- AccountsRecovery Daily Digest

- Posts

- Daily Digest - January 15, 2026

Daily Digest - January 15, 2026

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday: Yong Lim of Capital Group, Tanya Schluter of Absolute Resolutions Corporation, and Jennifer Turnage of Primeritus Financial Services.

🎉Congratulations for starting new positions: Louis Ochoa as Strategic Advisor at ACC Consumer Finance.

It’s not too late. Come and be part of the biggest and best ARMTech yet!

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Getting to Know John Coppola of Balanced Healthcare Receivables

If you ever see John Coppola leave a room, chances are it’s because he’s realized he’s the smartest person there and he knows that’s not the best way to learn. While he still loves working with his hands, John’s learned a lot in his 20 years in collections, which has helped him ascend to be the director of operations at his current company. Read on to learn more about John, how a medical issue jumpstarted his career in collections, and what he loves most about working in the mornings.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

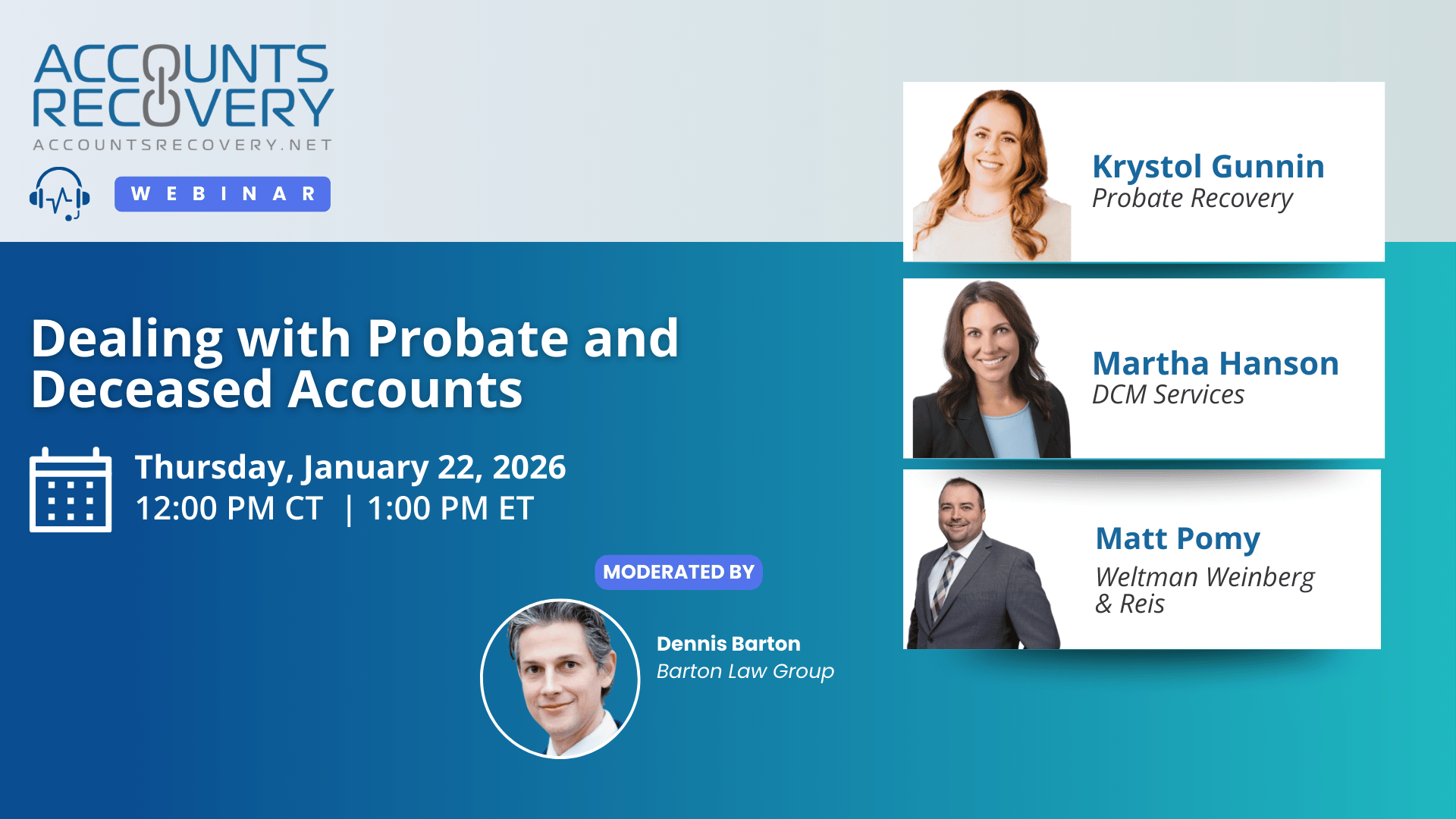

TODAY’S WEBINAR

UPCOMING WEBINARS

Judge Dismisses FDCPA Claim Tied to Post-Bankruptcy Collection Letter

A District Court judge in Kansas has granted a defendant’s motion to dismiss claims it violated the Fair Debt Collection Practices Act when it sent a communication to the plaintiff to collect on an unpaid auto loan debt after the plaintiff had filed for bankruptcy protection, ruling the communication did not violate the FDCPA because the notification about the bankruptcy filing that was sent to the defendant wasn’t sent by the plaintiff.

Former CFPB Staffer Accuses Agency of Gutting Student Loan Findings

A public battle has erupted between a former employee of the Consumer Financial Protection Bureau and the regulator over a report authored by the employee about the student loan market that was altered prior to being published last week, according to a report published yesterday by Politico. The dispute centers on the CFPB’s annual report on private and federal student loans, which was released after significant sections were removed from the version that was submitted by the report’s author, prompting accusations of political interference, claims of agency overreach, and pointed responses from CFPB leadership at a time when the bureau itself faces existential pressure.

Judge Denies MTD From Furnisher, CRA in FCRA Suit Over Alleged Inaccurate Reporting

A District Court judge in Indiana has denied motions to dismiss filed by a creditor and a credit reporting agency in a Fair Credit Reporting Act case over how how a credit card debt was reported and what happened after the plaintiff disputed the debt.

Medical Bills May Put Housing at Risk, New Research Shows

Medical debt may be doing more than straining household budgets; it may be pushing people closer to housing instability, according to data published last week in JAMA Network Open. Adults with medical debt were significantly more likely to experience housing problems the following year, including difficulty paying rent or a mortgage, eviction, or foreclosure, according to the report. Researchers concluded that medical debt raised the risk of housing instability by 44%, underscoring how healthcare costs can trigger financial consequences that extend far beyond the doctor’s office.

WORTH NOTING: If you want a Tesla with Full Self-Driving mode, it's going to cost you every month ... Would you pay $99 a month to get to interact with a Tony Robbins chatbot? ... The Consumer Financial Protection Bureau has placed the head of its Office of Minority and Women Inclusion on administrative leave ... The reason why so many companies are investing so much money in AI is a bit of a surprise ... How travel insiders deal with flight delays ... The CEO of Robinhood on why AI won't wipe out jobs ... How the "Rule of 3" can help make hard decisions easier ... How Microsoft plans to prevent AI data centers from raising your electric bill.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: From Turnover to Tenure

Attrition in collections isn’t just a staffing challenge—it’s a profit leak. In a recent webinar hosted by AccountsRecovery.net, panelists Jimmy Chebat (CEO of Zizo) and Brian Answeeney (VP of Operations, CBE Group) explored how behavioral science and gamification can reshape workforce engagement, retention, and performance.

Chebat emphasized that attrition is often misdiagnosed as a “people problem” when it’s really a system problem. Traditional approaches like pay raises or coaching fail to address the underlying issue: employees disengage when they lack visibility into progress, recognition, and purpose. Early-stage attrition is particularly costly, with Answeeney noting that 73% of agents leave within the first 60 days, often at transition points between training and production.

The panel highlighted the importance of small, meaningful wins during onboarding. Behavioral science shows that consistent progress builds confidence and belonging, which in turn drives retention. Gamification platforms like Zizo provide real-time feedback, micro-rewards, and inclusive recognition systems that engage not just top performers but the critical “middle 70%” of staff. By shifting focus from results alone to behaviors and KPIs—such as call quality, wrap time, and attendance—organizations can accelerate productivity and extend tenure.

Answeeney shared that after implementing gamification, average tenure at CBE increased by 30% in 2025, while new agents ramped to full productivity faster, improving profitability.

🧠 Key Takeaways:

Redesign Onboarding: Focus on the first 30–60 days with achievable goals and visible progress to reduce early attrition.

Engage the Middle Majority: Move beyond rewarding only top performers; use gamification to motivate and retain the average 70% of staff.

Shift Focus to Behaviors: Track and reward leading indicators (calls, RPCs, attendance) to build confidence and accelerate productivity.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN