- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 20, 2026

Daily Digest - January 20, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Basit Sheikh of Operator Labs, James Lincoln of Steel River Systems, Dawn McElligott of Total CollectR Virtual Agent & Debt Negotiator, and Liza Rozzelle of Women in Consumer Finance.

It’s not too late. Come and be part of the biggest and best ARMTech yet!

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Class Action Targets Debt Buyer Over Alleged False Chain of Title in Collection Suits

A debt buyer is facing a class-action lawsuit in New Jersey federal court alleging it violated the Fair Debt Collection Practices Act by including the names of intermediary assignees in the chains of title when filing collection lawsuits against the plaintiffs, when, according to the complaint, the debts were sold directly to the defendant by the original creditors.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY’S WEBINAR

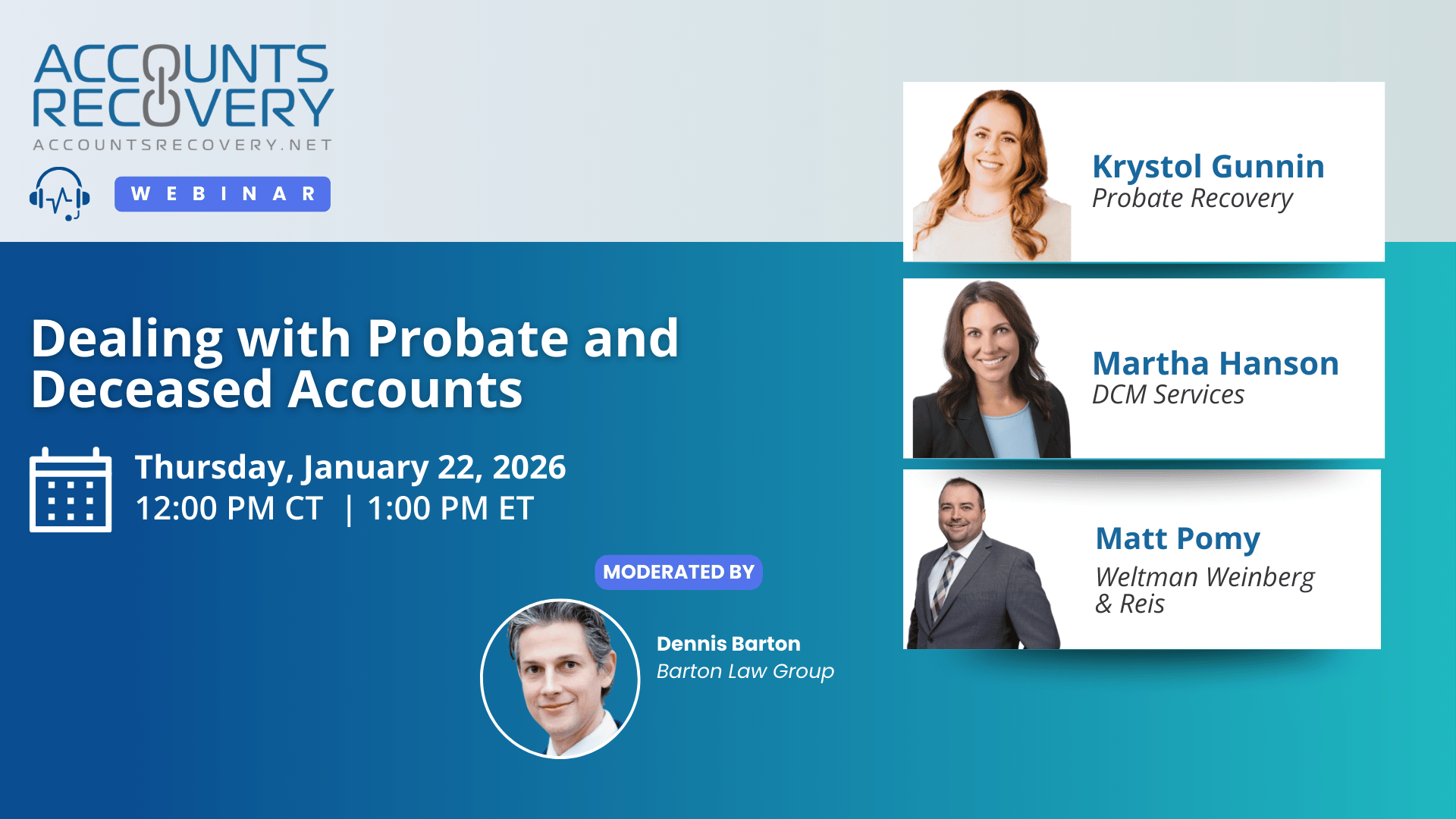

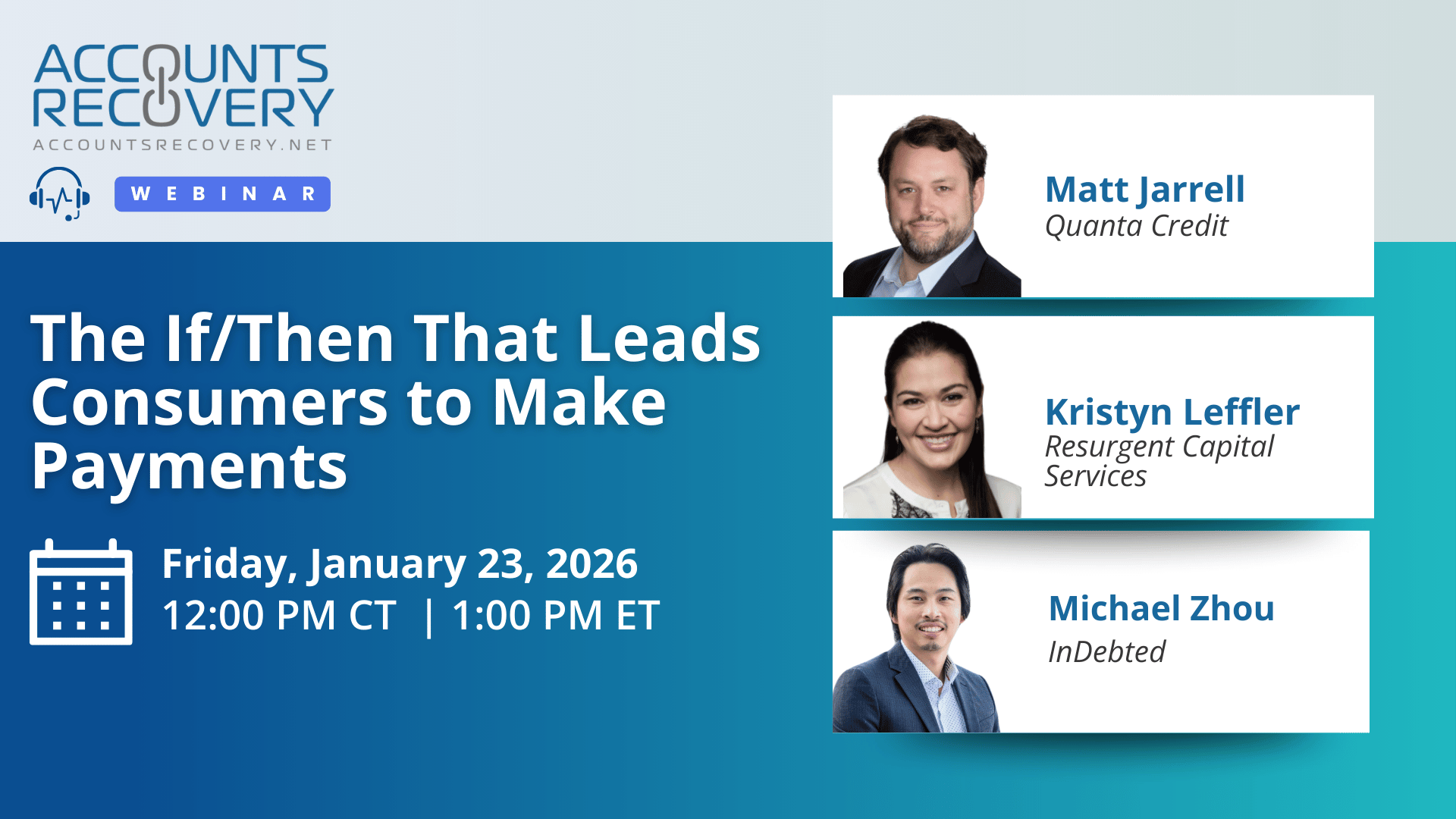

UPCOMING WEBINARS

New York Legislature Reopens Coerced Debt Debate With Expanded Consumer Protections

A coerced debt collection bill has been introduced in the New York legislature that would expand and clarify how creditors, debt collectors, and collection agencies must respond when a consumer claims a debt was incurred through coercion. The proposal builds on legislation enacted in 2025 and seeks to refine definitions, timelines, and enforcement mechanisms related to claims of coerced debt, while also pushing back the effective date of the underlying law.

Judge Says Student Loan Servicer Not Shielded by Sovereign Immunity

A District Court judge in Florida has denied a defendant’s motion for judgment on the pleadings in a Fair Credit Reporting Act case on the grounds that the defendant is not subject to immunuty under the Eleventh Amendment of the Constitution.

CFPB Complaint Does Not Equal Cease-and-Desist Under FDCPA, Court Says

A Magistrate Court judge in California has recommended granting a defendant’s motion to dismiss claims it violated the Fair Debt Collection Practices Act by continuing to attempt to collect on a debt after the plaintiff had requested that the defendant stop its collection attempts on the grounds that the request was filed in the form of a complaint with the Consumer Financial Protection Bureau and not directly with the defendant.

Nearly Half of New Yorkers Say a $1,000 Medical Bill Would Push Them Into Debt

Nearly half of New Yorkers say they could not cover an unexpected $1,000 medical bill without going into debt, underscoring the continued strain medical costs place on household finances and the downstream implications for providers, payers, and revenue cycle operations. According to a January MetroPlusHealth Care Crunch Index survey, 46% of respondents reported they would need to borrow or incur debt to manage such an expense, while roughly one in three households said medical debt already affects their finances.

WORTH NOTING: A debt reduction strategy that would likely not be recommended by Dave Ramsey ... Why people believe misinformation even when they are told facts ... Affirm is going to let consumers use its BNPL services to pay their rent ... The secret to why you catch colds may be in your nose ... How to overcome FOMO ... A tactic used by players on the Los Angeles Rams to stay warm during their game in Chicago on Sunday raised a few eyebrows ... Americans continue to drive less, which is causing ripples across other areas of the economy ... The average time of day when people hit an energy slump is smack-dab in the middle of the work day.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: The Art and Science of Negotiation

In a recent webinar moderated by Dennis Barton of Barton Law Group, industry leaders explored how negotiation in collections blends compliance-driven science with the human-centered art of communication. Panelists included Melanie Frizzell (Revco Solutions), Kelly Parsons-O’Brien (Pacific Credit Services), Greg Reffner (Abstrakt), and Stacey Sexton (ARS National Services).

The discussion emphasized that negotiation is more than asking for payment—it’s about solving problems, building trust, and creating meaningful conversations. Collectors must balance empathy with accountability, tailoring strategies to debt type and consumer circumstances while maintaining compliance.

Key insights included the importance of asking for payment in full to set a baseline for negotiation, the need to avoid self-limiting assumptions about consumers’ ability to pay, and the role of training methods like shadowing and role-playing in developing authentic communication skills. As Melanie Frizzell noted, “The science is what we have to do; the art is how we do it.”

🧠 Key Takeaways:

Set clear expectations early: Always begin with a request for payment in full to establish a negotiation baseline, even if concessions are expected later.

Balance empathy with recovery goals: Encourage collectors to understand consumer circumstances without losing focus on resolution. Creative policies, like Kelly Parsons-O’Brien’s “granny account” allowance, can help manage this balance.

Invest in training beyond compliance: Use shadowing and role-playing to help new agents develop conversational skills and confidence, ensuring they can apply both the art and science of negotiation effectively.

This session reinforced that successful negotiation requires both structure and flexibility. By combining compliance-driven processes with authentic, empathetic communication, agencies can improve recovery outcomes while strengthening consumer relationships.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN