- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 21, 2026

Daily Digest - January 21, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Ryan Wilcox of AllianceOne, and David C. Mitchell of Security Service Federal Credit Union.

It’s not too late. Come and be part of the biggest and best ARMTech yet!

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Judge Rejects TCPA Claims Based on Call Volume Alone

A District Court judge in California has granted a defendant’s motion for summary judgment in a Telephone Consumer Protection Act case after the plaintiff received “hundreds” of calls from a debt collector, ruling there was not enough evidence to prove the defendant’s calls used artificial or prerecorded voices.

A MESSAGE FROM TCN

TODAY’S WEBINAR

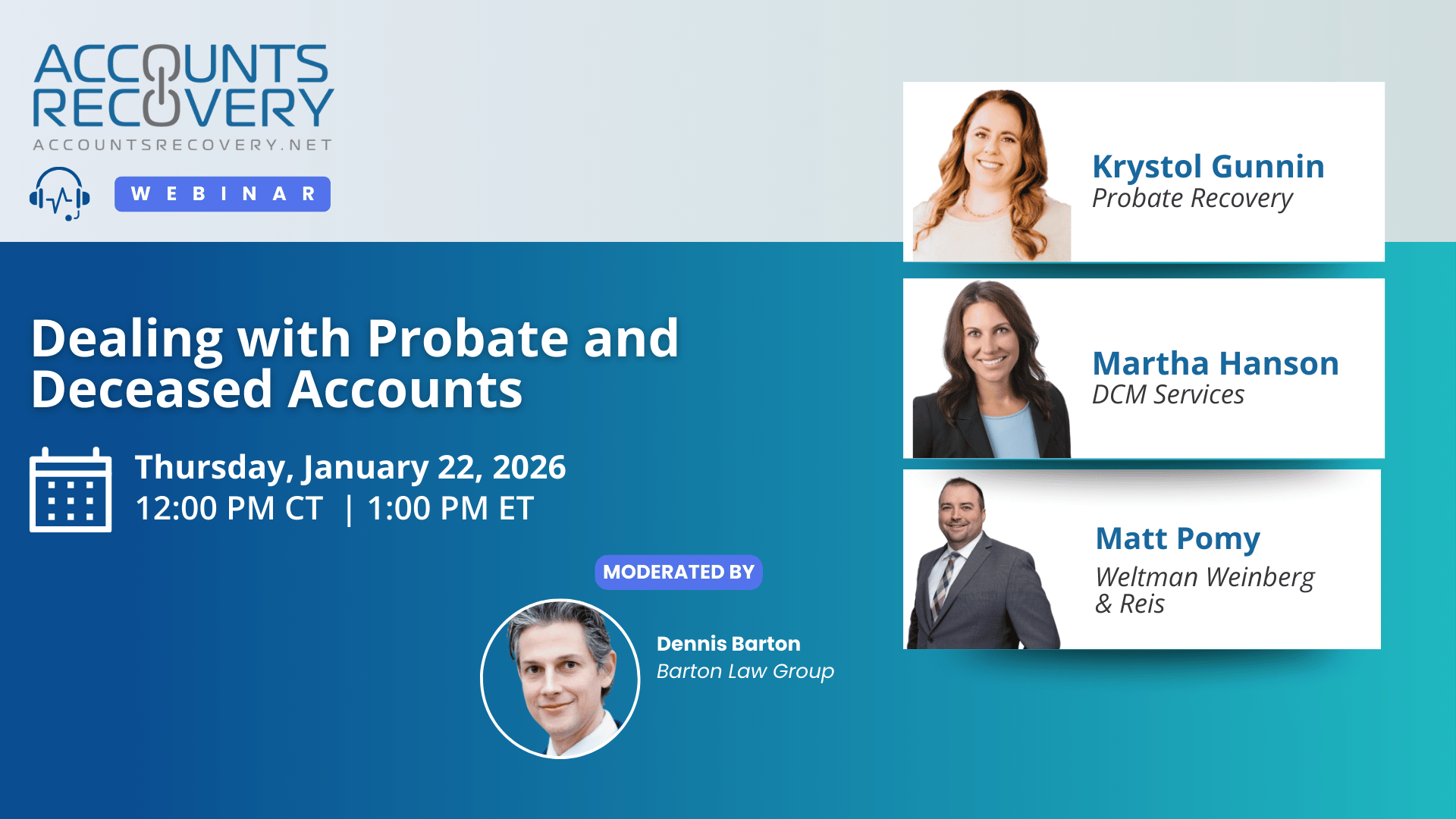

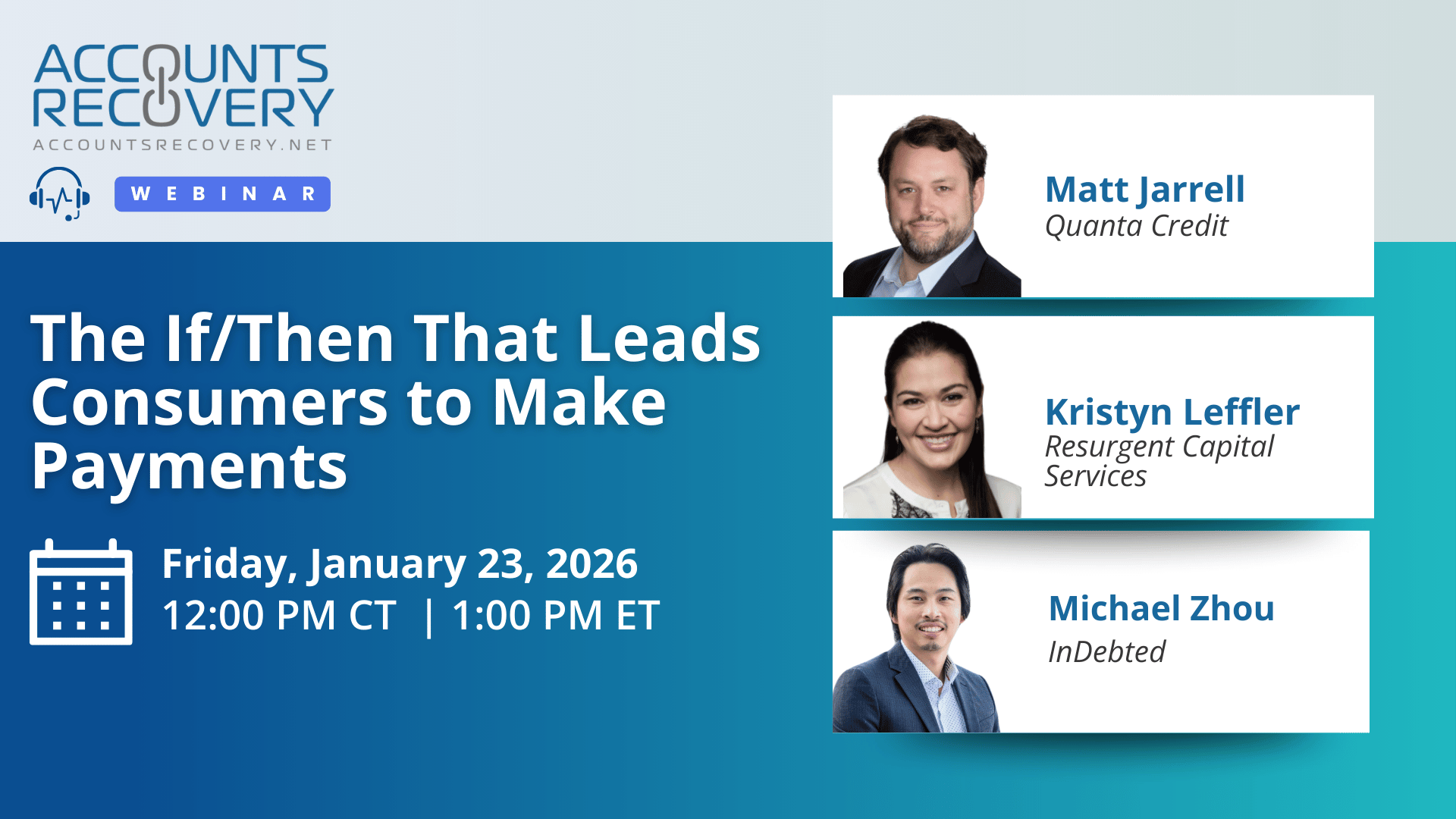

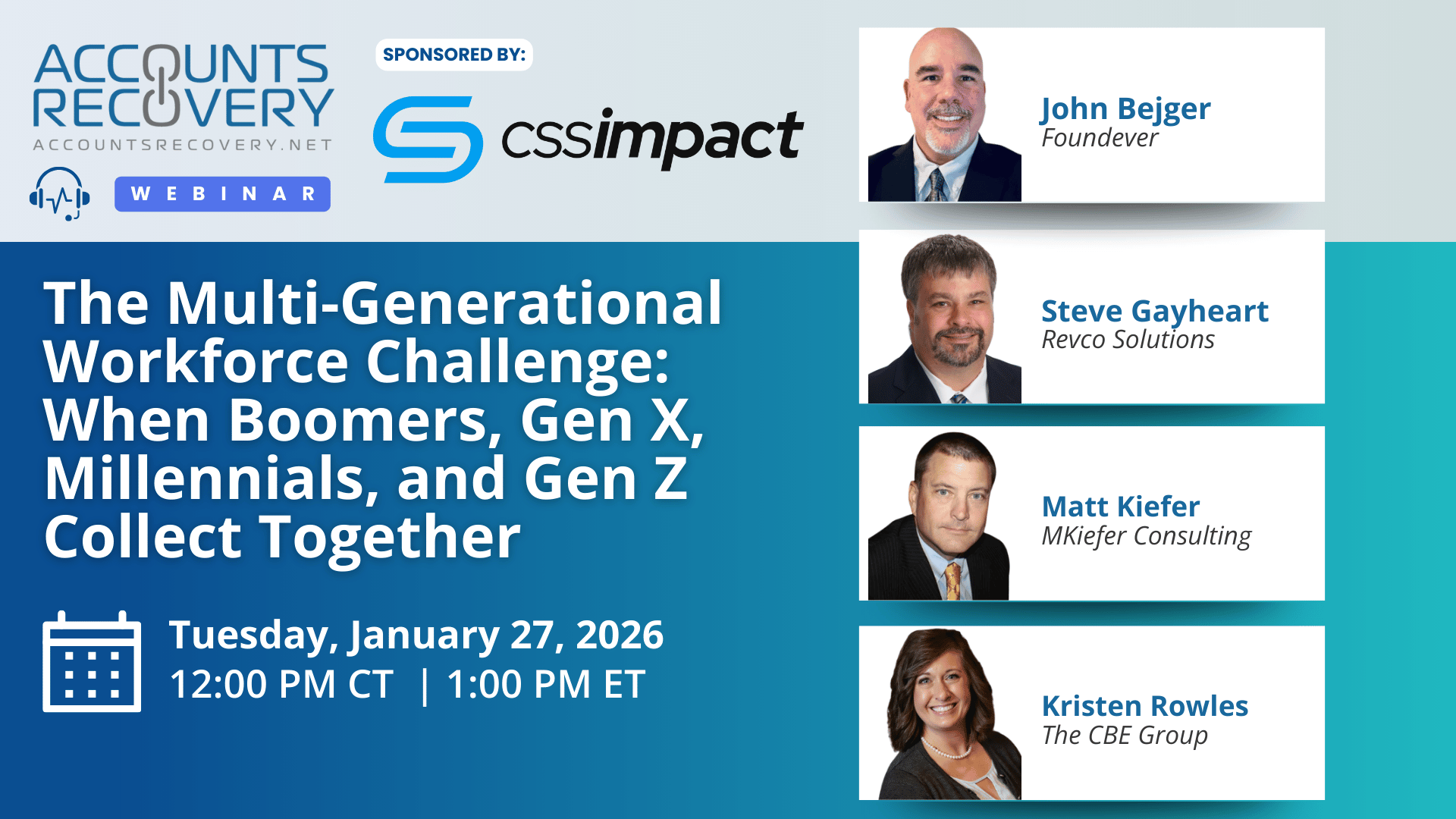

UPCOMING WEBINARS

Healthcare RCM Enters an AI Inflection Point as Fragmentation Emerges as the Biggest Risk

Artificial intelligence is no longer experimental in healthcare revenue cycle management, according to a recently released industry report, but fragmented data and disconnected solutions now pose the biggest threat to scaling results. AI is already reducing denials, accelerating scheduling, and lowering administrative costs, yet most organizations remain stuck in early or mid-stage maturity, limiting enterprise-wide impact.

Judge Grants MTD in FCRA Case Over Reporting of Discharged Student Loans

A District Court judge in New York has granted a motion to dismiss claims that the defendants violated the Fair Credit Reporting Act over how they handled information related to the discharge of the plaintiff’s student loans after filing for bankruptcy protection. The case centered on how discharged student loan accounts were reflected on consumer credit reports following a Chapter 7 bankruptcy and a subsequent discharge of federally held student loans. The court ultimately concluded that the plaintiff failed to plausibly allege that the credit reporting was inaccurate or materially misleading under the FCRA.

Think You Are Using LLMs Wrong? Google Says Just Ask Twice

In the chaotic world of large language model optimization, engineers have spent years piling on complexity in hopes of getting better answers. But new research from Google suggests the fix may be far simpler. A recently released paper from Google Research finds that simply repeating a prompt verbatim can significantly improve performance across major models including Gemini, GPT-4o, Claude, and DeepSeek, without increasing latency or response length.

48 Companies Seeking Collection Talent

Here’s a job, there’s a job, everywhere’s a job-job. Regardless of where you live, what you do know, or what you would like to do in the future, chances are there is a job for you in this week’s job listings summary. Check out four dozen companies across credit and collections that are actively looking for their next rock-star employee.

WORTH NOTING: A list of the top 10 priorities for chief information officers in 2026 ... The Attorney General of Arizona has announced an enforcement action with a healthcare provider over its billing practices ... More and more people are using the first month of the year as "No Buy January" ... Look! In the sky! It's a bird! It's a plane! It's a burrito ... How to keep your laptop charged when you are on the road ... Movie critics share how you can be a better movie watcher ... At last: Ashton Kutcher cleans up the rumors about his shower habits. Now we can all move on to more important things ... A look at house prices in 2026 in 380 housing markets across the country.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: The Pro Se Litigation Playbook

The recent webinar, The Pro Se Litigation Playbook, brought together legal and compliance experts to discuss the growing trend of consumers representing themselves in debt collection litigation. Moderator Mike Gibb noted that the rise of “pro se plaintiffs and defendants” is reshaping courtroom dynamics, fueled by online resources and AI-driven tools.

Panelists Marissa Coyle (Frost Echols), Meghan Jean (Sequium Asset Solutions), Justin Penn (Hinshaw & Culbertson), and Rick Perr (Kaufman Dolowich) shared their experiences on how courts handle pro se litigants and what creditor-side professionals need to know.

While the rules of civil procedure technically apply equally, judges often grant pro se litigants more leeway—such as allowing repeated missed appearances or offering procedural guidance. As Justin Penn observed, “Technically…the rules apply equally…but in practice, they will get many breaks.” However, once cases reach the merits, judges generally “call balls and strikes” and apply the law consistently.

Panelists agreed that pro se filings are increasing, with consumers using AI to draft stronger pleadings and social media to share strategies. This trend can make cases harder to dismiss early, though many pro se litigants remain inexperienced and inconsistent. Rick Perr emphasized the cost implications: defending pro se suits can be more expensive procedurally, but without opposing counsel, attorney fee exposure is eliminated. Sanctions, while costly to pursue, can serve as deterrents and negotiation leverage.

🧠 Key Takeaways:

Expect more pro se litigation: Consumers are increasingly filing suits on their own, often aided by AI and social media.

Balance settlement vs. litigation costs: While defending can be expensive, the absence of attorney fee exposure changes the calculus.

Use sanctions strategically: Sanctions orders can discourage frivolous filings and strengthen your position in future disputes.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN