- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 6, 2026

Daily Digest - February 6, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Maria Soria of Gulf Coast Collection.

🎉Congratulations for starting new positions: Mac Crandell as Head of Recovery at Upstart, Catie Collins as Vice President Enterprise Enablement at Capio, Steve Biehl as Chief Portfolio Officer at Flagship Financial Group, Jeremiah Hinson as Assistant Vice President - Financial Recovery Rep 2 at Huntington National Bank, Bethany Cayton as Sr. Director of Client Services at InvestiNet, Anna Weiss as Compliance Associate at CACi, John Hughes as Associate Vice President of Business Development at Williams & Fudge, Chris Busse as Chief Client Officer, Enterprise | Head of AI at SingleStone, and Eric Cartwright as Technical Solutions Architect at TEC Services Group.

🏈 🎉 Super Bowl Poll

Who is going to win the Super Bowl? |

Creditor, CRAs Facing FCRA Suit Over Alleged Fraudulent Debt

A creditor and two credit reporting agencies are facing claims of violating the Fair Credit Reporting Act over a $36,000 loan that the plaintiff claims was originated by someone else who signed the plaintiff’s name on a contract to obtain the funds, although the complaint makes no mention of the plaintiff obtaining an identity theft affidavit to bolster his claims.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

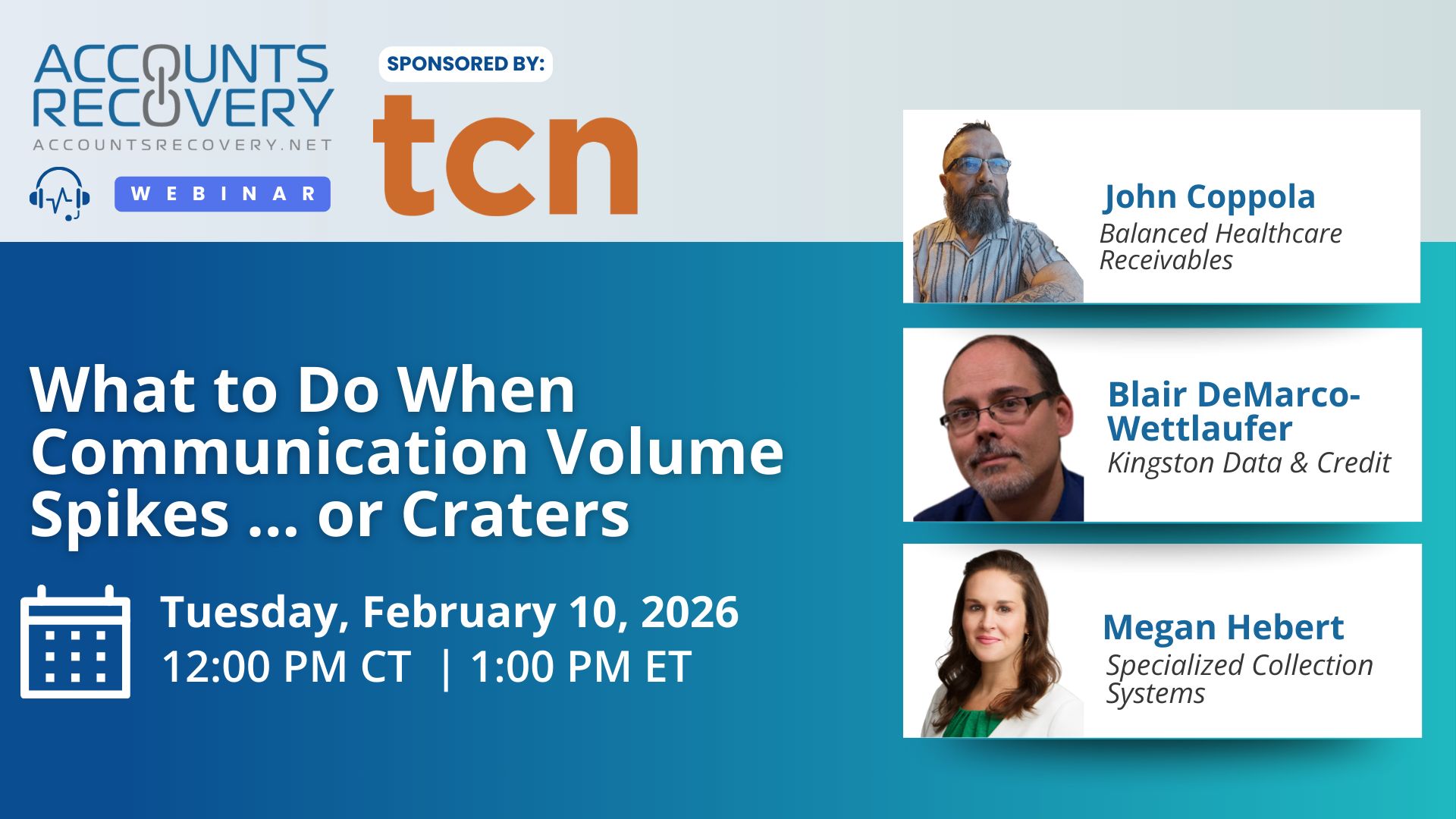

TODAY’S WEBINAR

UPCOMING WEBINARS

Bankruptcy Filings Climb Again as Consumer and Business Financial Strain Grows

Bankruptcy filings are continuing their steady climb, sending a clear signal to creditors that financial strain among both consumers and businesses is intensifying. New data from the Administrative Office of the U.S. Courts and Epiq AACER shows that filings rose sharply through the end of 2025 and into January 2026, narrowing the gap between today’s volumes and pre pandemic levels.

Judge Denies Motion to Dismiss in FCRA Case Tied to Hiring and Termination

A Magistrate Court judge in Louisiana has denied a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act over claims about how it handled an employment background check that led to the plaintiff being fired just a few months after being hired. The ruling is a reminder that FCRA compliance risks extend well beyond traditional credit reporting and into employment screening practices.

Warren Launches Probe as Repossessions Hit Post-2008 Highs

Auto repossessions have climbed to levels not seen since the 2008 financial crisis, and that spike is now drawing direct attention from Capitol Hill. This week, Sen. Elizabeth Warren [D-Mass.], Ranking Member of the Senate Banking, Housing, and Urban Affairs Committee, launched a broad probe into auto lenders, repossession agents, and industry trade groups, citing concerns about wrongful repossessions and consumer harm as the Consumer Financial Protection Bureau’s enforcement capacity remains sidelined.

Judge Sends FDCPA Claims to Arbitration Over Challenges to Auto Purchase Contract

A District Court judge in Oregon has granted a defendant’s motion to compel arbitration after it was sued for allegedly violating the Fair Debt Collection Practices Act over issues with the contract that was signed when purchasing a vehicle.

WORTH NOTING: File this under "U" for understatement of the week - new research shows that when employees feel slighted, they work less ... The Federal Bureau of Investigation has launched a campaign to help improve cybersecurity defenses ... Veritus has raised $10.1 million in seed funding for its AI agent platform ... Staying up late doesn't appear to be good for your heart ... January was the worst month for job cuts in 17 years ... Meet a group of kids who run a credit union from inside their high school ... It's not too late: tech upgrades to level up your Super Bowl Sunday ... What if everything you know about passwords is wrong?

Funny Friday, part I

Funny Friday, Part II

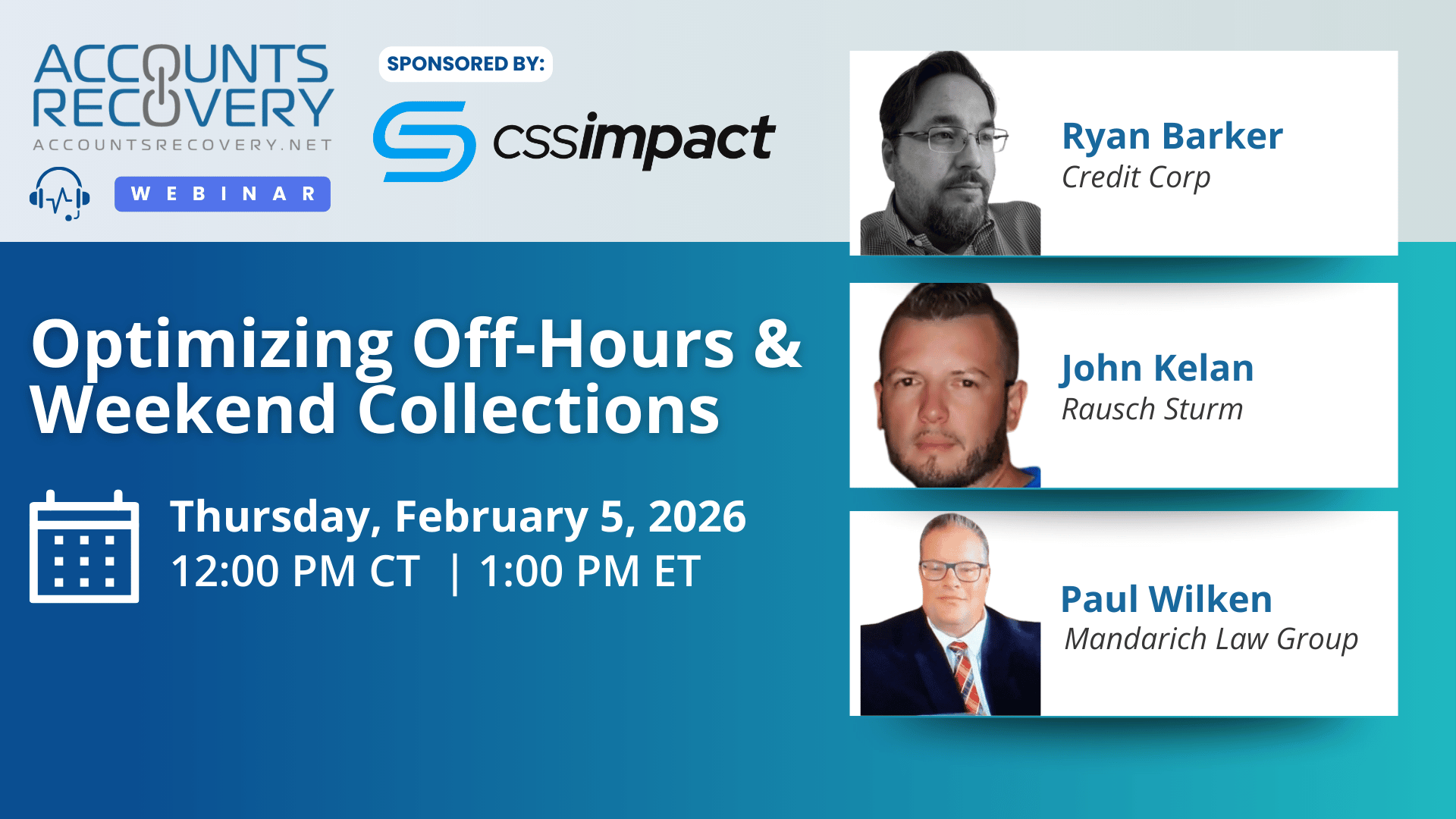

Webinar Recap: Optimizing Off-Hours & Weekend Collections

The recent webinar on “Optimizing Off-Hours & Weekend Collections” highlighted how agencies and financial institutions can enhance recovery rates by strategically engaging consumers outside traditional business hours. Panelists from across the credit and collections ecosystem—spanning agencies, fintechs, and healthcare providers—shared insights on consumer behavior, compliance, and operational innovation.

One panelist emphasized: “Consumers don’t stop having obligations after 5 PM—our strategies shouldn’t stop either.” The discussion underscored that evenings and weekends present untapped opportunities to connect with consumers in ways that respect their schedules and preferences.

Key themes included the importance of balancing compliance with consumer convenience, leveraging technology to automate outreach, and adopting flexible staffing models to cover extended hours. Another panelist noted: “Weekend outreach is not about working harder—it’s about working smarter with the right tools.”

🧠 Key Takeaways:

Leverage Technology for Smarter Outreach

Adopt AI-driven dialers, chatbots, and omnichannel platforms to engage consumers during evenings and weekends without increasing manual workload.Prioritize Compliance While Extending Hours

Review federal and state regulations on permissible contact times to ensure off-hours strategies remain compliant and defensible.Test and Scale Weekend Campaigns

Pilot targeted outreach on Saturdays or evenings, measure engagement, and refine strategies before rolling out at scale.

The webinar reinforced that off-hours collections are not about more calls, but about better timing and smarter engagement. By combining compliance-first practices with technology and consumer insights, agencies and financial institutions can unlock new opportunities for recovery while maintaining trust.

Key takeaway: Off-hours strategies, when executed thoughtfully, can transform collections into a more consumer-centric and effective process.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN