- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 12, 2026

Daily Digest - February 12, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Eric Hinderberger of Provana.

🎉Congratulations for starting new positions: Sara Bray as Loan Servicing Supervisor at Credit Union of Southern California, Rick Collins as Vice President at Upgrade, and Jake VanAusdall as Principal at Maurice Wutscher.

Getting to Know Brian Answeeney of CBE Companies

It’s no surprise that someone with the competitive fire that Brian Answeeney has would not only be drawn to collections, but would thrive as well. It may feel like juggling fireballs most days — his words — but after getting a taste, there is nowhere else he would rather be, unless that place has a great food scene. Read on to learn more about Brian, why he prefers early mornings over late nights, and why he may walk away one day for a career in disater recovery.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

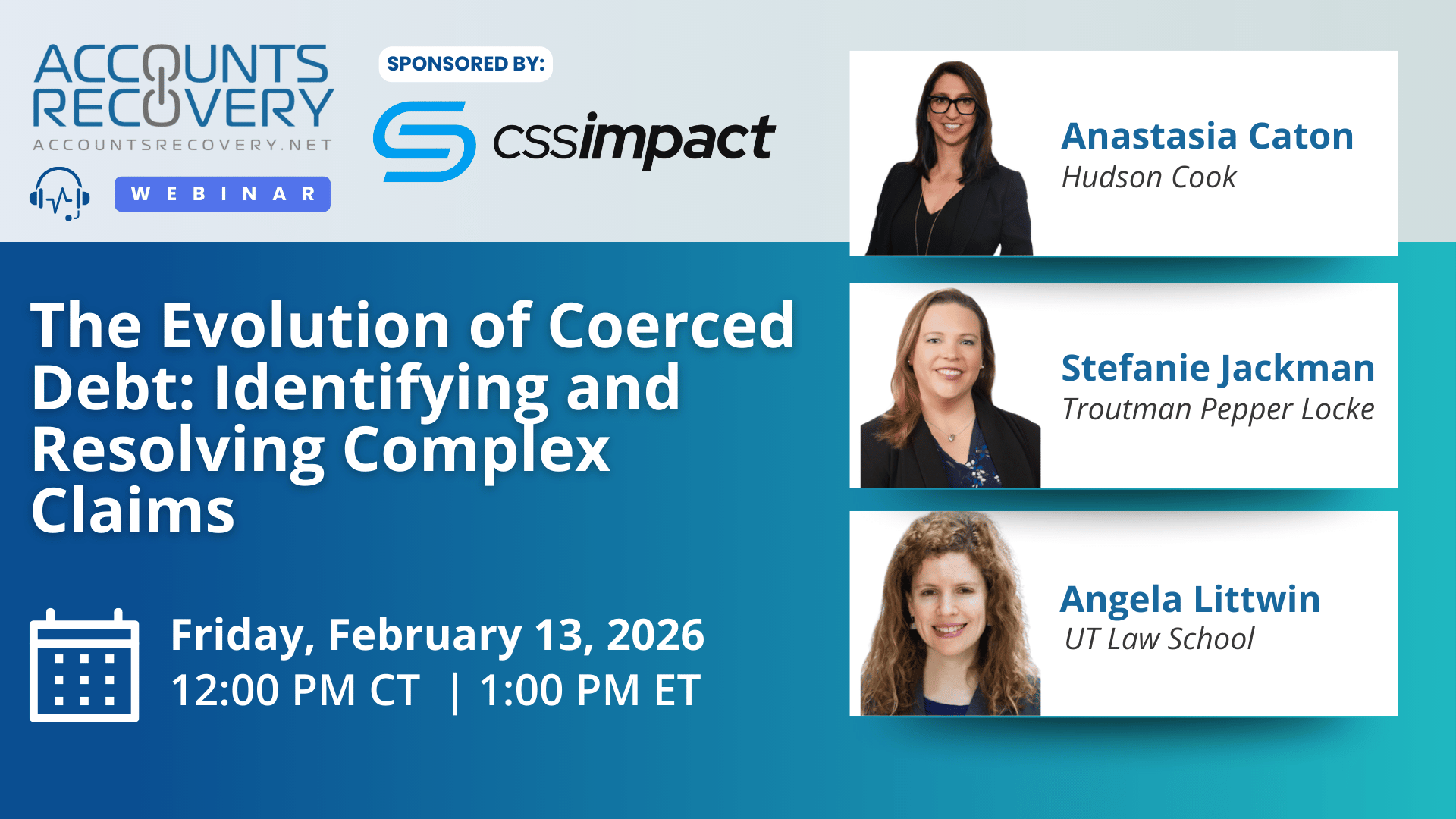

TODAY’S WEBINAR

UPCOMING WEBINARS

Consent Primary Issue With Carriers and Texting: CTIA

LAS VEGAS — When it comes to engaging with consumers on their cell phones via text messages, the conversation begins and ends with consent, said Jeff Simmons, the vice president of technology programs with the CTIA, a trade group representing wireless carriers, during a session at RMAI’s annual conference yesterday. And in case anyone reading this thinks cell phones aren’t important to engaging with consumers, companies in the receivables management industry are estimated to be sending approximately 10 billion text messages annually, and 90% of people living in America have a smartphone.

GAO: CFPB Downsizing Slashes Enforcement, Raises Risks to Core Consumer Protection Functions

A new Government Accountability Office report says the Consumer Financial Protection Bureau has sharply reduced enforcement, supervision, staffing, and rulemaking activity over the past year as part of a broad reorganization, raising questions about the agency’s capacity to carry out its core consumer protection mission. The GAO found the Bureau has issued stop work orders, closed supervisory exams, terminated contracts and enforcement cases, and pursued workforce reductions approaching nine out of ten employees, while also rescinding or withdrawing dozens of guidance documents and rules. The watchdog also said it received little cooperation from CFPB leadership during the review, relying largely on public records and court filings to complete the report.

Judge Tosses FDCPA and FCRA Claims Over Post-Dispute Communications

A District Court judge in New Jersey has granted a defendant’s motion to dismiss claims it violated the Fair Debt Collection Practices Act and Fair Credit Reporting Act over its actions after the plaintiff disputed the debt and refused to pay it.

Judge Says Reporting Student Loan Balance During Chapter 13 Is Not Misleading

A District Court judge in Nevada has granted a motion to dismiss filed by a creditor in a Fair Credit Reporting Act case over how it furnished information related to a student loan after the plaintiff filed for bankruptcy protection. The case centers on how a student loan was reported to the credit bureaus while the plaintiff was in an active Chapter 13 bankruptcy.

WORTH NOTING: Small businesses remain very optimistic about where the economy is heading ... "Surveillance" pricing is a major turnoff for most Americans ... Valentine's Day gift ideas for her and him ... How to hone your friendship intuition ... Calming noises at bedtime might not be as harmless as it sounds ... The markets that are seeing the sharpest declines in house prices ... How the 4-day work week helps people get more done ... What does it mean to live a "comfortable" life today.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: Breaking Down FCRA Lawsuit Trends

The webinar, sponsored by Halsted Financial, examined the evolving landscape of Fair Credit Reporting Act (FCRA) litigation. Panelists—including Lauren Burnette, Brendan Little, Jason Tompkins, and Colin Winkler—highlighted how identity theft, permissible purpose disputes, and claims of inaccurate reporting by omission are driving a surge in lawsuits.

Key Trends Discussed:

Identity theft claims are becoming more sophisticated, making it harder for furnishers to detect mismatches. Jason Tompkins noted, “ID theft has become so much more prevalent and more sophisticated.”

Permissible purpose disputes are rising, often fueled by pro se litigants who misunderstand when reports can legally be accessed.

Claims by omission are emerging, with consumers alleging violations for failing to furnish certain account details. As Burnette explained, “I’m seeing claims that basically say you’re furnishing inaccurate information by omission.”

AI-assisted litigation is reshaping timelines. Self-represented consumers now generate lengthy pleadings almost instantly, compressing response windows and increasing complexity.

Despite a finite number of statutory claims, panelists agreed that creative plaintiff strategies and jury receptiveness are fueling multimillion-dollar verdicts. Defense challenges hinge on thorough investigations, documentation, and understanding the quality of opposing counsel.

🧠 Key Takeaways:

Invest in technology: Use advanced tools to detect errors and patterns early, reducing litigation exposure.

Audit and evaluate clients: Identify accounts or clients generating frequent disputes and consider pausing or reevaluating reporting practices.

Strengthen collaboration: Work closely with creditors to ensure dispute responses are backed by robust documentation and data integrity.

Bottom Line: FCRA litigation is intensifying, driven by identity theft, consumer misunderstandings, and AI-enabled filings. Agencies, debt buyers, and financial institutions must adapt with stronger compliance, smarter technology, and proactive partnerships to reduce risk and protect operations.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN