- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 11, 2026

Daily Digest - February 11, 2026

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: Deborah (Kaelin) Marsh of Revco Solutions, Ron Bartleson of Diversified Adjustment Service, and Jessica Morrow of Starmark Financial.

🎉Congratulations for starting new positions: Dianne Huff as Associate General Counsel at Guardian Savings Bank, and Toney Fedullo as Vice President of Business Development at IC System.

Optimism, Interest in Improved Efficiencies Focus on Day One of RMAI

LAS VEGAS — It’s likely not a coincidence that the biggest crowd ever has descended upon Las Vegas for RMAI’s annual conference at a time when the Consumer Financial Protection Bureau’s influence over the industry is at an all-time low. But beyond the relief that is being felt across the industry, even if it ends up only being temporary, what is driving so many people to this conference appears to also be a renewed commitment to working together.

A MESSAGE FROM TCN

TODAY’S WEBINAR

UPCOMING WEBINARS

House Bill Targets Identity Fraud With State Grants, Digital ID Guardrails

A new bipartisan bill introduced in the U.S. House would create a government-wide strategy to combat identity fraud and theft, fund state efforts to modernize digital identity systems, and address emerging threats like AI-powered deepfakes. H.R. 7270, the Stop Identity Fraud and Identity Theft Act of 2026, directs the Treasury Department to launch innovation grants for states to strengthen identity verification, protect government benefit programs, and reduce fraud tied to compromised identities. The legislation, introduced by Rep. Pete Sessions [R-Texas], arrives as regulators and banks report that identity compromise now underpins the majority of suspicious activity reports, and as data breaches and deepfake-enabled fraud continue to surge, raising operational and compliance stakes for companies in the credit and collection industry.

Judge Keeps Debt Collection and Habitability Claims Alive Over Unlicensed Rent Collection

A District Court judge in Maryland has denied a motion to dismiss claims that a property management company is not a debt collector under state law while also denying a motion over attempts to collect rent when it did not have the proper licenses to do so. The ruling keeps alive consumer protection, debt collection, habitability, and negligence claims tied to allegations that tenants were charged rent during periods when the property was unlicensed and conditions were unsafe, while trimming back some theories that lacked allegations of concrete injury.

Judge Declines to Halt Auto Repossession While FCRA Claims Proceed

A District Court judge in Pennsylvania has denied a plaintiff’s motion for a preliminary injunction prohibiting the defendant from repossessing her car while the plaintiff’s suit alleging the defendant violated the Fair Credit Reporting Act proceeds. The ruling means the defendant is not barred from moving forward with repossession while the case continues, after the court found the plaintiff failed to meet the high legal standard required for emergency injunctive relief.

42 Companies Seeking Collection Talent

The grass is always greener on the other side, the saying goes. For that to be true, one of the more than 40 listings in this week's job listings summary is your next step toward world domination. Check out the listings and see if your dream job, or your forever job, or just the next step in your career is waiting for you.

WORTH NOTING: Nearly 40% of cancer cases worldwide are preventable, according to new research ... 300 finance leaders weigh in on what's next in fintech ... Figure skaters at the Olympics are dancing to music created by AI ... Cigna is laying off more than 2,000 employees worldwide ... Three overlooked subscription fees that might be costing you hundreds of dollars each year ... Looking back on how the term "hat trick" came to be ... A neuroscientist shares how to be resilient when things fall apart ... The 10 most expensive car brands of 2026.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

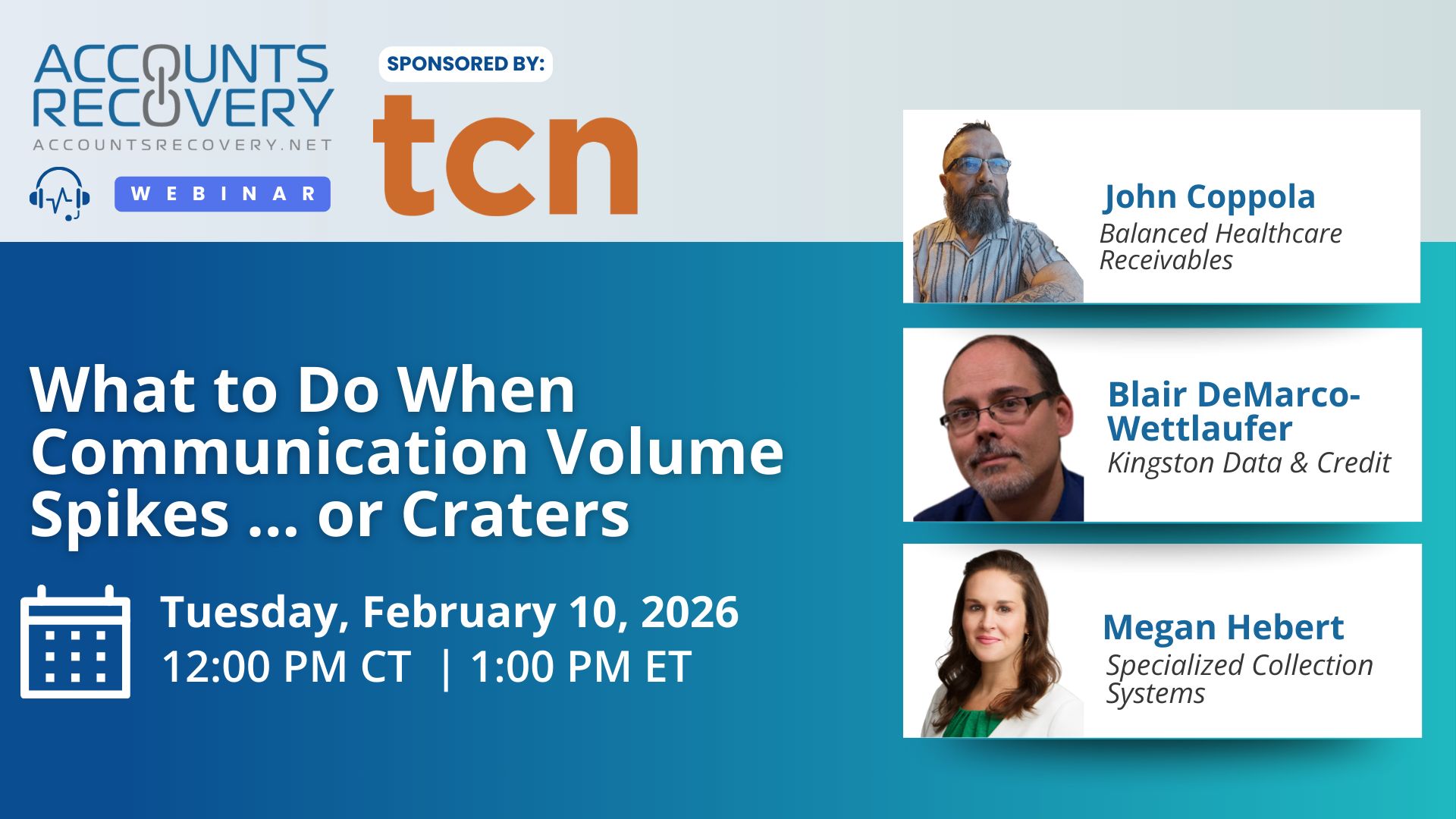

Webinar Recap: What to Do When Communication Volume Spikes ... or Craters

The webinar “What to Do When Communication Volume Spikes … or Craters” brought together industry leaders to discuss how sudden changes in call and communication volume affect collection operations. Panelists emphasized that spikes or drops in volume are rarely random—they are symptoms of prior actions, client behavior, or external factors. By leveraging data, monitoring trends, and adjusting workflows, agencies can stabilize operations while maintaining compliance and customer experience.

John Coppola reminded attendees, “You’re not here to win arguments. You’re here to close resolutions.” Blair DeMarco-Wettlaufer added, “If you are in emotional conflict, you can’t solve problems,” underscoring the importance of clear-headed decision-making. Megan Hebert highlighted her father’s mantra, “Buy low, sell high,” applying it to operations by refining processes during low periods and maximizing efficiency during high ones.

🧠 Key Takeaways:

Monitor and Analyze Data: Track inbound/outbound ratios, campaign performance, and historical benchmarks to identify whether changes are trends, problems, or temporary blips.

Throttle and Segment Outreach: Avoid overwhelming systems or staff by pacing text/email drops, adjusting dialer ratios, and prioritizing motivated inbound callers.

Cross-Train and Empower Staff: Ensure team members can pivot between roles, manage campaigns, and respond quickly to spikes, creating accountability and resilience.

This session reinforced that communication volatility is inevitable, but with proactive monitoring, smart workflow adjustments, and a compliance-first mindset, agencies can turn challenges into opportunities for stronger engagement and recovery.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN