- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 3, 2026

Daily Digest - February 3, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy birthday to the following: Amanda Gilbert of Provana, Chris Eaton of Tucker, Albin and Associates, Rob Kennedy of Deluxe, and Matt Allison of World Insurance.

🎉Congratulations for starting new positions: Amber Calogero as People Operations Manager at BHG Financial, Andrew Cali-Vasquez as Executive Director and Assistant General Counsel at JP Morgan Chase, Cassandra Schoen as Human Resources Generalist at Coast Professional, and Andy Zehren as Sales Director at AdvicePay.

If you check your credit report and notice a number of “unauthorized” inquiries that are being made by a collection operation, yet the operation has yet to make any attempt to communicate with you — at least according to the complaint you have filed — is your first thought to file a lawsuit against that operation? One individual did, accusing the defendant of violating the Fair Debt Collection Practices Act and the Fair Credit Reporting Act, along with state law in New York.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

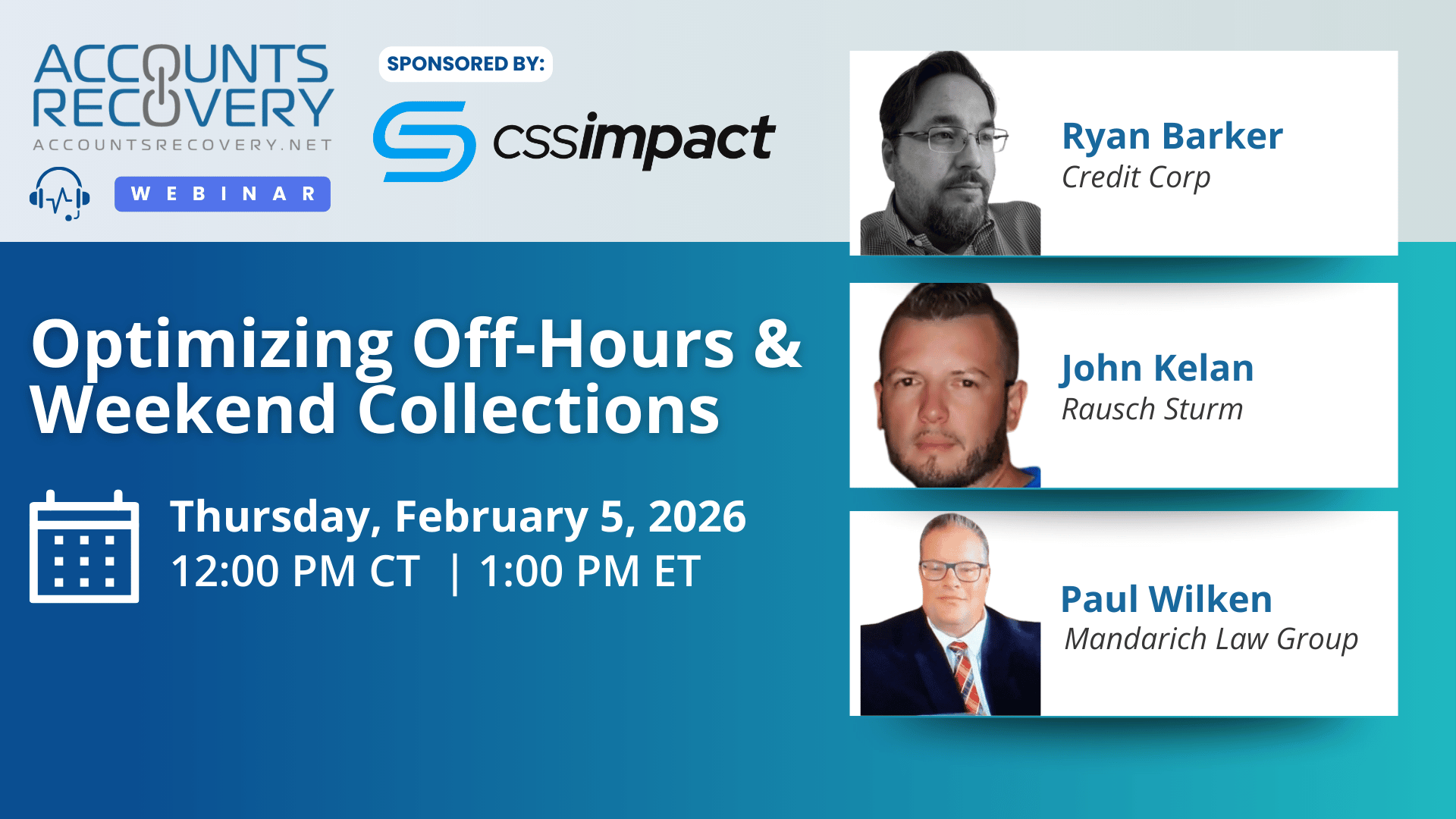

TODAY’S WEBINAR

UPCOMING WEBINARS

Eighth Circuit Upholds FCRA Win for Furnisher Over Late Payment Dispute

The Court of Appeals for the Eighth Circuit has affirmed a ruling in favor of a defendant that was sued for violating the Fair Credit Reporting Act over information it furnished to the credit reporting agencies and then allegedly failing to conduct a reasonable investigation.

Proposed Hawaii Law Targets Medical Debt Lawsuits, Garnishments, and Liens

A bill has been introduced in the Hawaii Senate that would restrict lawsuits against consumers to collect on unpaid medical debts. The proposal, Senate Bill 2165, titled the Medical Debt Protection and Patient Dignity Act, would significantly reshape how medical debt can be collected in the state.

Study Finds AI Can Build Emotional Rapport Better Than Humans … With a Catch

A newly published study suggests that artificial intelligence can outperform humans at building emotional closeness during text-based conversations, but only when people believe they are interacting with another human. For organizations experimenting with AI-driven customer engagement, the findings highlight both a major opportunity and a serious risk. The research shows that conversational AI can foster feelings of trust and connection that rival, and sometimes exceed, human interactions, while also underscoring why transparency and governance matter more than ever.

Judge Allows FDCPA Claims Over Post-Bankruptcy Payment Demands to Proceed

A District Court judge in Illinois has denied a motion to dismiss claims that a defendant violated the Fair Debt Collection Practices Act over how it handled a debt that was part of the plaintiffs’ bankruptcy proceedings.

WORTH NOTING: the item at the top of a patient safety organization's list of healthcare hazards might surprise you ... How to practice the lost art of negotiating the price of a car ... PRA Group is opening an office in Charlotte ... U-Haul ranks the states that consumers are moving to most ... A look at the storylines heading into the Winter Olympics ... For the first time in 50 years, astronauts are heading back to the moon ... When taxpayers will start getting their refunds ... A list of myths that bankers should ignore in 2026.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: Where Collections Leaders Are Placing Their Bets

In a recent webinar hosted by Mike Gibb of AccountRecovery.net, industry leaders shared where they are investing, pulling back, and preparing for rapid change in collections. Panelists included Chris Dunkum (First Collection Services), Matthew Maloney (FFMA 360 Alliance), and Josh Seuberling (Lendly).

The discussion centered on artificial intelligence (AI), compliance, workforce models, and operational priorities. Josh Seuberling emphasized AI’s role in predictive modeling and portfolio scoring, noting: “I am a huge fan of getting away from the outbound call.” His focus is on driving inbound engagement through SMS and email, supported by skilled human agents.

Matthew Maloney highlighted his firm’s automation journey, where agents no longer take notes manually. He stressed the next evolution: “I want our modeling, our strategy, our next best action—all driven through machine learning.” His organization is shifting investments from customer-facing tools to back-end decision-making systems.

Chris Dunkum underscored the importance of foundational technology, moving to a new collections platform to gain better control of data and agility in compliance. He acknowledged the risks but sees it as essential: “I just felt like I had to get in a platform that allowed me to change faster.”

The panel also discussed workforce and real estate strategies. Remote work adoption varies, with some firms fully remote and others balancing client demands for in-office presence. Rising labor costs and regulatory uncertainty continue to shape investment decisions.

🧠 Key Takeaways:

Invest in AI strategically: Use AI for modeling, scoring, and next-best-action strategies while balancing automation with human empathy.

Build a flexible foundation: Modern platforms and CRM/LMS upgrades enable faster adaptation to compliance and operational shifts.

Reassess workforce models: Remote work and reduced real estate footprints can improve efficiency, but client expectations must guide decisions.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN