- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 4, 2025

Daily Digest - December 4, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: James Dickson of Arvest Bank, and Tyler Simendinger of SIMM Associates.

🎉 Congratulations for starting a new position: Jose Giron as Vice President of Operations at TSI - Transworld Systems Inc., and Adam Parham as Chief Platform & Integration Officer at Williams & Fudge, Inc.

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Getting to Know Meg Scotty of Brennan & Clark

For anyone just getting a start in collections, if you want to see what is possible, look no further than Meg Scotty. Like most of the people in this industry, she didn’t grow up dreaming of owning a collection operation, but falling in love with the people and the process has lead her to a career where she now owns the agency she started working at 39 years ago. Read on to learn more about Meg, where she gets her best thinking done, and how designing dresses for walking down the aisle helped pay her way through school.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

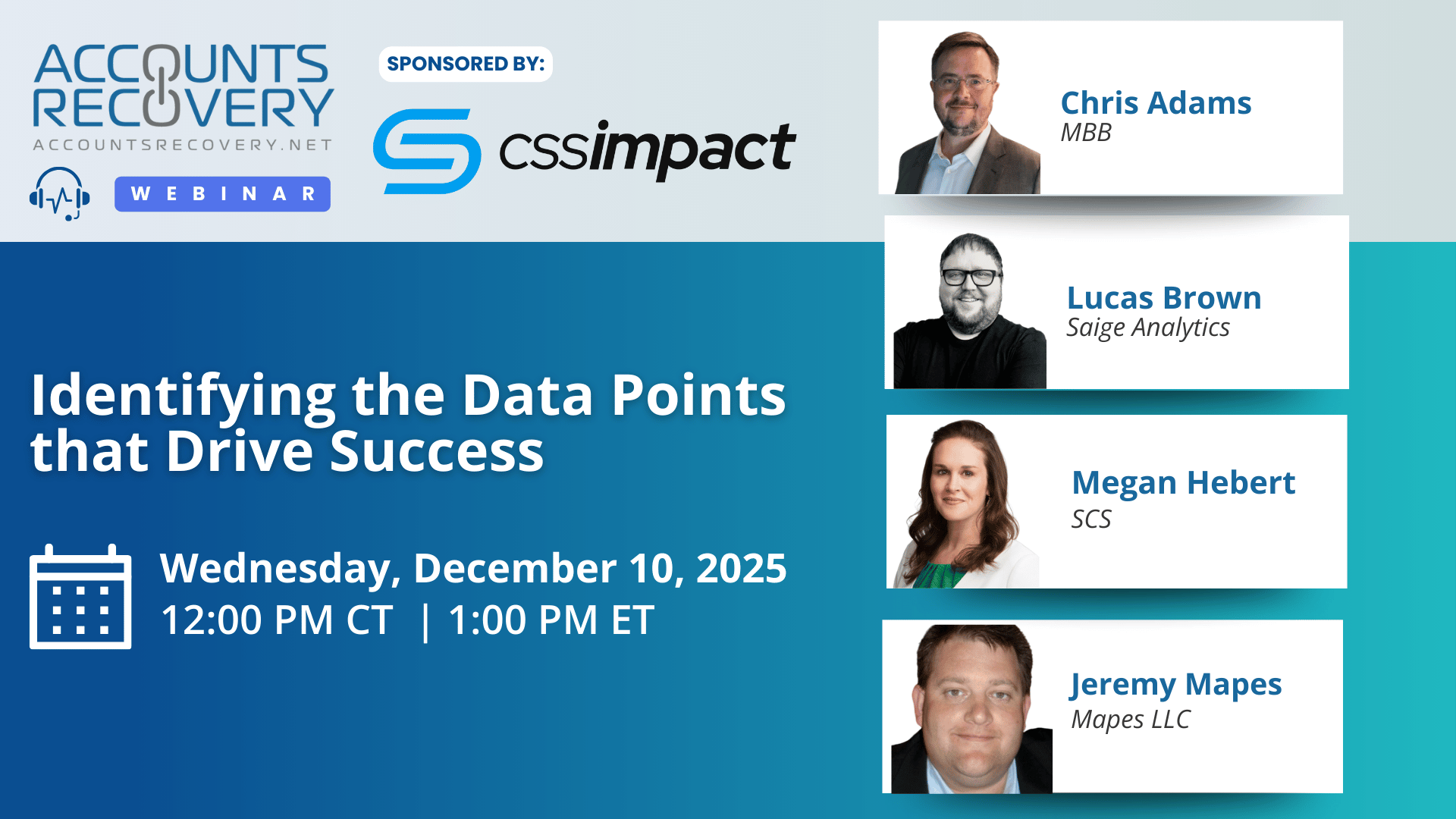

TODAY‘S WEBINAR

UPCOMING WEBINARS

Minnesota Court Rejects FDCPA Claim Over Statute of Limitations Disclosure

A District Court judge in Minnesota has granted a defendant’s motion for judgment on the pleadings after it was accused of violating the Fair Debt Collection Practices Act pver a disclosure in a collection notice that advised the plaintiff that the statute of limitations on the debt had expired and that he could not be sued to collect.

AGs Target Four Major Carriers In Phase 2 Of ‘Operation Robocall Roundup’

A bipartisan coalition of 51 state attorneys general has entered Phase 2 of “Operation Robocall Roundup,” directing four of the largest voice providers in the country – Inteliquent, Bandwidth, Lumen, and Peerless – to stop transmitting suspected illegal robocalls across their networks.

Court Rejects MTD in Pay-to-Pay Fee Class Action

A District Court judge in North Carolina has denied a defendant’s motion to dismiss claims over its charging of “pay-to-pay” fees. The decision keeps alive a proposed class action alleging that a mortgage servicer violated the North Carolina Debt Collection Act (NCDCA) and the North Carolina Unfair and Deceptive Trade Practices Act (NCUDTPA) by charging borrowers fees to make mortgage payments online or by phone.

Judge Refuses to Decertify FCRA Class, Rejects Argument That ‘Facts Have Changed’

A District Court judge in Pennsylvania has denied a defendant’s motion to decertify a class in a Fair Credit Reporting Act case, disagreeing with the defendant that the facts of the case have changed enough to warrant decertification.

WORTH NOTING: A fintech vendor that works with a number of banks and credit unions is warning them of a data breach that has affected at least 400,000 people so far ... Why December is still the best month to buy a new car ... Three ways that healthcare in the United States is getting worse ... To fight the onset of dementia, make sure to get out and socialize ... The president is promising the largest tax refund season ever is coming in 2026 ... The backlash against tipping is spilling over into the holiday season ... People are spending more this holiday season, but are also looking more for discounts and debt to finance those purchases ... A list of 15 tiny habits that can help you make huge productivity gains.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: What Smart Organizations Automate First: A Decision Framework for Choosing the Right Workflows

Automation is reshaping collections, but success depends on choosing the right workflows to start with. In a recent webinar hosted by AccountsRecovery.net and sponsored by CSS Impact, industry leaders shared practical frameworks and examples for identifying automation opportunities that deliver measurable ROI, strengthen compliance, and improve staff efficiency.

Panelists included Rob Graff (CSS Impact), Steve Cusick (National Recovery Agency), Jeremy Mapes (Mapes LLC/Strategy Q), and Josh Serling (Lenley). Together, they emphasized that automation should target repetitive, low-judgment tasks while freeing staff to focus on exceptions and higher-value activities.

Josh Serling introduced the impact vs. effort matrix, noting: “If it’s high impact and low effort, that’s a great place to start.” Steve Cusick stressed aligning automation with KPIs such as compliance, ROI, and vendor integration, while Jeremy Mapes highlighted the importance of auditing frontline processes to uncover hidden inefficiencies. Rob Graff pointed to “armies of staff doing repetitive tasks” as prime automation targets, citing RPA tools and OCR as proven solutions.

Beyond ROI, panelists underscored the human side of automation. As Graff noted, automation improves employee quality of life by eliminating “mind-numbing” tasks. Serling added that saving staff even 30 minutes daily boosts retention and productivity. Rising labor costs and competitive pressures in healthcare collections make automation not just strategic—but essential.

🧠 Key Takeaways:

Build an Impact vs. Effort Matrix: Prioritize workflows that deliver measurable ROI with minimal complexity.

Audit Regularly: Interview frontline staff to uncover hidden manual tasks that executives may overlook.

Automate Repetitive, Low-Judgment Workflows: Use RPA and OCR to handle tasks like file imports, skip tracing, and portal downloads, freeing staff for exceptions and customer engagement.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN