- AccountsRecovery Daily Digest

- Posts

- Daily Digest - February 10, 2026

Daily Digest - February 10, 2026

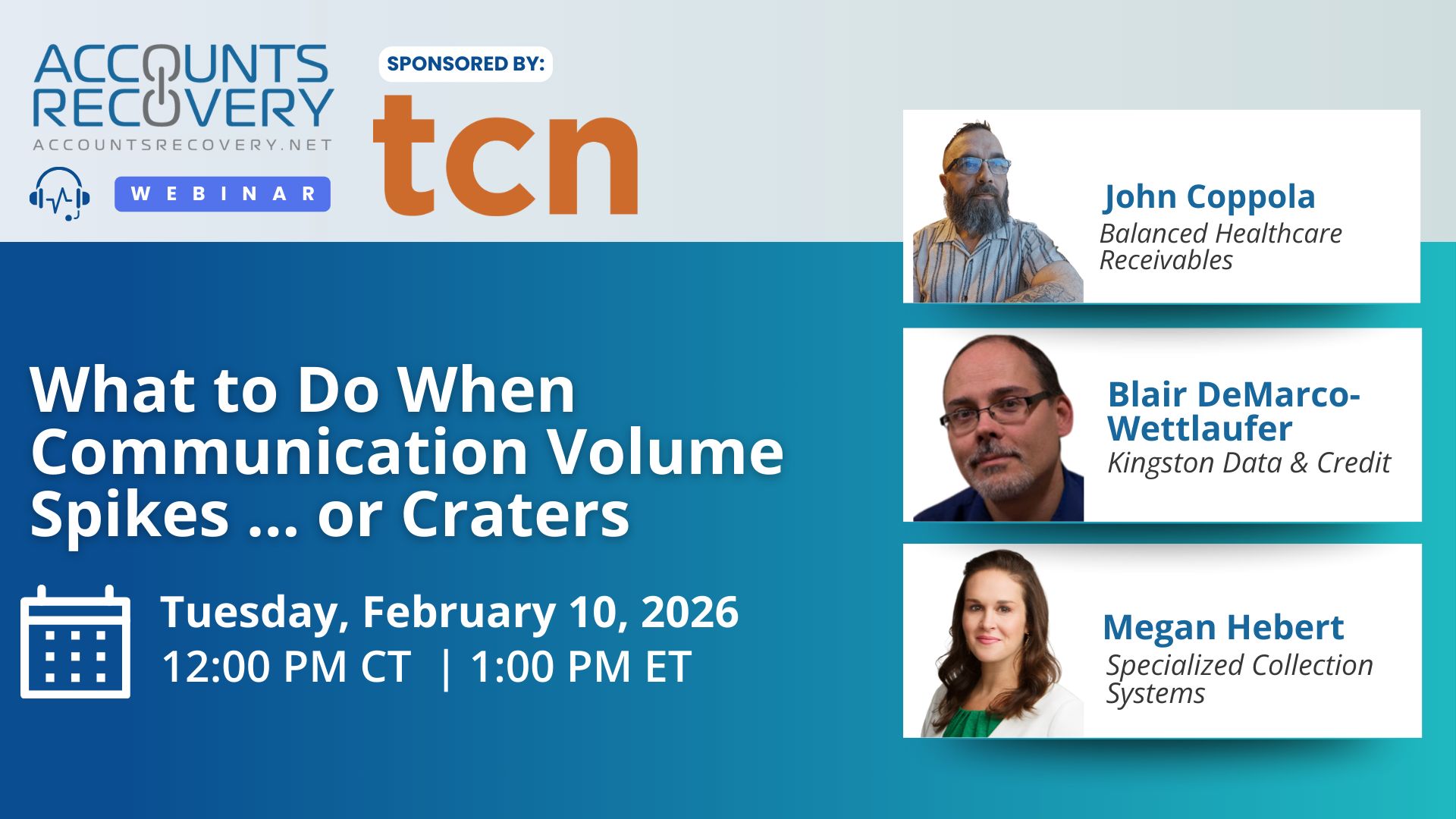

Brought to you by: TCN | By Mike Gibb

🎂Happy Birthday to the following: William Woodard of PRA Group, and Gary Gross of Helvey & Associates.

🎉Congratulations for starting new positions: Patrick Austin as Senior Cybersecurity & Data Privacy Counsel at BroadStreet Partners, and Karley Gloede as Head of Servicing at GoodLeap.

Suit Accuses Law Firm of ‘Mocking’ Plaintiff in Email, Undertaking Surveillance

A law firm is facing claims it violated the Fair Debt Collection Practices Act and Regulation F by threatening to have the plaintiff’s water turned off if a homeownership association debt was not paid off, while also communicating in emails information that the plaintiff claims was obtained through surveillance of the plaintiff’s lifestyle, travel, and entertainment activities.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY’S WEBINAR

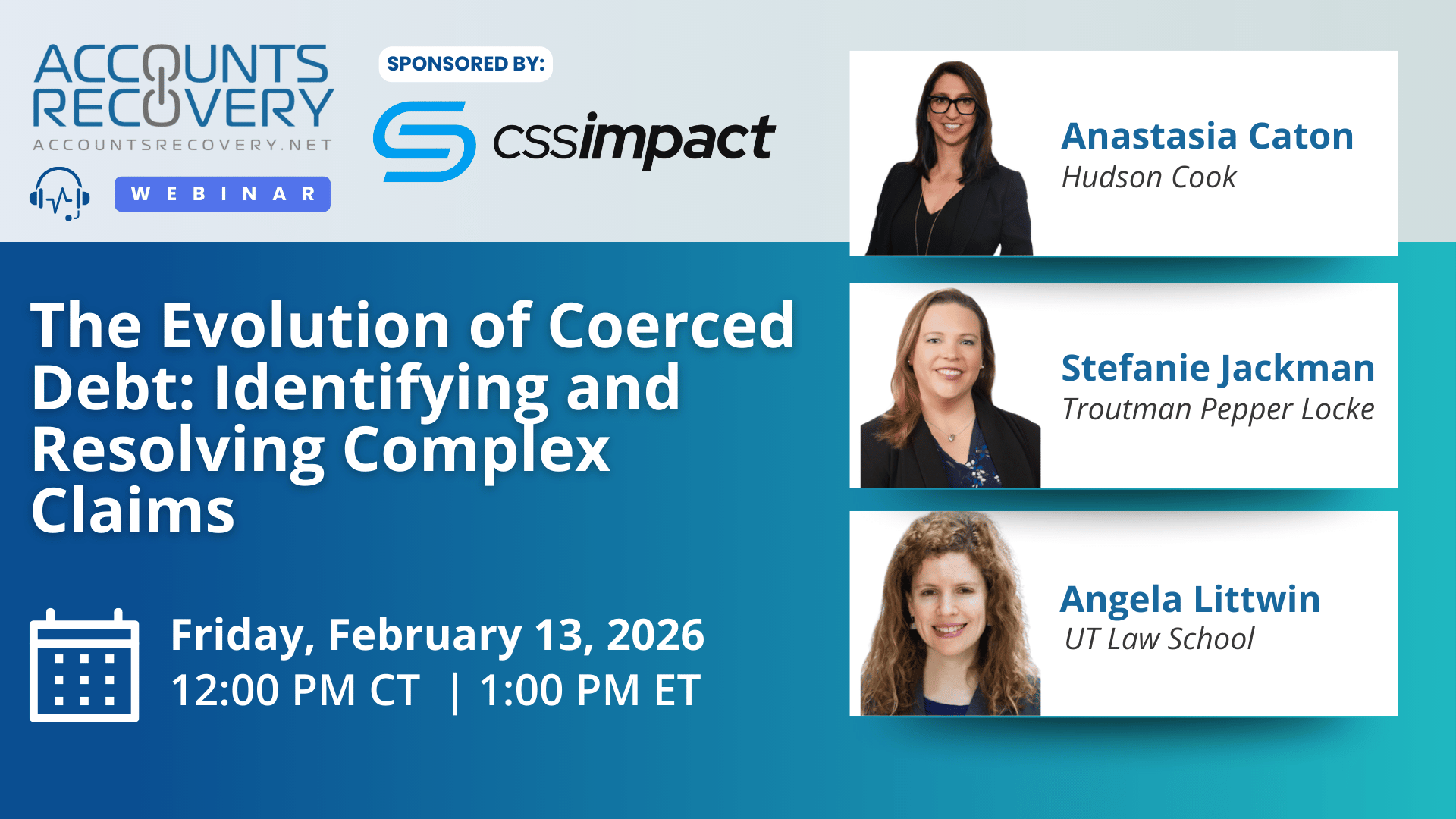

UPCOMING WEBINARS

Medical Debt Bill Clears Washington Senate as Industry Warns of Hospital Impact

Washington’s push to rein in medical debt interest moved a step closer to becoming law this week, with the State Senate voting to advance Senate Bill 5993 along party lines. The bill, which now heads to the House for consideration, would cap interest on certain medical debt at 1%, marking a significant shift from the state’s current framework and signaling continued momentum among lawmakers to reshape how medical debt is treated in Washington.

Appeals Court Clarifies How Defendants Can Deny Class Certification

The Court of Appeals for the Fourth Circuit has partially affirmed and partially vacated a lower court’s ruling related to how and when a defendant can seek to deny certification of a class action. The court clarified the proper procedural path for early challenges to class allegations and set a high bar for when courts can shut down class claims before discovery.

New Senate Report Puts $19B Price Tag on CFPB Pullback

A new report from the Senate Banking Committee Minority Staff estimates that actions taken to scale back the Consumer Financial Protection Bureau over the past year have cost American consumers as much as $19 billion, largely due to dismissed enforcement actions, abandoned settlements, rescinded rules, and a sharply reduced consumer complaint function. The report argues that the cumulative impact of fewer investigations, undone consent orders, and rolled back fee regulations has shifted billions of dollars back onto households, while weakening the CFPB’s role as the primary federal “cop on the beat” for consumer finance oversight.

Judge Blocks Second Attempt to Relitigate Foreclosure Under FDCPA

Anyone who watches TV will likely know the concept of double jeopardy, where an individual can’t be tried twice for the same crime. Turns out, there is a similar dynamic with a much less sexy name, the Rooker-Feldman doctrine. One plaintiff’s attempt at suing a mortgage lender for violating the Fair Debt Collection Practices Act has been dismissed by a federal judge in New Jersey because the plaintiff had previously tried and failed to make the same claims in state court.

WORTH NOTING: Social Security myths that retirees still believe, and how much they are costing you ... A new study reveals that people who are using AI the most are the ones who are burning out the fastest ... Most couples keep at least some of their money separate, according to a new survey ... How someone who travels a lot makes her hotel rooms feel like home ... Why you may not want to give up that morning cup of coffee just yet ... The price of beef is at a record high, but people are buying more of it than ever ... This might be the worst insult you can hurl at someone these days ... High schools are rethinking how to teach money skills to students.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: Training the Trainers: How to Coach Managers for an AI-Powered Workforce

The webinar “Training the Trainers: How to Coach Managers for an AI-Powered Workforce” brought together industry leaders to discuss how managers can guide frontline teams through digital transformation. Panelists emphasized that while AI offers efficiency and insights, success depends on leadership skills, communication, and adaptability.

David Lee Richardson highlighted the importance of change leadership, noting that managers must help employees navigate the emotional side of disruption: “Managing the process is one thing, but understanding the emotional rollercoaster people experience is another.” Kristi Loyer added that exposure to AI tools reduces fear and builds confidence: “Look what this can do for you, look what this can do for our business.” Both agreed that openness to experimentation and alignment across leadership, managers, and staff are critical.

The discussion also touched on practical applications, such as speech analytics that flag tone changes in calls, and AI-driven coaching insights that save managers hours of manual review. However, panelists cautioned against adopting technology just because it’s trendy, stressing the need for project management discipline and agility to avoid wasted investments.

🧠 Key Takeaways:

Lead with change leadership: Managers must go beyond process management to guide teams through emotional and cultural shifts brought by AI.

Expose teams to AI benefits: Demonstrating how AI saves time and improves outcomes builds trust and reduces resistance.

Balance agility with strategy: Training programs and technology investments should remain flexible, ensuring they adapt to evolving tools without wasting resources.

This conversation underscored that AI is not replacing managers—it’s reshaping their role. The future belongs to leaders who can blend technology with human judgment to drive performance and engagement.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN