- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 4, 2026

Daily Digest - February 4, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Patrick Newman of Bassford Remele, Jacqueline Hair of EasyPay Finance, Jimmy Richards of Capio, Michelle Bingle of Citi, Anthony Lorenzo of Giggle Finance, Alexandra Lamos of Farmers State Bank, and Justin Matthews of TSI.

🎉Congratulations for starting new positions: Matt Laws as Chairman of the Board at Revco Solutions, Kylie Hart as Senior Messaging Solutions Advisor at Solutions by Text, Harlan Flint as Senior Vice President and Partner at EP Wealth Advisors, and Noelle Ten Eyck as SVP PMP at Alacrity Solutions.

When Service of Process Comes Up Short

Part of me decided to write about this ruling because it allowed me to start the article with, “I guess it’s true … size matters.” A Washington Appeals Court has affirmed a lower court’s ruling vacating a default judgment for an unpaid debt against a consumer, ruling that the differences in size between the plaintiff, who is six feet, six inches tall, and the description of the man provided by the process server who served the complaint, five feet, 10 inches, was one reason why the judgment should be vacated.

A MESSAGE FROM TCN

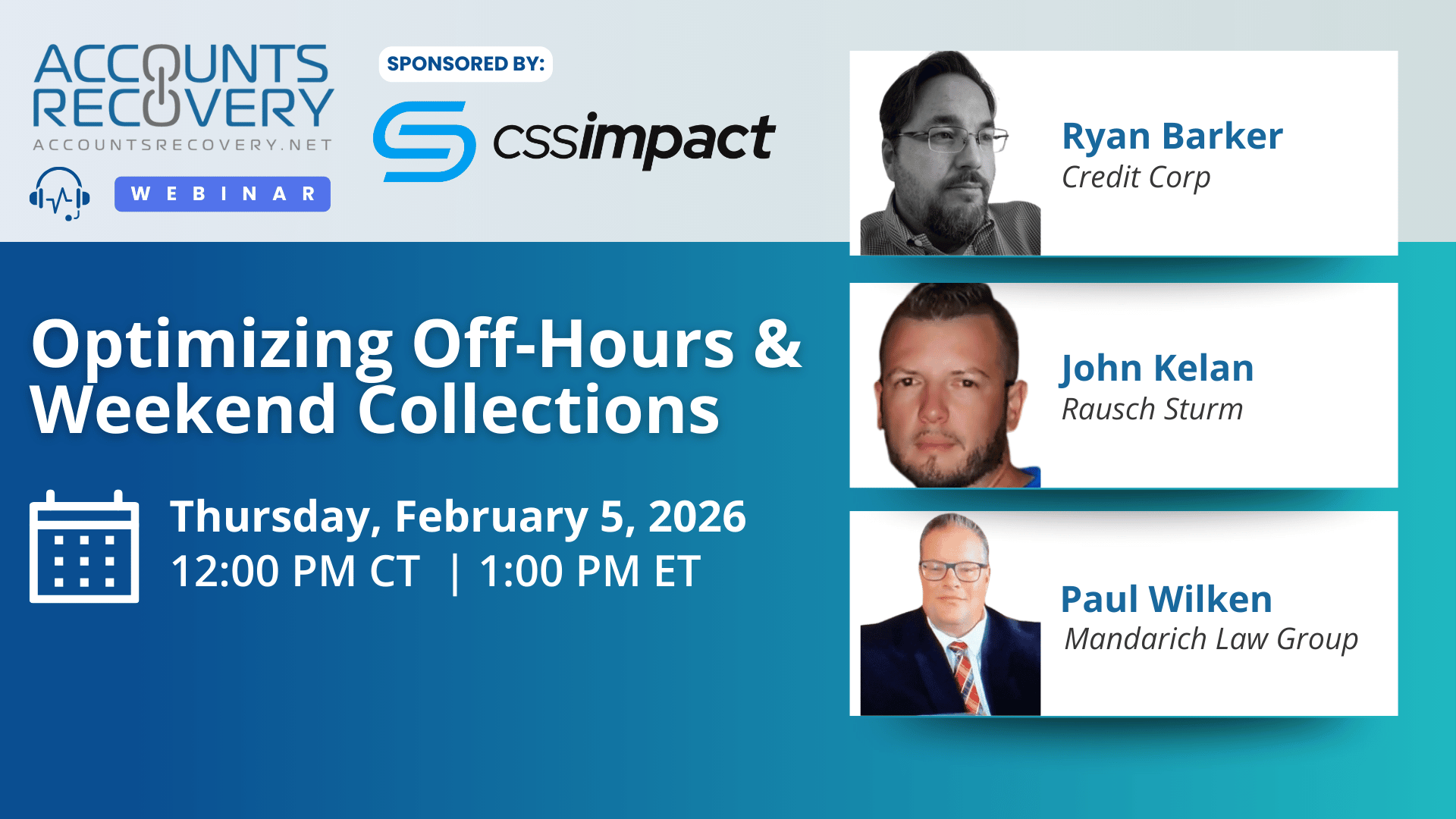

TODAY’S WEBINAR

UPCOMING WEBINARS

Court Clarifies When Vehicle Repossessions Cross the FDCPA Line

The Court of Appeals for the Ninth Circuit has affirmed a lower court’s ruling that the defendants in a Fair Debt Collection Practices Act case did not violate the statute when repossessing the plaintiff’s vehicle, ruling there was no breach of the peace.

42 Million Users, 11,000 FTEs: What BofA’s Virtual Assistant Signals for AI in Collections

Bank of America’s virtual assistant, Erica, is now used by 42 million consumers, 40,000 business customers and 95% of the bank’s 213,000 employees, handling roughly two million interactions a day and delivering efficiency gains leaders equate to the work of 11,000 employees. For operations leaders watching AI closely, the headline is not just scale. It is how a highly governed, task-focused assistant can materially reduce call volumes, improve digital containment and still hand off seamlessly to humans when needed.

New Senate Report Flags Risks as Private Student Lending Expands

A new Senate report warns that private student loan lending is poised to expand rapidly following recent federal student loan caps, potentially reshaping how millions of borrowers finance higher education. The report analyzes responses from six major private student loan lenders and concludes that more students and families will likely turn to private loans as limits on federal borrowing take effect. Lawmakers argue this shift could expose borrowers to higher costs and fewer protections, while lenders prepare to meet rising demand.

51 Companies Seeking Collection Talent

Banks, credit unions, fintechs, collection operations, creditors, debt buyers, collection law firms -- they are all actively hiring. Check out this week's job listings summary to see more than 50 different opportunities across the country and across the industry.

WORTH NOTING: A look at the 30 different state AG races that are on the ballot this year and which are the ones to watch ... The debt snowball vs. the avalanche -- which one will get you out of credit card debt faster? ... A lot of consumers are using AI to help provide financial advice, but not everyone trusts what the machines are saying ... Credit card debt is a dating dealbreaker for a lot of consumers ... A Florida man has pleaded guilty to charges after threatening to commit a school shooting if a law firm kept attempting to collect on a defaulted business loan ...Oracle has released an agentic AI platform that offers services for collections ... A lot of consumers are planning on buying a car this year ... Nine in 10 consumers believe we are in a "cost-of-living" crisis.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: AI Assistants on the Phones: How to Deploy, Measure, and Govern Virtual Negotiators

Artificial intelligence is moving from the back office to the frontline, with AI-powered voice assistants now handling inbound and outbound calls in collections and servicing. In a recent webinar hosted by AccountRecovery.net and sponsored by CSS Impact, panelists discussed how agencies, debt buyers, and financial institutions can effectively deploy these tools, measure their performance, and ensure compliance.

Panelists emphasized that readiness begins with data quality and accessibility. As Mike Walsh noted, “Anything an agent would use to answer a question, that AI voice agent needs that same access.” Saket Sahoo added, “Garbage in, garbage out. AI amplifies problems in your workflow.” Abby Hogan stressed the importance of regulatory transparency, reminding organizations to be prepared to explain AI usage clearly to examiners.

The discussion highlighted that AI should not be seen as replacing humans, but rather complementing them. AI can manage repetitive, low-risk tasks, freeing human agents to focus on complex negotiations. Case studies show AI achieving near-human performance in right-party contacts while handling significantly more calls, with higher payment rates.

Infrastructure readiness is also critical. Cloud-based, API-enabled CRMs, dialers, and payment processors are better suited to real-time AI integration. Interoperability across channels—voice, SMS, email, and web portals—ensures a seamless customer experience.

🧠 Key Takeaways:

Validate and Clean Data Before Deployment: Start small, test sample sets, and ensure data quality to avoid amplifying errors.

Implement Real-Time Oversight: Move beyond quarterly reviews; daily or real-time monitoring is essential for compliance and performance.

Balance AI and Human Roles: Use AI for repetitive tasks while reserving complex, high-risk interactions for human agents.

AI voice assistants are no longer experimental—they are delivering measurable ROI and reshaping call center operations across collections and financial services.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN