- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 16, 2026

Daily Digest - February 16, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Vicki Baltzell of Value Recovery Holding, Julie Anderson of CBE Companies, Prateek Gupta of Skit.ai, and Eric Christensen of Torrey Pines Advisors. Happy belated Birthday to: Antonio (Tony) Castanon of Barclays Bank (Feb. 15), Andres Leondardo Andrade Urintive of Alta (Feb. 15), Christiaan Masucci of Credit Control (Feb. 14), Thomas Sandoval of SoFi (Feb. 14), Anita Scott of Great American Insurance Group (Feb. 14), Brad Carey of Revco Solutions (Feb. 14), Mary Fatu of Launch Credit Union (Feb. 14), Andrew Domino of Bridgeforce (Feb. 14), Kevin Hunt of Kafene (Feb. 14), and Nitya Shah of Phillips & Cohen Associates (Feb. 14).

🎉Congratulations for starting new positions: Jessica Fagen as Chief Legal Officer at The Moore Law Group, Heather Hartwig as Account Resolution Specialist at ECMC, and Chris Benson as Senior Vice President, Lending at ORNL Federal Credit Union.

Post-Judgment Collections Can Still Trigger FDCPA Liability, Appeals Court Rules

The Court of Appeals for the Seventh Circuit has vacated a lower court’s dismissal of a Fair Debt Collection Practices Act case, ruling the lower court judge misapplied the Rooker-Feldman doctrine related to the defendant’s conduct in attempting to collect on a garnishment order.

A MESSAGE FROM TCN

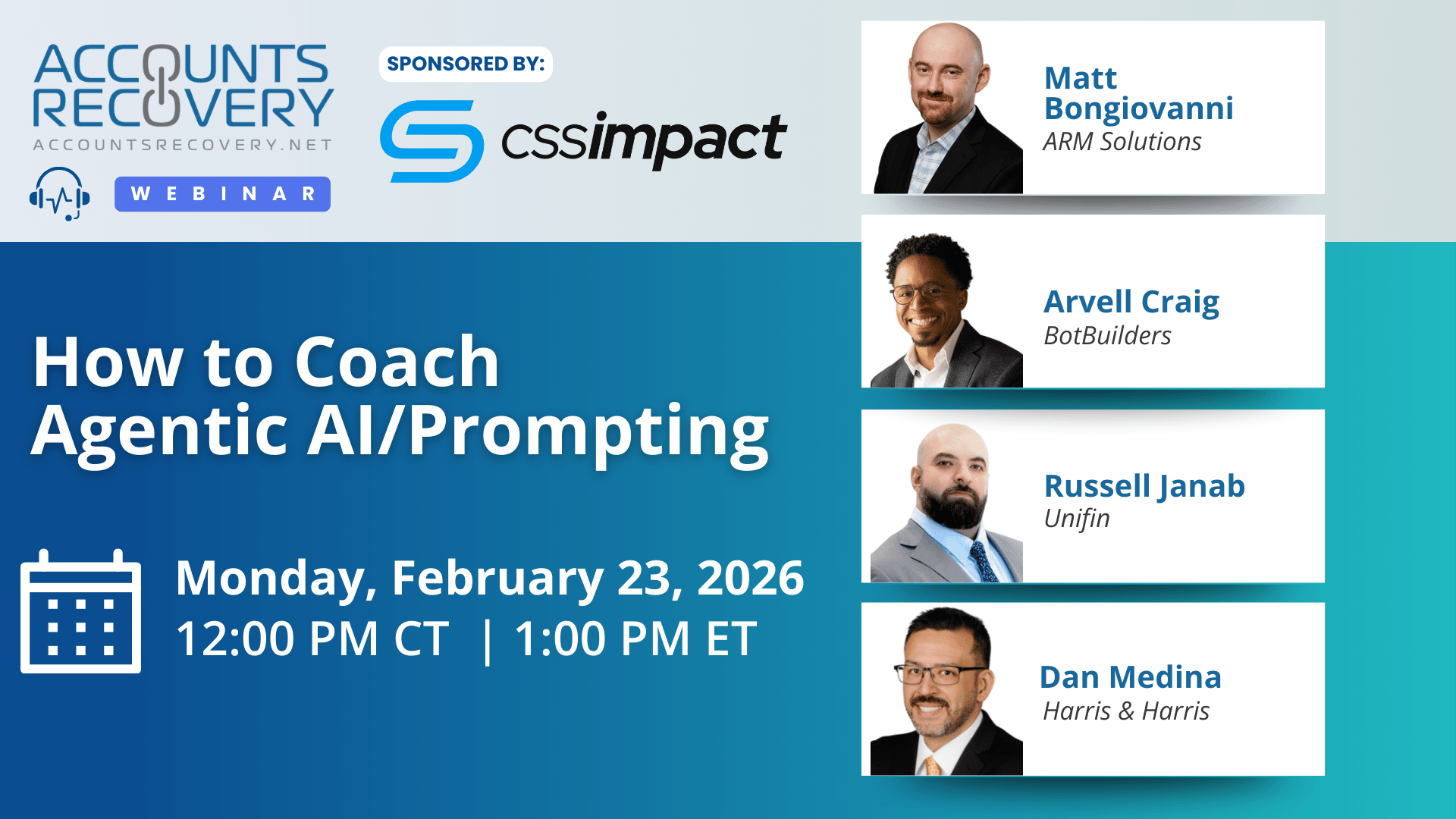

TODAY’S WEBINAR

UPCOMING WEBINARS

Appeals Court Backs Creditor in Prescreened Offer FCRA Dispute

The Court of Appeals for the Tenth Circuit has affirmed a ruling in favor of a creditor that was sued for violating the Fair Credit Reporting Act after it denied the plaintiff an application for credit it had previously prescreened him for. What makes the case extra interesting is that the plaintiff apparently cited fictional cases in his arguments, perhaps relying on artificial intelligence tools that led him astray.

TransUnion Report Finds Collections Industry Betting Big on AI and Digital Channels

The debt collection industry is entering 2025 facing a mix of rising consumer delinquencies, growing account volumes, and accelerated investment in technology, according to TransUnion’s latest Debt Collection Industry Report. The survey finds that agencies, creditors, debt buyers, and law firms are preparing for higher volumes of distressed accounts while shifting more resources toward automation, digital communication channels, and self service tools to improve efficiency and manage costs.

Household Debt Hits $18.8 Trillion as Student Loan Defaults Accelerate

Roughly one million federal student loan borrowers slid into default in late 2025, according to data released last week by the Federal Reserve Bank of New York, as total household debt climbed to $18.8 trillion. The latest Quarterly Report on Household Debt and Credit shows that nearly 10% of student loan balances are now more than 90 days past due, even as overall household debt rose by $191 billion in the fourth quarter of 2025. For banks, agencies, fintechs, and collection law firms, the data points to mounting pressure within the student loan portfolio at the same time consumer balance sheets are carrying higher overall leverage.

Kaufman Dolowich Welcomes Seven Attorneys from McGlinchey Stafford

Kaufman Dolowich, a leading national law firm, today announced that seven attorneys from McGlinchey Stafford led by Partner Chantel Wonder and including three additional partners, two of counsel, and one associate have joined the firm. The group’s capabilities include consumer financial services, employment defense, hospitality, and insurance coverage, enhancing Kaufman Dolowich’s national platform and expanding its depth across key strategic practice areas. Most of the team will be based in Florida, dual-officing between the firm’s Fort Lauderdale and Orlando offices, with two attorneys working remotely.

Compliance Digest – February 16

Get insights from eight legal experts -- Joann Needleman, Tomio Narita, Akeela White, Chad Echols, Anastasia Caton, Stephanie Strickler, Skip Kohlmyer, and Jeff Turner - on recent legal rulings and lawsuits, to make sure you know how to update your policies and procedures and any changes that need to be made to your operation.

This series is sponsored by Frost Echols

WORTH NOTING: Consumers are far more likely to buy something recommended by a chatbot than a fellow human, according to new research ... How the economy is impacting where consumers eat when they dine out ... Financial performance of rural hospitals is improving ... How the government is finding money to protect the acting director of the Consumer Financial Protection Bureau ... The seven mistakes that most CEOs make and how to avoid them ... The airports you choose may be impacting how much you're spending on flights ... It's not you -- this has been a crazy winter for everyone ... The do's and don'ts of writing a good resume.

Music Moniday, part I

Music Monday, Part II

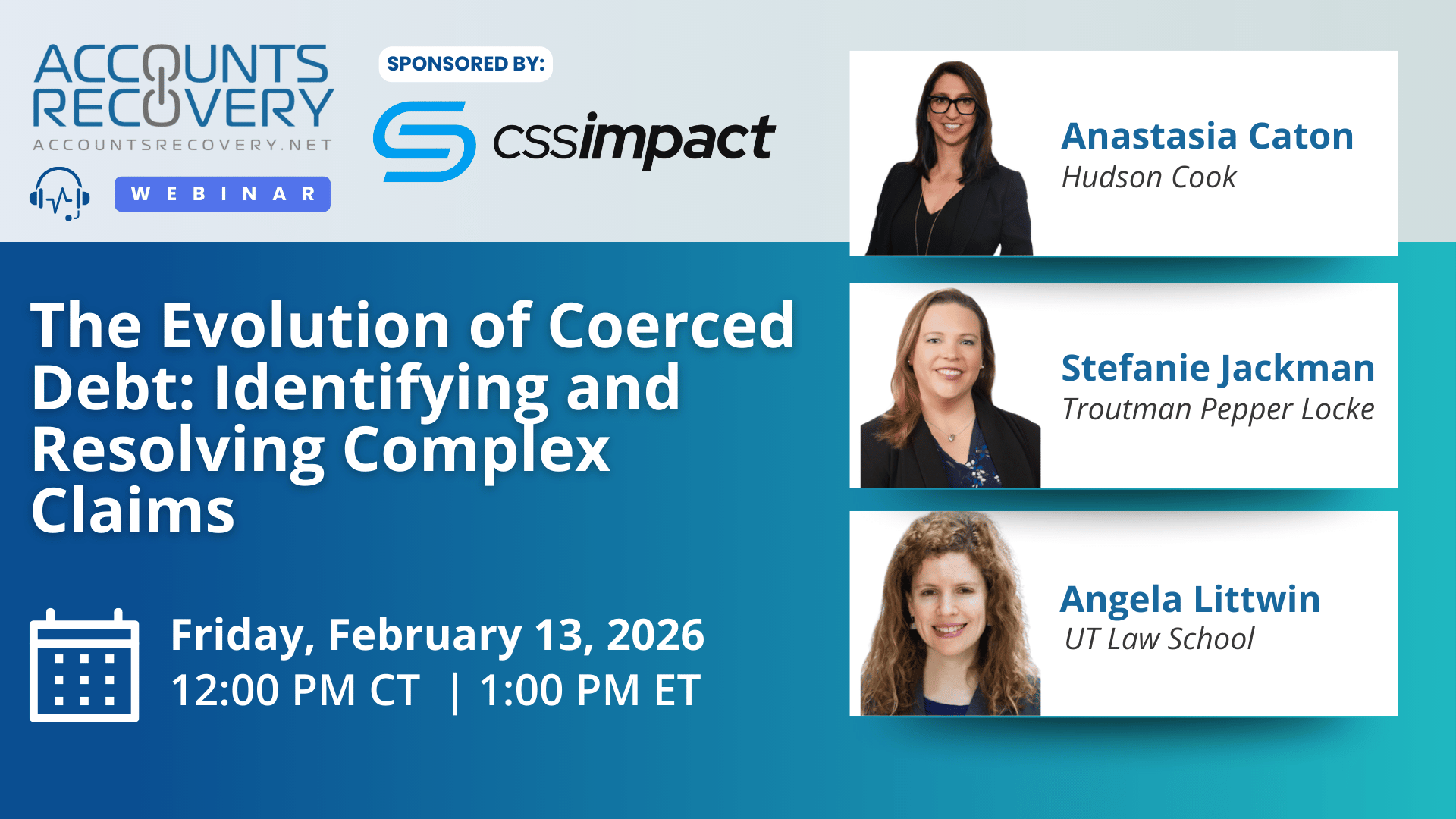

Webinar Recap: The Evolution of Coerced Debt: Identifying and Resolving Complex Claims

The recent webinar, “The Evolution of Coerced Debt: Identifying and Resolving Complex Claims,” brought together legal and industry experts to discuss the growing recognition of coerced debt—financial obligations created through fraud, manipulation, or coercion in abusive relationships.

Professor Angela Littwin shared research showing that over 50% of domestic violence survivors reported coerced debt, with median amounts exceeding $22,000. She explained: “Credit can be a tool of coercive control… If you take out debt in somebody’s name and trash their credit, it makes it much harder for them to leave the relationship.”

Panelists emphasized that current identity theft laws are insufficient, as they cover fraud but not coercion. Survivors often face barriers such as police skepticism, high legal costs, and unsafe communication practices. Operational risks were highlighted, including the danger of sending notices to shared addresses or joint obligors, which could expose survivors to retaliation.

Industry perspectives raised concerns about whether coerced debt should be separately coded in credit reporting. Panelists agreed that deletion or classification under identity theft may be safer than creating a new code, which could disproportionately affect women and elderly populations.

The discussion concluded with recognition that while coerced debt is not new, awareness and structured responses are only beginning to take shape. Agencies, banks, and fintechs must prepare for emerging state laws and compliance obligations.

🧠 Key Takeaways:

Prioritize survivor safety: Establish secure communication channels and avoid practices that could expose survivors to perpetrators.

Prepare for compliance shifts: Monitor state-level coerced debt laws and adapt operational frameworks accordingly.

Review reporting practices: Consider whether trade line deletion or identity theft classification is more appropriate than new coding, to avoid unintended impacts.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN