- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 5, 2026

Daily Digest - February 5, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Stephanie McDaniel of My Compliance Alliance, Chelsea Jordan of Caine & Weiner, Janneen Jackson of Alleviate, Abigail Hurt of SWC Group, Nicole Huse of CBE Companies, and Steve Guinaldo of AR Resources.

🎉Congratulations for starting new positions: Chris Bension as Senior Vice President, Lending at ORNL Federal Credit Union, Mindy Boeve as VP Financial Recovery Group Section 3 Manager at Huntington National Bank.

Coming April 20-22 … TCN’s C3 User Conference

Getting to Know Kitty Johnson of Camp & Johnson

You have to admire someone who can quote Heraclitus and Davy Crockett in the same set of answers. If Kitty Johnson can do that, then maybe she can teach herself anything in three hours like she believes she can. Read on to learn more about Kitty, how a friend moving away led to her career in the industry, and why she is your go-to if you need podcast recommendations.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

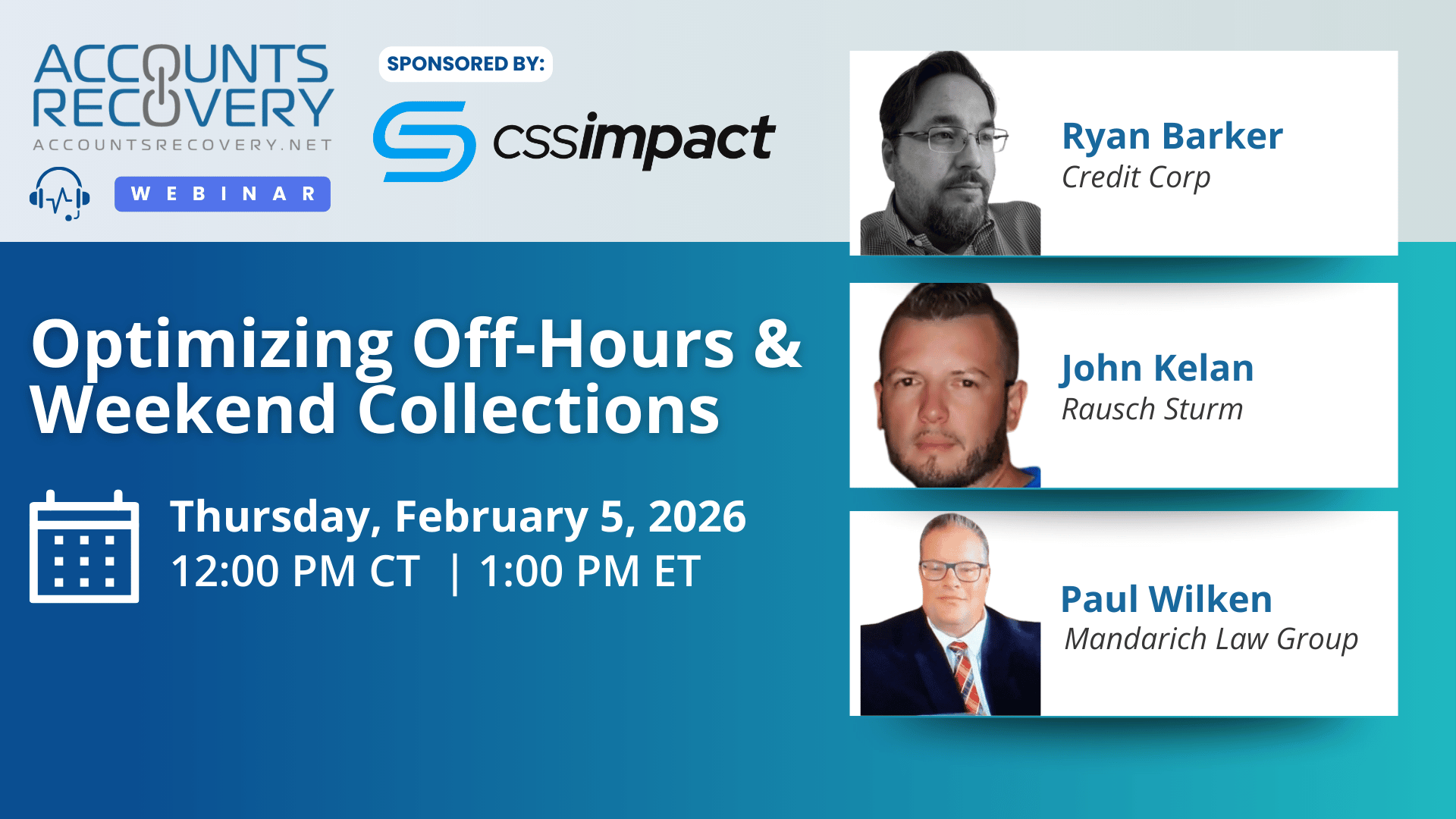

TODAY’S WEBINAR

UPCOMING WEBINARS

Court Tosses FDCPA Suit After Calling Out Plaintiff’s ‘Scorched Earth’ Litigation Tactics

Anytime a judge notes that a plaintiff is engaging in “scorched-earth litigation tactics” you have to think it’s not going to work out well for that individual, and that is definitely true in this case. A District Court judge in Tennessee has dismissed a lawsuit against a collection law firm, a bank, and other defendants that accused them of violating the Fair Debt Collection Practices Act over issues with a collection lawsuit that was filed against the plaintiff. In adopting a magistrate judge’s Report and Recommendation, the court not only rejected the claims on the merits, but also shut down a flood of procedural motions that the court said had overtaken the case.

Why Medical Debt Collection May Get Harder in 2026: Consumers Expect Health Costs to Keep Rising

A new KFF Health Tracking Poll offers a blunt data point for anyone collecting or servicing medical balances: healthcare costs now top the public’s list of “can I afford this?” worries, ahead of utilities, food, housing, and gas. Two-thirds of adults (66%) say they worry about affording healthcare for themselves and their families, and a majority (55%) say their healthcare costs increased over the past year.

Debt Buyer Judgment Overturned After Trial Court Lets Improper Witness Testify

A California Appeals Court has overturned a lower court’s ruling in favor of a debt buyer that obtained a judgment following a collection lawsuit, ruling the lower court judge erred by denying motions from the consumer to exclude a witness who testified during the trial. The appellate court concluded that the trial court should not have allowed testimony from a witness who was not properly disclosed before trial and should not have admitted key account records without the proper foundation.

New Mexico Targets ‘Coerced Debt’ With New Consumer Protection Bill

A bill has been introduced in the New Mexico legislature that establishes rules for how creditors — which includes debt buyers and debt collectors — must handle coerced debt situations.

WORTH NOTING: A look at the privacy laws that are taking effect across the country in 2026 ... Nearly one-third of consumers have more credit card debt than emergency savings ... A look at the financial strain that Valentine's Day puts on couples and how Waffle House is trying to help ... A company has raised $35 million with the intention of making doctor's visits free for patients ... Hosting a Super Bowl party is going to cost you a little bit more this year ... A peek inside the Olympic Village in Milan ... Could humans one day live to be 150 years old? ... Everything you ever wanted to know about burnout, but were too afraid to ask.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: Convincing Consumers to Engage With You

In a recent webinar hosted by Mike Gibb of accountrecovery.net and sponsored by Halsted Financial, industry leaders discussed strategies to overcome the growing challenge of consumer engagement in collections. Moderator Dennis Barton (Barton Law Group) and Panelists Wes Deming (Meduit), Drew Marston (Resurgent Capital Services), and Sam Matthews (TDECU) shared insights on transparency, omnichannel communication, and the role of AI in reshaping outreach.

The conversation highlighted a major shift from disguising caller identity to openly presenting agencies as legitimate, trustworthy partners. As Wes Deming noted, “You don’t want the person to think you’re just spam or a telemarketer.” AI emerged as a critical tool, enabling agencies to analyze vast datasets and personalize outreach—pinpointing not only the right channel but also the right timing for each consumer.

Panelists agreed that initial contact remains the toughest hurdle, while repeat engagement is more promising if handled respectfully. Email was cited as a particularly effective channel, with open rates far surpassing phone calls. The group also emphasized balancing persistence with compliance, using AB testing to avoid bias and prevent consumer fatigue. As Sam Matthews reminded, “Be moral, ethical, and legal… don’t be afraid to try different things.”

🧠 Key Takeaways:

Prioritize Transparency: Clearly identify your agency in all outreach to build consumer confidence and reduce complaints.

Leverage AI for Personalization: Use AI-driven analytics to determine preferred channels and timing, freeing human capital for higher-value tasks.

Balance Persistence with Compliance: Employ AB testing and data-driven strategies to maximize engagement without crossing into nuisance territory.

This webinar underscored that effective engagement today requires a blend of technology, transparency, and empathy—creating a win-win for both consumers and the industry.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN