt, regulators are revisiting data integrity and substantiation of debt, questioning whether consumers fully understand what they owe and whether information flows between creditors, buyers, and collectors are sufficiently clear. Enforcement actions increasingly tie these concerns to technology and data transmission.

The discussion also underscored the rise of novel enforcement theories. Municipalities like Baltimore are importing CFPB-style investigative processes, while state AGs expand UDAP authority into areas traditionally handled by financial regulators. Panelists warned that SaaS and tech providers could be swept into debt collector classifications, creating new licensing and compliance risks.

Finally, bipartisan interest in AI and data privacy is reshaping the regulatory landscape. Both red and blue states are advancing legislation, blurring traditional political lines and signaling that technology oversight will be a defining issue in 2026.

🧠 Key Takeaways:

Track Medical Debt Legislation: Monitor state bills restricting credit reporting and collection practices; anticipate litigation over FCRA preemption.

Strengthen Data Integrity: Ensure debt substantiation and clear information flow across creditors, buyers, and collectors to mitigate enforcement risk.

Prepare for Expanded Enforcement: Anticipate UDAP-driven actions, novel municipal theories, and potential licensing exposure for tech platforms.

This year’s message is clear: compliance teams must stay proactive, as 2026 will bring both familiar challenges and new, aggressive enforcement strategies.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN