- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 20, 2026

Daily Digest - February 20, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Christopher McCaleb of Reliant Capital Solutions, and Anthony Kelly of ControlCredit.ie. Happy belated Birthday to Mike Becker of RMA International.

🎉Congratulations for starting new positions: Greg Ward as Director of Recovery at USAA.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, David Alderman from CBE Companies shares what collectors should do when a consumer keeps asking personal questions about the collector. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

Collector Facing TCPA Class Action Over Wrong Number Calls Using Artificial or Prerecorded Voice

A collection operation is facing a Telephone Consumer Protection Act class-action lawsuit in Michigan federal court over calls that it allegedly made to an individual’s cell phone using an artificial or prerecorded message attempting to reach someone other than the plaintiff, using a number the plaintiff obtained last June.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY’S WEBINAR

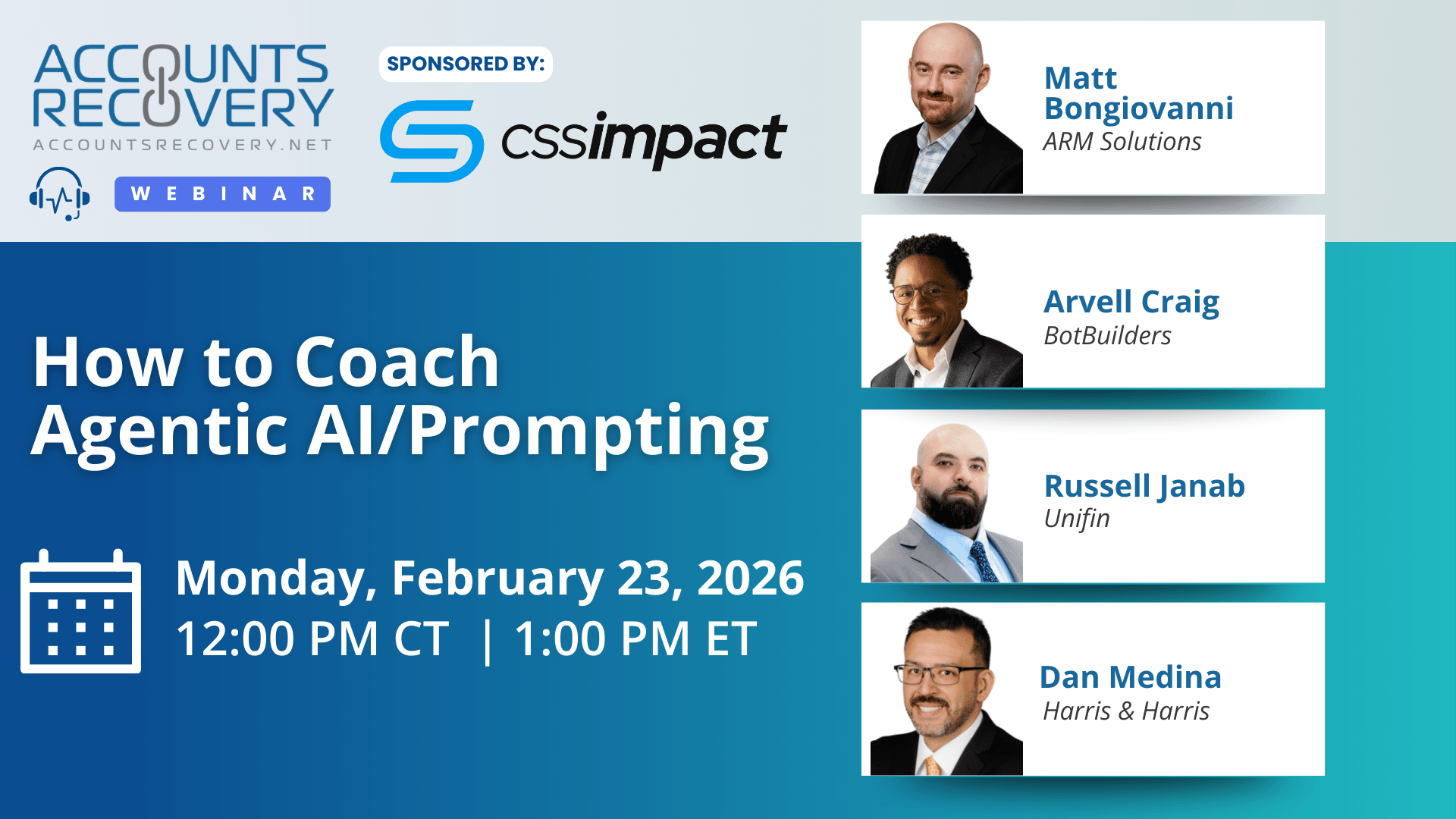

UPCOMING WEBINARS

Fifth Circuit Sanctions Attorney Over AI Generated Errors in FCRA Appeal

A plaintiff’s attorney has been ordered to pay $2,500 in sanctions to the Court of Appeals for the Fifth Circuit for her use of artificial intelligence in drafting documents that were submitted to the court, which came after a District Court judge, since overturned, ordered another attorney from the firm representing the plaintiff to pay $33,000 in attorney’s fees to the defendants for not doing enough of an investigation into the plaintiff’s claims before filing a lawsuit alleging the defendants violated the Fair Credit Reporting Act.

Wells Fargo Agrees to $57M Settlement Over COVID Forbearance Credit Reporting

Wells Fargo has reached a $57 million settlement in a Fair Credit Reporting Act lawsuit over how it reported mortgage forbearances during the COVID-19 pandemic, which led to issues with the credit scores of borrowers.

Minn. Regulator Penalizes Company for Unlicensed Collections and Noncooperation

The Minnesota Department of Commerce has fined an organization $20,000 for engaging in collection activity in the state without a license and for failing to respond to the state’s requests for information.

Maine Lawmakers Weigh Ban on Liens and Wage Garnishment for Medical Debts

A hearing was held this week in Maine to discuss a bill that would prohibit liens and garnishments to collect on unpaid medical debts. The proposal, LD 2129, would bar creditors and debt collectors from placing liens on a consumer’s principal residence or garnishing wages when the underlying obligation is medical debt. The measure was introduced by Sen. Donna Bailey and received testimony before the Legislature’s Health Coverage, Insurance and Financial Services Committee, which will take the bill up for a work session in the coming weeks.

WORTH NOTING: The pace of rent increases slowed at the end of 2025, compared with previous years ... The mayor of New York City have sent warnings to 200 different gyms about junk fees and subscription traps ... How to turn an acquaintance into a friend and make the friendship stick ... Keurig Dr Pepper is planning to roll out 35 new drinks this year ... Some tips to help you hit breakthrough ideas ... The states where gas prices are the highest in 2026 ... Is your car ratting you out to your insurance company? ... What life is like after the "great resignation".

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: Advanced Asset Location Strategies for Commercial Collections

The recent webinar, moderated by Annette Waggoner of the Commercial Collection Agencies of America, featured insights from Peter Ramsey Helt (Baylinson, Kudysh, Greenberg & Helt) and Matt Osgood (Altus Commercial Receivables). The discussion explored how asset location in commercial collections has evolved, blending traditional skip tracing with AI-driven tools and unconventional investigative strategies.

Key Highlights:

Foundational Practices: Peter emphasized deep dives into debtor businesses, garnishing major banks, and leveraging industry-specific data. Matt stressed time management, using skip trace tools efficiently, and setting timers to avoid wasted effort.

Prioritization: Both panelists agreed that active businesses and guarantors deserve more attention. Matt noted that scoring systems from vendors help prioritize accounts, while Peter shared persistence stories—like tracking a guarantor chef for two years until he resurfaced.

Technology & AI: Matt described AI as a “game changer,” enabling collectors to quickly uncover executive contacts and business details during live calls.

Unconventional Moves: Peter highlighted PPP loan data and building permit searches, while Matt pointed to social media, LinkedIn networks, and even Google Maps to confirm operations and locate debtors.

Human Judgment: Both stressed empathy and professionalism in debtor interactions. As Matt put it: “You’ll be shocked sometimes at what people will tell you if you’re nice to them.”

🧠 Key Takeaways:

Leverage AI and scoring systems to prioritize high-probability recoveries while saving time on low-yield accounts.

Adopt unconventional strategies—PPP loan databases, building permits, and social media can reveal hidden debtor assets.

Balance automation with human empathy—professional, polite interactions often yield more actionable information than aggressive tactics.

This session underscored that successful asset location is both an art and a science—requiring persistence, creativity, and the right mix of technology and human judgment.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN