- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 16, 2026

Daily Digest - January 16, 2026

Brought to you by: TCN | By Mike Gibb

🎉Congratulations for starting new positions: Kathryn Taylor as Senior Human Resources Manager at InvestiNet, Al Rossman as Executive Vice President at AFM, and Chris Straiter as AVP of Agency Management at Portfolio Recovery Associates.

It’s not too late. Come and be part of the biggest and best ARMTech yet!

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Nick Prola from Bassford Remele shares how to respond when a third party contacts a collector to talk about a debt Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

Lawsuit Targets Credit Reporting of Disputed Pandemic-Era Rental Debt

A consumer has filed a lawsuit in California federal court against a collection operation and a credit reporting agency for furnishing information about an unpaid debt dating back to the COVID-19 pandemic, that not only does the consumer dispute he owes, but also that he had previously filed another lawsuit against a different collection operation for the same alleged actions.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

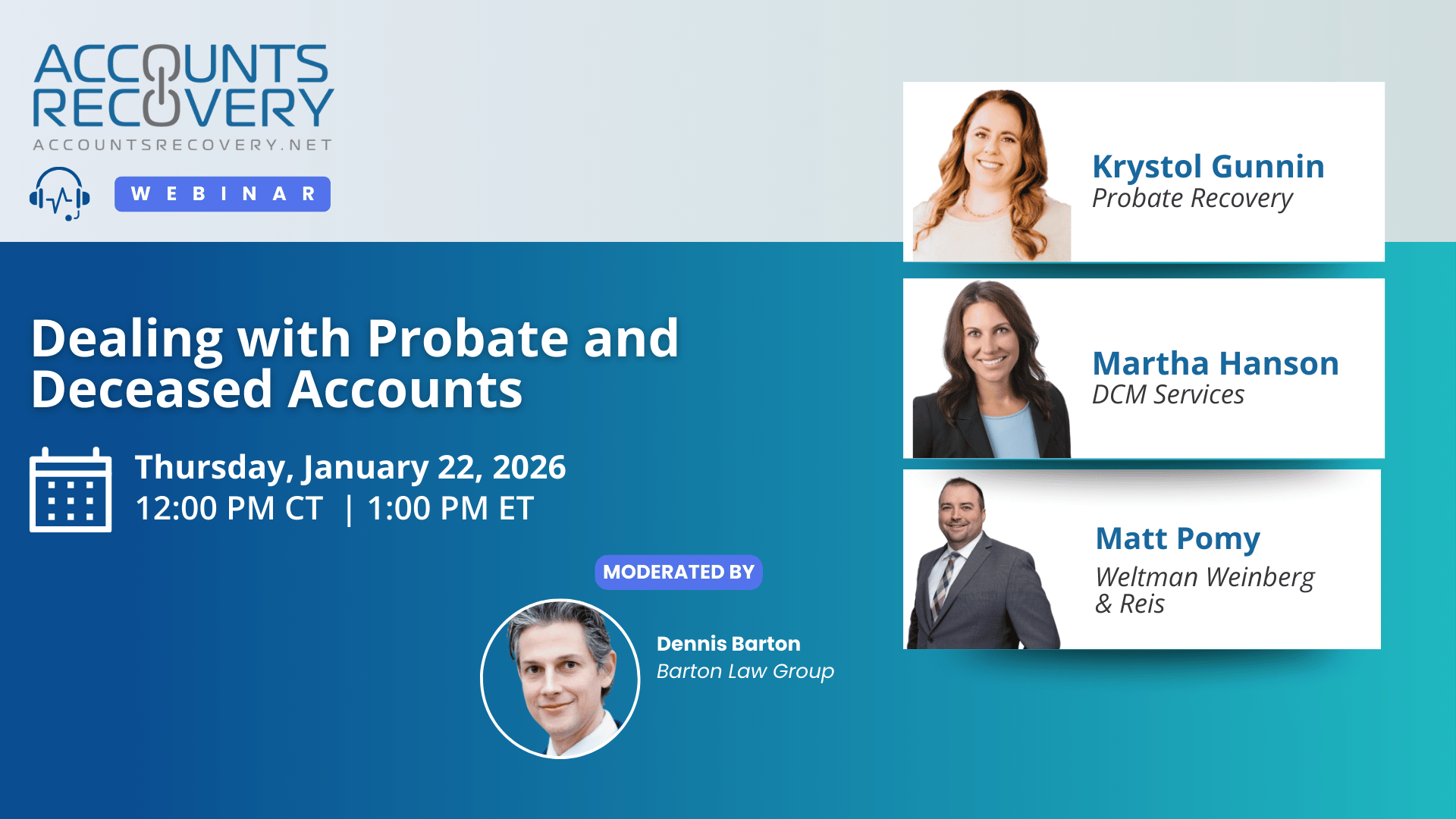

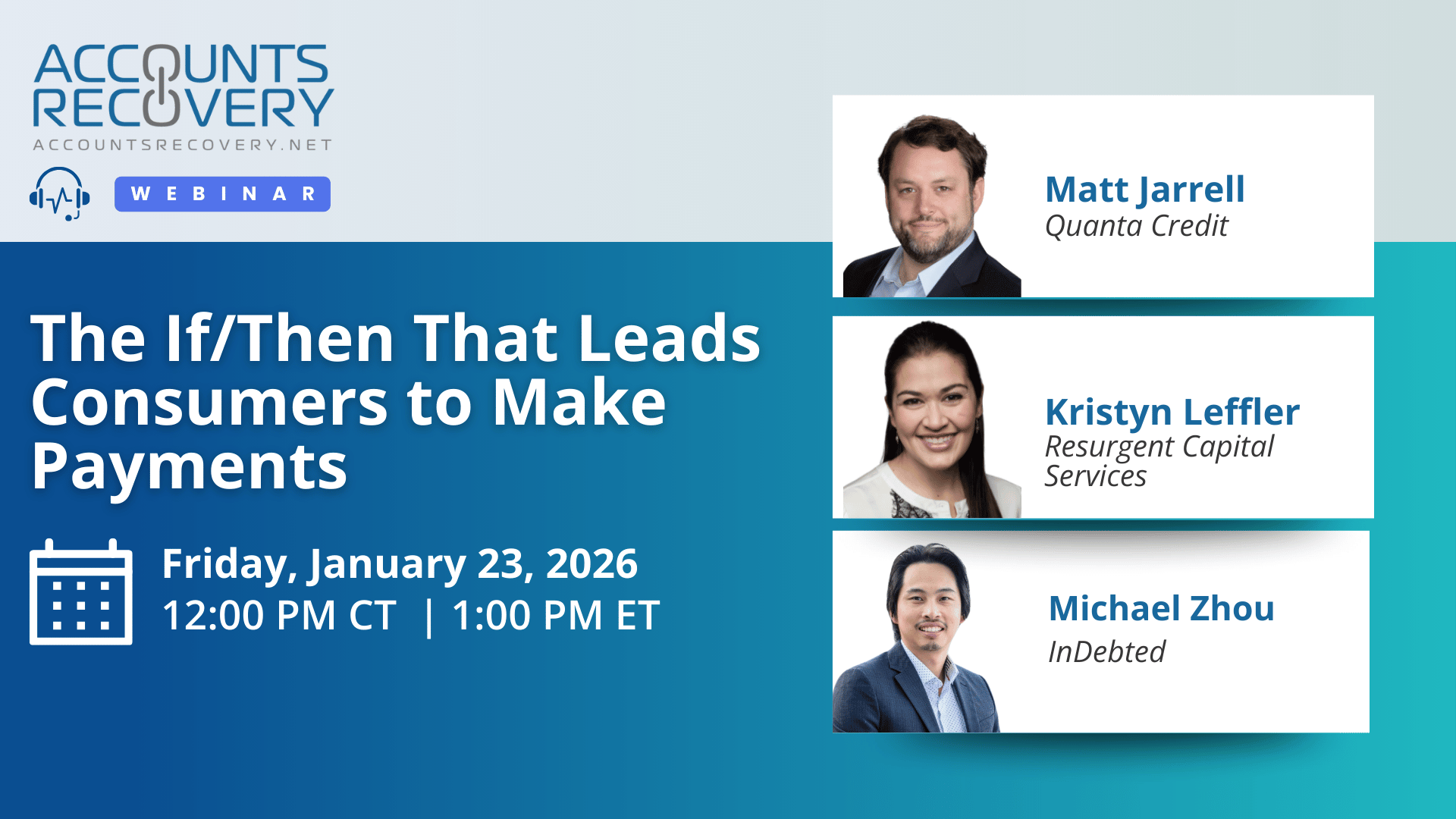

TODAY’S WEBINARS

UPCOMING WEBINARS

Trinity Health Cuts 10.5% of RCM Roles as Cost Pressures Mount

One of the nation’s largest nonprofit health systems is making a significant move that underscores the growing financial pressure facing healthcare providers and the ripple effects that pressure is having on revenue cycle operations. Livonia, Mich.-based Trinity Health confirmed that it is eliminating 10.5% of positions within its revenue cycle department as part of a broader effort to reduce costs and protect long-term financial sustainability, according to published reports. The system did not disclose how many employees will be affected, but local reporting indicates revenue cycle staff are spread across as many as 15 states.

Bill Introduced in Virginia Adds Attorney Disclosure Requirements to Collection Cases

A bill has been introduced in the Virginia legislature that would augment what needs to be provided when a collection lawsuit is filed against a consumer.

Arbitration Loss Bars Later FCRA Claims, Eleventh Circuit Rules

The Court of Appeals for the Eleventh Circuit has affirmed the dismissal of a Fair Credit Reporting Act case that started with the plaintiff losing an arbitration case brought against the defendants before filing this lawsuit.

Court Dismisses FDCPA and FCRA Claims Over Debt Validation Dispute

A District Court judge in New York has granted a motion to dismiss a Fair Debt Collection Practices Act case against a credit union and collection law firm over claims that the defendants failed to properly validate a debt and continued collection activities without providing proper validation.

WORTH NOTING: When it comes to saving money today, there are definitely the haves and the have-nots ... A bill has been introduced in the New York legislature that would create a private right of action for improper debt collection procedures ... President Trump unveiled a "Great Healthcare Plan" yesterday. Here are the takeaways and what critics think of it ... On top of the proposal to cap credit card interest rates at 10%, a bill has been introduced in the Senate to cap credit card late fees at $8 ... Gig workers have a new side gig: renting out their accounts to allow unverified workers to perform work in their name ... PNC Bank is the latest company to mandate employees return to the office five days a week ... A look at the best business laptops ... A look at the jobs that will be in the highest demand in 2026.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: Everything AI-Related You Need to be Concerned About

Artificial intelligence is rapidly moving from an experimental tool to a core operational driver across credit and collections. In this webinar, industry leaders examined where AI is already influencing outcomes—agent guidance, quality assurance, compliance monitoring, analytics, and consumer engagement—and why that acceleration brings new risks that organizations must actively manage.

Panelists emphasized that AI does not eliminate responsibility. When AI systems guide agents or automate decisions, accountability remains with leadership. As one panelist noted, organizations cannot “outsource risk” to vendors; regulators and clients will always look to the agency, bank, or servicer that deployed the technology. Governance, vendor diligence, and ongoing oversight are therefore non-negotiable.

A central theme was explainability. Whether addressing regulators, clients, or internal stakeholders, organizations must be able to clearly articulate how AI models reach decisions and what data they rely on. Explainability was framed not only as a compliance requirement, but as a prerequisite for trust and long-term adoption. Closely tied to this was the need for continuous monitoring to detect bias, drift, or unintended outcomes after deployment.

The discussion also cautioned against waiting for “perfect” regulatory clarity before using AI. The panel drew parallels to earlier hesitations around digital communications, noting that excessive delay can create competitive disadvantage. Instead, they advocated for targeted, well-governed use cases that deliver measurable value quickly while maintaining human oversight.

Finally, speakers stressed that AI should be treated like any other high-impact technology: start with defined business objectives, apply existing vendor risk frameworks, secure sensitive data, and keep humans “in the helm” for critical decisions.

🧠 Key Takeaways:

Establish clear AI governance and accountability: Leadership ownership is essential; responsibility cannot be shifted to vendors or frontline staff.

Prioritize explainability and monitoring: Ensure AI decisions can be traced, explained, and continuously reviewed for bias or drift.

Start small, prove value, and scale responsibly: Focus on specific use cases that deliver ROI quickly while maintaining compliance and human oversight.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN