- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 3, 2025

Daily Digest - December 3, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Jack Gordon of WebRecon, Tracy-Lee Mangan of RMS, Linda Varner of Crown Asset Management, Irene Hoheusle of ARM Compliance Business Solutions, and Danny McBride of Optimized Payments.

🎉 Congratulations for starting a new position: Dustin Allen as Manager, Counsel at Capital One.

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Court Overrules Plaintiff’s Reconsideration Request in FDCPA Dispute

A District Court judge in Ohio has denied a plaintiff’s motion for reconsideration — among other rulings — in a Fair Debt Collection Practices Act case over an alleged unpaid apartment debt.

A MESSAGE FROM TCN

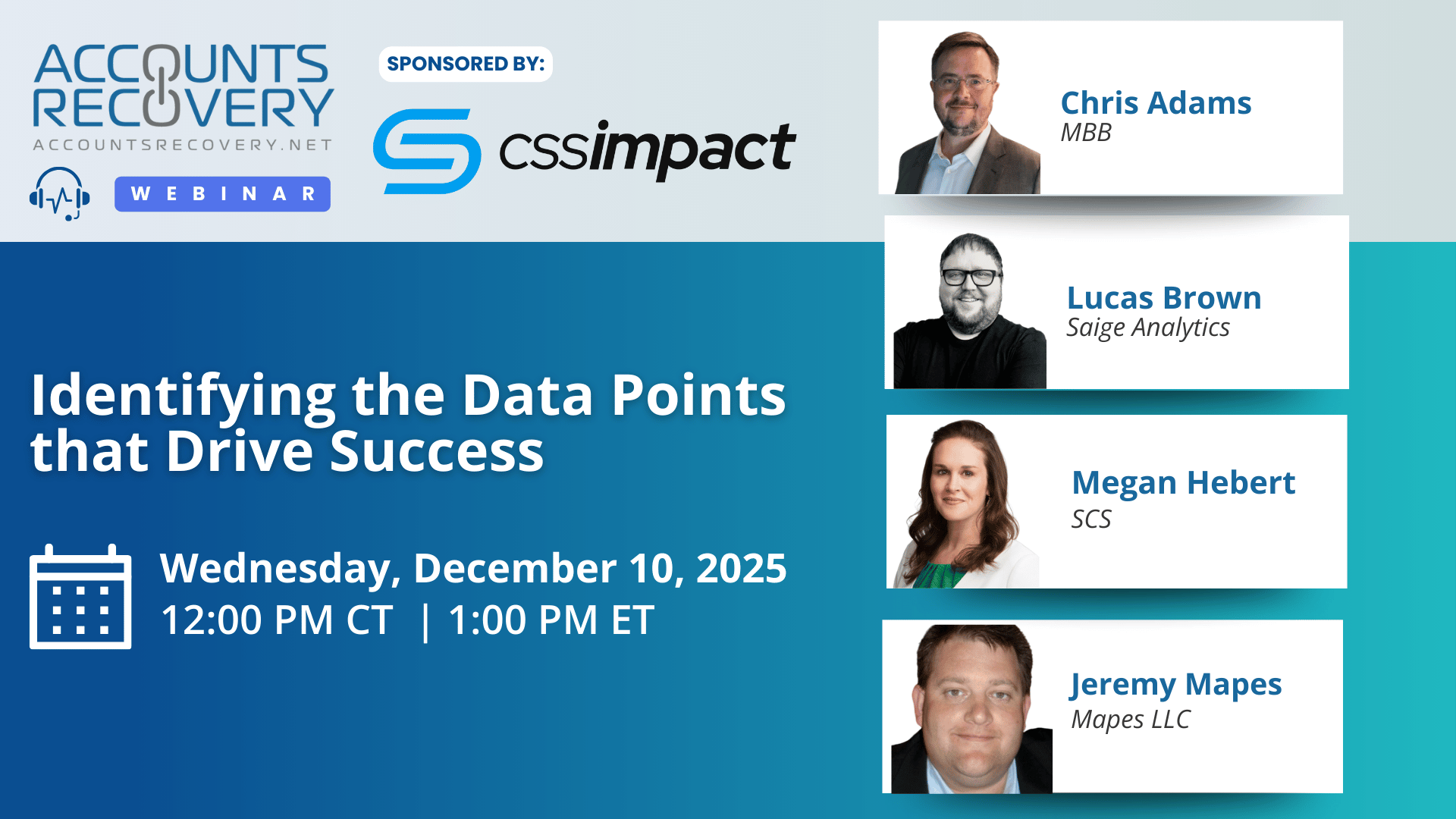

TODAY‘S WEBINAR

UPCOMING WEBINARS

Washington AI Task Force Releases Aggressive Policy Roadmap as States Take the Lead on Regulation

In a move that underscores just how quickly states are stepping in as federal oversight stalls, Washington’s Artificial Intelligence Task Force has released an interim report calling for sweeping AI regulation across sectors from healthcare to law enforcement. The Task Force’s recommendations are some of the most comprehensive in the country, laying out transparency mandates, rules for high-risk AI systems, and new limits on automated decision-making in areas like healthcare and employment.

Court Permits Late Amendment In FCRA Suit

A Magistrate Court judge in Oregon has granted a plaintiff’s motion to amend her complaint in order to change the defendant in a Fair Credit Reporting Act case.

Minnesota Regulator Issues Two Consent Orders Against Collection Operations

A pair of new enforcement actions from the Minnesota Department of Commerce has resulted in more than $55,000 in civil penalties against two collection operations, though the respondents will pay only a small fraction of that amount. One company was accused of collecting without a license in the state and the other failed to provide contact information for nonprofit organizations in the state that provide credit counseling services to consumers.

48 Companies Seeking Collection Talent

Each week, the number of companies seeking collection talent just seems to keep growing. In this week's job listing summary, there are nearly 50 companies looking for qualified professionals at all levels of the corporate ladder. So regardless of whether you're looking for your next job or just looking to see how others are attracting their talent, you should check out this week's summary

WORTH NOTING: The government shutdown forced a lot of people to make changes to their holiday travel plans ... How to double the money in your investment portfolio faster ... If you keep financial secrets from people close to you, you're definitely not alone ... Former CFPB Director Rohit Chopra has found a new gig ... A list of the best games of 2025 ... Even athletes who make more than $100 million can have financial problems ... A list of music fun facts, such as the massive height difference between Hall and Oates ... The top three turn-offs for people when going to the doctor.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: The Blurring Between Consumer and Commercial Collections

The webinar “The Blurring Between Consumer and Commercial Collections” explored how once-clear distinctions between consumer and commercial debt are rapidly dissolving. Panelists Humberto Matz, Meg Scotty, and Albert Rossman agreed that the shift is no longer emerging—it's already here. As Scotty noted, “It’s not a trend; it’s the norm.”

Drivers of this change include new state regulations redefining small-business obligations, creditors who increasingly bundle business and personal products, and auditors who default to consumer compliance rules. Matz highlighted that regulators are adopting broader definitions: “They’re going to consider sole proprietors, single-member LLCs, independent contractors… as consumer debt.”

Operationally, agencies must navigate rising compliance expectations while managing hybrid accounts, personal guarantees, and mismatches between how clients classify accounts and how regulators interpret them. Many commercial agencies now encounter consumer obligations through PGs, employee-related debts, mixed-use credit, and misclassified accounts. This pressure is prompting some agencies to apply consumer-level protections—such as Reg F letters—across the board.

Panelists emphasized that the convergence is reshaping staffing, training, and process design. Rossman described the distinction as “art versus science,” with commercial collections requiring negotiation and analysis, and consumer collections relying on scale, process, and rigor. Successfully managing both requires specialized infrastructure, strong compliance programs, and clear routing logic to keep collectors in the correct lane.

Looking ahead, panelists expect more state-level licensing requirements, increasing enforcement activity, and broader application of consumer protections to small-business and personally-guaranteed debt. While the shift poses challenges, all three panelists agreed it also presents opportunities for agencies prepared to adapt, modernize, and demonstrate compliance excellence.

🧠 Key Takeaways:

Strengthen Compliance Across All Portfolios. Expect regulators and clients to treat many small-business and PG-backed accounts as consumer; ensure your processes, letters, and call practices reflect that reality.

Enhance Training and Segmentation. Equip collectors to identify hybrid accounts, use correct scripts, and avoid regulatory missteps; route uncertain accounts to experienced staff.

Prepare for Increased State Oversight. Maintain robust documentation, call recordings, and internal controls as states expand licensing, examinations, and complaint-driven inquiries.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN