- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 8, 2025

Daily Digest - December 8, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Joey Nichols of CBC, Beth Miller of Golden 1 Credit Union, and Zachary Bostick of TransUnion. Happy belated Birthday to: Erin Thunholm of Action RCM Powered by Harris & Harris (Dec. 7), Adam Herbert of Bell & Williams Associates (Dec. 7), Steve LaMere of DCM Services (Dec. 7), Adrienne Byrne of Caine & Weiner (Dec. 7), Lisa Ann Thomas of Watermark TPO (Dec. 7), Florence Worthen Brown of Global Solution Biz (Dec. 6), Pam Kirchner of BCA Financial Services (Dec. 6), Rick Glass of Castle & Cooke Mortgage (Dec. 6), and Bob Lycett of Bank of America (Dec. 6)

🎉 Congratulations for starting a new position: Thomas Von Eschen as Vice President, Consumer Loan Servicing at SchoolsFirst Federal Credit Union

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Groups Sue CFPB, Vought to Keep Regulator Open

A coalition of consumer advocacy groups has filed a lawsuit seeking to block what they call a deliberate attempt by Acting CFPB Director Russell Vought and the Trump administration to “shut down” the Consumer Financial Protection Bureau by cutting off its access to funding. The case, filed in the Northern District of California, marks the most direct legal challenge yet to the administration’s effort to wind down the Bureau after months of internal turmoil, shrinking reserves, and warnings of an imminent funding lapse.

A MESSAGE FROM TCN

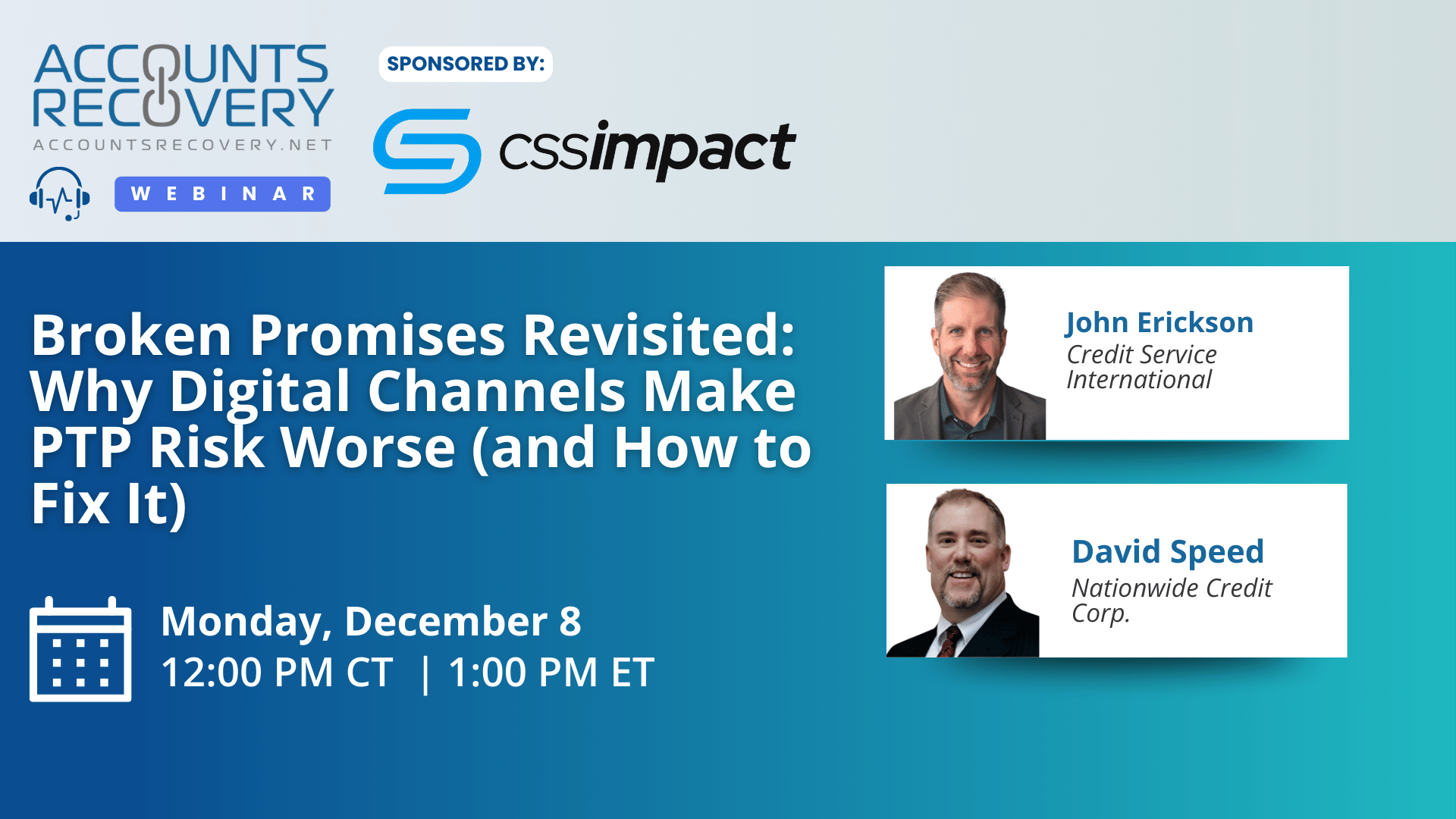

TODAY‘S WEBINAR

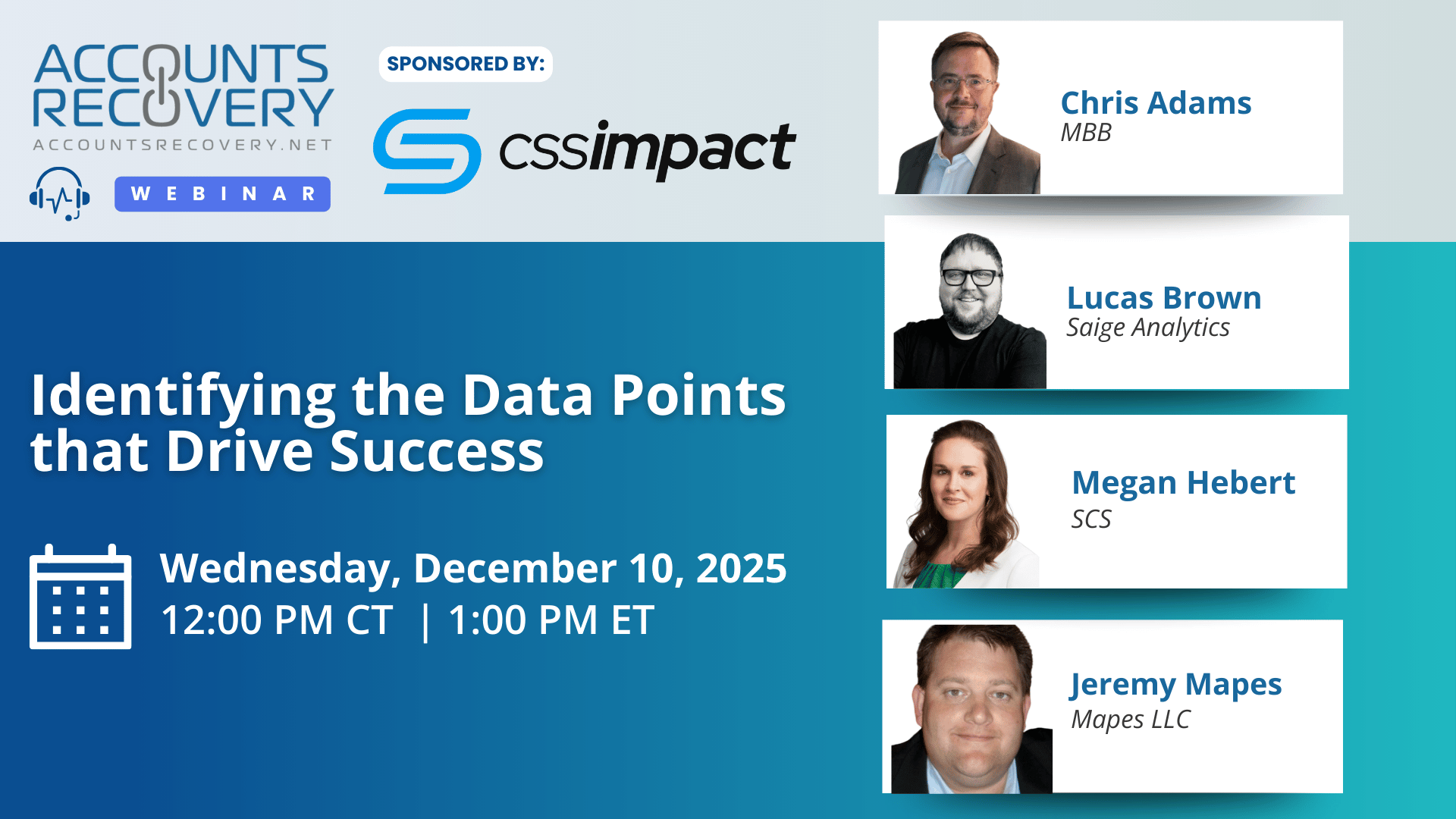

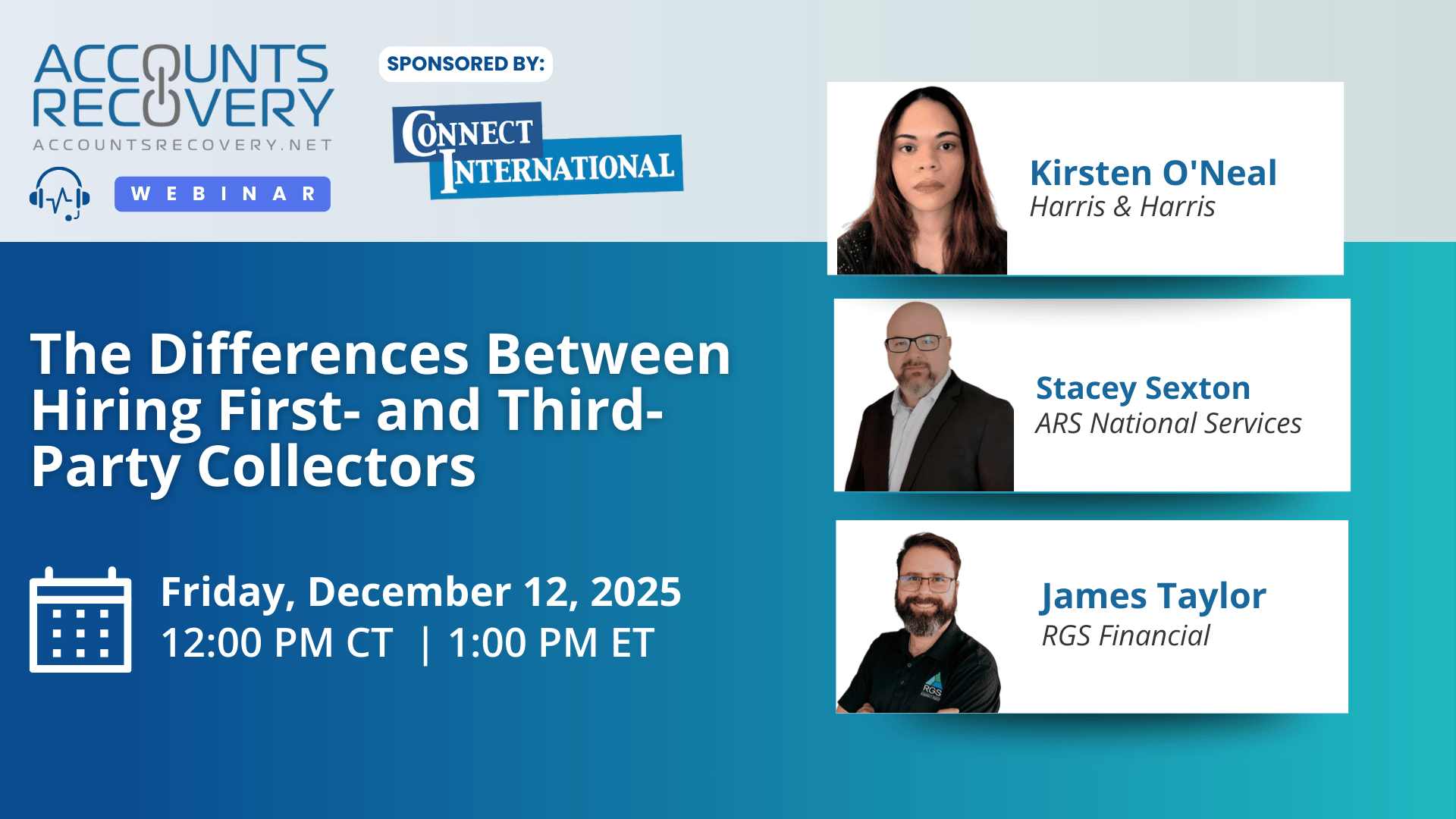

UPCOMING WEBINARS

FDCPA Case Falls Apart After Plaintiff Omits Basic Elements Needed to Proceed

When suing collection operations, there are boxes that plaintiffs need to check, and if those steps are missed, it makes it easy for judges to rule. A District Court judge in Florida has granted a defendant’s motion for summary judgment in a Fair Debt Collection Practices Act case because the plaintiff forgot, or chose not to, make sure that she alleged the debts were for personal use and that the defendants were, in fact, debt collectors under the statute.

New Report Warns: Do Not Trust AI Without Human Oversight

A new report from Billtrust, a provider of AI powered accounts receivable technology, carries a clear message for finance and credit professionals: do not put blind faith in artificial intelligence.

Missouri Appeals Court Revives Pre-Spokeo FCRA Settlement

Timing is everything. A settlement inked between parties in a Fair Credit Reporting Act case four days before the Supreme Court issued its ruling in Spokeo v. Robins has led a Missouri Appeals Court to overturn a lower court’s dismissal of that settlement.

Compliance Digest – December 8

Staying on top of the legal rulings and compliance updates is a full-time job for me, which means I can only imagine how much harder it is for you, where you really need to know what is going on so you can make changes and adjustments that keep your operation out of trouble. The Compliance Digest is meant to provide important insights and context to help you not only stay up-to-date, but also provide perspective about potential changes that may need to be made. Thanks to Jenna Williams, Kim Phan, John Marees, Heath Morgan, Alex McFall, Brendan Little, and Justin Penn for participating!

This series is sponsored by Bedard Law Group

Sponsored: Using Conversation Intelligence in Loan Servicing: How AI Agents Recognize Consumer Intent

Loan servicing teams handle millions of consumer interactions every year. Yet for decades, almost nothing from those conversations has been captured as usable intelligence.

WORTH NOTING: Consumers keep using their credit cards to make more purchases and increase how much they owe ... Consumers are ending 2025 feeling pretty pessimistic about the state of the economy ... Seniors are getting dozens of Medicare-related scam calls a day ... A look at some statistics about medical debt in America ... A list of the most mis-prounounced words in America in 2025 ... A new home equity financing trend that might be creating more problems than it solves ... Why healthcare is more important to the economy and the country than artificial intelligence is ... Just how far are people willing to go to visit a doctor they like.

Music Monday, part I

Music Monday, Part II

Webinar Recap: Student Loan Collections: Where Things Stand and Where They Are Heading

In a recent webinar sponsored by CSS Impact, industry experts examined the evolving landscape of student loan collections and the mounting pressures facing borrowers, institutions, and collection operations. Panelists agreed that the long-discussed “student loan bubble” is still growing and may not fully burst until 2026, driven by economic strain, servicing breakdowns, and widespread borrower confusion.

Speakers highlighted that many borrowers are struggling to manage rising expenses while juggling multiple debts—credit cards, medical bills, mortgages, and auto loans—which complicates repayment prioritization. As one panelist noted, collectors today are “almost being put into the role of a counselor,” requiring more collaborative, flexible engagement strategies.

The discussion also addressed the significant influence of social media misinformation, with borrowers increasingly convinced they can delay or avoid repayment. This challenge is compounded by servicing failures that make it difficult for consumers to access reliable information. Panelists emphasized the need for industry-driven education efforts to counteract these trends.

Policy changes—including program reclassifications and new federal loan limits—are expected to push more borrowers toward private student loans beginning in 2026, introducing higher-cost options and stricter credit requirements. These dynamics will create new challenges for both borrowers and collection agencies, while potentially expanding the volume of accounts requiring recovery.

Throughout the conversation, experts underscored the importance of empathy, communication, and data-driven strategies to sustain recoveries in an environment shaped by economic uncertainty and evolving borrower expectations.

🧠 Key Takeaways:

Adopt Collaborative Collection Strategies

Rigid formulas and aggressive tactics no longer produce results. A counseling-oriented, flexible approach leads to stronger engagement and higher long-term recovery rates.Combat Misinformation with Clear, Accurate Guidance

Train teams to address social media myths and proactively educate borrowers on repayment options, consequences, and available support.Prepare for Growth in Private Loan Activity

Anticipate an influx of higher-risk private student loan accounts starting in 2026 and strengthen analytics, training, and workflows accordingly.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN