- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 19, 2026

Daily Digest - February 19, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Tom Young of Commercial Collection Corp. of NY, Patrick Rushenberg of North Star Strategies and Solutions, and Mark Gutierrez of Allied Customer Solutions.

🎉Congratulations for starting new positions: David Petroske as Lead Procurement Analyst, Category Management at GM Financial, Erik Rahbun as Vice President of Sales at Key 2 Recovery, David Lippman as Principal at Lease Link, Ashley Nelson as Partner at DLF Law Group, and Diego Granados G. as Manager of Credit Disputes and Quality Assurance at UGA Finance.

Getting to Know DavidLee Richardson of Harris & Harris

Regardless of where you are working and what you aspire to, this industry has an opportunity for you. DavidLee Richardson makes sure that people see that on a daily basis. Seeing things that nobody else can see, and asking the question nobody else has thought of are his super power. Read on to learn more about DavidLee, what he likes most at the end of the day to help him unwind, and the advice that has propelled his career.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

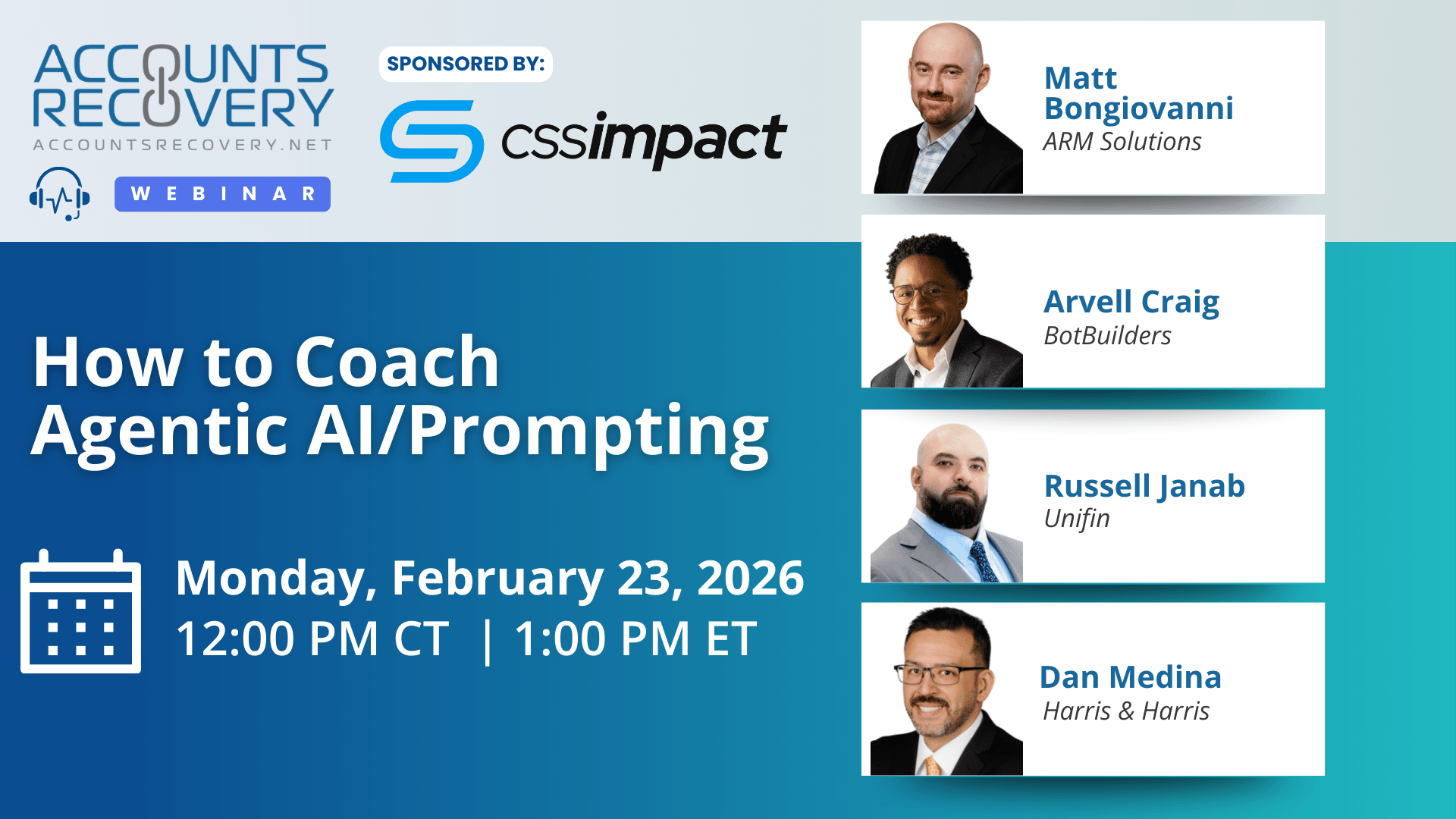

TODAY’S WEBINAR

UPCOMING WEBINARS

CFPB Urges Court to Lift Injunction Blocking Layoffs Ahead of En Banc Hearing

The Consumer Financial Protection Bureau has formally asked the full Court of Appeals for the District of Columbia Circuit to lift the injunction that is currently preventing it from laying off most of its workforce, arguing that the court order represents a “sweeping intrusion” into the agency’s internal management and operational authority.

New Ed. Dept. Guidance Urges Colleges to Step Up Outreach as Defaults and Delinquencies Rise

The Department of Education has issued new guidance urging colleges and universities to take more aggressive steps to reduce student loan delinquencies and defaults, as updated federal data show that more than 1,800 institutions now have nonpayment rates of 25% or higher. The Department is calling on schools to strengthen default management and prevention plans, expand outreach to former students who are delinquent or in default, and better prepare borrowers for repayment. The updated nonpayment data, released this week, is being positioned as an early warning sign for institutions that could later face high cohort default rates and potential loss of access to federal student aid programs.

Judge Grants MTD in FCRA Case Over Conflicting Credit Report Data

A District Court judge in Washington has granted a motion to dismiss filed by three credit reporting agencies in a Fair Credit Reporting Act case alleging the CRAs violated the statute because there is conflicting information on his credit reports. The court ruled that pointing to differences between how the CRAs reported the same account was not enough, by itself, to plausibly allege that any of the reporting was inaccurate or materially misleading under the FCRA.

N.J. Appeals Court Revives Hunstein Case Over Due Process Concerns

While this looks like a Hunstein case where a ruling in favor of the defendant was overturned, a New Jersey Appeals Court had issue with the plaintiff’s right to due process and not the merits of her argument. The ruling does not decide whether using a letter vendor violates the FDCPA. Instead, it focuses squarely on how the case was dismissed and whether the plaintiff was given a fair chance to respond before her claims were thrown out.

WORTH NOTING: Nearly half of Americans say they receive communications that they suspect are scams every day ... Vet bills are skyrocketing, and here's why … A lawyer to the stars shares his best negotiating secret … A former staffer at the CFPB who was fired is now running for Congress in Maryland ... More than one-third of teachers are unable to cover all of their monthly bills ... What you can learn when you watch how people pay their bills ... A guide to getting rid of stains ... What to do when someone tells you to smile more.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: Thriving in Remote

Remote work has shifted from a temporary solution to a permanent operating model in credit collections and contact centers. In a webinar hosted by Mike Gibb of AccountRecovery.net and sponsored by CollaborationRoom.ai, industry leaders shared strategies for managing productivity, compliance, and culture in dispersed teams.

Panelists emphasized that effective remote management requires intentional engagement, clear processes, and outcome-based leadership. As John Farinacci noted, “Be clear, be fair, and be consistent”—principles that resonate even more in virtual environments. Tim Haag highlighted early missteps, such as disabling cameras, which hindered culture-building, while Peter Sorrentino described the evolution from managing attendance to managing performance outcomes.

Technology plays a critical role. Collaboration Room’s platform replicates the contact center floor virtually, enabling supervisors to monitor activity, coach agents in real time, and ensure compliance with InfoSec requirements. Features like AI-driven alerts for cell phones or multiple faces in a workspace address client security concerns while fostering transparency.

Panelists agreed that success depends on framing technology as support, not surveillance. As Maxime Cote-Tremblay advised, leaders must “set the stage” by explaining intent—engagement and collaboration—rather than oversight. Building trust, training managers specifically for remote leadership, and defining clear escalation paths are essential to reducing attrition and sustaining performance.

🧠 Key Takeaways:

Shift focus to outcomes: Move beyond attendance and activity tracking to performance-based management.

Train managers for remote leadership: Equip supervisors with skills tailored to virtual engagement and compliance.

Leverage technology transparently: Use platforms like Collaboration Room to replicate in-office support while clearly communicating their purpose as collaboration tools, not surveillance.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN