- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 19, 2026

Daily Digest - January 19, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Jer'Ron J.L. Dinwiddie of Harris & Harris, Bill Sorgatz of The Bureaus, Timothy Smith of Monarch Recovery Management, Letitia Cherry of Capital One, Kristen Anderson of Total Expert, Jacob Adamo of United Holding Group, Ashley Yager of National Loan Exchange, Alix Schmidt of PaymentVision, and Tushar Chitra of Oracle Financial Services Software. Happy belated Birthday to Marc Carter of CBC (Jan. 18), Michael Philippe of Stately Credit (Jan. 17), Devin Sullivan of BlackRock (Jan. 17), and Joe Peck of Teleperformance (Jan. 17).

🎉Congratulations for starting new positions: James Lyle as Senior Director II Servicer Performance at Resurgent Capital Services, Florence Worthen Brown as Debt Collection Account Manager at Capstone Financial Management, Brian Tonner as Executive Vice President of Outsourcing Operations at NCB Management Services, Taylor Stone as Senior Account Executive at Success KPI, and Brett Schklar as Co-chair at Denver AI.

It’s not too late. Come and be part of the biggest and best ARMTech yet!

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Ed. Dept. Pauses Wage Garnishment and Tax Refund Seizures for Defaulted Student Loans

The Department of Education announced on Friday it will temporarily suspend plans to garnish wages and seize tax refunds from borrowers who are in default on their federal student loans, backing away from collection actions that were expected to resume later this month. The pause affects millions of borrowers nationwide and is intended to give the Department time to implement new repayment and rehabilitation options before restarting involuntary collection activity.

A MESSAGE FROM TCN

TODAY’S WEBINAR

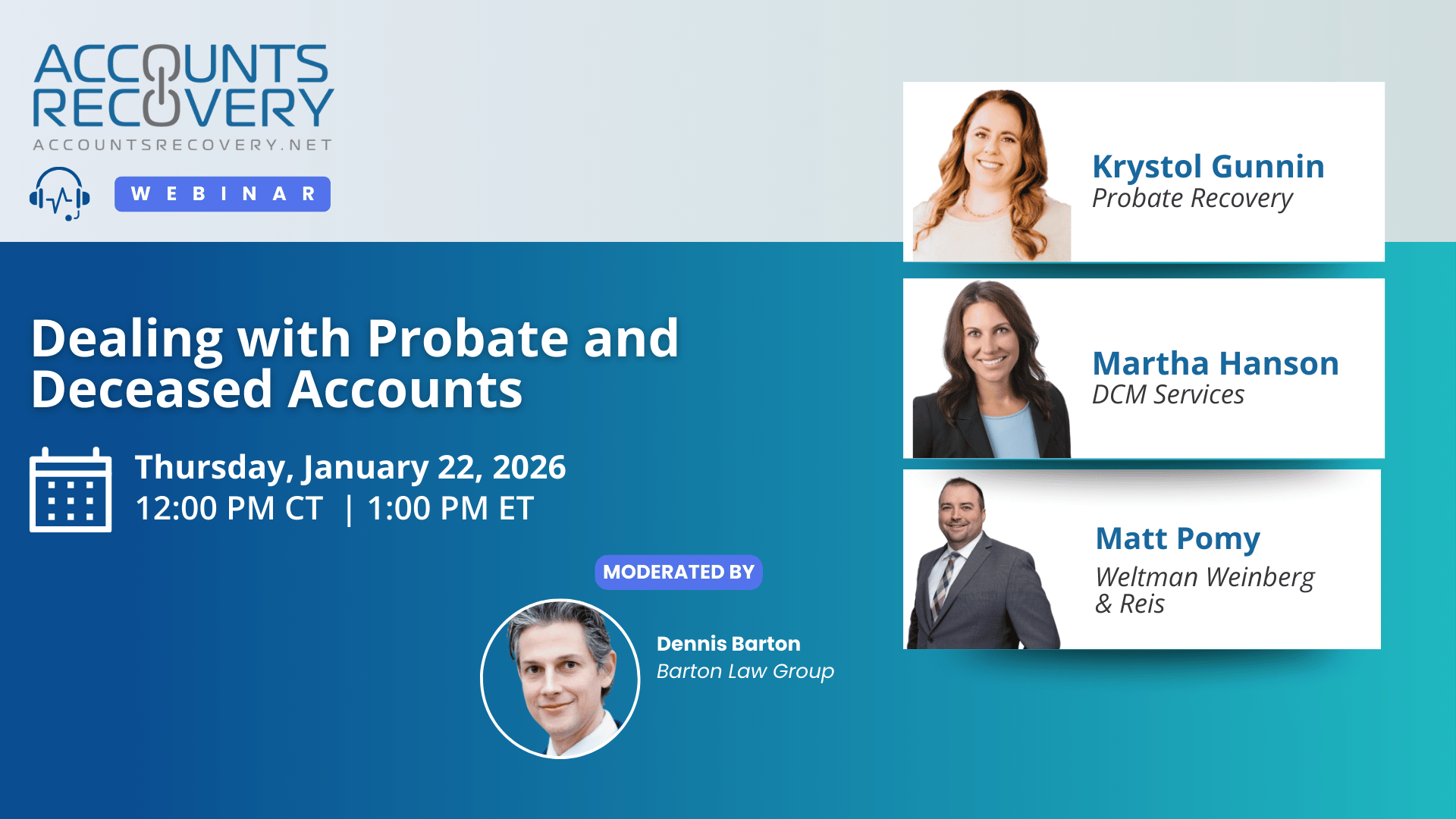

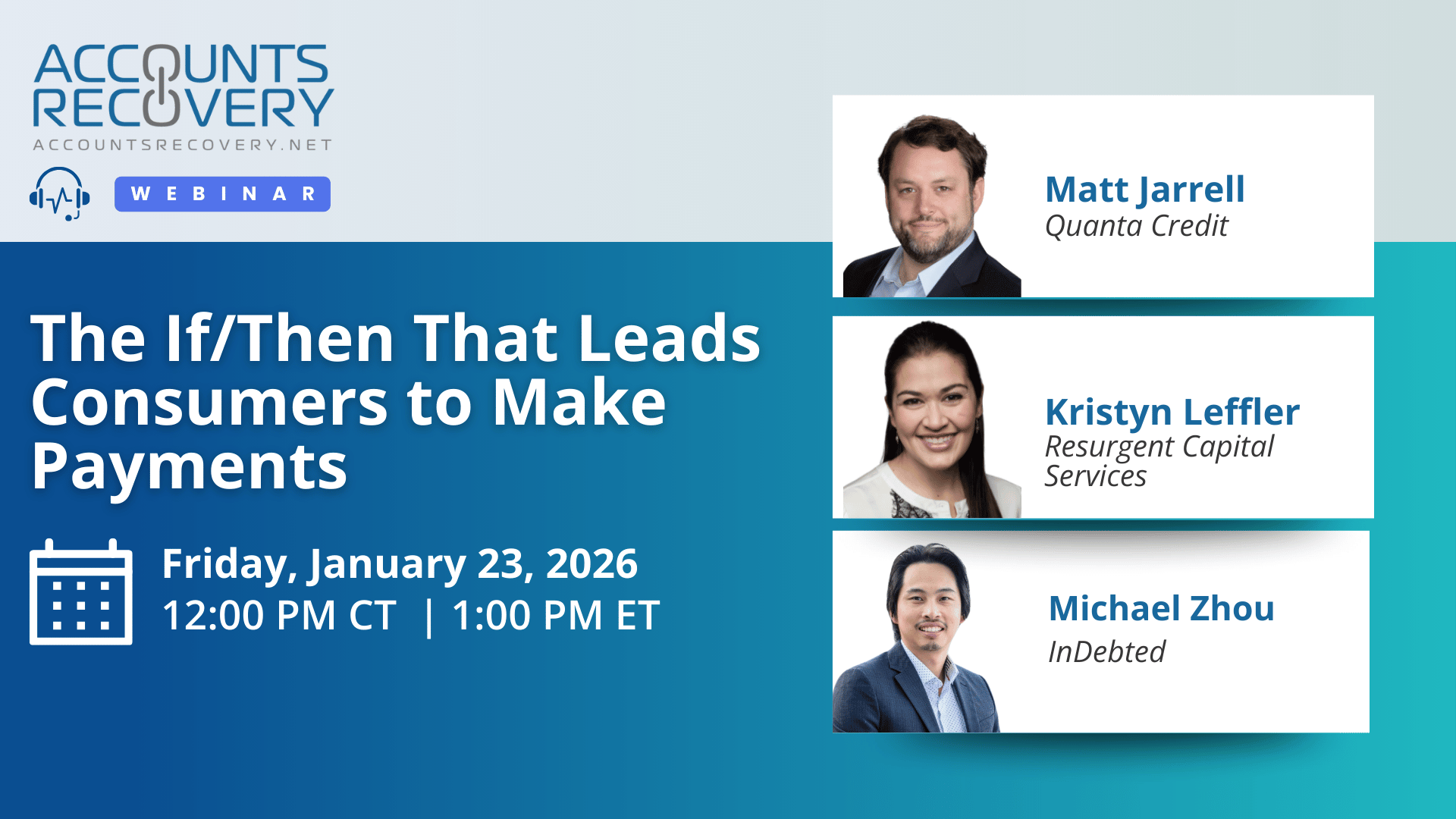

UPCOMING WEBINARS

Court Cautions Pro Se Plaintiff Over Fictional Cases and AI Reliance in FCRA Ruling

A District Court judge in Idaho has denied a plaintiff’s motion to dismiss counterclaims and affirmative defenses filed by a defendant in a Fair Credit Reporting Act case while also cautioning the plaintiff for citing fictional cases and relying on artificial intelligence when making his arguments.

Washington Bill Would Void Medical Debt That Is Credit Reported

A medical debt collection bill has been introduced in the Washington legislature that aims to enhance consumer protections and significantly reshape how medical debt can be collected, reported, and enforced across the state. House Bill 1632 would amend multiple sections of Washington law to restrict credit reporting of medical debt and impose new compliance obligations on healthcare providers, collection agencies, and debt buyers.

Judge Dismisses FDCPA Claim Over Failure to Remove Dispute Notation

A District Court judge in Texas has granted a motion to dismiss filed by one of the defendants in a Fair Debt Collection Practices Act case after the defendant was accused of violating the statute by not removing a dispute flag when furnishing information to the credit reporting agencies.

Compliance Digest – January 19

Facts matter. But when it comes to court cases, legal rulings, and new laws and regulations, trying to understand the facts, let alone develop perspective about what those facts mean, is nuanced and difficult. Thankfully, there are experts like Nick Prola, Stephanie Strickler, Crystal Duplay, Brit Suttell, Brendan Little, and David Kaminski to make sure you understand exactly what you need to know.

This series is sponsored by Frost Echols

WORTH NOTING: Consumers are setting strong financial goals for 2026, but are worried that they aren't going to be able to achieve them ... What you can learn about spending from Warren Buffett's grocery list ... More and more consumers are underwater on their auto loans ... Medical debt is one of the key items on the agenda for lawmakers in Colorado this year ... Older workers are making up more of the labor force today than they did 20 years ago ... Prediction markets are the day trading of the 2020s ... A doctor weighs in on what you need to consider before starting a diet ... The tax deduction that could put more money into the pockets of seniors this year.

Music Monday, part I

Music Monday, Part II

Webinar Recap: When to Litigate in Commercial Collections — and When It’s a Waste of Time

Litigation remains one of the most powerful yet costly tools in commercial collections. In this webinar, a panel of attorneys and collection professionals explored how to evaluate when pursuing a lawsuit is worthwhile and when it risks becoming a drain on resources.

Panelists emphasized that the decision to litigate should go beyond account size. Debtor profile, jurisdictional rules, and hidden operational costs often matter more than the balance itself. As one panelist noted, “Debt is dead. Collectible is collectible.”

Key discussion points included:

Evaluating collectibility upfront: Responsiveness of the debtor, bankruptcy searches, liens, and operational status are critical indicators.

Jurisdictional differences: States vary widely in enforcement tools and costs. For example, Delaware restricts garnishments, while filing fees in California are far higher than in Virginia.

Hidden costs: Beyond attorney fees, litigation consumes internal time, requires discovery responses, and can stretch across years due to court backlogs.

Client communication: Agencies must align litigation thresholds with creditor policies and ensure unified messaging to avoid undermining cases.

Reputational risks: Litigation can harm branding if perceived as heavy-handed, but refusing to litigate can embolden debtors who learn there are no consequences.

🧠 Key Takeaways:

Do the homework upfront: Conduct thorough asset searches, review debtor responsiveness, and assess jurisdiction before recommending litigation.

Set clear thresholds: Work with clients to establish minimum balances for suit and provide transparent feedback on profitability.

Balance risk and reputation: Litigation decisions should weigh recovery potential against hidden costs and brand impact.

This session underscored that smart litigation strategy requires a blend of legal insight, operational discipline, and strong client communication.

Webinar Recap: Capping Credit Card Interest Rates: Fact or Fiction and How it Impacts the ARM Industry

In this webinar, panelists Joann Needleman and Manny Newburger examined the potential consequences of proposed legislation to cap credit card interest rates. The discussion highlighted both legal complexities and economic risks, underscoring how such measures could reshape consumer credit markets and impact financial institutions.

Joann Needleman emphasized the uncertainty around how caps would interact with the National Bank Act, raising questions about whether reducing rates on existing accounts could be considered a “taking.” She warned of significant litigation ahead and expressed concern about policymakers’ ability to craft balanced compromises. Needleman also noted that alternative credit products, such as BNPL, may benefit: “BNPL is really gonna go through the roof.”

Manny Newburger focused on broader economic consequences, cautioning that caps could reduce access to credit for middle-class families: “You will kill the middle class. You’ll kill the American dream. People won’t be able to buy cars or houses or send their kids to college.” He warned that such restrictions could lead to more bank failures and urged industry stakeholders to recognize the political realities: “Guess what? They’re coming for you and no one in the public cares.”

The panelists agreed that while the legislation’s future remains uncertain, its signaling effect is already shifting consumer preferences and industry behavior.

🧠 Key Takeaways:

Prepare for Litigation: Anticipate challenges around constitutional “takings” and conflicts with the National Bank Act.

Monitor Market Shifts: Expect BNPL and alternative credit products to gain traction if traditional credit becomes less accessible.

Engage in Advocacy: Ensure policymakers understand the potential consequences for credit access, financial stability, and consumer choice.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN