- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 18, 2026

Daily Digest - February 18, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Derek Scheskie of Capio Partners.

🎉Congratulations for starting new positions: Gabriel Grover as Vice President of Sales at EXL, Ashley Nelson as Partner at DLF Law Group, Buddy Beaman as Head of Operations - Receivables at Hilco Global Capital Solutions, Justin Gray as Advisor & Investor at Helia Care, Ohad Samet as Member Board of Directors at Sydecar.

White House Report Puts CFPB Consumer Cost at Up to $369B Since 2011

A new White House analysis estimates that federal consumer finance regulations have cost Americans between $237 billion and $369 billion since 2011, largely by increasing borrowing costs and reducing access to credit. The report from the Council of Economic Advisers says rules issued by the Consumer Financial Protection Bureau have pushed up interest rates on mortgages, auto loans, and credit cards, adding hundreds of dollars per borrower over time. The findings are already fueling fresh calls from Republican lawmakers to reform the CFPB, while consumer advocates and Democratic lawmakers dispute the methodology and argue the agency’s protections have returned billions to harmed consumers.

A MESSAGE FROM TCN

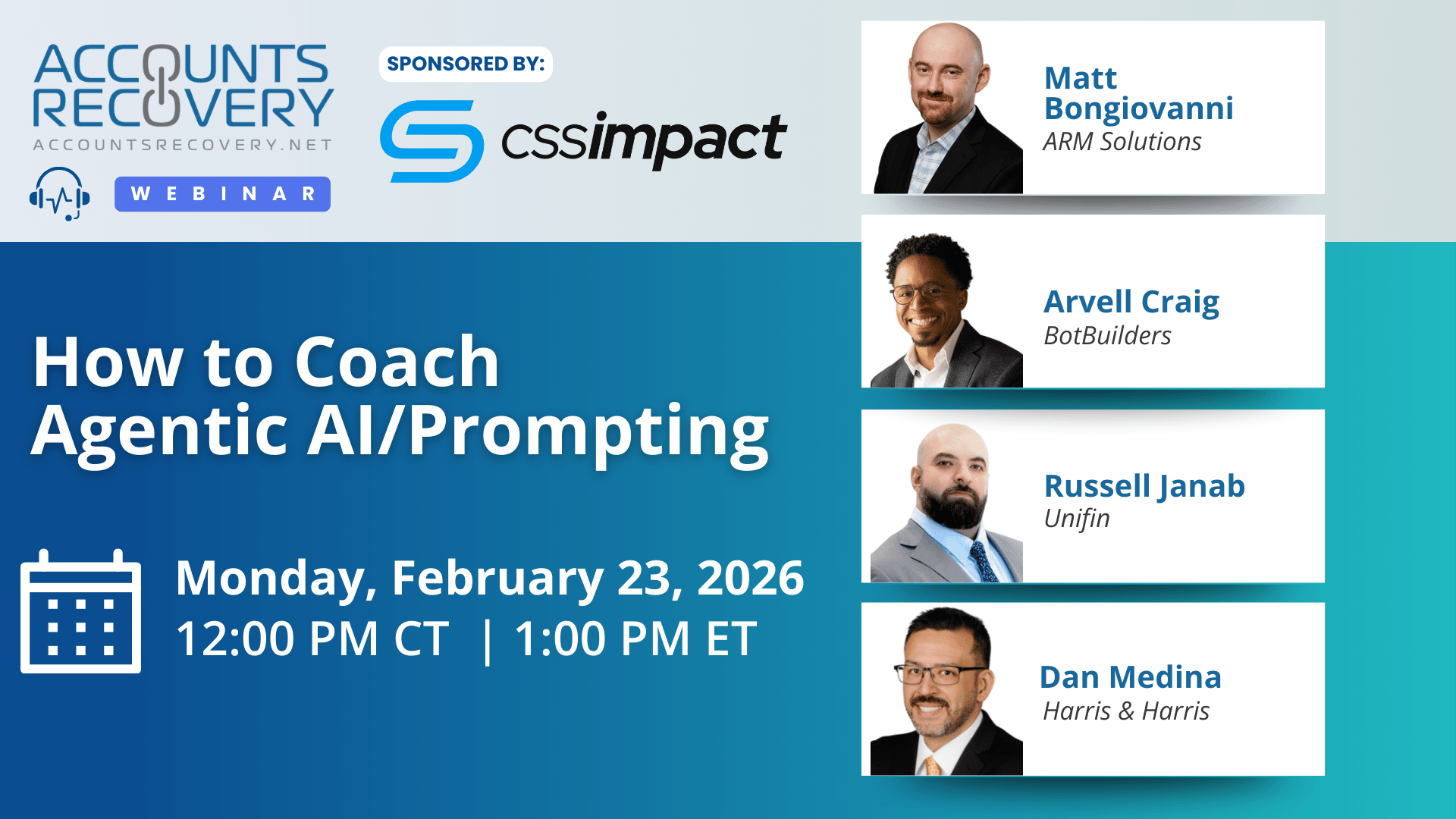

TODAY’S WEBINAR

UPCOMING WEBINARS

Judge Sends FCRA Case to Trial After Denying Summary Judgment Motions

A District Court judge in Texas has denied competing summary judgment motions from both the plaintiff and the defendant in a Fair Credit Reporting Act lawsuit where the defendant mixed the plaintiff’s credit file with that of his son. The court found that genuine disputes of material fact remain on whether the defendant used reasonable procedures to assure maximum possible accuracy and whether the alleged inaccuracies caused compensable harm.

Judge Certifies FDCPA Class Over Added Interest in Collection Letters

A District Court judge in Michigan has certified a class action in a Fair Debt Collection Practices Act lawsuit that accuses a collector of adding interest to any debt, regardless of whether the underlying contract stated it was allowed. The ruling follows earlier decisions in the case rejecting the collector’s attempt to justify the practice under Michigan law and denying a request to end the case at the pleadings stage.

Traumatic Injuries Drive Medical Debt and Bankruptcies, Even for the Privately Insured: Study

People hospitalized for traumatic injuries in the United States face a measurable increase in medical debt and bankruptcies, even when they have health insurance, according to new research published in Health Affairs. The study tracked more than 12,000 injured patients and found that within 18 months of hospitalization, medical debt sent to collections rose sharply and bankruptcy filings increased. Public insurance programs like Medicare and Medicaid provided stronger financial protection, while privately insured patients were the only insured group to experience significant increases in both debt and bankruptcy, challenging the assumption that insurance alone shields households from financial fallout after serious medical events.

43 Companies Seeking Collection Talent

Which creditor is looking for a director of portfolio performance? Which bank needs someone to keep an eye on outbound collection efforts? Which creditors and debt buyers are looking for legal help? Find out the answers to those questions and see more than 40 other companies that are hiring collection talent in this week’s job listings summary.

WORTH NOTING: The newest vacation trend? Good places to sleep ... This is a pretty cool thing for him to do with his money ... A District Court judge has ruled that documents generated by AI are not protected by attorney-client privilege ... A tech company has rolled out an insurance product for AI agents ... Illinois has eliminated $1.1 billion in unpaid medical debts for some residents ... Having the same bedtime might be the secret to a happy marriage ... How to stop making bad coffee ... There is a new cheapest day to fly.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: How to Manage A, B, C, and D-level Collectors

The panel discussion, hosted by Mike Gibb and sponsored by Abstrakt, explored how to effectively manage collectors across performance tiers. Panelists Mara Morgan, Greg Reffner, and Kelli VanCleave debated definitions of A, B, C, and D-level collectors, emphasizing that performance alone is not enough—compliance, culture, and teamwork also matter.

Greg Reffner highlighted the Pareto principle: “80% of collections come from 20% of collectors,” underscoring the need to focus on top performers while questioning the value of retaining low performers. Mara Morgan cautioned against categorizing too quickly, sharing her own experience of taking 18 months to hit targets but ultimately excelling. Kelli VanCleave stressed that “D stands for drama,” noting that agencies often spend disproportionate time managing low performers, draining leadership resources.

The panel agreed that the greatest opportunity lies in elevating B and C-level collectors. Strategies include targeted coaching on specific weaknesses, incremental progress tracking, and using scorecards to set clear expectations. They also warned against overburdening A-level collectors with supervisory duties, which can lead to burnout.

Ultimately, the conversation balanced the tension between “cash is king” and “culture is king,” concluding that sustainable success requires both.

🧠 Key Takeaways:

Invest in mid-tier performers: Focus coaching and resources on B and C-level collectors to maximize organizational impact.

Use objective scorecards: Evaluate collectors on compliance, attendance, teamwork, and performance to remove bias and guide retention decisions.

Balance culture and cash: Avoid keeping high-revenue collectors who damage morale; culture drives long-term success.

Webinar Recap: Optimizing Relationships with Debt Settlement Companies

Debt settlement companies are playing a larger role in the consumer debt ecosystem, offering opportunities for creditors, debt buyers, agencies, and service providers to recover more while improving consumer outcomes. In a recent webinar moderated by Mike Gibb and sponsored by Halsted Financial Services, industry leaders discussed how to identify reputable partners, strengthen collaboration, and overcome friction points.

Panelists emphasized that licensing remains a critical marker of legitimacy. As Teresa Dodson noted, “You need to look at what state licensing is required… and make sure all of that is in compliance.” Beyond licensing, Barbara Nilsen highlighted the importance of tracking consumer complaints and trends, while Chris Atallah stressed that “documentation really protects the performance,” underscoring the need for clear records of authorizations and settlements.

Relationship-building emerged as a central theme. Conferences like RMAI and creditor roundtables provide vital face-to-face opportunities to align strategies and resolve misunderstandings. As Dodson put it, “Bottom line, at the end of the day, you need to resolve the debt… we’re on the same page, we just have to figure out how we work better together.”

Friction points remain, particularly around communication inefficiencies and document exchange. Wade Isbell pointed to the need for standardized file layouts and secure, automated data transfers to reduce reliance on email and manual processes. Tools like Debt Settlement Info Bank were cited as helpful for identifying and resolving accounts in a compliant manner.

🧠 Key Takeaways:

Verify Licensing & Compliance: Ensure debt settlement partners are properly licensed and understand their operating model (attorney vs. non-attorney).

Track Complaints & Documentation: Monitor complaint trends per thousand accounts and demand clear, auditable records of settlements.

Invest in Relationships & Technology: Strengthen collaboration through face-to-face meetings and adopt standardized, secure communication channels to reduce friction.

Webinar Recap: How to Use RCS, SMS, and MMS Effectively

In a recent webinar sponsored by TCN, industry leaders discussed how debt collection agencies, banks, credit unions, fintechs, and healthcare providers can leverage SMS, MMS, and RCS to improve consumer engagement. Panelists emphasized that text messaging is no longer optional—it’s central to building trust, driving self-service payments, and creating digital-first journeys.

Chris Repholz described text messaging as “one arrow in our quiver,” highlighting its role alongside calls, emails, and letters. Miller Magness went further, calling SMS “the broadhead in my quiver,” underscoring its importance in reaching consumers quickly. Amruta Joshi explained that MMS builds brand trust with logos and images, while RCS offers richer experiences like embedded “Pay Now” buttons—though compliance concerns limit its current use in collections. Wendy Terrazzini added that SMS works best for concise reminders, while MMS reduces defensiveness by legitimizing outreach.

The panel agreed that strategy matters: indiscriminate blasts waste resources and risk opt-outs. Instead, agencies should tailor messaging by debt type, balance size, and consumer segment. For example, healthcare collections often succeed with simple SMS payment links, while higher-balance debts benefit from MMS to establish legitimacy. Deliverability remains a consideration, with SMS outperforming MMS (98% vs. ~90%), but both channels are essential.

🧠 Key Takeaways:

Build trust first: Use MMS for initial outreach to establish legitimacy and reduce consumer defensiveness.

Use SMS strategically: Deploy concise SMS reminders for quick nudges, but avoid “walls of text” or indiscriminate blasts.

Prepare for RCS cautiously: Monitor regulatory developments and experiment with RCS only where clear consent and compliance frameworks exist.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN