- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 13, 2026

Daily Digest - February 13, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Tami Birner of FMA Alliance, and Nick Curry of Modern Asset Management.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, David Alderman from CBE Companies shares what collectors should do when a consumer keeps asking personal questions about the collector. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

Suit Accuses Debt Buyer, CRAs of Not Updating Credit Report After ID Theft Claim

There is nothing particularly sexy or unusual about this complaint. If you were looking for a man-bites-dog type of story, you’re likely to be disappointed. The reason I chose to write about this particular complaint is precisely because of how not-unusual it is. For companies in the credit and collection industry, the claims that are being made in this suit are the most common claims they are facing today, and likely will be facing for the foreseeable future. A debt buying organization and two credit reporting agencies are facing claims of violating the Fair Credit Reporting Act and the Fair Debt Collection Practices Act because the plaintiff didn’t recognize a new on her credit report, disputed it, and then didn’t see the debt disappear from her credit report.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

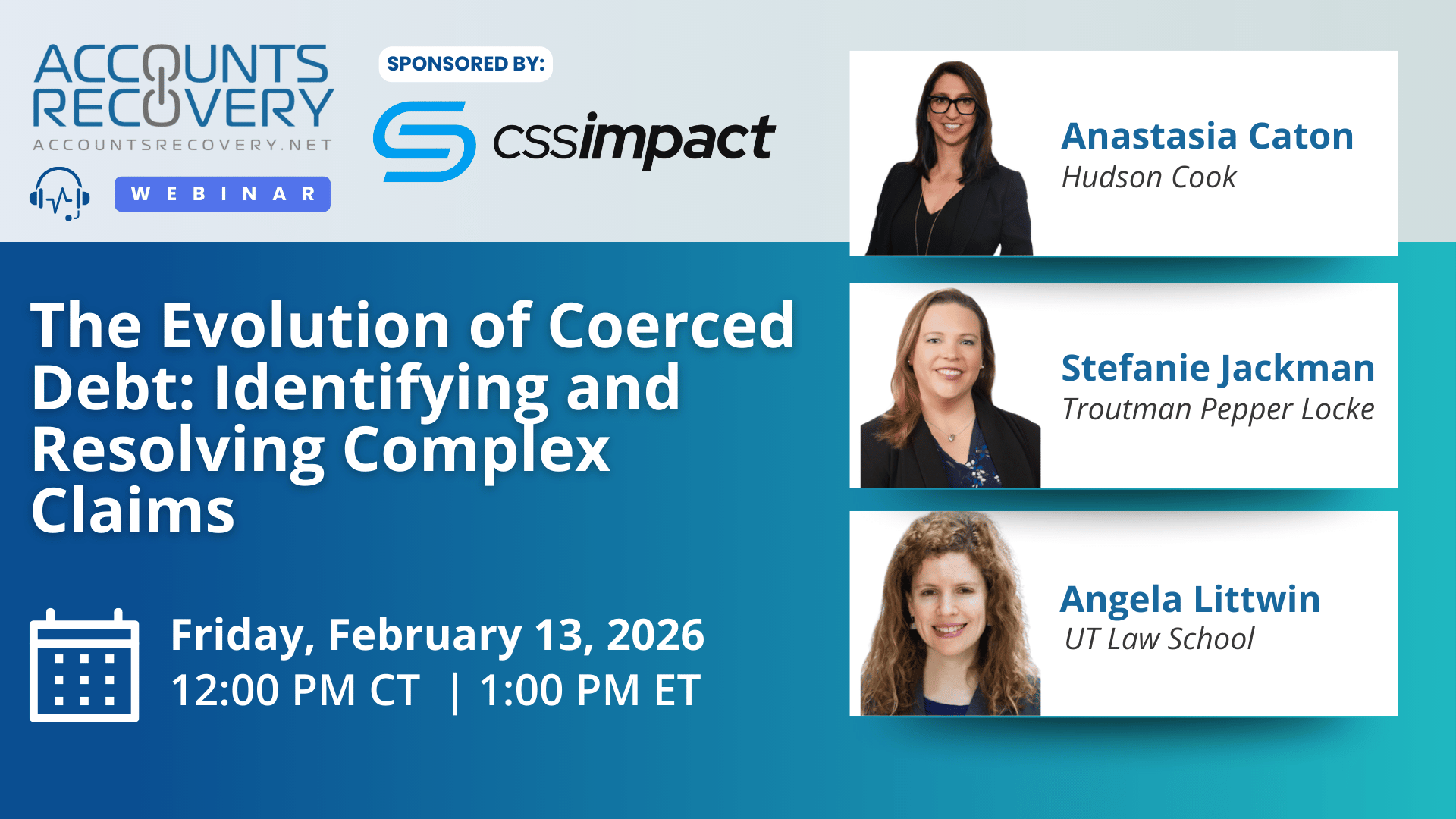

TODAY’S WEBINAR

UPCOMING WEBINARS

Health insurance is consuming 10% or more of median family income in 19 states, according to a new Commonwealth Fund analysis, underscoring how affordability pressures are building for working families even when they have employer coverage. The burden is heaviest in Southern states, with Louisiana at the top end of the range, while Washington, D.C. is at the low end. As policymakers increasingly debate consumer protection and affordability, New York continues to set the tone nationally on cost and access issues, and other states are likely to take cues from how it frames and responds to rising household financial strain tied to essential services like health care.

Appeals Court Says BFE Defense Fails After Misreading Social Security Exemption Law

The Court of Appeals for the Ninth Circuit has overturned a lower court’s summary judgment ruling in favor of a collection law firm that was accused of violating the Fair Debt Collection Practices Act for garnishing the plaintiff’s Social Security funds, ruling it was not entitled to the statute’s bona fide error defense. The court did affirm the lower court’s ruling in favor of the other defendant — a bank — that was accused of unjust enrichment and the intentional infliction of emotional distress.

New NCLC Report Warns Bank Account Seizures Are Pushing Families Closer to Financial Collapse

A new report from the National Consumer Law Center finds that growing household debt and a surge in debt collection lawsuits are increasing the risk that consumers will see their bank accounts frozen or seized, often wiping out money set aside for rent, food, utilities, and transportation. The report, Safe Deposits: How to Protect Family Bank Accounts from Debt Collectors, highlights wide differences in state laws governing bank account garnishment and calls on states to automatically protect a baseline amount of funds so families can continue meeting basic financial obligations.

Judge Dismisses FCRA Claims Tied to How BK Was Displayed on Credit File

A District Court judge in Florida has granted a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act related to how it furnished information related to the plaintiff’s bankruptcy filing.

WORTH NOTING: Revenue Cycle Management leaders weigh in on the skills that are most important to their jobs these days ... The city of Chicago is mulling the sale of $1 billion in unpaid parking tickets ... How the death of actor James Van Der Beek is rekindling the medical debt debate in the United States ... In honor of Valentine's Day, a look at why humans kiss and the one question to deepen any romantic relationship ... How much the typical American worker has saved for retirement ... The 10 "most American" cars you can buy today ... Home heating bills are soaring for homeowners nationwide ... The physics behind the most difficult jump in figure skating, the quadruple axel.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: The Importance of Personalization When Engaging with Consumers

Hosted by Mike Gibb and sponsored by Halsted Financial, this webinar highlighted why personalization is now a critical driver of trust, engagement, and recovery outcomes in credit and collections. Panelists from TrueML, PayReady, Digital Vision Banking, and Central Portfolio Control emphasized that personalization goes far beyond inserting a consumer’s name into a message—it requires operational, contextual, and emotional strategies that respect consumer circumstances and reduce friction.

Shannon Brown noted, “Most consumers in delinquency don’t want shiny features—they want legitimacy and trust.” Tim Collins urged the industry to benchmark against the best digital experiences consumers encounter, not just peers. Richard Rotondo reminded professionals, “You’ve got a human being on the other end of that phone.” Tom Stefani reinforced the importance of listening and adapting outreach based on consumer responses.

The discussion also explored how AI and machine learning can scale personalization, enabling agencies and creditors to tailor timing, channels, and tone across thousands of accounts while maintaining compliance.

🧠 Key Takeaways:

Adopt holistic personalization: Move beyond static outreach to operational (channel/timing), contextual (life events), and emotional (trust-building) personalization.

Leverage data and AI: Use historical touchpoints and machine learning decision engines to automate and refine outreach strategies at scale.

Prioritize consumer experience: Benchmark against leading digital platforms, ensure portals reduce friction, and remember that empathy and respect drive engagement.

This webinar underscored that personalization is not optional—it’s the foundation for effective consumer engagement and sustainable recovery outcomes across the credit and collections ecosystem.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN